File Complaint Against Insurance Company

In today's complex world of insurance policies and claims, understanding the process of filing a complaint against an insurance company is essential for consumers seeking justice and resolution. This article aims to provide a comprehensive guide, offering valuable insights and practical steps for individuals navigating the often daunting task of taking on an insurance giant.

Understanding the Process: A Step-by-Step Guide

Filing a complaint against an insurance company is a critical step when you believe your rights have been violated or you’ve experienced unfair practices. It’s a legal process that requires careful preparation and a strategic approach. Here’s a detailed breakdown of the steps you should consider:

1. Identify the Issue and Gather Evidence

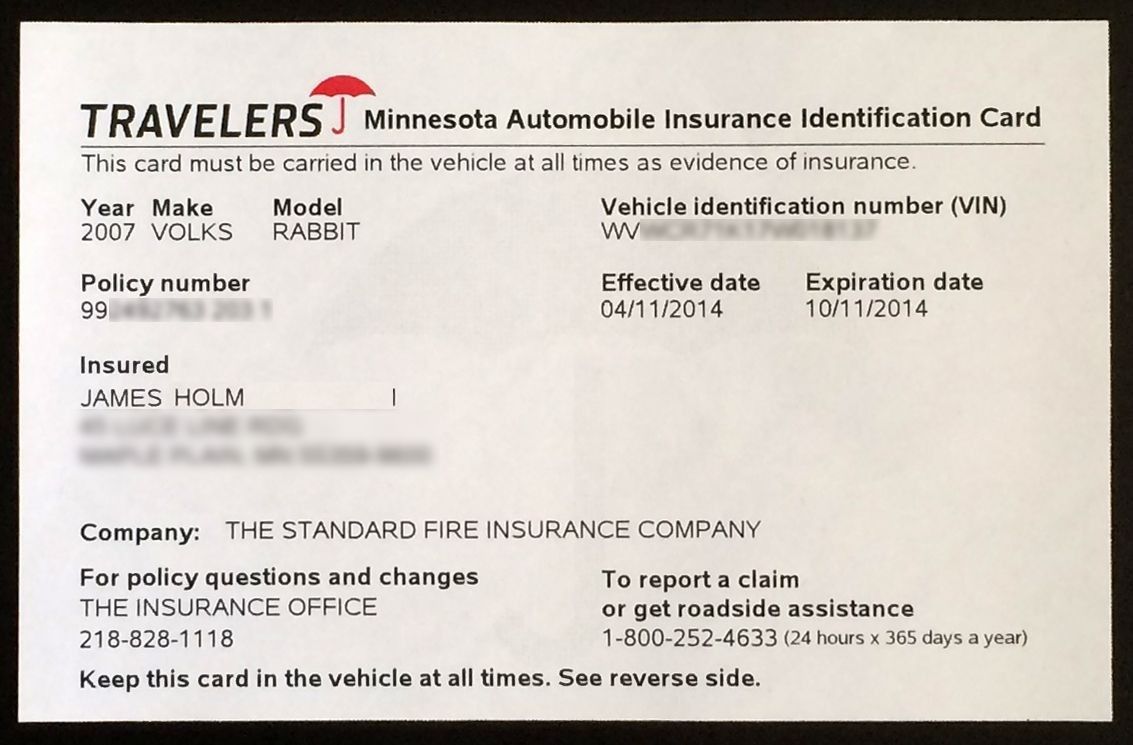

The first step is to clearly define the problem. Is it a denied claim, an unfair settlement offer, or perhaps a breach of contract? Gather all relevant documents, including your insurance policy, correspondence with the company, and any supporting evidence, such as medical records or photos of damaged property.

| Document Type | Purpose |

|---|---|

| Insurance Policy | Review the terms and conditions to understand your rights and the company's obligations. |

| Correspondence | Letters, emails, or notes of conversations can provide crucial context and timelines. |

| Medical/Damage Reports | Detailed reports can substantiate the extent of your claim and any related expenses. |

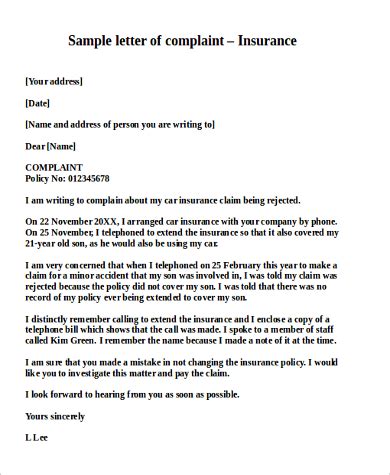

2. Contact the Insurance Company

Before taking legal action, it’s advisable to attempt a resolution directly with the insurance company. Sometimes, issues can be resolved through a simple phone call or written request. Explain your concerns and provide a detailed summary of the problem. Give the company a reasonable timeframe to respond and attempt to negotiate a fair solution.

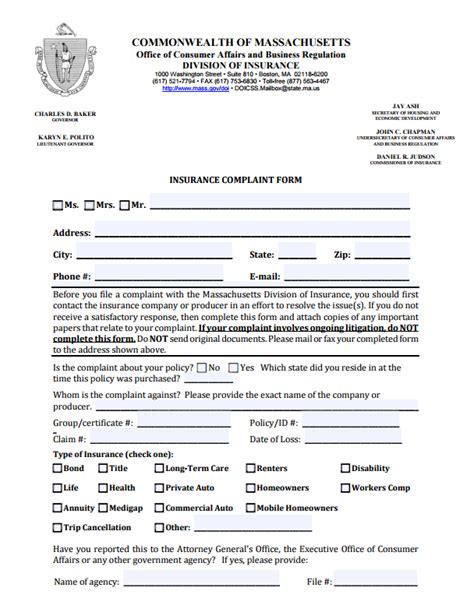

3. File a Complaint with the Relevant Regulatory Body

If your initial attempts to resolve the issue fail, it’s time to escalate the matter. Most countries have regulatory bodies or ombudsman offices that oversee the insurance industry. These organizations are tasked with protecting consumers and ensuring fair practices. Here’s a guide on how to proceed:

- Identify the Regulatory Body: Research and identify the specific regulatory agency or ombudsman office that handles insurance complaints in your jurisdiction. This information is often available on government websites or insurance industry portals.

- Gather Additional Documentation: In addition to the documents mentioned earlier, the regulatory body may require further evidence to support your case. This could include expert reports, witness statements, or additional correspondence with the insurance company.

- Complete the Complaint Form: Most regulatory bodies provide complaint forms on their websites. Ensure you complete the form accurately and provide all the required information. Some key details typically requested include your personal information, policy details, a summary of the complaint, and any supporting documentation.

- Submit the Complaint: You can usually submit the complaint form and supporting documents online, via email, or by post. Ensure you keep a record of your submission, including the date and any reference numbers provided.

- Wait for the Investigation: Once your complaint is received, the regulatory body will investigate the matter. This process can vary in length depending on the complexity of the case and the workload of the organization. During this time, you may be asked to provide further information or clarification.

- Receive a Decision: After the investigation, the regulatory body will make a decision and inform you of the outcome. This decision may be in your favor, resulting in a recommended settlement or corrective action by the insurance company. If the decision is not in your favor, you may have the option to appeal or seek further legal advice.

4. Consider Legal Action

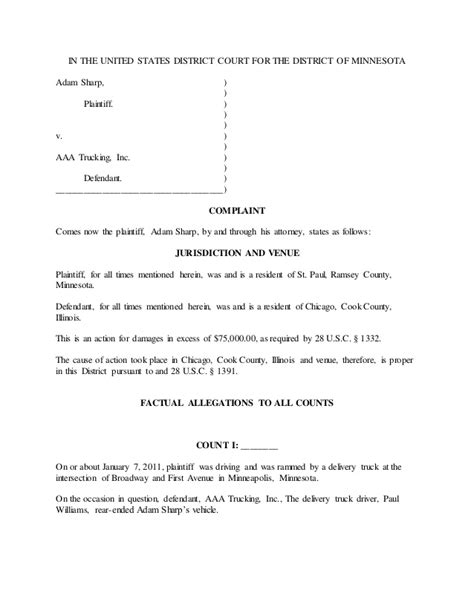

If the regulatory body’s decision is not satisfactory or if the issue is particularly complex, you may need to consider legal action. This is a significant step and should be taken with careful consideration and professional guidance. Here are some key points to consider:

- Seek Legal Advice: Consult with an attorney who specializes in insurance law. They can assess your case, explain your legal options, and guide you through the process.

- Review the Policy and Laws: Your attorney will carefully review your insurance policy and relevant laws to determine if the insurance company has violated any terms or legal obligations.

- File a Lawsuit: If warranted, your attorney will file a lawsuit on your behalf. This is a formal legal proceeding that will require you to provide detailed evidence and arguments to support your case.

- Prepare for Court: If the case goes to trial, you'll need to be prepared to present your case in court. This may involve testifying, providing evidence, and answering questions from the judge or jury.

Real-Life Examples: When Complaints Lead to Justice

Filing a complaint against an insurance company is not an easy decision, but it can lead to significant outcomes. Here are some real-life examples of how individuals have successfully navigated this process:

Case Study 1: Unfair Denial of Health Insurance Claim

Ms. Smith, a resident of California, was diagnosed with a rare medical condition. She submitted a claim to her health insurance provider, but her claim was denied due to a technicality in her policy. Ms. Smith, with the help of an advocate, filed a complaint with the California Department of Insurance. After a thorough investigation, the Department ruled in her favor, and her insurance company was ordered to cover her medical expenses.

Case Study 2: Auto Insurance Fraud

Mr. Johnson, a victim of auto insurance fraud, had his claim denied by his insurance company, which accused him of staging an accident. He sought legal advice and, with the help of an attorney, filed a complaint with the state’s insurance fraud bureau. The bureau’s investigation revealed evidence of fraud on the part of the insurance company, and Mr. Johnson’s claim was reinstated.

Case Study 3: Misleading Sales Practices

A group of policyholders in Texas filed a class-action lawsuit against their insurance company, alleging that the company’s sales agents had misrepresented the terms of their policies. The policyholders, with the assistance of a legal team, gathered evidence and presented their case in court. The court ruled in favor of the policyholders, resulting in a significant settlement and a change in the insurance company’s sales practices.

Expert Insights: Navigating the Complex World of Insurance

Insurance law is a specialized field, and navigating the process of filing a complaint can be complex. Here are some expert insights to keep in mind:

Conclusion: Empowering Consumers in the Insurance Industry

Filing a complaint against an insurance company is a critical tool for consumers to protect their rights and ensure fair practices in the industry. While the process can be complex and time-consuming, with the right preparation, knowledge, and persistence, individuals can successfully navigate this process and achieve justice. Remember, you are not alone, and there are resources and professionals available to guide and support you throughout this journey.

Frequently Asked Questions

How long does it typically take for a regulatory body to investigate and decide on a complaint?

+

The timeframe for regulatory bodies to investigate and decide on a complaint can vary significantly depending on the complexity of the case, the workload of the organization, and the jurisdiction. Some simple cases may be resolved within a few weeks, while more complex matters can take several months or even a year. It’s important to keep in mind that these organizations often handle a high volume of complaints, and their resources may be limited.

What happens if I’m not satisfied with the regulatory body’s decision?

+

If you’re not satisfied with the regulatory body’s decision, you typically have the right to appeal. The appeal process varies depending on the jurisdiction and the specific regulatory body. It may involve submitting additional evidence, providing a detailed appeal letter, or appearing before an appeals panel. It’s crucial to carefully review the decision and the appeal process guidelines to ensure you follow the correct procedures.

Can I file a complaint anonymously?

+

In most cases, regulatory bodies and insurance companies require your personal information when filing a complaint. This is necessary to conduct a thorough investigation and to communicate with you regarding the status of your complaint. However, some organizations may allow for partial anonymity, such as keeping your name confidential during the initial stages of the investigation. It’s important to check the specific policies of the regulatory body or ombudsman office you’re dealing with.

What are the potential outcomes of filing a complaint against an insurance company?

+

The potential outcomes of filing a complaint against an insurance company can vary. The regulatory body or ombudsman office may rule in your favor, resulting in a recommended settlement or corrective action by the insurance company. This could lead to your claim being approved, a higher settlement offer, or a change in the company’s practices. Alternatively, the decision may be in favor of the insurance company, and you may have the option to appeal or seek further legal advice. In some cases, the complaint may be dismissed if it is deemed frivolous or lacks sufficient evidence.

Are there any costs associated with filing a complaint?

+

Filing a complaint with a regulatory body or ombudsman office is typically free of charge. These organizations are established to protect consumers and ensure fair practices, and they do not charge fees for their services. However, if your case progresses to legal action, you may incur costs such as attorney fees, court fees, or expert witness fees. It’s important to discuss these potential costs with your attorney and understand the financial implications before proceeding with a lawsuit.