Homeowners Insurance Premium

Homeowners insurance is a vital financial protection for millions of property owners across the United States. It provides coverage for various risks, from natural disasters to theft, offering peace of mind and a safety net in times of unexpected events. However, the cost of this protection can vary significantly, and understanding the factors that influence homeowners insurance premiums is crucial for making informed decisions about your coverage.

In this comprehensive guide, we delve into the intricacies of homeowners insurance premiums, exploring the key elements that impact your policy's cost. From the fundamental factors like location and property value to the less obvious considerations such as credit score and claims history, we aim to provide you with a detailed understanding of what influences your insurance rates. Additionally, we'll discuss strategies to potentially lower your premiums and offer insights into the future trends that may shape the cost of homeowners insurance.

Understanding the Basics of Homeowners Insurance Premium

At its core, the homeowners insurance premium is the cost you pay to an insurance company to secure coverage for your home and its contents. This premium is typically paid annually or semi-annually, and it provides financial protection against various perils, including fire, wind damage, theft, and liability claims.

The amount you pay for your homeowners insurance premium is determined by a multitude of factors, which we'll delve into in the following sections. Understanding these factors can help you make informed decisions when choosing an insurance policy and potentially identify areas where you can save on your premiums.

Location: A Key Determinant of Premium Costs

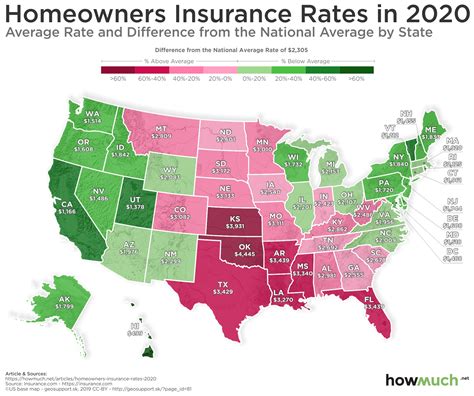

One of the most significant factors influencing homeowners insurance premiums is the location of your property. Insurance companies consider various geographic and environmental factors when assessing risk, which directly impacts the premium they charge.

Areas prone to natural disasters, such as hurricanes, tornadoes, or earthquakes, generally face higher insurance premiums due to the increased risk of damage. For instance, homes located along coastal regions vulnerable to hurricanes often pay significantly more for insurance coverage compared to those in inland areas.

| Location Type | Average Annual Premium |

|---|---|

| Coastal Regions | $2,500 - $5,000 |

| Urban Areas | $1,200 - $2,000 |

| Suburban/Rural Areas | $800 - $1,500 |

Beyond natural disasters, crime rates and the prevalence of theft or vandalism in an area can also affect insurance premiums. Urban areas with higher crime rates may result in higher insurance costs to cover potential property damage and liability risks.

The Impact of Property Value and Construction Type

The value of your home and the materials used in its construction are other critical factors that insurance companies consider when determining your premium.

Homes with higher replacement costs, typically due to their size, construction materials, or unique features, will generally have higher insurance premiums. For instance, a luxury home built with high-end materials and custom finishes will likely require a more extensive coverage plan and, consequently, a higher premium.

| Property Type | Average Annual Premium |

|---|---|

| Luxury Home | $3,000 - $6,000 |

| Standard Single-Family Home | $1,000 - $2,500 |

| Condominium/Apartment | $500 - $1,200 |

The construction type of your home also plays a role. Homes built with more resilient materials, such as brick or concrete, may qualify for lower insurance premiums compared to those constructed with less durable materials like wood.

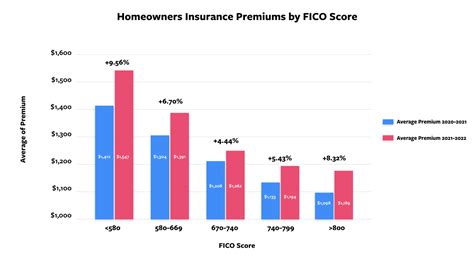

Credit Score and Its Surprising Influence on Premiums

Your credit score, a measure of your financial reliability, surprisingly also affects your homeowners insurance premium. Insurance companies use credit-based insurance scores to assess the risk of insuring a homeowner.

Individuals with higher credit scores are often seen as more responsible and less likely to file claims, leading to lower insurance premiums. On the other hand, those with lower credit scores may be charged higher premiums due to the perceived increased risk of claims.

| Credit Score Range | Average Annual Premium |

|---|---|

| Excellent (800+) | $800 - $1,200 |

| Good (700-799) | $1,000 - $1,500 |

| Fair/Average (600-699) | $1,200 - $1,800 |

The Role of Claims History and Personal Risk Factors

Your past claims history with insurance companies is another factor that can significantly impact your future homeowners insurance premiums.

If you've filed multiple claims in the past, even for minor incidents, insurance companies may view you as a higher risk and increase your premiums. Conversely, a long history of claim-free years can lead to lower premiums and potentially better rates.

Additionally, personal risk factors such as your age, marital status, and even your profession can affect your insurance premiums. For instance, younger individuals or those with high-risk occupations may face higher premiums due to perceived increased risk of accidents or claims.

Strategies to Lower Your Homeowners Insurance Premium

Understanding the factors that influence your homeowners insurance premium is the first step towards managing your costs effectively. However, there are also several strategies you can employ to potentially lower your premiums and save money on your insurance coverage.

Bundling Policies for Discounts

One of the most effective ways to reduce your homeowners insurance premium is by bundling it with other insurance policies, such as auto insurance or life insurance.

Many insurance companies offer multi-policy discounts when you combine multiple types of insurance under one provider. By bundling your policies, you can often save significantly on your overall insurance costs, including your homeowners insurance premium.

Increase Your Deductible

Another strategy to consider is increasing your deductible, which is the amount you pay out-of-pocket before your insurance coverage kicks in.

While this approach may require you to pay more in the event of a claim, it can lead to lower premiums. Insurance companies often offer reduced rates for higher deductibles, as it reduces their financial exposure and shifts more of the risk back to the policyholder.

Explore Discounts and Special Programs

Insurance companies often provide a range of discounts and special programs that can help reduce your homeowners insurance premium.

- Loyalty Discounts: Some insurers offer discounts to long-term customers as a way to reward their loyalty.

- Safety Features Discounts: Installing safety features like smoke detectors, security systems, or fire-resistant roofing can qualify you for discounts, as these features reduce the risk of claims.

- New Home Discounts: If you've recently purchased a new home, some insurers offer discounts for the first year of insurance.

- Senior Discounts: Older individuals, often with more stable financial situations and lower risk profiles, may qualify for senior discounts on their homeowners insurance.

Regularly Review and Shop Around

The insurance market is highly competitive, and rates can vary significantly between providers. It’s essential to regularly review your insurance coverage and shop around for the best rates.

Consider comparing quotes from multiple insurers to ensure you're getting the most competitive premium for your needs. Online insurance marketplaces can be a convenient way to compare rates from various providers in one place.

Future Trends in Homeowners Insurance Premiums

The cost of homeowners insurance is an ever-evolving landscape, influenced by a multitude of factors, from changing environmental conditions to advancements in technology and shifts in the insurance market.

Climate Change and Environmental Risks

One of the most significant trends impacting homeowners insurance premiums is the increasing frequency and severity of natural disasters due to climate change.

As extreme weather events become more common, insurance companies face growing claims costs, which can lead to higher premiums for homeowners. For instance, areas prone to wildfires, hurricanes, or severe storms may experience rising insurance costs to cover the increased risk of damage.

Advancements in Technology and Risk Assessment

Advancements in technology are also shaping the future of homeowners insurance premiums. Insurance companies are leveraging big data and predictive analytics to more accurately assess risk and price insurance policies.

For example, some insurers are using satellite imagery and advanced algorithms to assess the condition of roofs, which can impact the likelihood of water damage claims. This level of precision in risk assessment can lead to more tailored insurance premiums, offering benefits to both insurers and policyholders.

The Rise of Telematics and Usage-Based Insurance

Telematics, the technology that enables the collection and transmission of data from connected devices, is increasingly being used in the insurance industry.

In the context of homeowners insurance, telematics can provide real-time data on factors like home occupancy, energy usage, or even the presence of water leaks. This data can be used to offer usage-based insurance policies, where premiums are adjusted based on actual usage and risk exposure.

The Impact of Economic and Regulatory Changes

Economic factors and regulatory changes can also influence homeowners insurance premiums.

During economic downturns, insurance companies may face increased financial pressure, leading to higher premiums to maintain profitability. Conversely, a robust economy can provide more stability, potentially resulting in more competitive insurance rates.

Regulatory changes, such as updates to building codes or new environmental regulations, can also impact insurance premiums. For instance, stricter building codes may require homeowners to invest in more expensive construction materials, which can lead to higher insurance costs to cover the increased replacement value.

Conclusion: Navigating the Cost of Homeowners Insurance

Understanding the factors that influence homeowners insurance premiums is crucial for making informed decisions about your coverage and managing your costs effectively.

From the location of your home and its construction type to your credit score and claims history, each factor plays a role in determining your insurance premium. By being aware of these influences and employing strategies like bundling policies, increasing deductibles, and exploring discounts, you can potentially lower your premiums and save on your insurance costs.

Furthermore, staying informed about the future trends shaping the insurance industry, such as the impact of climate change, technological advancements, and economic fluctuations, can help you anticipate changes in your insurance costs and make proactive decisions about your coverage.

How often should I review my homeowners insurance policy and premiums?

+It’s a good practice to review your homeowners insurance policy and premiums annually, or whenever you experience significant life changes, such as a home renovation, marriage, or retirement. Regular reviews ensure that your coverage remains adequate and that you’re not overpaying for your insurance needs.

Can I negotiate my homeowners insurance premium with my insurer?

+While negotiating insurance premiums is not always possible, it’s worth discussing with your insurer. Highlight any improvements you’ve made to your home, such as security upgrades or fire-resistant materials, as these can potentially reduce your risk profile and lead to lower premiums.

What should I do if my homeowners insurance premium increases significantly?

+If your homeowners insurance premium increases significantly, it’s essential to understand the reason behind the hike. Contact your insurer to discuss the increase and inquire about any available discounts or alternatives. Consider shopping around for competitive quotes from other insurers to ensure you’re getting the best value for your insurance needs.

Are there any government programs or subsidies available to help reduce homeowners insurance premiums?

+Some states and local governments offer programs or subsidies to help reduce homeowners insurance premiums, particularly for low-income households or properties in high-risk areas. It’s worth researching and inquiring about these programs to see if you’re eligible for any financial assistance.