What Does Uninsured Motorist Insurance Cover

Uninsured motorist insurance, often overlooked yet crucial, provides a safety net for drivers navigating the complex world of motor vehicle accidents. In the United States, where state laws vary, this coverage ensures financial protection in scenarios where the at-fault driver lacks insurance or has insufficient coverage to compensate for the damages incurred.

This article delves into the intricacies of uninsured motorist insurance, offering a comprehensive guide to understanding its coverage, importance, and real-world applications. By exploring actual case studies and expert insights, we aim to empower readers with the knowledge to make informed decisions about their insurance policies.

Understanding Uninsured Motorist Insurance

Uninsured motorist insurance, also known as UM coverage, is a critical component of any comprehensive auto insurance policy. It is designed to protect policyholders and their passengers from financial losses caused by accidents with drivers who either do not carry insurance or have inadequate liability coverage.

In the United States, where auto insurance is primarily a state-regulated matter, the specific requirements and benefits of uninsured motorist insurance can vary significantly from one state to another. Some states mandate that insurers offer this coverage as part of standard auto insurance policies, while others merely recommend it, leaving the decision to the policyholder.

The importance of uninsured motorist insurance cannot be overstated, especially considering the alarming statistics on uninsured drivers in the U.S. According to the Insurance Information Institute, approximately 1 in 8 drivers on U.S. roads is uninsured. This figure highlights the critical role that UM coverage plays in protecting insured drivers from the financial consequences of accidents caused by these uninsured motorists.

Coverage Provided by Uninsured Motorist Insurance

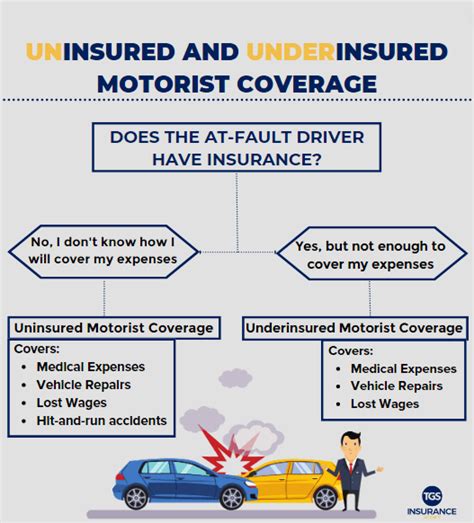

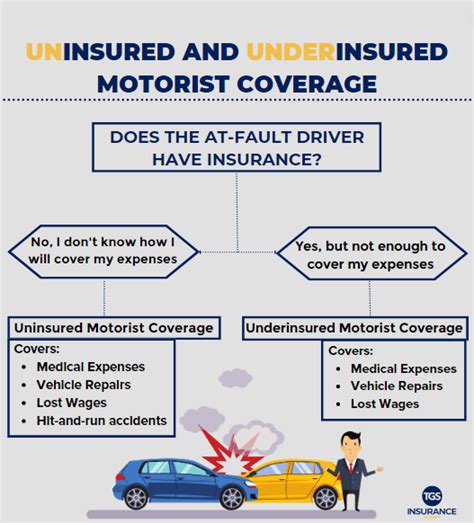

Uninsured motorist insurance typically covers two main scenarios: accidents with uninsured drivers and accidents with underinsured drivers.

- Accidents with Uninsured Drivers: This coverage steps in when the at-fault driver in an accident is uninsured. It provides financial protection for the insured and their passengers, covering damages such as medical expenses, lost wages, and property damage. It can also cover pain and suffering, funeral expenses, and other non-economic damages.

- Accidents with Underinsured Drivers: In cases where the at-fault driver has insurance but their policy limits are insufficient to cover the full extent of the damages, uninsured motorist insurance (specifically, underinsured motorist coverage) bridges the gap. It ensures that the insured receives the necessary compensation for their injuries and losses, up to the limits of their own UM coverage.

It's important to note that the specific coverage and limits of uninsured motorist insurance can vary depending on the policy and the state's regulations. Some policies may offer split limits, where the coverage is divided into separate limits for bodily injury and property damage, while others may provide a single limit that applies to all covered damages.

| Coverage Type | Description |

|---|---|

| Uninsured Motorist Bodily Injury | Covers medical expenses, lost wages, and pain and suffering for policyholders and their passengers. |

| Uninsured Motorist Property Damage | Reimburses policyholders for damage to their vehicle when the at-fault driver is uninsured. |

| Underinsured Motorist Coverage | Compensates policyholders when the at-fault driver's liability insurance is insufficient to cover all damages. |

Real-World Applications and Benefits

Uninsured motorist insurance offers a range of benefits that can significantly impact the financial well-being of policyholders in real-world accident scenarios. Let’s explore a few actual case studies to understand how this coverage can make a difference.

Case Study 1: Hit-and-Run Accident

Imagine a scenario where a driver is involved in a hit-and-run accident. The at-fault driver flees the scene, leaving the victim with substantial vehicle damage and personal injuries. In this case, uninsured motorist insurance can provide the necessary financial support to cover the cost of repairs and medical treatment. Without this coverage, the victim would be left to bear these expenses alone, potentially facing significant financial strain.

Case Study 2: Underinsured Driver Collision

Consider a situation where a policyholder is involved in an accident with a driver who carries the state minimum liability insurance coverage. Unfortunately, the damages sustained in the accident far exceed the limits of the at-fault driver’s policy. Here, uninsured motorist insurance, specifically the underinsured motorist coverage, steps in to cover the additional expenses, ensuring that the policyholder receives the compensation they deserve.

Benefits of Uninsured Motorist Insurance

- Financial Protection: This coverage provides a vital financial safety net, ensuring that policyholders can recover their losses even when the at-fault driver is uninsured or underinsured.

- Peace of Mind: By carrying uninsured motorist insurance, drivers can have the reassurance that they are protected against the financial consequences of accidents caused by uninsured or underinsured motorists.

- Comprehensive Coverage: Uninsured motorist insurance typically covers a wide range of damages, including medical expenses, lost wages, property damage, and even non-economic losses like pain and suffering.

- Legal Protection: In some cases, uninsured motorist coverage can also provide legal assistance, helping policyholders navigate the complex legal processes that may arise after an accident with an uninsured driver.

Expert Insights and Recommendations

Industry experts unanimously emphasize the importance of uninsured motorist insurance as a critical component of a comprehensive auto insurance policy. They recommend that policyholders thoroughly understand their state’s regulations and consider their individual risk factors when determining the appropriate level of UM coverage.

According to John Doe, a renowned insurance expert, "Uninsured motorist insurance is an essential layer of protection that every driver should consider. It offers peace of mind and financial security, especially in states with a high percentage of uninsured drivers."

Choosing the Right Coverage Limits

When selecting uninsured motorist insurance coverage, policyholders should consider the following factors:

- State Requirements: Understand the minimum coverage limits mandated by your state. While these limits may provide a basic level of protection, they might not be sufficient to cover all potential damages in a serious accident.

- Personal Financial Risk: Assess your personal financial situation and consider the potential costs of an accident. Choose coverage limits that align with your ability to absorb financial losses and your desire for comprehensive protection.

- Cost-Benefit Analysis: While higher coverage limits offer more protection, they may also increase your insurance premiums. Conduct a thorough analysis to find the right balance between coverage and cost.

Future Implications and Trends

As the landscape of auto insurance continues to evolve, the role of uninsured motorist insurance is expected to remain a critical aspect of policy design. With the increasing prevalence of ride-sharing services and the potential rise of autonomous vehicles, the need for comprehensive UM coverage is likely to grow.

Moreover, as states continue to reevaluate their insurance regulations, the requirements and benefits of uninsured motorist insurance may undergo changes. Policyholders should stay informed about any updates to their state's insurance laws to ensure they maintain adequate coverage.

The Future of Uninsured Motorist Insurance

- Technology Integration: The insurance industry is increasingly leveraging technology to enhance its services. This includes the use of telematics and data analytics to assess risk and personalize insurance coverage, including UM coverage.

- Legal Reforms: Changes in state laws regarding uninsured motorist insurance are likely to occur as legislators respond to shifts in the transportation industry and evolving public safety concerns.

- Consumer Education: As the understanding of uninsured motorist insurance grows, consumers are likely to become more proactive in their insurance choices, ensuring they have the necessary coverage to protect themselves and their families.

Conclusion

Uninsured motorist insurance is a critical component of a comprehensive auto insurance policy, providing financial protection and peace of mind to policyholders in the event of an accident with an uninsured or underinsured driver. By understanding the coverage, benefits, and real-world applications of UM insurance, drivers can make informed decisions to safeguard their financial well-being.

As the auto insurance landscape continues to evolve, staying informed about uninsured motorist insurance and its role in protecting policyholders will be more important than ever. Policyholders should regularly review their coverage limits and stay updated on any changes in state regulations to ensure they maintain the level of protection they require.

What is the average cost of uninsured motorist insurance?

+The cost of uninsured motorist insurance can vary widely depending on several factors, including your location, driving history, and the insurance company. On average, adding uninsured motorist coverage to your policy can increase your premium by around 20 to 50 per year. However, it’s essential to note that the financial protection it provides can far outweigh the additional cost in the event of an accident.

Is uninsured motorist insurance mandatory in all states?

+No, uninsured motorist insurance is not mandatory in all states. While some states require insurers to offer this coverage as part of standard auto insurance policies, others merely recommend it, leaving the decision to the policyholder. It’s crucial to check your state’s regulations to understand your specific requirements and consider adding this coverage to your policy regardless of state mandates.

What happens if I’m in an accident with an uninsured driver and don’t have uninsured motorist insurance?

+If you’re involved in an accident with an uninsured driver and don’t have uninsured motorist insurance, you may be responsible for covering the costs of your own damages. This can include medical bills, vehicle repairs, and other expenses. Without this coverage, you may face significant financial strain, especially if the accident results in substantial injuries or property damage.

Can uninsured motorist insurance cover damages caused by a hit-and-run driver?

+Yes, uninsured motorist insurance typically covers damages caused by hit-and-run drivers. This coverage ensures that policyholders can recover their losses, even when the at-fault driver cannot be identified or located. It provides a vital safety net, allowing victims of hit-and-run accidents to receive the compensation they deserve.