Nevada Insurance License Lookup

The Nevada Division of Insurance (DOI) offers a convenient online platform for conducting an insurance license lookup, enabling individuals and businesses to verify the status and details of insurance professionals and entities operating within the state. This service is particularly useful for consumers seeking to ensure they are dealing with legitimate and properly licensed agents or brokers, as well as for businesses looking to partner with reputable insurance professionals.

In this comprehensive guide, we will delve into the intricacies of the Nevada Insurance License Lookup system, providing an in-depth analysis of its features, benefits, and the information it makes available to the public. By the end of this article, you will have a thorough understanding of how to navigate this valuable resource and the insights it can offer regarding the insurance landscape in Nevada.

Understanding the Nevada Insurance License Lookup System

The Nevada Insurance License Lookup platform is a publicly accessible database maintained by the DOI. It serves as a central repository of information on all insurance professionals and entities licensed to operate within the state. The system is designed to be user-friendly, allowing individuals with minimal technical expertise to conduct thorough searches and obtain the information they need.

The DOI regularly updates the license lookup database to ensure the information provided is current and accurate. This commitment to data integrity ensures that users can rely on the system as a trustworthy source for verifying insurance licenses and related details.

Key Features and Benefits

- Comprehensive Search Functionality: The license lookup platform offers a robust search function, enabling users to query the database using various criteria, including individual names, business names, license numbers, and more. This versatility ensures that users can easily find the specific information they require.

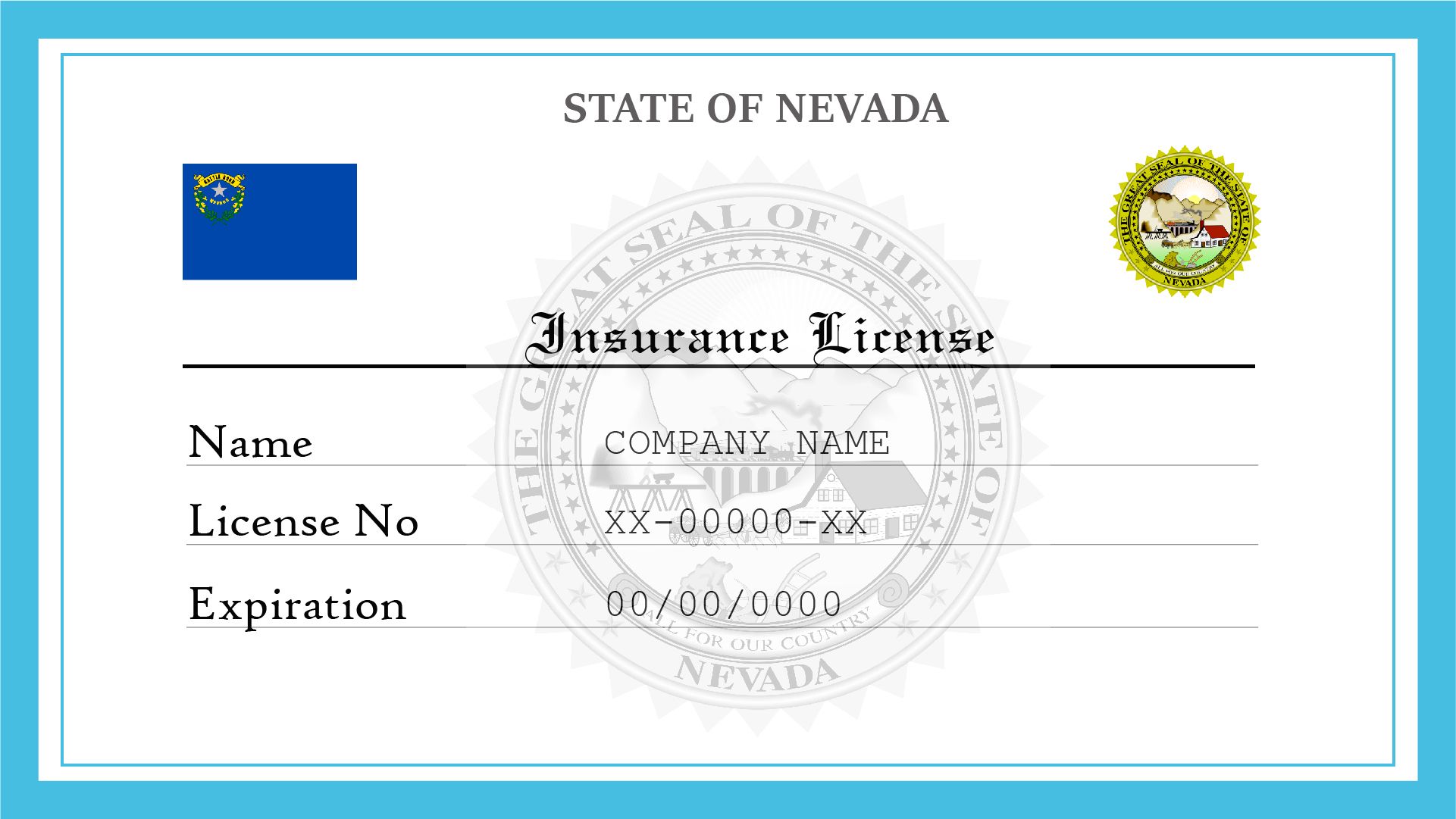

- Detailed License Information: Upon conducting a successful search, users are presented with a wealth of information related to the license holder. This includes basic details such as name, license type, and status, as well as more advanced information like appointment history, disciplinary actions, and education and training credentials.

- License Verification: One of the primary benefits of the license lookup system is its ability to verify the legitimacy and status of insurance licenses. Users can quickly determine whether a license is active, expired, or under suspension, providing valuable insight into the professional’s current standing.

- Public Protection: By making license information publicly available, the DOI empowers consumers and businesses to make informed decisions when engaging with insurance professionals. This transparency helps protect the public from unlicensed or unscrupulous individuals and ensures a fair and trustworthy insurance market.

- Easy Access and Convenience: The online nature of the license lookup platform means that users can access it from anywhere with an internet connection. This convenience eliminates the need for physical visits to government offices or lengthy wait times, making it a valuable resource for busy individuals and businesses.

Navigating the Nevada Insurance License Lookup Process

To ensure a smooth and successful license lookup experience, it’s important to understand the step-by-step process involved. Here’s a detailed breakdown of how to navigate the Nevada Insurance License Lookup platform:

Step 1: Access the License Lookup Platform

The first step is to access the official Nevada Insurance License Lookup website. You can do this by visiting the DOI’s website and navigating to the license lookup section, or by using a direct link provided by the DOI. This ensures that you are accessing the legitimate and secure platform.

Step 2: Choose Your Search Criteria

Once you’ve accessed the license lookup platform, you’ll be presented with a search interface. Here, you’ll have the option to choose from various search criteria, including:

- Individual Name Search: Enter the full name or partial name of the insurance professional you wish to look up.

- Business Name Search: Search for insurance entities or agencies by entering their business name.

- License Number Search: If you have the license number of the professional or entity, you can enter it directly to retrieve detailed information.

- Additional Search Options: Some advanced search options may include license type, appointment status, or geographic location.

Step 3: Conduct Your Search

After selecting your search criteria, click the “Search” or “Lookup” button to initiate the search. The platform will then query its database based on your chosen parameters.

Step 4: Review Search Results

Depending on the specificity of your search criteria, you may receive a list of search results. Review these results carefully to identify the specific license or entity you are looking for. If your search yields multiple results, you can further refine your search by adding additional criteria or adjusting your initial search terms.

Step 5: Access Detailed License Information

Once you’ve identified the correct license or entity in the search results, click on the corresponding link or button to access detailed information. This will take you to a dedicated page containing comprehensive details about the license holder.

Step 6: Review License Details

On the detailed license information page, you’ll find a wealth of data related to the license holder. This may include, but is not limited to:

- Basic Information: Name, address, license type, and status.

- License History: Appointment history, license issuance and expiration dates, and any license renewals.

- Disciplinary Actions: Any recorded disciplinary actions or complaints against the license holder.

- Education and Training: Details of the professional’s educational background and any relevant certifications or training completed.

- Appointment Information: Information about the insurance companies or entities the professional is currently appointed with, as well as their appointment history.

Step 7: Verify License Status and Details

After reviewing the detailed license information, you can verify the license holder’s current status and ensure that they are properly licensed and authorized to conduct insurance-related activities in Nevada. Pay close attention to the license status, which will indicate whether the license is active, expired, or under suspension.

Real-World Applications and Benefits

The Nevada Insurance License Lookup platform offers a range of practical applications and benefits for both consumers and businesses operating within the insurance industry. Here are some real-world scenarios where the license lookup system proves invaluable:

Consumer Protection

Consumers seeking insurance coverage can use the license lookup platform to verify the legitimacy and standing of insurance agents or brokers they are considering working with. This ensures that they are dealing with licensed professionals and helps protect them from potential fraud or unscrupulous practices.

Business Due Diligence

Insurance companies and other businesses looking to partner with insurance professionals can utilize the license lookup system to conduct thorough due diligence. By verifying the license status and history of potential partners, businesses can ensure they are aligning themselves with reputable and compliant individuals or entities.

License Renewal and Compliance

Insurance professionals themselves can benefit from the license lookup platform by using it to stay informed about their own license status and renewal requirements. By regularly checking their license details, professionals can ensure they remain compliant with state regulations and avoid any issues related to license expiration or suspension.

Public Awareness and Transparency

The public availability of insurance license information promotes transparency within the insurance industry. This transparency helps foster trust between consumers, businesses, and insurance professionals, leading to a more robust and fair insurance market in Nevada.

Conclusion: Empowering the Nevada Insurance Community

The Nevada Insurance License Lookup platform is a powerful tool that empowers consumers, businesses, and insurance professionals alike. By providing easy access to comprehensive license information, the DOI ensures that the insurance landscape in Nevada remains transparent, compliant, and trustworthy. Whether you’re a consumer seeking protection, a business conducting due diligence, or an insurance professional staying compliant, the license lookup system is an invaluable resource that enhances the overall integrity of the insurance industry in Nevada.

How often is the Nevada Insurance License Lookup database updated?

+The Nevada Insurance License Lookup database is updated on a regular basis to ensure the information provided is current and accurate. While the exact frequency of updates may vary, the DOI strives to maintain up-to-date records to provide reliable and timely information to users.

Can I verify the license status of an insurance professional from another state using the Nevada platform?

+No, the Nevada Insurance License Lookup platform is specific to professionals and entities licensed within the state of Nevada. To verify the license status of an insurance professional from another state, you would need to access the corresponding license lookup platform of that particular state.

What should I do if I find disciplinary actions against an insurance professional during my license lookup?

+If you discover disciplinary actions or complaints against an insurance professional during your license lookup, it is important to exercise caution. While disciplinary actions do not necessarily indicate fraudulent or illegal behavior, they may suggest potential red flags. It is advisable to thoroughly research the professional’s history and, if necessary, seek alternative insurance professionals to ensure a safe and reliable insurance experience.