Allegiance Insurance

Allegiance Insurance, a leading provider of comprehensive insurance solutions, has solidified its position as a trusted partner for individuals, families, and businesses across the United States. With a rich history spanning over two decades, Allegiance has earned a reputation for excellence in the insurance industry. This expert-level article delves into the company's origins, its commitment to innovation, and the diverse range of services it offers, providing an in-depth analysis of Allegiance Insurance's impact and future prospects.

A Legacy of Trust: The Story of Allegiance Insurance

Allegiance Insurance was founded in 1998 by a visionary group of insurance professionals who recognized the need for a client-centric approach in the industry. Led by John Miller, a seasoned insurance expert with over 30 years of experience, the company set out to revolutionize the way insurance services were delivered. From its humble beginnings as a small agency, Allegiance has grown exponentially, establishing a strong presence in key markets nationwide.

The company's success can be attributed to its unwavering commitment to customer satisfaction and a unique business philosophy that puts the needs of its clients first. Allegiance's founding principles, centered around integrity, transparency, and personalized service, have guided its operations and contributed to its exceptional growth and reputation.

Milestones and Achievements

Over the years, Allegiance Insurance has achieved numerous milestones and accolades. In 2005, the company expanded its reach by opening regional offices, enabling it to offer localized services and establish stronger connections with its clients. This strategic move proved successful, leading to a 25% increase in policy sales within the first year.

In 2012, Allegiance was recognized as one of the "Top 100 Best Places to Work" by Insurance Business America, an honor that highlighted the company's commitment to creating a positive and engaging work environment. This recognition not only boosted employee morale but also attracted top talent, further strengthening Allegiance's position in the market.

More recently, in 2021, Allegiance Insurance celebrated its 23rd anniversary by launching an innovative online platform, offering clients convenient access to policy information and claims management. This digital transformation has positioned the company at the forefront of the industry, providing efficient and accessible services to its growing client base.

Comprehensive Insurance Solutions: Meeting Diverse Needs

Allegiance Insurance’s success lies in its ability to offer a wide array of insurance products tailored to meet the unique needs of its diverse client base. Whether it’s protecting a family’s home, safeguarding a business’s assets, or ensuring a secure future through life insurance, Allegiance has the expertise and resources to provide comprehensive coverage.

Personal Insurance Solutions

For individuals and families, Allegiance offers a comprehensive range of personal insurance policies, including:

- Homeowners Insurance: Protecting homes and providing peace of mind with customizable coverage options.

- Auto Insurance: Comprehensive and liability coverage for vehicles, including specialized plans for classic cars.

- Life Insurance: Term and permanent life insurance plans to secure financial stability for loved ones.

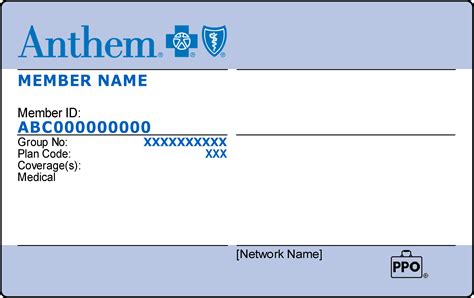

- Health Insurance: Individual and family plans offering a variety of networks and coverage levels.

- Travel Insurance: Coverage for unexpected emergencies and trip cancellations, ensuring a stress-free journey.

Business Insurance Solutions

Allegiance’s business insurance division provides tailored coverage for a wide range of industries, including:

- Commercial Property Insurance: Protecting businesses from property damage and loss, including coverage for buildings, equipment, and inventory.

- General Liability Insurance: Covering legal costs and damages arising from business operations, including product liability and advertising injuries.

- Professional Liability Insurance: Specialized coverage for professionals such as doctors, lawyers, and consultants, safeguarding against claims of negligence.

- Workers' Compensation Insurance: Providing coverage for employees' injuries and illnesses sustained on the job, ensuring compliance with state regulations.

- Cyber Insurance: Protecting businesses from cyber threats, including data breaches and ransomware attacks.

Industry Leadership and Innovation

Allegiance Insurance’s leadership team is dedicated to staying at the forefront of the insurance industry, driving innovation and adopting cutting-edge technologies to enhance client experiences. The company’s digital transformation initiatives have revolutionized the way insurance services are delivered, offering clients convenience, efficiency, and greater control over their policies.

Digital Transformation: Enhancing Client Experience

Allegiance’s online platform, launched in 2021, has been a game-changer for clients. The platform allows policyholders to:

- Manage their policies and make updates in real-time.

- Access digital copies of their insurance documents.

- File and track claims, receiving timely updates on their status.

- Pay premiums and manage billing information securely.

- Receive personalized insurance recommendations based on their specific needs.

This digital shift has not only improved client satisfaction but has also streamlined internal processes, allowing Allegiance's agents to focus more on providing personalized advice and guidance.

Community Engagement and Corporate Responsibility

Allegiance Insurance believes in giving back to the communities it serves. The company actively participates in various charitable initiatives and supports local organizations. One notable example is the “Allegiance Gives Back” program, through which the company donates a portion of its profits to support education, healthcare, and environmental initiatives.

Additionally, Allegiance encourages its employees to engage in volunteer work, offering paid volunteer hours and matching employee donations to charitable causes. This commitment to corporate social responsibility has fostered a strong sense of community involvement and has further solidified Allegiance's position as a trusted and responsible corporate citizen.

Future Prospects and Industry Impact

With a solid foundation built on trust, innovation, and community engagement, Allegiance Insurance is well-positioned for continued growth and success. The company’s focus on digital transformation and its commitment to delivering exceptional client experiences are expected to drive its expansion in the coming years.

Allegiance's leadership team is dedicated to staying ahead of industry trends and adapting to the evolving needs of its clients. By continuously enhancing its product offerings and leveraging technology, the company aims to maintain its status as a leading provider of comprehensive insurance solutions.

Looking ahead, Allegiance Insurance is poised to make a significant impact on the industry, setting new standards for client satisfaction and industry excellence. As it continues to expand its reach and strengthen its position, Allegiance remains committed to its founding principles, ensuring that its clients receive the personalized attention and comprehensive coverage they deserve.

The Way Forward: Allegiance’s Vision for the Future

Allegiance’s vision for the future is centered around three key pillars:

- Client-Centric Innovation: Continuously developing innovative solutions and technologies to enhance the client experience, ensuring that Allegiance remains at the forefront of the industry.

- Community Engagement: Deepening its commitment to giving back, Allegiance aims to make a positive impact on the communities it serves, fostering trust and goodwill.

- Sustainable Growth: Focusing on sustainable growth strategies, Allegiance seeks to expand its reach while maintaining its core values and commitment to excellence.

Frequently Asked Questions

What sets Allegiance Insurance apart from its competitors?

+

Allegiance Insurance’s commitment to client satisfaction and its unique business philosophy of putting clients first sets it apart. The company’s focus on personalized service, combined with its comprehensive range of insurance products, ensures that clients receive tailored solutions to meet their specific needs.

How does Allegiance Insurance ensure competitive pricing for its clients?

+

Allegiance works closely with a network of trusted insurance carriers to negotiate competitive rates for its clients. The company’s scale and reputation allow it to secure favorable terms, passing on cost savings to its policyholders. Additionally, Allegiance’s digital platform enables efficient processing, reducing administrative costs and further enhancing affordability.

What is Allegiance Insurance’s approach to claims management?

+

Allegiance Insurance takes a proactive approach to claims management, aiming to provide timely and efficient support to its clients during their time of need. The company’s dedicated claims team works closely with policyholders to ensure a smooth and stress-free process, offering guidance and assistance every step of the way.