Renter Insurance Companies

Renter insurance, often overlooked, is an essential aspect of financial planning for individuals living in rented accommodations. This comprehensive guide aims to shed light on the importance of renter insurance and the top companies offering this critical coverage. With a rising number of renters across the globe, understanding the nuances of renter insurance and the companies that provide it becomes increasingly vital.

The Importance of Renter Insurance

Renter insurance, or tenants insurance as it is sometimes known, is a form of property insurance that provides protection for individuals who do not own the property they live in. It offers coverage for personal belongings, liability protection, and additional living expenses in case of a covered loss. Unlike homeowner’s insurance, which is typically owned by the property owner, renter insurance is a necessity for anyone renting a home, apartment, or condominium.

The importance of renter insurance cannot be overstated. It safeguards your personal belongings, which can be costly to replace, in the event of a fire, theft, or other covered perils. Additionally, renter insurance provides liability protection, which can cover you if someone is injured in your home or if you accidentally cause damage to someone else's property. This type of insurance also covers additional living expenses if your rented home becomes uninhabitable due to a covered loss, ensuring you have the means to maintain your standard of living during the repair or rebuilding process.

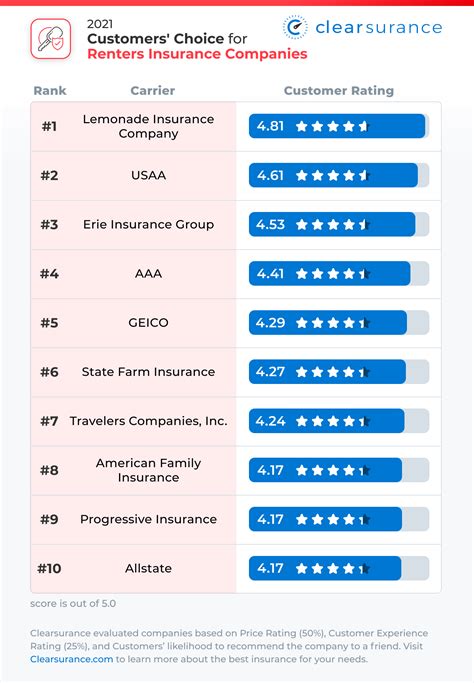

Top Renter Insurance Companies

When it comes to choosing a renter insurance company, it’s essential to select one with a strong reputation, financial stability, and comprehensive coverage options. Here are some of the top renter insurance companies:

1. State Farm

State Farm is a leading insurance provider in the United States, offering a wide range of insurance products, including renter insurance. They are known for their excellent customer service and comprehensive coverage options. State Farm’s renter insurance policies typically include personal property coverage, liability protection, and additional living expenses. They also offer discounts for bundling renter insurance with other policies, such as auto insurance.

2. Allstate

Allstate is another well-known insurance company that provides renter insurance policies. Their policies often include coverage for personal belongings, liability, and additional living expenses. Allstate also offers various discounts, such as the “Safe Tenant” discount for tenants who maintain a clean and safe living environment.

3. Liberty Mutual

Liberty Mutual is a global insurance company that offers renter insurance tailored to the needs of tenants. Their policies include personal property coverage, liability protection, and additional living expenses. Liberty Mutual also provides options for customized coverage, allowing renters to choose the limits and deductibles that best fit their needs and budget.

4. Progressive

Progressive is a renowned insurance provider that offers a simple and straightforward renter insurance policy. Their policies typically include personal property coverage, liability protection, and additional living expenses. Progressive also provides the option to add endorsements to customize your policy, such as coverage for high-value items like jewelry or fine art.

5. USAA

USAA is an insurance provider that caters specifically to military members, veterans, and their families. While their services are limited to this specific demographic, they offer comprehensive renter insurance policies. USAA’s renter insurance includes personal property coverage, liability protection, and additional living expenses. They are known for their excellent customer service and often provide discounts to members of the military community.

6. Farmers Insurance

Farmers Insurance is a leading insurance company that provides a range of insurance products, including renter insurance. Their policies typically include coverage for personal belongings, liability, and additional living expenses. Farmers Insurance also offers discounts for bundling renter insurance with other policies, such as auto or homeowners insurance.

7. Lemonade

Lemonade is a unique insurance company that operates primarily online. They offer a simple and tech-driven approach to renter insurance. Their policies include personal property coverage, liability protection, and additional living expenses. Lemonade stands out for its efficient claims process, often settling claims within minutes using artificial intelligence and machine learning.

| Company | Coverage Highlights |

|---|---|

| State Farm | Comprehensive coverage, excellent customer service, bundling discounts. |

| Allstate | Safe Tenant discount, personalized coverage options. |

| Liberty Mutual | Customizable coverage, global presence. |

| Progressive | Simple and straightforward policy, option for endorsements. |

| USAA | Tailored to military community, excellent customer service. |

| Farmers Insurance | Bundling discounts, comprehensive coverage. |

| Lemonade | Tech-driven claims process, efficient and innovative approach. |

Understanding Renter Insurance Policies

Renter insurance policies can vary significantly between insurance companies. Here’s a breakdown of some key components to consider when reviewing renter insurance policies:

Coverage Options

- Personal Property Coverage: This covers your personal belongings, such as furniture, electronics, and clothing, in case of theft, fire, or other covered perils.

- Liability Protection: Provides coverage if you are legally responsible for bodily injury or property damage to others.

- Additional Living Expenses: Covers the cost of temporary living arrangements if your rented home becomes uninhabitable due to a covered loss.

- Personal Liability Coverage: Protects you from lawsuits if someone is injured in your home or if you cause damage to someone else’s property.

Deductibles and Limits

Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles can result in lower premiums, so it’s essential to choose a deductible that aligns with your financial comfort level. Additionally, insurance policies often have coverage limits, which specify the maximum amount the insurance company will pay for a covered loss.

Endorsements and Riders

Some renter insurance policies allow you to add endorsements or riders to customize your coverage. These can include coverage for high-value items like jewelry, fine art, or musical instruments. They can also cover specific perils, such as flood or earthquake, which are typically not included in standard renter insurance policies.

Additional Benefits

Certain renter insurance companies offer additional benefits, such as identity theft protection, credit monitoring, or rental car reimbursement. These benefits can add significant value to your policy and provide extra peace of mind.

The Future of Renter Insurance

The renter insurance market is evolving, with a growing focus on technology and customer experience. Insurance companies are increasingly leveraging digital tools and artificial intelligence to streamline the insurance process, from quote generation to claims handling. This digital transformation is expected to continue, making renter insurance more accessible and efficient for tenants.

Additionally, as the sharing economy continues to grow, with platforms like Airbnb and VRBO becoming increasingly popular, renter insurance policies are adapting to cover short-term rentals and shared living spaces. This evolution in coverage ensures that renters in these unique living arrangements are not left vulnerable to potential losses.

As the renter insurance market evolves, it's crucial for tenants to stay informed about the latest coverage options and benefits. Regularly reviewing and updating your renter insurance policy ensures that you have the right level of protection for your specific needs and circumstances.

FAQs

How much does renter insurance cost?

+The cost of renter insurance can vary based on several factors, including the location of your rental property, the coverage limits you choose, and any additional endorsements or riders you add to your policy. On average, renter insurance policies can range from 15 to 30 per month. However, it’s essential to obtain quotes from multiple insurance companies to find the best rate for your specific needs.

What factors can impact the cost of renter insurance?

+Several factors can influence the cost of renter insurance, including the location of your rental property, the value of your personal belongings, the coverage limits you select, and any discounts you may be eligible for. For instance, if you live in an area with a higher crime rate or a higher risk of natural disasters, your insurance premiums may be higher. Additionally, if you have valuable possessions or require higher coverage limits, your premiums will likely increase.

Can I bundle renter insurance with other insurance policies?

+Yes, many insurance companies offer the option to bundle renter insurance with other policies, such as auto insurance or homeowners insurance. Bundling insurance policies can often result in significant discounts and simplified billing. It’s worth exploring bundling options to potentially save money and streamline your insurance coverage.

What should I do if I need to file a claim under my renter insurance policy?

+If you need to file a claim under your renter insurance policy, it’s important to contact your insurance company as soon as possible. Provide them with all the relevant details about the incident and any supporting documentation, such as photos or receipts. Your insurance company will guide you through the claims process and help you understand what is and is not covered under your policy.

How often should I review my renter insurance policy?

+It’s recommended to review your renter insurance policy annually or whenever your circumstances change significantly. Life events such as marriage, the acquisition of valuable possessions, or a change in your rental property can impact your insurance needs. Regularly reviewing your policy ensures that your coverage remains adequate and up-to-date.