Best Auto And Home Insurance

In the realm of financial protection, auto and home insurance are two essential pillars safeguarding individuals and their assets. These policies offer crucial coverage against unforeseen events, providing peace of mind and financial security. When it comes to selecting the best auto and home insurance, there are several key factors to consider. From comprehensive coverage options to competitive pricing, understanding the nuances of these policies is vital for making informed decisions.

Understanding Auto Insurance: Coverage and Benefits

Auto insurance is a fundamental aspect of responsible vehicle ownership. It provides financial protection in the event of accidents, theft, or other vehicle-related incidents. Here’s a closer look at the key components of auto insurance:

Liability Coverage

Liability insurance is a cornerstone of auto insurance policies. It covers the policyholder for bodily injury and property damage caused to others in an accident for which the insured is at fault. This coverage is essential for protecting against potentially devastating financial losses resulting from legal claims.

Collision and Comprehensive Coverage

Collision coverage pays for repairs or the replacement cost of the insured vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, provides protection for non-accident-related incidents such as theft, vandalism, natural disasters, or damage caused by animals. Both coverages are crucial for ensuring the financial well-being of policyholders.

Personal Injury Protection (PIP)

Personal Injury Protection is a vital component of auto insurance, offering medical coverage for the policyholder and their passengers, regardless of fault. PIP covers medical expenses, lost wages, and other related costs, providing essential financial support during times of need.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage protects policyholders against financial losses caused by drivers who either lack insurance or have insufficient coverage. This coverage is especially important for ensuring fair compensation in the event of an accident with an uninsured or underinsured driver.

Home Insurance: Protecting Your Most Valuable Asset

Home insurance is an indispensable tool for safeguarding one of life’s most significant investments - your home. It provides financial protection against a wide range of potential risks, offering peace of mind and stability.

Dwelling Coverage

Dwelling coverage is the cornerstone of home insurance policies, providing protection for the physical structure of the home. It covers the cost of repairing or rebuilding the home in the event of damage or destruction caused by covered perils, such as fire, windstorms, or vandalism.

Personal Property Coverage

Personal property coverage protects the policyholder’s belongings, such as furniture, electronics, and clothing, against damage or loss due to covered perils. This coverage is essential for replacing or repairing cherished possessions and maintaining a sense of security.

Liability Protection

Home insurance policies also include liability coverage, which protects the policyholder against financial losses resulting from accidents or injuries that occur on their property. This coverage is crucial for ensuring that homeowners are not held personally liable for such incidents.

Additional Living Expenses

In the event that a policyholder’s home becomes uninhabitable due to a covered peril, additional living expenses coverage provides financial support for temporary housing and other necessary expenses until the home is restored.

Key Considerations for Choosing the Best Auto and Home Insurance

When selecting auto and home insurance, several critical factors should be taken into account to ensure the best possible coverage and value:

Coverage Options and Limits

It’s essential to carefully review the coverage options and limits offered by different insurance providers. Ensure that the policy provides adequate protection for your specific needs, taking into account the value of your vehicle or home and any unique circumstances.

Competitive Pricing

While coverage is paramount, competitive pricing is also a crucial consideration. Compare quotes from multiple insurers to find the best value for your money. Keep in mind that the cheapest policy may not always offer the best coverage, so strike a balance between affordability and comprehensive protection.

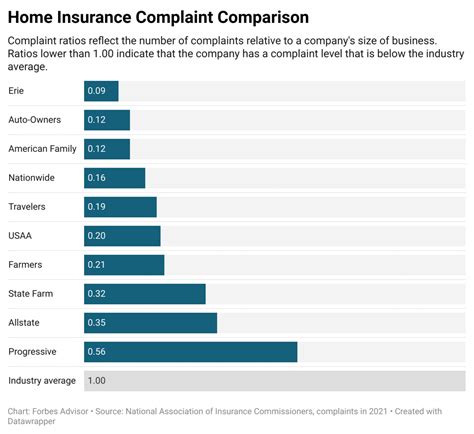

Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your overall insurance experience. Choose an insurer with a reputation for prompt, efficient, and fair claims processing. Positive customer reviews and industry ratings can provide valuable insights into an insurer’s performance in these areas.

Policy Flexibility and Personalization

Look for insurance providers that offer flexible and customizable policies. This allows you to tailor your coverage to your specific needs, ensuring that you’re not paying for unnecessary add-ons while still maintaining comprehensive protection.

Discounts and Rewards

Many insurance companies offer discounts and rewards programs to incentivize policyholders. These can include discounts for safe driving, multi-policy bundles, or loyalty programs. Take advantage of these opportunities to save money on your insurance premiums.

The Top Auto and Home Insurance Providers

Now, let’s explore some of the top auto and home insurance providers in the market, highlighting their unique features and benefits:

State Farm

State Farm is a leading insurance provider known for its comprehensive coverage options and exceptional customer service. They offer a wide range of auto and home insurance policies, including customizable coverage for specific needs. State Farm’s claims handling process is highly regarded, with a reputation for prompt and fair settlements.

Allstate

Allstate is another prominent player in the insurance industry, offering a suite of auto and home insurance products. They are known for their innovative approach to insurance, providing digital tools and resources to enhance the customer experience. Allstate’s Drivewise program rewards safe driving habits with discounts, making it an attractive option for conscientious drivers.

Progressive

Progressive is a forward-thinking insurance company that offers a wide range of auto and home insurance policies. They are particularly renowned for their competitive pricing and extensive coverage options. Progressive’s Name Your Price tool allows customers to set their desired coverage and price, providing a unique and flexible approach to insurance shopping.

Geico

Geico is a well-established insurance provider known for its affordable rates and comprehensive coverage. They offer a wide range of auto and home insurance policies, catering to various needs and budgets. Geico’s digital platform provides convenient access to policy management and claims filing, making it a preferred choice for tech-savvy individuals.

USAA

USAA is a highly regarded insurance provider that serves military members, veterans, and their families. They offer specialized auto and home insurance policies tailored to the unique needs of military personnel. USAA is known for its exceptional customer service and competitive rates, making it a top choice for those eligible for their services.

The Impact of Credit Score on Insurance Rates

It’s important to note that your credit score can significantly impact your insurance rates. Insurance providers often use credit-based insurance scores to assess the risk associated with insuring a policyholder. A higher credit score may result in lower insurance premiums, while a lower score could lead to higher rates. Maintaining a good credit score is, therefore, crucial for obtaining the best insurance rates.

Understanding Deductibles and Policy Exclusions

When selecting auto and home insurance policies, it’s essential to understand the concept of deductibles and policy exclusions. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Policy exclusions, on the other hand, are specific events or circumstances that are not covered by the insurance policy. Understanding these aspects is vital for making informed decisions about your coverage and potential out-of-pocket expenses.

Comparing Quotes and Bundling Policies

Comparing quotes from multiple insurance providers is a crucial step in finding the best auto and home insurance. Online quote comparison tools can make this process more efficient and convenient. Additionally, bundling your auto and home insurance policies with the same provider can often result in significant savings, so it’s worth considering this option when shopping for insurance.

The Role of Technology in Auto and Home Insurance

Technology is transforming the auto and home insurance industry, offering new opportunities for policyholders. Telematics devices, for instance, can track driving behavior and provide personalized insurance rates based on safe driving habits. Similarly, smart home technology can enhance home insurance coverage by providing real-time monitoring and early detection of potential hazards, leading to more efficient claims handling.

Future Trends in Auto and Home Insurance

The auto and home insurance landscape is evolving, driven by technological advancements and changing consumer needs. Here are some future trends to watch:

- Increased use of telematics and connected devices for personalized insurance rates.

- Growth of peer-to-peer insurance models, offering alternative insurance options.

- Expansion of usage-based insurance programs, rewarding safe driving and home maintenance practices.

- Integration of artificial intelligence and machine learning for more accurate risk assessment and claims processing.

- Enhanced focus on sustainability and green initiatives in insurance coverage.

Conclusion

Choosing the best auto and home insurance involves a careful evaluation of coverage options, pricing, customer service, and personalized needs. With a wide range of insurance providers offering competitive policies, it’s essential to compare quotes, understand policy details, and leverage technology for a seamless insurance experience. By staying informed and proactive, you can ensure comprehensive protection for your vehicles and homes, providing the financial security and peace of mind you deserve.

How much does auto insurance typically cost?

+The cost of auto insurance can vary widely depending on factors such as your location, driving history, and the type of vehicle you own. On average, you can expect to pay anywhere from 500 to 1,500 annually for basic liability coverage. However, comprehensive policies with additional coverage options can cost significantly more.

What factors influence home insurance rates?

+Home insurance rates are influenced by various factors, including the location and value of your home, the level of coverage you choose, and your claims history. Additionally, factors such as the age and condition of your home, as well as any security measures in place, can impact your insurance premiums.

Can I bundle my auto and home insurance policies for better rates?

+Yes, bundling your auto and home insurance policies with the same provider is often a cost-effective strategy. Many insurance companies offer multi-policy discounts, which can result in significant savings. Bundling also simplifies your insurance management, as you only have one provider to deal with for both policies.