Cheapest Car Insurance

When it comes to finding the cheapest car insurance, there are several factors to consider. The cost of insurance can vary significantly depending on your location, driving history, the type of vehicle you own, and the coverage you choose. This comprehensive guide will delve into the world of auto insurance, providing you with expert insights and strategies to secure the most affordable coverage tailored to your needs.

Understanding the Basics of Car Insurance

Car insurance is a contract between you and the insurance provider, designed to protect you financially in the event of an accident, theft, or other covered incidents. It is a legal requirement in most countries and plays a crucial role in keeping you and other road users safe.

There are typically three main types of car insurance coverage:

- Liability Coverage: This covers the cost of damage or injury you cause to others in an accident. It is often the minimum required by law.

- Collision Coverage: This option covers damage to your vehicle resulting from a collision, regardless of fault.

- Comprehensive Coverage: This covers damages not caused by a collision, such as theft, vandalism, or natural disasters.

Factors Influencing Car Insurance Costs

Several factors impact the cost of your car insurance premiums. Understanding these factors can help you make informed decisions to reduce your insurance costs.

Location and Demographics

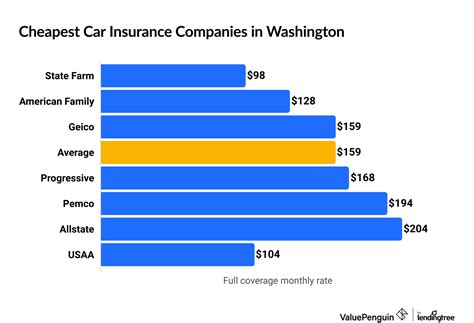

Your location is a significant factor in determining insurance rates. Insurance companies consider the risk associated with your area, including crime rates, accident statistics, and the cost of living. Urban areas often have higher premiums due to increased traffic and accident risks.

| Urban Area | Rural Area |

|---|---|

| Higher rates due to congestion and theft risks | Lower rates due to reduced accident risks |

Driving History

Your driving record plays a crucial role in insurance costs. A clean driving history with no accidents or violations can lead to lower premiums. Conversely, a history of accidents or traffic violations may result in higher rates or even difficulty obtaining insurance.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance costs. High-performance sports cars or luxury vehicles often carry higher premiums due to their value and increased risk of theft or accidents.

Additionally, the purpose of your vehicle’s usage matters. If you primarily use your car for business purposes, your insurance rates may be higher due to the increased risk associated with commercial driving.

Coverage and Deductibles

The level of coverage you choose and your deductible amount can significantly affect your insurance costs. Higher coverage limits and lower deductibles typically result in higher premiums, while opting for lower coverage and higher deductibles can reduce your monthly payments.

Tips to Find the Cheapest Car Insurance

Now that we’ve covered the basics, here are some expert strategies to help you secure the cheapest car insurance tailored to your specific circumstances.

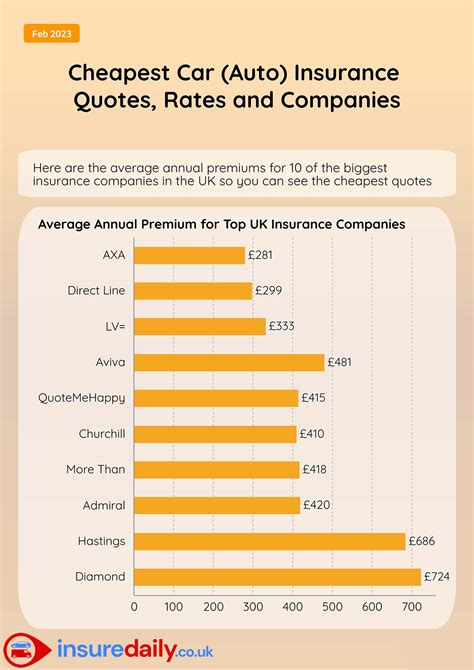

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Online insurance marketplaces can provide you with multiple quotes from different insurers, making it easier to find the best deal.

Consider Bundling Policies

If you have multiple insurance needs, such as home and auto insurance, bundling your policies with the same provider can often result in significant savings. Many insurers offer discounts when you combine different types of insurance.

Choose the Right Coverage

Assess your specific needs and choose the coverage that suits them. If you have an older vehicle with low monetary value, you may not need comprehensive or collision coverage, which can save you money.

Improve Your Driving Record

Maintaining a clean driving record is crucial for keeping insurance costs down. Avoid traffic violations and accidents to ensure your premiums remain as low as possible.

Explore Discounts and Savings

Insurance companies offer various discounts, such as safe driver discounts, good student discounts, loyalty discounts, and more. Ask your insurer about the discounts they provide and ensure you meet the eligibility criteria to take advantage of them.

Pay Annually or Semi-Annually

Many insurers offer discounts for paying your premium in full annually or semi-annually instead of monthly. This can save you money in the long run and reduce administrative fees.

Consider Telematics Insurance

Telematics insurance, also known as usage-based insurance, uses a device or app to track your driving behavior. Insurers can offer discounts based on your safe driving habits, making it an excellent option for cautious drivers.

Maintain a Good Credit Score

In many cases, your credit score can impact your insurance rates. Maintaining a good credit score can help you secure lower premiums, so be sure to manage your credit responsibly.

Stay Informed and Review Your Policy Regularly

Insurance rates and coverage options can change over time. Stay informed about market trends and review your policy annually to ensure you’re still getting the best deal. If your circumstances have changed, such as moving to a new area or purchasing a new vehicle, you may be eligible for better rates.

The Future of Affordable Car Insurance

The insurance industry is evolving, and new technologies are shaping the way insurance is priced and delivered. Here are some future trends and developments that may impact the cost of car insurance.

Advanced Telematics and Connected Cars

As telematics technology advances, insurers may gain even more insight into your driving behavior. This could lead to more precise pricing and potentially lower rates for safe drivers.

Autonomous Vehicles and Accident Reduction

The widespread adoption of autonomous vehicles is expected to reduce the number of accidents, which could drive down insurance costs over time. However, this technology is still in its early stages, and the full impact on insurance rates remains to be seen.

Blockchain and Insurance

Blockchain technology has the potential to revolutionize the insurance industry by improving data security and streamlining claims processes. This could lead to more efficient and cost-effective insurance operations, potentially benefiting consumers with lower premiums.

Artificial Intelligence and Risk Assessment

AI is already being used by insurers to assess risk and personalize insurance offerings. As AI continues to advance, insurers may be able to offer more accurate and affordable coverage tailored to individual needs.

Conclusion: Your Journey to Affordable Car Insurance

Finding the cheapest car insurance is a journey that requires careful consideration of your specific circumstances and a thorough understanding of the insurance market. By following the expert strategies outlined in this guide, you can navigate the complex world of auto insurance with confidence and secure the most affordable coverage for your needs.

Frequently Asked Questions

What is the average cost of car insurance?

+The average cost of car insurance varies significantly depending on your location, driving history, and the coverage you choose. Nationally, the average annual premium for minimum liability coverage is approximately 500, while full coverage insurance can cost upwards of 1,500 per year.

How can I lower my car insurance costs if I have a poor driving record?

+If you have a poor driving record, you can still take steps to lower your insurance costs. Consider taking a defensive driving course, which may result in a discount. Additionally, focus on maintaining a clean driving record going forward to gradually reduce your premiums over time.

Are there any discounts available for young drivers?

+Yes, many insurance companies offer discounts for young drivers. These may include good student discounts, driver training course discounts, and discounts for good grades. Additionally, some insurers provide telematics programs specifically designed for young drivers to encourage safe driving habits.