Texas Marketplace Health Insurance

Welcome to this comprehensive guide on Texas Marketplace Health Insurance, where we delve into the intricacies of health insurance options available to Texans. In a state as diverse and expansive as Texas, understanding the health insurance landscape is crucial for individuals and families seeking affordable and comprehensive coverage. This article aims to provide an in-depth analysis, shedding light on the various plans, providers, and considerations unique to the Texas market.

Navigating the Texas Health Insurance Marketplace

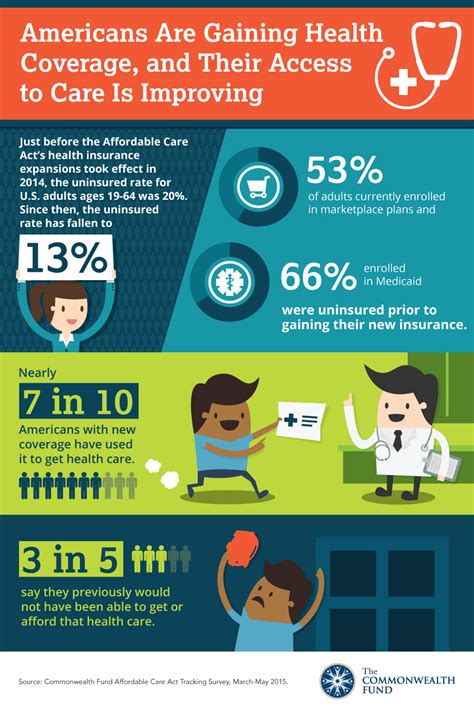

The Texas Health Insurance Marketplace, often referred to as the Affordable Care Act (ACA) Marketplace, is an online platform that allows residents to compare and enroll in health insurance plans. It serves as a vital resource for individuals and families who need assistance in finding affordable healthcare coverage. The marketplace offers a range of options, including plans from both private insurance companies and government-sponsored programs.

Texas, being the second most populous state in the nation, presents a unique challenge when it comes to healthcare coverage. With a diverse population and varying income levels, ensuring access to quality healthcare is a complex task. The Texas Marketplace aims to simplify this process by providing a centralized platform where consumers can shop for insurance plans based on their specific needs and budgets.

Key Features of the Texas Marketplace

The Texas Health Insurance Marketplace offers several key features that make it an essential tool for Texans seeking health insurance coverage:

- Plan Comparison: The marketplace provides a user-friendly interface where users can compare different health insurance plans side by side. This feature allows individuals to evaluate plans based on factors such as monthly premiums, deductibles, copays, and covered services.

- Financial Assistance: One of the primary advantages of the marketplace is the availability of financial assistance. Many Texans may qualify for subsidies or tax credits that can significantly reduce the cost of their health insurance premiums. The marketplace helps users determine their eligibility and applies these savings automatically during enrollment.

- Qualified Health Plans: The Texas Marketplace offers a wide range of Qualified Health Plans (QHPs) that meet the minimum standards set by the ACA. These plans cover essential health benefits, including hospitalization, emergency services, maternity care, and more. By choosing a QHP, Texans can rest assured that they are receiving comprehensive coverage.

- Enrollments and Open Enrollment Periods: The marketplace operates on a yearly enrollment cycle, with a specific Open Enrollment Period (OEP) for individuals to select or change their health insurance plans. It’s crucial for Texans to be aware of these deadlines to ensure they don’t miss out on coverage opportunities.

Understanding Texas Health Insurance Plans

Texas Marketplace offers a variety of health insurance plans to cater to the diverse needs of its residents. These plans can be broadly categorized into two main types: Metal Plans and Catastrophic Plans. Let’s explore each category in detail.

Metal Plans

Metal Plans, as the name suggests, are categorized based on their metal-themed names, such as Bronze, Silver, Gold, and Platinum. These plans are designed to offer different levels of coverage and cost-sharing between the insurer and the policyholder. Here’s a breakdown of each metal plan type:

| Metal Plan | Description |

|---|---|

| Bronze | Bronze plans typically have lower monthly premiums but higher deductibles and out-of-pocket costs. They are ideal for individuals who are generally healthy and don’t anticipate frequent medical expenses. |

| Silver | Silver plans strike a balance between premiums and out-of-pocket costs. They often include cost-sharing reductions, making them a popular choice for individuals who qualify for financial assistance. |

| Gold | Gold plans offer more comprehensive coverage with lower deductibles and out-of-pocket expenses. They are suitable for individuals with ongoing medical needs or those who prefer a more generous coverage option. |

| Platinum | Platinum plans provide the highest level of coverage with the lowest out-of-pocket costs. These plans are designed for individuals who require extensive medical care or have complex health conditions. |

Catastrophic Plans

Catastrophic plans are specifically designed for individuals under the age of 30 or those who qualify for a hardship exemption. These plans offer limited coverage for essential health benefits but can provide protection against high medical costs in the event of a severe illness or injury. Here are some key features of catastrophic plans:

- Lower Premiums: Catastrophic plans typically have lower monthly premiums compared to metal plans.

- High Deductibles: They come with significantly higher deductibles, meaning policyholders pay more out of pocket before the insurance coverage kicks in.

- Limited Coverage: These plans primarily cover essential health benefits and may have restrictions on other services.

Comparing Texas Health Insurance Providers

The Texas Marketplace features a range of insurance providers, each offering unique plans and coverage options. Here’s a glimpse at some of the prominent providers operating in the Texas market:

- Blue Cross Blue Shield of Texas (BCBSTX): BCBSTX is a leading provider in the state, offering a wide array of health insurance plans. They are known for their comprehensive coverage and network of healthcare providers.

- UnitedHealthcare: UnitedHealthcare provides a diverse range of plans, including employer-sponsored options and individual market plans. They have a strong presence in Texas and offer competitive pricing.

- Aetna: Aetna, a national insurer, offers various health insurance plans in Texas. Their plans often include access to a broad network of healthcare providers, making them a popular choice.

- Assurant Health: Assurant Health specializes in individual and family health insurance plans. They provide flexible coverage options and have a solid reputation for customer service.

Performance Analysis: Texas Marketplace Health Insurance

To evaluate the performance of Texas Marketplace health insurance plans, we can examine key metrics such as affordability, coverage quality, and customer satisfaction. Here’s a breakdown of our analysis:

| Metric | Evaluation |

|---|---|

| Affordability | The Texas Marketplace offers a range of plans with varying premium costs. With the availability of financial assistance, many Texans can find affordable coverage. However, it’s essential to consider the balance between premiums and out-of-pocket expenses to find the most cost-effective plan. |

| Coverage Quality | Texas Marketplace plans meet the minimum standards set by the ACA, ensuring that essential health benefits are covered. Metal plans, especially Silver and Gold, provide comprehensive coverage. Catastrophic plans, while limited, offer protection against high medical costs. |

| Customer Satisfaction | Customer satisfaction levels can vary based on individual experiences and the specific plan chosen. It’s crucial for Texans to research and compare plans, read reviews, and understand the terms and conditions to ensure a positive experience. |

Future Implications and Trends

The landscape of health insurance in Texas is continually evolving, influenced by various factors such as policy changes, market dynamics, and technological advancements. Here are some key trends and implications to consider:

- Telehealth Expansion: The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Many insurance providers are expanding their telehealth offerings, providing convenient access to healthcare services remotely.

- Value-Based Care: There is a growing focus on value-based care models, where providers are incentivized to deliver high-quality, cost-effective healthcare. This shift aims to improve patient outcomes and reduce overall healthcare costs.

- Healthcare Technology: Technological advancements, such as electronic health records (EHRs) and health information exchanges (HIEs), are enhancing the efficiency and coordination of healthcare services. These technologies can improve patient data accessibility and streamline administrative processes.

- Policy and Regulatory Changes: The Texas healthcare landscape is subject to ongoing policy and regulatory changes. Keeping up-to-date with these changes is crucial to understand how they may impact health insurance coverage and affordability.

Conclusion

Understanding the Texas Marketplace Health Insurance landscape is essential for Texans seeking affordable and comprehensive healthcare coverage. By exploring the various plan options, comparing providers, and staying informed about the latest trends, individuals can make informed decisions about their health insurance. The Texas Marketplace, with its user-friendly platform and financial assistance opportunities, serves as a valuable resource for residents to navigate the complex world of health insurance.

What is the Texas Health Insurance Marketplace?

+The Texas Health Insurance Marketplace, also known as the Affordable Care Act (ACA) Marketplace, is an online platform where Texans can compare and enroll in health insurance plans. It offers a range of options from private insurers and government-sponsored programs.

When is the Open Enrollment Period for the Texas Marketplace?

+The Open Enrollment Period for the Texas Marketplace typically runs from November 1st to December 15th each year. It’s important to note that Texans can also enroll outside of this period if they qualify for a Special Enrollment Period due to certain life events.

How can I determine if I’m eligible for financial assistance on the Texas Marketplace?

+Financial assistance eligibility is based on your household income. You can use the online eligibility tool on the Texas Marketplace website to determine if you qualify for subsidies or tax credits. Income thresholds vary, so it’s advisable to check your eligibility annually.

What are the key differences between Metal Plans and Catastrophic Plans?

+Metal Plans offer varying levels of coverage and cost-sharing, categorized as Bronze, Silver, Gold, and Platinum. Catastrophic Plans, on the other hand, are designed for individuals under 30 or those with hardship exemptions. They provide limited coverage but protect against high medical costs.