Life Insurance Policy

Life insurance is a fundamental aspect of financial planning, offering individuals and their families a crucial safety net in times of uncertainty. With a multitude of policy options available, understanding the nuances and implications of each is essential for making informed decisions. This comprehensive guide aims to delve into the world of life insurance, exploring its various types, key considerations, and the impact it can have on your financial well-being.

Navigating the Landscape of Life Insurance Policies

In the realm of financial protection, life insurance policies stand as a cornerstone, providing a safety net for individuals and their loved ones. The primary purpose of life insurance is to offer financial security and peace of mind, ensuring that beneficiaries are well-catered for even in the absence of the policyholder. The significance of life insurance lies in its ability to address potential financial challenges, such as covering outstanding debts, providing for dependents, or even funding retirement plans.

The landscape of life insurance is diverse, encompassing various policy types, each designed to cater to unique needs and circumstances. Understanding these variations is pivotal in selecting the most suitable coverage. From term life insurance, offering protection for a specified period, to whole life insurance, providing lifelong coverage with an added cash value component, the choices are numerous.

Additionally, riders and add-ons can further tailor policies to individual requirements. These enhancements can include options such as accelerated death benefits, which allow for access to a portion of the policy's death benefit while the insured is still alive, or waiver of premium, which waives premium payments if the insured becomes disabled.

Moreover, the role of life insurance extends beyond mere financial protection. It can also serve as a strategic tool for estate planning, ensuring the efficient transfer of assets and minimizing potential tax liabilities. For business owners, life insurance can be an integral part of business succession planning, providing funds for buyouts or covering key person risks.

In today's dynamic financial landscape, the relevance of life insurance remains undeniable. As economic conditions fluctuate and personal circumstances evolve, life insurance policies provide a stable foundation for financial security and peace of mind. By offering a comprehensive overview of life insurance, this guide aims to empower readers with the knowledge needed to navigate the complex world of financial protection, ultimately making informed decisions to safeguard their futures.

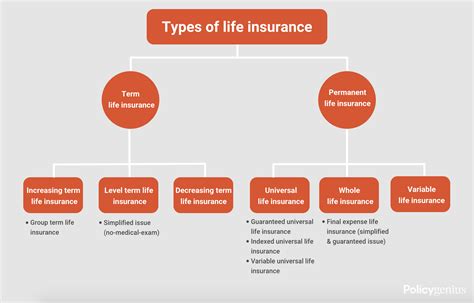

Types of Life Insurance Policies: Unveiling the Options

Life insurance policies come in various forms, each catering to different needs and financial goals. Understanding these variations is crucial for making informed decisions. Here’s an overview of the primary types of life insurance policies:

Term Life Insurance

Term life insurance is a straightforward and affordable option, offering coverage for a specified period, typically ranging from 10 to 30 years. During this term, the policyholder pays a fixed premium, and in the event of their death, the beneficiaries receive a lump-sum payout. Term life insurance is ideal for those seeking temporary coverage, such as covering mortgage payments or providing financial support for dependents during their formative years.

One of the key advantages of term life insurance is its cost-effectiveness. Since it provides coverage for a limited period, premiums are generally lower compared to other policy types. This makes it an attractive option for individuals with budget constraints or those looking for a basic level of protection.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers lifelong coverage with the added benefit of a cash value component. This type of policy combines insurance coverage with an investment element, allowing policyholders to build savings over time. The cash value can be accessed through loans or withdrawals, providing flexibility for various financial needs.

Whole life insurance is ideal for individuals seeking long-term financial protection and those who value the stability of guaranteed premiums and death benefits. The cash value component can also be used to pay premiums in later years, making it a suitable option for retirement planning.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that offers policyholders the ability to adjust premiums and death benefits over time. This flexibility allows individuals to customize their coverage based on changing financial circumstances. Universal life insurance policies also have a cash value component, similar to whole life insurance, which can be used for various financial needs or to reduce premiums.

One of the key advantages of universal life insurance is its adaptability. Policyholders can increase or decrease coverage amounts and premium payments, providing a level of control that aligns with their financial goals and priorities.

Variable Life Insurance

Variable life insurance is another form of permanent life insurance that offers policyholders the opportunity to invest a portion of their premiums in separate accounts, similar to mutual funds. These separate accounts are typically managed by professional investment managers, allowing policyholders to potentially earn higher returns compared to traditional life insurance policies.

Variable life insurance provides the potential for higher investment returns, but it also carries a higher level of risk. The policy's cash value and death benefit are tied to the performance of the underlying investments, meaning there is no guaranteed minimum return.

Riders and Add-Ons

In addition to the primary policy types, life insurance policies often come with the option of adding riders or add-ons. These enhancements can significantly customize a policy to meet specific needs. Some common riders include:

- Accelerated Death Benefit: This rider allows policyholders to access a portion of the death benefit while still alive, typically in the case of a terminal illness.

- Waiver of Premium: With this rider, premium payments are waived if the policyholder becomes disabled and unable to work.

- Long-Term Care Rider: This add-on provides coverage for long-term care expenses, ensuring financial support during extended periods of illness or disability.

- Spouse Coverage: Adding spouse coverage to a policy ensures that both partners are protected under the same plan, providing financial security for the entire family.

The availability and specific details of riders and add-ons may vary depending on the insurance provider and the policy type. It's essential to carefully review these options and understand their implications before making any decisions.

Key Considerations for Choosing the Right Life Insurance Policy

When navigating the complex world of life insurance, making informed decisions is crucial. Here are some key considerations to guide you in choosing the right life insurance policy:

Assessing Your Financial Needs

Start by evaluating your financial situation and identifying your specific needs. Consider factors such as your current and future income, outstanding debts, and the financial well-being of your dependents. Assess how much coverage you require to address these needs and ensure financial security for your loved ones.

For instance, if you have a mortgage, you might want to consider a policy that covers the outstanding balance, ensuring your family doesn't face the burden of a large debt in your absence. Similarly, if you have young children, you may opt for a policy that provides sufficient funds to cover their upbringing and education costs.

Understanding Policy Types

As mentioned earlier, life insurance policies come in various types, each with its own set of features and benefits. Term life insurance is ideal for temporary coverage, while whole life insurance offers lifelong protection with an investment component. Universal life insurance provides flexibility, and variable life insurance offers potential higher returns but carries increased risk.

Understanding the nuances of each policy type and how they align with your financial goals is essential. Consider factors such as the duration of coverage, premium payments, and the potential for cash value accumulation.

Evaluating Policy Riders and Add-Ons

Policy riders and add-ons can significantly enhance the value of your life insurance policy. These enhancements can address specific needs, such as providing coverage for long-term care expenses or ensuring the financial stability of your spouse.

Evaluate the availability and cost of riders that align with your priorities. For example, if you have a family history of chronic illnesses, a long-term care rider could be a valuable addition to your policy. Similarly, a waiver of premium rider can provide peace of mind by waiving premium payments if you become unable to work due to disability.

Considering Policy Flexibility

The financial landscape is dynamic, and your circumstances may change over time. Policy flexibility is a critical consideration when choosing a life insurance policy. Universal life insurance, for instance, allows you to adjust premiums and coverage amounts as your financial situation evolves.

Consider whether you need the ability to increase coverage in the future, such as during major life events like starting a family or purchasing a new home. Policy flexibility ensures that your life insurance remains aligned with your changing needs and financial goals.

Assessing Provider Reputation and Stability

When selecting a life insurance policy, it’s crucial to choose a reputable and financially stable insurance provider. Research the company’s reputation, financial strength, and customer satisfaction ratings. A stable provider ensures that your policy will remain in force and that claims will be paid out as promised.

Consider factors such as the provider's track record of paying claims, their financial health, and their customer service reputation. Reading reviews and seeking recommendations from trusted sources can provide valuable insights into the provider's reliability and service quality.

The Impact of Life Insurance on Financial Well-Being

Life insurance is more than just a financial product; it’s a cornerstone of financial security and peace of mind. The impact of life insurance extends far beyond the policy itself, influencing various aspects of your financial well-being and overall life planning.

Providing Financial Security for Dependents

One of the primary purposes of life insurance is to ensure the financial security of your dependents in the event of your untimely demise. Whether it’s covering outstanding debts, funding your children’s education, or providing a stable income for your spouse, life insurance ensures that your loved ones are well-catered for even in your absence.

For instance, a well-chosen life insurance policy can pay off your mortgage, ensuring your family doesn't lose their home. It can also provide funds for daily living expenses, allowing your dependents to maintain their standard of living and pursue their goals without financial strain.

Funding Retirement and Estate Planning

Life insurance can also play a significant role in funding your retirement and estate planning. Whole life insurance, with its cash value component, can be used to accumulate savings over time, providing a reliable source of funds for retirement. The death benefit can also be used to minimize potential tax liabilities and efficiently transfer assets to your beneficiaries.

By integrating life insurance into your retirement planning, you can ensure a stable income stream and maintain your desired standard of living throughout your golden years. Additionally, the tax advantages of life insurance can help preserve your estate's value and pass on more wealth to your heirs.

Covering Business Succession and Key Person Risks

For business owners, life insurance is an essential tool for business succession planning. It provides funds to buy out a partner’s share in the event of their death, ensuring business continuity and protecting the interests of all stakeholders.

Life insurance can also cover key person risks, providing financial support to the business in the event of the loss of a vital employee or executive. This ensures that the business can continue operations and mitigate potential financial setbacks.

Offering Peace of Mind and Financial Stability

Perhaps the most significant impact of life insurance is the peace of mind and financial stability it brings. Knowing that your loved ones are financially protected and that your financial goals are secured provides a sense of security and well-being. Life insurance allows you to focus on living your life to the fullest, knowing that your future is well-planned and protected.

The financial stability offered by life insurance extends beyond the immediate family. It can also provide support for extended family members, such as aging parents or siblings, ensuring they receive the care they need without burdening your dependents.

Conclusion: Navigating the Future with Financial Security

In the dynamic landscape of financial planning, life insurance stands as a beacon of stability and security. The journey towards financial well-being is paved with various considerations, and understanding the nuances of life insurance policies is a critical step. From assessing your financial needs to evaluating policy types and enhancements, each decision brings you closer to a future fortified by financial security.

Life insurance is not merely a financial product; it's a cornerstone of your overall life planning. It provides a safety net for your loved ones, ensures the continuity of your financial goals, and offers peace of mind in an uncertain world. By choosing the right life insurance policy, you empower yourself to navigate life's challenges with confidence, knowing that your future is well-protected.

As you embark on this journey, remember that life insurance is a dynamic tool that adapts to your evolving needs. Stay informed, seek expert advice, and regularly review your policy to ensure it remains aligned with your financial aspirations. With the right life insurance coverage, you can face the future with the assurance that your financial well-being is secure.

What is the average cost of life insurance?

+The average cost of life insurance can vary widely based on factors such as age, health, lifestyle, and the type of policy. Term life insurance is generally more affordable, with premiums starting as low as a few dollars per month for younger individuals. Whole life insurance, on the other hand, typically has higher premiums due to its lifelong coverage and cash value component. It’s essential to obtain quotes from multiple providers to find the most competitive rates.

Can I purchase life insurance if I have a pre-existing medical condition?

+Yes, individuals with pre-existing medical conditions can still purchase life insurance. However, the cost and coverage may be affected. Insurance providers typically require a medical exam and may impose additional exclusions or limitations based on your health status. It’s advisable to consult with an insurance professional who can guide you through the process and help you find the most suitable policy.

How often should I review my life insurance policy?

+It’s recommended to review your life insurance policy regularly, ideally every 3-5 years or whenever there are significant life changes. Life events such as marriage, the birth of a child, purchasing a new home, or changes in income can impact your insurance needs. Regular reviews ensure that your policy remains aligned with your current circumstances and financial goals.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage expires, and you may need to consider purchasing a new policy or exploring other options. Some term policies offer the option to convert to a permanent life insurance policy, which can provide lifelong coverage. It’s important to review your options and make decisions that align with your financial needs and goals.