Insurance Rates By State

Insurance rates, particularly auto insurance, can vary significantly from state to state in the United States. These variations are influenced by a multitude of factors, including state-specific regulations, demographics, and driving conditions. Understanding these disparities is crucial for consumers as it directly impacts their insurance costs and coverage options. This comprehensive analysis aims to delve into the intricate world of insurance rates by state, shedding light on the key factors that influence them and providing valuable insights for informed decision-making.

The Complex Landscape of Insurance Rates Across States

The United States presents a diverse landscape when it comes to insurance rates, with each state enacting its own set of regulations and standards. These regulations govern various aspects of insurance, from mandatory coverages to rate-setting methodologies, thereby influencing the overall cost of insurance for consumers.

Key Factors Shaping Insurance Rates

Several critical factors contribute to the variability of insurance rates across states. These include:

- State Regulations: Each state has its own insurance department that sets rules and regulations for the insurance industry. These regulations can dictate minimum coverage requirements, approved rate-setting methods, and even the types of discounts insurers can offer. For instance, some states may require insurers to use specific rating factors, while others may allow more flexibility.

- Population Density and Demographics: The population density and demographic makeup of a state can significantly impact insurance rates. More densely populated areas often experience higher rates of accidents and claims, leading to increased insurance costs. Additionally, factors like the average age of drivers, their driving experience, and the prevalence of certain age groups can influence rates.

- Weather and Natural Disasters: States prone to severe weather conditions or natural disasters often face higher insurance rates. Insurers consider the risk of property damage due to hurricanes, tornadoes, earthquakes, or floods when setting rates. For instance, coastal areas vulnerable to hurricanes typically have higher home insurance rates.

- Traffic and Road Conditions: The quality of roads, traffic congestion, and the overall driving environment can impact insurance rates. States with more congested roads and higher accident rates may see increased insurance costs. Similarly, states with harsh winters and icy road conditions may experience higher auto insurance rates.

- Crime Rates: Higher crime rates, particularly those involving vehicle theft or vandalism, can lead to increased insurance premiums. Insurers consider the risk of theft, vandalism, and other criminal activities when determining rates.

- Medical Costs: The cost of medical care varies across states, and this can influence insurance rates, especially for health and auto insurance. States with higher medical costs may see increased insurance premiums to cover these expenses.

A Comparative Analysis of Insurance Rates by State

To illustrate the variations in insurance rates across states, let’s examine some real-world examples:

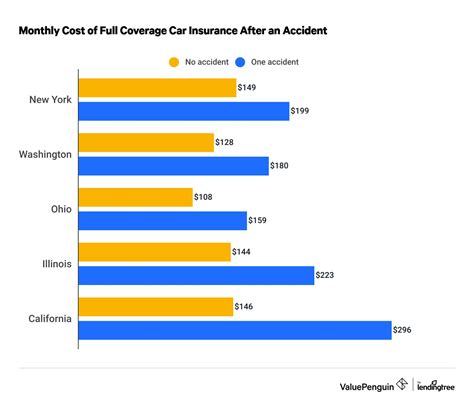

Auto Insurance Rates by State

| State | Average Annual Premium |

|---|---|

| Louisiana | 2,091</td> </tr> <tr> <td>Michigan</td> <td>2,168 |

| Florida | 1,730</td> </tr> <tr> <td>New York</td> <td>1,696 |

| Texas | $1,316 |

As seen above, the average annual premium for auto insurance varies significantly across these states. Louisiana and Michigan have the highest premiums, while Texas has the lowest.

Home Insurance Rates by State

| State | Average Annual Premium |

|---|---|

| Oklahoma | 2,287</td> </tr> <tr> <td>Louisiana</td> <td>2,219 |

| Florida | 2,167</td> </tr> <tr> <td>California</td> <td>1,477 |

| New York | $1,226 |

Home insurance rates also exhibit significant variations. Oklahoma and Louisiana have the highest average premiums, while New York has the lowest.

Health Insurance Rates by State

Health insurance rates can be influenced by various factors, including state-specific regulations and the cost of healthcare. While precise data on health insurance rates by state can be challenging to obtain due to privacy concerns, some states publish aggregate data. Here’s an example:

| State | Average Monthly Premium for Individual Plans |

|---|---|

| Massachusetts | 469</td> </tr> <tr> <td>New Hampshire</td> <td>478 |

| Connecticut | 485</td> </tr> <tr> <td>Rhode Island</td> <td>487 |

| Vermont | $491 |

The above data showcases the average monthly premium for individual health insurance plans in several Northeastern states. It’s important to note that health insurance rates can vary significantly within a state based on factors like age, location, and plan type.

The Impact of State-Specific Factors

State-specific factors play a pivotal role in shaping insurance rates. For instance, consider the state of California, known for its strict insurance regulations. The California Department of Insurance (CDI) imposes rigorous oversight on insurers, including mandatory minimum coverages and rate review processes. As a result, California often sees lower insurance rates compared to states with less stringent regulations.

On the other hand, states like Florida, which is prone to hurricanes and other natural disasters, typically experience higher insurance rates. The risk of property damage due to severe weather conditions drives up the cost of insurance. Similarly, states with higher crime rates or more congested roads may also see increased insurance premiums.

Tips for Navigating Insurance Rates by State

For consumers, understanding the insurance landscape in their state is crucial for making informed decisions. Here are some tips to navigate insurance rates by state:

- Research State-Specific Regulations: Familiarize yourself with the insurance regulations in your state. Understanding the minimum coverage requirements and any unique regulations can help you make more informed choices.

- Compare Multiple Quotes: Obtain quotes from several insurers to compare rates and coverage options. This can help you identify the best value for your insurance needs.

- Explore Discounts: Insurers often offer a variety of discounts, such as safe driver discounts, multi-policy discounts, or loyalty discounts. Check with insurers to see what discounts you may be eligible for.

- Consider Bundle Options: Bundling multiple insurance policies, such as auto and home insurance, can often lead to significant savings.

- Review Your Coverage Regularly: Insurance needs can change over time. Regularly review your coverage to ensure it aligns with your current needs and circumstances.

The Future of Insurance Rates by State

The insurance industry is continually evolving, and the landscape of insurance rates by state is no exception. Several emerging trends and factors are likely to shape the future of insurance rates:

- Advancements in Technology: Technological advancements, such as telematics and usage-based insurance, are transforming the insurance industry. These innovations allow insurers to gather more precise data on individual driving behavior, potentially leading to more personalized and accurate insurance rates.

- Changing Regulatory Landscape: The insurance regulatory environment is subject to change. New regulations or amendments to existing laws can significantly impact insurance rates. Staying informed about regulatory changes in your state is essential for understanding potential rate fluctuations.

- Climate Change and Natural Disasters: The increasing frequency and severity of natural disasters due to climate change may lead to higher insurance rates, particularly for property insurance. Insurers will need to adapt their rates and risk assessment models to account for these changing conditions.

- Population Shifts: Changes in population demographics and migration patterns can impact insurance rates. As certain areas become more populated or experience demographic shifts, insurance rates may adjust accordingly.

- Data Analytics and Predictive Modeling: Insurers are increasingly leveraging data analytics and predictive modeling to improve risk assessment and pricing. This can lead to more accurate and tailored insurance rates, benefiting both insurers and consumers.

Conclusion

Insurance rates by state present a complex and dynamic landscape influenced by a myriad of factors. Understanding these variations is essential for consumers to make informed decisions about their insurance coverage. By researching state-specific regulations, comparing quotes, and staying abreast of industry trends, consumers can navigate the insurance market effectively and find the best coverage at competitive rates.

Why do insurance rates vary so much between states?

+Insurance rates vary between states due to a combination of factors, including state regulations, demographics, weather conditions, traffic patterns, crime rates, and medical costs. Each state has its own set of regulations that govern insurance coverage and rates, which can significantly impact the overall cost of insurance.

How can I find the best insurance rates in my state?

+To find the best insurance rates in your state, it’s essential to compare quotes from multiple insurers. You can use online comparison tools or directly contact insurance providers to request quotes. Additionally, understanding your state’s insurance regulations and exploring available discounts can help you identify the most cost-effective coverage options.

Are there any states with consistently lower insurance rates?

+While insurance rates can fluctuate over time, certain states tend to have lower insurance rates on average. Factors such as lower population density, favorable weather conditions, and stricter insurance regulations can contribute to more affordable insurance rates. However, it’s important to note that individual circumstances and risk factors can still impact your specific insurance rates.

How do natural disasters affect insurance rates in a state?

+Natural disasters, such as hurricanes, tornadoes, or wildfires, can significantly impact insurance rates in affected areas. Insurers often increase rates to account for the increased risk of property damage and claims. Additionally, states prone to frequent natural disasters may have higher insurance rates overall to cover the potential costs associated with these events.

Can I negotiate my insurance rates with my provider?

+While insurance rates are primarily determined by risk factors and regulatory guidelines, it’s worth discussing your specific circumstances with your insurance provider. Some insurers may offer flexibility in certain situations, such as if you have a clean driving record or have implemented safety measures to reduce risks. However, it’s important to understand that insurance rates are largely predetermined and based on actuarial data.