Best Insurance Company In Texas

In the vast landscape of Texas, known for its diverse population and unique challenges, the insurance industry plays a crucial role in providing financial protection and peace of mind to residents and businesses alike. With a myriad of options available, choosing the best insurance company can be a daunting task. This comprehensive guide aims to shed light on the top insurance providers in Texas, highlighting their strengths, services, and why they stand out in the market.

Understanding the Texas Insurance Market

Texas boasts a highly competitive insurance market, with a diverse range of companies catering to various needs. From global insurance giants to local, community-focused providers, the options are extensive. The state’s unique regulations and its reputation for natural disasters further shape the insurance landscape, making it essential for consumers to understand the market dynamics.

Key considerations for Texans seeking insurance include:

- Coverage Options: Texas residents often require comprehensive coverage, given the state's susceptibility to hurricanes, tornadoes, and other natural calamities.

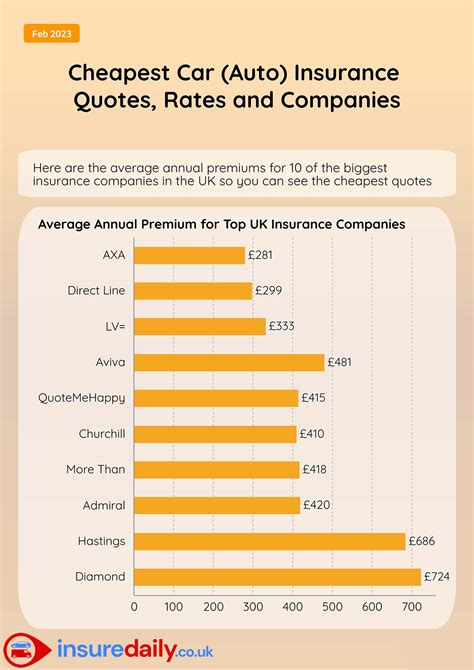

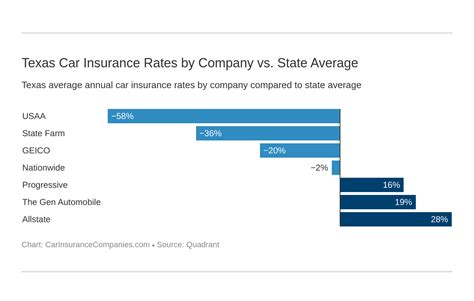

- Affordability: With a diverse population, insurance companies must offer competitive pricing without compromising on quality.

- Claims Handling: Efficient and fair claims processing is a critical factor, especially during catastrophic events.

- Customer Service: A responsive and knowledgeable customer support team can make a significant difference in the overall insurance experience.

The Top Insurance Providers in Texas

Several insurance companies have established themselves as leaders in the Texas market, excelling in various aspects of service and coverage. Here's an in-depth look at some of the best:

State Farm

State Farm, a household name in insurance, has built a strong presence in Texas with its comprehensive range of insurance products. From auto and home insurance to life and health coverage, they offer a one-stop solution for Texans’ insurance needs.

- Strengths: Known for their exceptional customer service, State Farm boasts a network of knowledgeable agents who provide personalized guidance. They also offer competitive pricing and flexible payment options.

- Coverage Highlights: Their auto insurance policies include unique features like rideshare coverage for Uber and Lyft drivers, catering to the state’s growing gig economy. Homeowners can benefit from their comprehensive disaster coverage, which includes wind and hail damage.

- Claims Experience: State Farm has a proven track record of efficient claims handling, with a dedicated team that works swiftly to process claims, especially during natural disasters.

Allstate

Allstate is another prominent player in the Texas insurance market, offering a wide array of insurance products and services. They are particularly known for their innovative approach to insurance and their commitment to customer satisfaction.

- Innovative Solutions: Allstate introduces cutting-edge technology to enhance the insurance experience. Their digital tools, like the Allstate Drivewise app, reward safe driving habits with discounts.

- Customizable Coverage: They understand that every Texan’s insurance needs are unique. Their policies can be tailored to fit individual requirements, offering flexibility and personalized protection.

- Claims Satisfaction: Allstate guarantees a stress-free claims process with their “Guaranteed Repair Network,” ensuring high-quality repairs for vehicles and homes.

USAA

USAA stands out as a leading insurance provider, primarily serving military members, veterans, and their families. With a strong focus on community and excellent customer service, they have gained a loyal following in Texas.

- Military Expertise: Given their target audience, USAA offers specialized insurance products tailored to the unique needs of military personnel, including coverage for deployments and frequent moves.

- Discounts and Benefits: They provide exclusive discounts and benefits to their members, such as reduced rates for safe driving and loyalty rewards.

- Digital Convenience: USAA excels in digital services, offering a seamless online and mobile experience for policy management and claims filing.

Geico

Geico, known for its catchy advertisements, has made a significant impact in the Texas insurance market with its competitive rates and extensive coverage options.

- Affordability: Geico is renowned for offering some of the most competitive insurance rates in Texas, making it an attractive option for budget-conscious consumers.

- Wide Range of Coverage: From auto and homeowners insurance to renters and umbrella policies, Geico provides a comprehensive suite of insurance products to protect Texans’ assets.

- Customer Convenience: They prioritize customer convenience with 24⁄7 customer support and an easy-to-use online platform for policy management and claims filing.

Progressive

Progressive has established itself as a go-to insurance provider in Texas, offering innovative solutions and a customer-centric approach.

- Name Your Price Tool: Progressive provides a unique “Name Your Price” tool, allowing Texans to choose their auto insurance premium and then tailor their coverage to fit their budget.

- Snapshot Program: Their Snapshot program uses telematics to monitor driving behavior, offering discounts to safe drivers.

- Comprehensive Coverage: In addition to auto insurance, Progressive offers a wide range of other insurance products, including motorcycle, RV, and boat insurance, catering to Texans’ diverse needs.

Choosing the Right Insurance Company for You

Selecting the best insurance company is a highly personal decision, influenced by individual needs, budget, and preferences. Here are some key factors to consider when making your choice:

- Coverage Requirements: Assess your specific insurance needs. Do you require comprehensive coverage for natural disasters, or are you more concerned with everyday risks like theft or accidents? Ensure the company you choose offers the coverage you need.

- Pricing and Discounts: Compare insurance quotes from different providers to find the most competitive rates. Many companies offer discounts for safe driving, multiple policies, or other qualifying factors.

- Claims Handling: Research the company’s reputation for claims handling. Look for reviews and ratings to understand how they handle claims, especially in cases of catastrophic events.

- Customer Service: Excellent customer service can make a significant difference in your insurance experience. Consider factors like response time, knowledgeability, and overall satisfaction ratings.

The Future of Insurance in Texas

The insurance landscape in Texas is continually evolving, driven by technological advancements, changing consumer preferences, and the state’s unique environmental challenges. As natural disasters become more frequent and intense, insurance companies are adapting their coverage and claims processes to better serve Texans.

The rise of digital insurance platforms and telematics is also transforming the industry, offering Texans more convenient and personalized insurance experiences. With the increasing popularity of online insurance marketplaces, consumers now have more power to compare and choose the best insurance providers for their needs.

In conclusion, the Texas insurance market offers a wide array of options, with several companies excelling in various aspects of service and coverage. Whether you prioritize affordability, comprehensive coverage, or exceptional customer service, there's an insurance provider in Texas that can meet your needs. By understanding your specific requirements and researching the market, you can make an informed decision and choose the best insurance company for your situation.

How do I know if an insurance company is reputable in Texas?

+Reputable insurance companies in Texas will be licensed by the Texas Department of Insurance and have a solid financial rating from independent agencies like AM Best or Moody’s. You can also check their reputation through customer reviews and ratings on trusted websites.

What should I look for in an insurance policy in Texas?

+When choosing an insurance policy in Texas, consider your specific needs and risks. Look for comprehensive coverage that includes protection against natural disasters like hurricanes and tornadoes. Also, check for additional benefits like rental car coverage or roadside assistance.

Can I bundle my insurance policies to save money in Texas?

+Yes, bundling your insurance policies, such as auto and home insurance, can often lead to significant savings. Many insurance companies in Texas offer multi-policy discounts, so it’s worth exploring this option to reduce your overall insurance costs.