Average Cost Of Small Business Insurance

Small business insurance is a crucial aspect of risk management and financial protection for entrepreneurs and small business owners. Understanding the average costs associated with insuring your small business is essential for budgeting and ensuring you have adequate coverage. The cost of insurance can vary significantly depending on various factors, including the type of business, location, industry risks, and the coverage limits chosen. This comprehensive guide aims to provide an in-depth analysis of the average cost of small business insurance, covering different policy types, factors influencing premiums, and strategies to find the right coverage at an affordable price.

Understanding the Average Cost of Small Business Insurance

The average cost of small business insurance can be influenced by a multitude of factors, making it challenging to provide a precise figure without considering specific circumstances. However, it is important to note that the cost of insurance is not a one-size-fits-all proposition. Premiums can vary significantly based on the unique needs and characteristics of each business.

To provide a general idea, the average annual premium for small business insurance in the United States can range from a few hundred dollars to several thousand dollars. This wide range highlights the importance of understanding the specific factors that impact insurance costs for your business.

Factors Affecting Insurance Premiums

Several key factors play a significant role in determining the cost of small business insurance. These factors include:

- Business Type and Industry: Different industries have varying levels of risk. For instance, a construction business may face higher premiums due to the inherent risks associated with heavy machinery and potential accidents. On the other hand, a consulting firm might have lower premiums due to a generally lower risk profile.

- Location: The geographic location of your business can impact insurance costs. Areas with a higher risk of natural disasters, such as hurricanes or earthquakes, may have higher premiums. Additionally, crime rates and local regulations can also influence insurance rates.

- Coverage Limits: The amount of coverage you choose directly affects your premium. Higher coverage limits provide more protection but also result in increased costs. It's essential to strike a balance between adequate coverage and affordability.

- Claims History: Insurers consider your business's claims history when calculating premiums. A history of frequent claims may lead to higher premiums, as it indicates a higher risk of future claims.

- Deductibles: Choosing a higher deductible can reduce your premium. However, this means you'll pay more out of pocket if a claim occurs, so it's a trade-off between immediate savings and potential future costs.

Common Types of Small Business Insurance and Their Costs

Small businesses have various insurance options to choose from, each designed to address specific risks. Understanding the different types of insurance and their average costs can help you make informed decisions about your coverage needs.

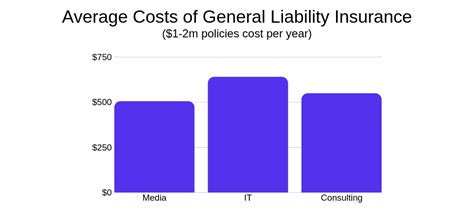

General Liability Insurance

General liability insurance is a fundamental coverage for most small businesses. It protects against third-party claims arising from bodily injury, property damage, or personal and advertising injury. The average cost of general liability insurance can vary, but for a small business with low risk, premiums typically range from 300 to 1,000 per year. Factors like the size of your business and the nature of your operations can influence this cost.

| Business Type | Average Annual Premium |

|---|---|

| Retail Store | $500–$1,200 |

| Consulting Firm | $300–$800 |

| Handyman Services | $600–$1,500 |

Professional Liability Insurance (Errors and Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is crucial for businesses providing professional services. It protects against claims of negligence, errors, or omissions in the services rendered. The cost of this insurance varies based on the nature of the profession and the coverage limits chosen. On average, professional liability insurance can range from 500 to 2,000 per year.

Product Liability Insurance

Product liability insurance is essential for businesses that manufacture, distribute, or sell products. It covers legal expenses and damages if a product causes harm or injury to a consumer. The cost of product liability insurance can be influenced by the type of product and the level of risk it poses. Premiums can range from 500 to 3,000 per year, with higher-risk products attracting higher premiums.

Workers’ Compensation Insurance

Workers’ compensation insurance is mandatory in most states for businesses with employees. It provides coverage for workplace injuries and illnesses. The cost of workers’ comp insurance is determined by the state’s rates, the nature of the work, and the number of employees. On average, premiums can range from 500 to 2,000 per employee annually.

Commercial Property Insurance

Commercial property insurance protects your business’s physical assets, such as buildings, equipment, and inventory, from damage or loss due to events like fire, theft, or natural disasters. The cost of this insurance depends on the value of the property and its location. Premiums can range from 500 to 5,000 per year or more for high-value properties.

Strategies to Find Affordable Small Business Insurance

Finding affordable small business insurance requires a strategic approach. Here are some tips to help you secure the right coverage at a reasonable cost:

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Shopping around and comparing quotes from multiple insurers is essential. Different insurers may have varying perceptions of risk and pricing strategies, so it’s beneficial to explore your options. Online insurance marketplaces and brokers can make this process more efficient.

Bundle Policies

Many insurance providers offer discounts when you bundle multiple policies. For instance, you can combine general liability, professional liability, and commercial property insurance into a single policy. This bundling can lead to significant savings, as insurers often provide a discount for multiple policies.

Consider Deductibles and Coverage Limits

Choosing higher deductibles can reduce your premium, but it’s important to find a balance that suits your financial situation. Additionally, carefully consider the coverage limits you require. Opting for lower limits can lower your premium, but it may not provide adequate protection in the event of a significant claim.

Improve Risk Management Practices

Implementing effective risk management strategies can make your business more attractive to insurers and lead to lower premiums. This includes implementing safety protocols, training employees, and maintaining a safe work environment. A good safety record can significantly impact your insurance costs.

Seek Professional Advice

Consulting with an insurance broker or agent who specializes in small business insurance can provide valuable insights. They can assess your unique needs, recommend appropriate coverage, and help you find the best rates. Their expertise can guide you toward making informed decisions about your insurance coverage.

Frequently Asked Questions

What is the average cost of small business insurance for a startup?

+For a startup, the average cost of small business insurance can vary widely depending on factors such as industry, location, and coverage needs. On average, startups can expect to pay between 500 and 2,000 annually for essential coverage like general liability and professional liability insurance.

Are there any ways to reduce the cost of small business insurance without compromising coverage?

+Yes, there are strategies to reduce insurance costs. These include choosing higher deductibles, implementing effective risk management practices, and exploring package deals or bundling policies. Additionally, regularly reviewing and adjusting your coverage to reflect your business’s changing needs can help optimize costs.

How do insurance companies determine the cost of small business insurance?

+Insurance companies assess various factors to determine the cost of small business insurance. These factors include the type of business, industry risks, location, claims history, coverage limits, and deductibles. Each insurer uses its own methodology to calculate premiums, taking into account these and other relevant factors.

Understanding the average cost of small business insurance is a crucial step in managing your business’s financial health and risk exposure. By considering the factors that influence premiums and exploring various coverage options, you can make informed decisions about your insurance needs. Remember, finding the right balance between cost and coverage is essential to protect your business’s future.