Good Medical Insurance Plans

When it comes to finding a good medical insurance plan, there are numerous factors to consider. The right plan can provide peace of mind, ensure access to quality healthcare, and offer financial protection during unexpected medical emergencies. This article aims to guide you through the complex world of medical insurance, offering insights and expertise to help you make informed decisions.

Understanding Your Healthcare Needs

Before diving into the world of medical insurance plans, it’s crucial to understand your unique healthcare requirements. Consider the following aspects:

- Health Status: Are you generally healthy, or do you have pre-existing conditions that require regular medical attention? Understanding your health status is key to finding a plan that covers your specific needs.

- Prescription Medications: If you rely on prescription drugs, ensure that your insurance plan provides adequate coverage for them. Some plans have limitations on the types and quantities of medications covered.

- Specialist Care: Do you have any ongoing specialist treatments or anticipate needing them in the future? Verify that the insurance plan includes coverage for specialists and the procedures they perform.

- Hospitalization: Consider your risk of hospitalization. While no one plans to be hospitalized, it's wise to choose a plan that offers comprehensive coverage for inpatient care, including surgery and intensive care.

- Preventive Care: Many insurance plans now emphasize preventive care, covering regular check-ups, screenings, and vaccinations. Ensure your plan includes these benefits to maintain optimal health.

Evaluating Plan Types and Coverage

Medical insurance plans come in various forms, each with its own set of features and benefits. Here’s a breakdown of some common plan types:

Health Maintenance Organization (HMO)

HMOs are known for their comprehensive coverage and cost-effectiveness. They typically require you to choose a primary care physician (PCP) who coordinates your healthcare. All services, including specialist care, must be referred by the PCP. While HMOs often have lower premiums, they may have more restrictions on out-of-network care.

Preferred Provider Organization (PPO)

PPOs offer more flexibility compared to HMOs. You can choose any healthcare provider, in-network or out-of-network, without a referral. While PPOs usually have higher premiums, they provide greater freedom of choice and often cover a wider range of services.

Exclusive Provider Organization (EPO)

EPOs strike a balance between HMOs and PPOs. Like HMOs, you select a primary care physician, but unlike HMOs, you can see specialists without a referral. However, EPOs typically do not cover out-of-network care, making them a cost-effective option for those who prefer a more structured plan.

Point of Service (POS) Plans

POS plans combine elements of HMOs and PPOs. You have a primary care physician, but you can also see specialists without a referral. POS plans often have lower premiums and higher out-of-pocket costs, making them a good choice for those who prioritize cost-effectiveness.

Comparing Costs and Benefits

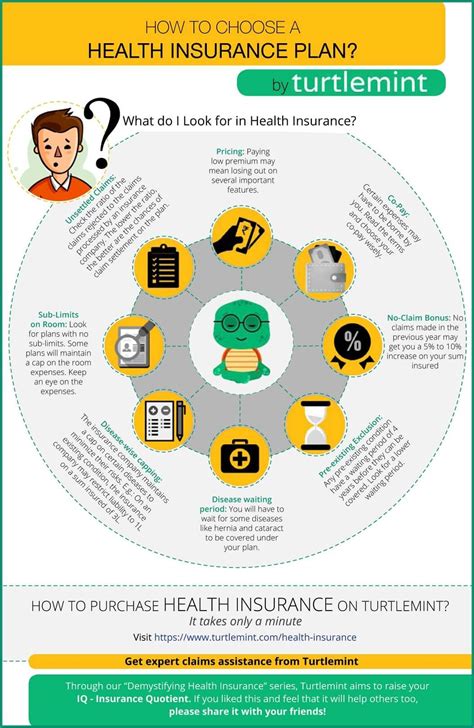

When evaluating medical insurance plans, it’s essential to compare the costs and benefits to find the best value for your needs. Consider the following:

- Premiums: This is the regular payment you make to maintain your insurance coverage. Compare premiums across different plans, keeping in mind that lower premiums may come with higher deductibles or out-of-pocket expenses.

- Deductibles: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles can lead to lower premiums, but they may not be suitable for those who anticipate frequent medical needs.

- Co-payments and Co-insurance: Co-payments are fixed amounts you pay for covered services, while co-insurance is a percentage of the cost you share with the insurance provider. These can vary significantly between plans, so choose a plan that aligns with your budget and healthcare needs.

- Out-of-Pocket Maximum: This is the most you'll pay in a year for covered services before your insurance plan covers 100% of the costs. Higher out-of-pocket maximums can result in lower premiums, so consider your financial capacity and anticipated healthcare expenses.

- Network of Providers: Review the network of healthcare providers associated with each plan. Ensure that your preferred doctors, hospitals, and specialists are included in the network to avoid unexpected out-of-network charges.

Key Considerations for a Good Medical Insurance Plan

To ensure you choose a high-quality medical insurance plan, keep the following factors in mind:

- Reputation and Financial Stability: Select an insurance provider with a strong reputation and financial stability. This ensures they will be able to provide coverage when you need it most.

- Customer Service and Claims Handling: Opt for a provider with a good track record of customer service and efficient claims handling. This can make a significant difference in your overall experience with the insurance company.

- Coverage for Pre-existing Conditions: If you have pre-existing conditions, ensure that the plan covers them adequately. Some plans have waiting periods or exclusions for certain conditions, so read the fine print carefully.

- Maternity and Pediatric Care: If you have children or plan to start a family, verify that the plan includes comprehensive coverage for maternity and pediatric care, including well-child visits and immunizations.

- Mental Health and Substance Abuse Coverage: Mental health services and substance abuse treatment are essential components of a good medical insurance plan. Ensure that these services are covered without excessive limitations or exclusions.

Making an Informed Decision

Choosing a good medical insurance plan is a crucial decision that impacts your health and financial well-being. By understanding your healthcare needs, evaluating plan types and coverage, and considering the key factors outlined above, you can make an informed choice. Remember, it’s essential to review and compare multiple plans to find the one that best suits your unique circumstances.

Stay diligent, ask questions, and seek advice from trusted sources to ensure you select a plan that provides comprehensive coverage at a reasonable cost.

What are some common exclusions in medical insurance plans?

+Common exclusions may include cosmetic procedures, elective surgeries, and certain types of therapy. It’s crucial to review the plan’s exclusions carefully to avoid unexpected out-of-pocket expenses.

How do I know if a plan covers my preferred healthcare providers?

+Check the plan’s network of providers. You can often search for specific doctors, hospitals, or specialists on the insurance provider’s website or by contacting their customer service.

What is the difference between in-network and out-of-network care?

+In-network care refers to services provided by healthcare professionals or facilities that have a contract with your insurance provider. Out-of-network care, on the other hand, involves services from providers who do not have such a contract. Out-of-network care may result in higher costs or may not be covered by your insurance plan.