Animal Health Insurance Plans

Welcome to the world of animal health insurance, a vital yet often overlooked aspect of pet ownership. As veterinary care advances and the costs associated with it rise, ensuring the long-term health and happiness of our furry companions has become increasingly important. This comprehensive guide aims to shed light on the ins and outs of animal health insurance plans, providing you with the knowledge to make informed decisions about your pet's healthcare.

Understanding Animal Health Insurance

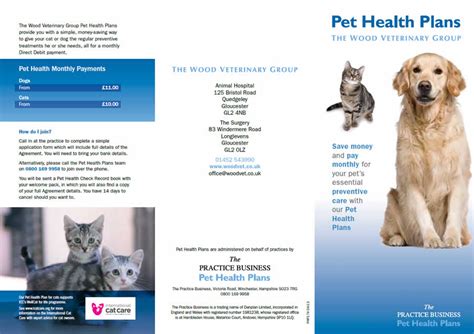

Animal health insurance operates on similar principles to human health insurance. It involves a contract between you, the policyholder, and an insurance company. You pay a premium, usually on a monthly basis, and in return, the insurance provider covers a portion or all of your pet’s medical expenses, depending on the policy terms.

These policies can cover a wide range of veterinary services, including routine check-ups, vaccinations, emergency treatments, surgeries, and even long-term conditions. The level of coverage varies significantly between providers and policies, which we will delve into later.

The Importance of Animal Health Insurance

The benefits of animal health insurance extend far beyond the financial aspect. Here are some key reasons why it’s an essential consideration for pet owners:

- Financial Protection: Veterinary care can be incredibly costly, especially for unexpected emergencies or chronic conditions. Insurance helps pet owners manage these expenses without breaking the bank.

- Early Detection and Prevention: Regular check-ups and screenings are often covered by insurance, allowing for the early detection of potential health issues. This can lead to more effective and less costly treatments.

- Peace of Mind: Knowing that your pet's health is protected can bring immense peace of mind. It allows you to focus on providing the best care without worrying about the financial burden.

- Enhanced Quality of Life: With insurance, pet owners can make decisions based on what's best for their animal's health, rather than what they can afford. This can lead to improved quality of life and a longer lifespan for your beloved companion.

Key Considerations for Choosing an Animal Health Insurance Plan

Selecting the right animal health insurance plan requires careful consideration of various factors. Here are some key elements to evaluate:

Coverage Options

Different insurance providers offer varying levels of coverage. Some policies may focus primarily on accident and illness, while others might include routine care and wellness treatments. Consider your pet’s age, breed, and any pre-existing conditions when evaluating coverage options.

It's crucial to review the policy's fine print to understand what's covered and what isn't. Some common exclusions may include pre-existing conditions, certain breeds with known genetic predispositions, and specific treatments or procedures.

Premiums and Deductibles

Premiums are the regular payments you make to maintain your insurance policy. These can vary significantly based on factors like your pet’s age, breed, location, and the level of coverage chosen. Higher coverage often comes with higher premiums.

Deductibles, on the other hand, are the out-of-pocket expenses you must pay before the insurance coverage kicks in. Policies with higher deductibles may have lower premiums, so it's essential to find the right balance for your budget.

Reimbursement Methods

Insurance providers offer different reimbursement methods. Some reimburse based on a percentage of the total bill, while others reimburse up to a certain limit. Understanding how reimbursements work is crucial, as it affects how much you’ll have to pay out of pocket.

Network of Veterinarians

Some insurance providers have networks of preferred veterinarians. If you choose an in-network vet, you may receive higher reimbursements or have lower out-of-pocket costs. However, if you prefer a specific veterinarian who is not in-network, you may have to pay more.

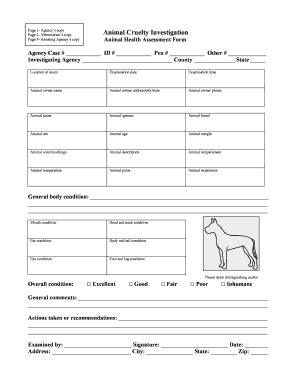

Customer Service and Claims Process

The claims process can be complex and time-consuming. Ensure that the insurance provider has a good reputation for customer service and a straightforward claims process. This can make a significant difference, especially during times of emergency.

Comparative Analysis of Leading Animal Health Insurance Providers

To help you navigate the vast array of animal health insurance providers, here’s a comparative analysis of some of the top companies in the industry.

Provider 1: Petplan

Coverage Options: Petplan offers comprehensive coverage for accidents, illnesses, and even hereditary conditions. Their policies cover a wide range of treatments, including emergency care, surgery, and ongoing medication. They also offer optional wellness coverage for routine care and preventative treatments.

Premiums and Deductibles: Premiums vary based on your pet's age, breed, and location. Deductibles start at $200, and you can choose from various reimbursement options, including 70%, 80%, or 90% coverage.

Reimbursement Methods: Petplan reimburses based on the actual veterinary bill, providing coverage up to the policy's limit. They offer a straightforward online claims process, with reimbursements typically within 5-7 business days.

Provider 2: Embrace Pet Insurance

Coverage Options: Embrace offers three main coverage options: accident and illness, accident-only, and wellness. Their accident and illness coverage is comprehensive, including hereditary and chronic conditions. The wellness plan covers routine care, vaccinations, and preventive treatments.

Premiums and Deductibles: Premiums are based on your pet's age, breed, and location. Deductibles are customizable, ranging from $0 to $1000, with higher deductibles leading to lower premiums. Reimbursement is based on the veterinary bill, and you can choose between 70%, 80%, and 90% coverage levels.

Reimbursement Methods: Embrace provides reimbursements based on the actual veterinary bill, with no maximum limits. Their claims process is digital, offering fast and efficient reimbursements typically within 10 days.

Provider 3: Healthy Paws

Coverage Options: Healthy Paws offers a single comprehensive plan that covers accidents, illnesses, and chronic conditions. Their policy includes coverage for alternative therapies like acupuncture and chiropractic care.

Premiums and Deductibles: Premiums are based on your pet's age, breed, and location. Deductibles are customizable, ranging from $50 to $500. Reimbursement is based on the actual veterinary bill, with no maximum limits.

Reimbursement Methods: Healthy Paws provides reimbursements based on the actual veterinary bill, with no maximum limits. Their claims process is digital, offering reimbursements within 5-10 business days.

Performance Analysis: Real-Life Case Studies

To further illustrate the impact of animal health insurance, let’s explore some real-life case studies.

Case Study 1: Emergency Surgery for a Cat

Luna, a 5-year-old domestic shorthair cat, suddenly became ill. After a visit to the vet, it was discovered that she had a severe blockage in her intestines requiring immediate surgery. The total cost of the emergency care and surgery amounted to $6,000.

With a Petplan policy in place, Luna's owner was reimbursed for 90% of the total bill, resulting in an out-of-pocket cost of only $600. This real-life example highlights the significant financial protection provided by animal health insurance.

Case Study 2: Long-Term Medication for a Dog

Max, a 7-year-old Golden Retriever, was diagnosed with a chronic kidney condition. His treatment plan included regular check-ups, blood tests, and lifelong medication. The annual cost of his care was estimated at $3,500.

Thanks to his Embrace Pet Insurance policy, Max's owner received reimbursements for the majority of these expenses, with only a small portion coming out of pocket. This case study emphasizes how insurance can help manage the costs of long-term conditions.

Case Study 3: Alternative Therapy for a Rabbit

Thumper, a 3-year-old rabbit, suffered from chronic pain due to arthritis. Traditional medications weren’t providing sufficient relief, so his owner opted for acupuncture treatment. The total cost of the acupuncture sessions was $800.

With a Healthy Paws policy that covered alternative therapies, Thumper's owner received full reimbursement for the acupuncture treatment, showcasing the benefits of a comprehensive insurance plan.

Future Implications and Trends in Animal Health Insurance

The animal health insurance industry is constantly evolving, with new trends and developments shaping the future of pet healthcare.

Telemedicine and Digital Innovations

The rise of telemedicine in human healthcare is now making its way into the pet world. Many insurance providers are incorporating digital tools and platforms to offer remote consultations and online claims processes. This trend is expected to continue, making veterinary care and insurance more accessible and efficient.

Focus on Preventative Care

There’s a growing emphasis on preventative care and wellness treatments in the animal health insurance industry. Providers are offering more comprehensive plans that include routine check-ups, vaccinations, and preventive treatments. This shift towards preventative care can lead to early detection of health issues and more effective long-term management.

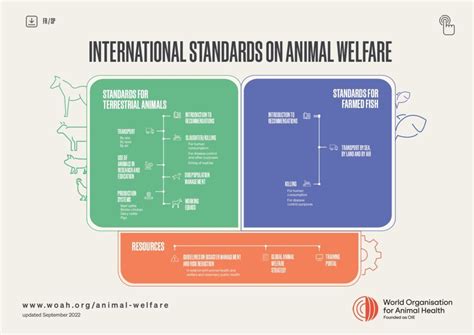

Specialty Insurance for Unique Pets

While dogs and cats are the most common pets insured, there’s a rising demand for insurance coverage for unique animals like birds, reptiles, and exotic species. Specialty insurance providers are emerging to cater to the specific needs of these pet owners, ensuring that all animals can receive the care they deserve.

Integration with Veterinary Technology

The integration of insurance with veterinary technology is an exciting development. Some insurance providers are now partnering with veterinary practices to streamline the claims process and offer real-time coverage verification. This integration can lead to faster reimbursements and a more seamless experience for pet owners.

Can I get insurance for my pet’s pre-existing condition?

+Most insurance providers exclude pre-existing conditions from coverage. However, some companies offer policies that can cover certain pre-existing conditions after a waiting period. It’s essential to carefully review the policy’s terms and conditions to understand what’s covered.

What’s the best age to get insurance for my pet?

+The best time to get insurance is when your pet is young and healthy. Premiums are generally lower for younger pets, and you can avoid the risk of being denied coverage due to pre-existing conditions as your pet ages.

How do I choose the right coverage level for my pet?

+The right coverage level depends on your pet’s age, breed, and any known health issues. It’s also a matter of personal preference and budget. Higher coverage levels usually come with higher premiums, so consider your financial situation and the potential risks your pet may face.

What happens if I switch insurance providers?

+When switching insurance providers, it’s essential to understand the new policy’s terms and conditions. Some providers may have waiting periods for certain conditions or may not cover pre-existing conditions. Ensure you thoroughly review the new policy to avoid any gaps in coverage.