What Is Comprehensive Vehicle Insurance

Comprehensive vehicle insurance, often referred to as "full coverage" insurance, is a vital aspect of responsible vehicle ownership. It is a type of auto insurance policy that provides a wide range of protections and benefits, going beyond the basic liability coverage. Comprehensive insurance aims to safeguard vehicle owners from various financial losses and liabilities that may arise from unexpected events, accidents, or damages.

In the following sections, we will delve deeper into the world of comprehensive vehicle insurance, exploring its features, benefits, and the critical role it plays in ensuring the financial security and peace of mind of vehicle owners. From understanding the scope of coverage to examining real-world scenarios where comprehensive insurance proves invaluable, this article will provide an in-depth analysis of this essential aspect of automotive protection.

The Comprehensive Coverage Spectrum

Comprehensive vehicle insurance is designed to offer a broad spectrum of coverage, providing protection against a wide array of risks and unforeseen events. Here’s a closer look at the key aspects of comprehensive coverage:

Collision Coverage

Collision coverage is a cornerstone of comprehensive insurance. It steps in to provide financial assistance when your vehicle sustains damage in an accident, regardless of who is at fault. This coverage ensures that you are not left bearing the full financial burden of repairs or replacements, even if the accident was your fault.

Collision coverage typically covers the cost of repairs or, in cases where the vehicle is deemed a total loss, the actual cash value of the vehicle at the time of the accident. This can provide significant peace of mind, knowing that you won't be left stranded with an unrepairable vehicle and a hefty bill.

| Coverage Type | Description |

|---|---|

| Collision | Covers repairs or replacements for damages caused by collisions with other vehicles, objects, or during rollovers. |

| Comprehensive | Protects against damages from non-collision events like theft, vandalism, natural disasters, or collisions with animals. |

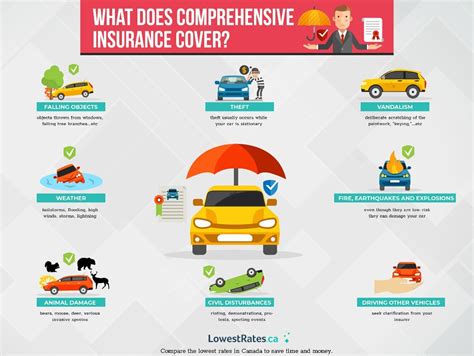

Comprehensive Coverage

Comprehensive coverage, distinct from collision coverage, protects against damages resulting from non-collision events. These can include theft, vandalism, natural disasters like hail or floods, or even collisions with animals. It provides a safety net for a wide range of unexpected situations that could otherwise leave vehicle owners facing significant financial losses.

For instance, if your vehicle is damaged in a hailstorm or is vandalized while parked, comprehensive coverage will step in to cover the costs of repairs or replacements. This level of protection ensures that you are not left financially vulnerable due to events beyond your control.

Additional Benefits

Beyond collision and comprehensive coverage, comprehensive vehicle insurance often includes additional benefits and protections. These can vary depending on the insurer and the specific policy, but may include:

- Rental Car Coverage: Provides assistance with rental car expenses when your vehicle is being repaired due to a covered incident.

- Roadside Assistance: Offers emergency services like towing, flat tire changes, or jump-starts when you're stranded on the roadside.

- Glass Coverage: Covers the cost of repairing or replacing damaged windshields or other glass components without applying a deductible.

- Personal Injury Protection (PIP): Provides medical coverage for you and your passengers, regardless of fault, after an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you financially if you're involved in an accident with a driver who doesn't have adequate insurance coverage.

These additional benefits further enhance the value of comprehensive insurance, offering a comprehensive safety net for vehicle owners.

The Role of Deductibles

Deductibles play a crucial role in comprehensive vehicle insurance policies. A deductible is the amount you, as the policyholder, agree to pay out-of-pocket for covered losses before your insurance coverage kicks in. For instance, if you have a 500 deductible and your vehicle sustains 3,000 worth of damage in an accident, you will pay the first 500, and your insurance provider will cover the remaining 2,500.

The choice of deductible can significantly impact the cost of your insurance premiums. Generally, higher deductibles lead to lower premiums, as you are taking on more financial responsibility in the event of a claim. Conversely, lower deductibles result in higher premiums, as the insurance provider assumes more of the financial burden.

It's important to carefully consider your deductible when selecting a comprehensive insurance policy. While a higher deductible can save you money on premiums, it also means you'll have to pay more out-of-pocket in the event of a claim. On the other hand, a lower deductible provides more financial protection but may result in higher premiums.

Real-World Scenarios and Comprehensive Insurance

Comprehensive vehicle insurance shines in real-world scenarios where unexpected events occur. Here are a few examples of how comprehensive insurance can provide vital protection:

Accidental Damage

Imagine you’re driving down a country road and suddenly encounter a large animal, like a deer, in your path. Despite your best efforts, you collide with the animal, causing significant damage to your vehicle’s front end. With comprehensive insurance, you’re covered for these types of accidents, ensuring you can repair or replace the damaged components without incurring a large financial burden.

Natural Disasters

Natural disasters, such as hurricanes, tornadoes, or floods, can cause extensive damage to vehicles. Comprehensive insurance provides protection in these scenarios. For instance, if your vehicle is flooded during a hurricane and the engine is damaged, comprehensive coverage will step in to cover the cost of repairs or replacements.

Vandalism and Theft

Unfortunately, vehicle theft and vandalism are common occurrences. Comprehensive insurance includes coverage for these events. If your vehicle is stolen or vandalized, the policy will provide financial assistance to help you replace or repair the vehicle, ensuring you’re not left financially devastated.

Choosing the Right Comprehensive Insurance Policy

Selecting the right comprehensive insurance policy involves careful consideration of your specific needs and circumstances. Here are some key factors to keep in mind:

Coverage Limits

Comprehensive insurance policies come with coverage limits, which define the maximum amount the insurer will pay for covered losses. It’s essential to choose coverage limits that align with the value of your vehicle and your financial situation. Higher coverage limits provide more protection but also result in higher premiums.

Customizing Your Policy

Comprehensive insurance policies can often be customized to fit your specific needs. This may include adding or removing certain coverages, adjusting deductibles, or opting for additional benefits like rental car coverage or roadside assistance. Customizing your policy allows you to tailor the coverage to your unique circumstances and budget.

Comparing Providers

When shopping for comprehensive insurance, it’s crucial to compare multiple providers. Different insurers may offer varying levels of coverage, benefits, and premiums. By comparing quotes and policy details, you can ensure you’re getting the best value and the most comprehensive protection for your vehicle.

The Future of Comprehensive Vehicle Insurance

The landscape of comprehensive vehicle insurance is continually evolving, driven by technological advancements and changing consumer needs. Here are some key trends and future implications to consider:

Telematics and Usage-Based Insurance

Telematics technology, which uses data from vehicles to assess driving behavior, is gaining traction in the insurance industry. Usage-based insurance policies, which leverage telematics data, offer a more personalized and dynamic approach to pricing. These policies can provide discounts to safe drivers and help identify areas for improvement, potentially leading to safer driving habits and reduced accident risks.

Connected Car Technologies

The rise of connected car technologies, such as advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, is expected to have a significant impact on comprehensive insurance. These technologies enhance safety and provide real-time data on vehicle performance and driver behavior. Insurers are likely to leverage this data to develop more accurate risk assessments and offer tailored coverage options.

Sustainable and Electric Vehicles

The growing adoption of sustainable and electric vehicles (EVs) is presenting new challenges and opportunities for comprehensive insurance providers. EVs, with their unique technological components and repair requirements, may require specialized coverage. Insurers are exploring ways to adapt their policies to meet the needs of EV owners, ensuring they have adequate protection for their unique vehicles.

Digital Transformation

The digital transformation of the insurance industry is set to continue, with insurers increasingly leveraging technology to enhance the customer experience. This includes the use of digital tools for policy management, claims processing, and customer service. The shift towards digital platforms can improve efficiency, reduce costs, and provide customers with greater convenience and control over their insurance coverage.

Conclusion

Comprehensive vehicle insurance is an essential component of responsible vehicle ownership, providing a comprehensive safety net against a wide range of risks and unforeseen events. From collision coverage to comprehensive protection against non-collision incidents, this type of insurance offers vital financial security and peace of mind. By understanding the scope of coverage, the role of deductibles, and the real-world benefits of comprehensive insurance, vehicle owners can make informed decisions to ensure they have the protection they need.

As the insurance industry continues to evolve, driven by technological advancements and changing consumer needs, comprehensive insurance policies are likely to become even more tailored and dynamic. With the rise of connected car technologies, sustainable vehicles, and digital transformation, insurers are poised to offer innovative solutions that meet the unique needs of modern vehicle owners.

What is the difference between comprehensive and collision coverage in auto insurance?

+Comprehensive coverage protects against damages from non-collision events like theft, vandalism, and natural disasters. Collision coverage, on the other hand, covers damages resulting from collisions with other vehicles, objects, or during rollovers.

Do I need comprehensive insurance if my vehicle is older or has low value?

+The decision to purchase comprehensive insurance depends on your individual circumstances. If your vehicle has low value and you can afford to repair or replace it without insurance, comprehensive coverage may not be necessary. However, if you rely on your vehicle for daily use or want financial protection against unexpected events, comprehensive insurance can still be beneficial.

How can I lower my comprehensive insurance premiums?

+There are several ways to lower your comprehensive insurance premiums. One effective method is to increase your deductible, as higher deductibles typically result in lower premiums. Additionally, maintaining a clean driving record and avoiding claims can lead to premium discounts. Shopping around and comparing quotes from different insurers can also help you find more competitive rates.