Instant Business Insurance Online

In today's fast-paced business world, obtaining insurance coverage is a crucial step for any enterprise, regardless of its size or industry. The process of acquiring insurance has traditionally been time-consuming and often requires extensive paperwork and back-and-forth communication with brokers or agents. However, the advent of instant online business insurance has revolutionized the way companies protect their operations, assets, and future.

This comprehensive guide delves into the world of instant business insurance, exploring its benefits, the types of coverage available, and the process of obtaining insurance online. We will also discuss the key considerations for businesses when selecting an online insurance provider and provide insights into the future of this rapidly evolving industry.

The Rise of Instant Online Business Insurance

The traditional method of purchasing business insurance involved extensive research, contacting multiple brokers, and waiting for quotes. This process could take days or even weeks, leaving businesses vulnerable to unforeseen risks and potential losses.

Enter instant online business insurance, a revolutionary concept that leverages technology to streamline the insurance procurement process. This innovative approach allows businesses to obtain coverage in a matter of minutes, providing them with the peace of mind they need to focus on their core operations.

Benefits of Instant Online Business Insurance

The advantages of instant online business insurance are multifaceted and offer significant value to modern enterprises.

- Speed and Efficiency: Perhaps the most significant benefit is the speed at which businesses can secure insurance coverage. With instant online platforms, companies can obtain quotes, compare options, and purchase policies within minutes, eliminating the need for lengthy delays.

- Cost Savings: Online insurance platforms often provide more competitive rates compared to traditional brokers. By cutting out the middleman and leveraging digital tools, these platforms can offer more affordable premiums, allowing businesses to allocate their resources more efficiently.

- Convenience: The ability to manage insurance needs from the comfort of one's office or home is a significant advantage. Business owners can access quotes, review policies, and make informed decisions without the hassle of physical meetings or lengthy phone calls.

- Flexibility: Instant online insurance platforms offer a wide range of coverage options, catering to the diverse needs of different industries. Whether a business requires general liability, professional indemnity, or specialized coverage, these platforms provide flexible solutions.

- Data-Driven Insights: Many instant online insurance platforms utilize advanced analytics and data-driven algorithms to assess risk and provide accurate quotes. This technology-driven approach ensures that businesses receive tailored coverage based on their unique circumstances, resulting in more efficient risk management.

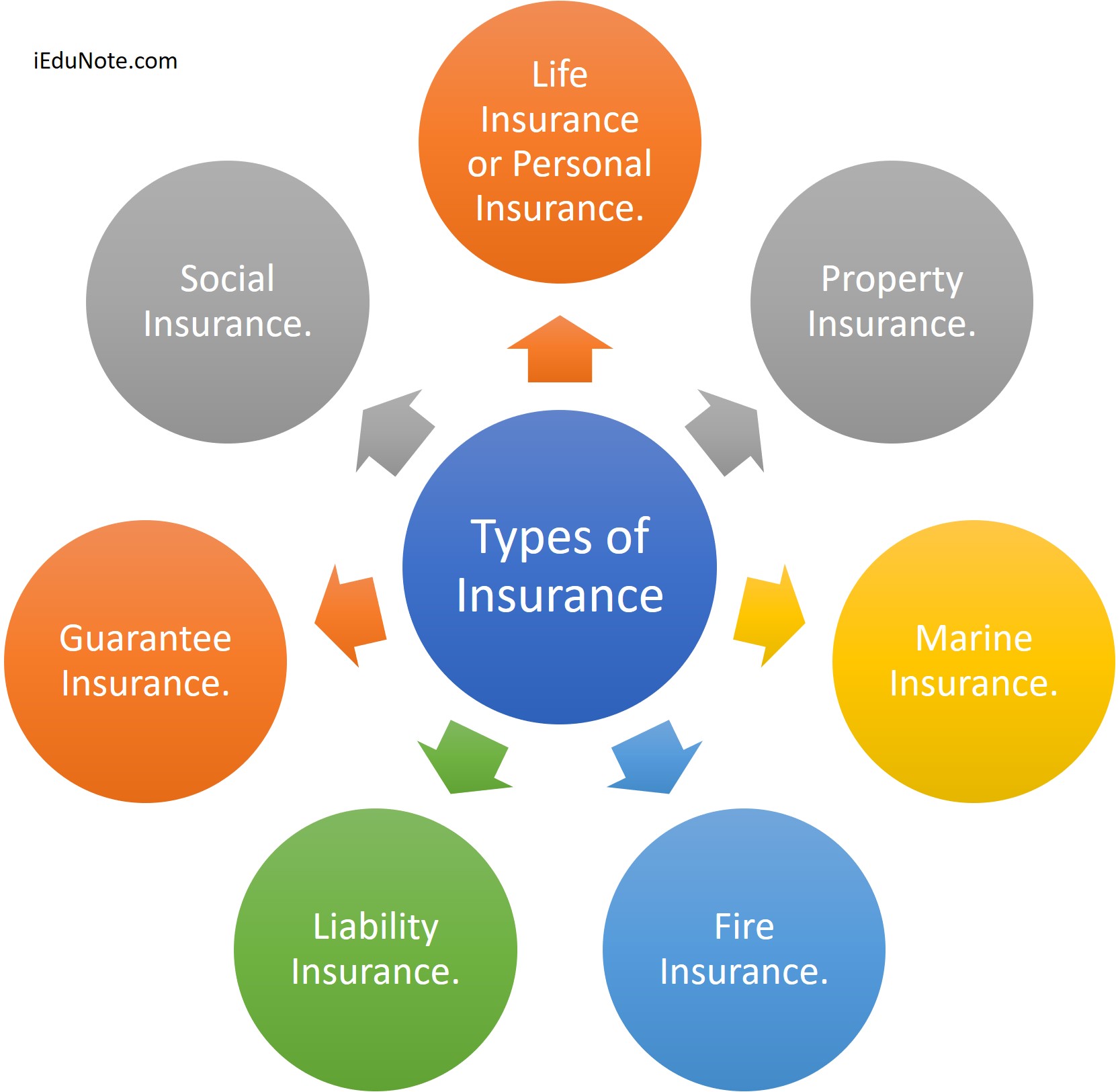

Understanding the Coverage Options

Instant online business insurance platforms offer a comprehensive range of coverage options to address the diverse needs of enterprises. Here’s an overview of some of the most common types of business insurance:

General Liability Insurance

General liability insurance is a fundamental coverage that protects businesses from various third-party claims, including bodily injury, property damage, and personal injury. This insurance is particularly crucial for businesses that interact directly with customers or have physical premises.

| Coverage Type | Description |

|---|---|

| Bodily Injury | Covers medical expenses and legal costs if a customer or visitor is injured on the business premises. |

| Property Damage | Provides coverage for damage caused to the property of others due to the business's operations. |

| Personal Injury | Protects against claims of slander, libel, or copyright infringement. |

Professional Liability Insurance (Errors & Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is essential for businesses that provide professional services. It protects against claims of negligence, errors, or omissions in the course of providing professional advice or services.

| Coverage Type | Description |

|---|---|

| Negligence Claims | Covers legal costs and damages if a client sues for professional negligence. |

| Errors and Omissions | Provides protection for mistakes or oversights that result in financial loss for the client. |

| Breach of Contract | Offers coverage if a client alleges that the business failed to fulfill its contractual obligations. |

Commercial Property Insurance

Commercial property insurance safeguards a business’s physical assets, including buildings, equipment, inventory, and furnishings. It provides financial protection in the event of damage or loss due to perils such as fire, theft, or natural disasters.

| Coverage Type | Description |

|---|---|

| Building Coverage | Protects the structure of the business premises, including repairs or rebuilding costs. |

| Business Personal Property | Covers the cost of replacing or repairing business-owned equipment, furniture, and inventory. |

| Business Interruption | Provides financial support during a temporary shutdown due to a covered loss, covering expenses and lost income. |

Business Interruption Insurance

Business interruption insurance is a critical coverage that helps businesses recover from financial losses incurred during a temporary shutdown. It provides a financial safety net to cover expenses and lost income during this period.

Product Liability Insurance

Product liability insurance is essential for businesses that manufacture, distribute, or sell products. It protects against claims of bodily injury or property damage caused by a defective product.

| Coverage Type | Description |

|---|---|

| Bodily Injury | Covers medical expenses and legal costs if a customer sustains an injury due to a defective product. |

| Property Damage | Provides coverage for damage to the property of others caused by a defective product. |

| Recall Expenses | Offers financial support for the cost of recalling and replacing defective products. |

The Process of Obtaining Instant Online Business Insurance

The process of acquiring instant online business insurance is straightforward and user-friendly. Here’s a step-by-step guide to help businesses navigate this process seamlessly:

Step 1: Choose a Reputable Online Insurance Platform

The first step is to select a trusted and reputable online insurance platform. Research and compare different providers based on their coverage options, customer reviews, and industry reputation. Look for platforms that offer a user-friendly interface and provide comprehensive support throughout the process.

Step 2: Provide Business Information

Once you’ve chosen a platform, you’ll be prompted to provide basic information about your business. This typically includes details such as the business name, address, nature of operations, and the number of employees. Accurate and detailed information is crucial to obtain an accurate quote.

Step 3: Select Coverage Options

The next step involves selecting the coverage options that align with your business’s unique needs. Most online platforms provide a range of customizable coverage packages, allowing you to choose the level of protection that suits your enterprise. Take the time to understand each coverage type and its benefits to make an informed decision.

Step 4: Receive Instant Quotes

After selecting your coverage options, the platform will generate instant quotes based on the information you’ve provided. These quotes will include the premium amounts, policy limits, and any applicable deductibles. Compare the quotes from different providers to ensure you’re getting the best value for your business.

Step 5: Review and Purchase

Once you’ve found the right coverage and provider, carefully review the policy terms and conditions. Ensure that the policy aligns with your expectations and provides the necessary protection. If satisfied, proceed with the purchase, and your insurance policy will be active immediately.

Key Considerations for Businesses

While instant online business insurance offers numerous benefits, there are a few key considerations for businesses to keep in mind when selecting an online insurance provider:

Reputation and Financial Stability

Ensure that the online insurance platform you choose has a solid reputation in the industry and is financially stable. Look for providers that have been in business for several years and have a track record of satisfying customer claims.

Customizable Coverage Options

Different businesses have unique insurance needs. Choose a platform that offers a wide range of customizable coverage options to ensure you can tailor your policy to your specific requirements.

Customer Support

Effective customer support is crucial when dealing with insurance matters. Select a platform that provides easy access to support staff, either through live chat, email, or phone. Having prompt and knowledgeable assistance can make a significant difference when managing insurance-related queries or claims.

Policy Flexibility

Consider platforms that offer flexible policy terms and the ability to make changes or additions to your coverage as your business grows or changes. This ensures that your insurance remains relevant and effective over time.

Online Reviews and Testimonials

Read online reviews and testimonials from other businesses that have used the platform. Real-life experiences can provide valuable insights into the quality of service, claim resolution processes, and overall customer satisfaction.

The Future of Instant Online Business Insurance

The instant online business insurance industry is evolving rapidly, driven by advancements in technology and changing consumer expectations. Here are some insights into the future of this dynamic sector:

AI and Machine Learning

Artificial intelligence (AI) and machine learning algorithms are expected to play an increasingly significant role in the insurance industry. These technologies can analyze vast amounts of data to provide more accurate risk assessments and personalized coverage recommendations, enhancing the efficiency and accuracy of the insurance procurement process.

Digital Transformation

The insurance industry as a whole is undergoing a digital transformation. Instant online insurance platforms are at the forefront of this change, leveraging technology to streamline processes, improve customer experiences, and enhance operational efficiency. As digital capabilities continue to advance, we can expect even more innovative solutions and improved accessibility.

Data-Driven Risk Management

With the proliferation of data analytics and predictive modeling, businesses can expect more accurate and data-driven risk management strategies. Insurance providers will utilize advanced analytics to identify emerging risks and develop tailored coverage solutions, ensuring businesses are adequately protected in an ever-changing landscape.

Expanded Coverage Options

As the business world becomes more diverse and complex, instant online insurance platforms will continue to expand their coverage options to meet the evolving needs of enterprises. This includes specialized coverage for emerging industries, such as technology startups, e-commerce businesses, and gig economy workers.

Seamless Integration with Existing Systems

Instant online insurance platforms will increasingly focus on seamless integration with existing business management systems. This integration will enable businesses to manage their insurance needs more efficiently, automating processes such as policy updates, claim submissions, and premium payments.

Enhanced Customer Experience

The customer experience will remain a top priority for instant online insurance providers. We can expect to see more intuitive platforms, improved user interfaces, and enhanced support options, ensuring that businesses can navigate the insurance landscape with ease and confidence.

How do I know if my business needs instant online insurance?

+Every business, regardless of size or industry, should consider insurance coverage. Instant online insurance is particularly beneficial for businesses that value speed, efficiency, and cost savings. It's ideal for startups, small businesses, and enterprises that want to streamline their insurance procurement process.

What happens if I need to file a claim with instant online insurance?

+Filing a claim with instant online insurance is typically a straightforward process. You'll need to provide details about the incident and any relevant documentation. The online platform will guide you through the claim process, and you'll receive updates and support from the provider as your claim is processed.

Can I customize my insurance policy after purchasing it online?

+Yes, many instant online insurance platforms offer policy customization even after purchase. You can often add or remove coverage options, adjust limits, or make other changes to ensure your policy remains aligned with your business's evolving needs.

Are there any additional fees associated with instant online business insurance?

+Some instant online insurance providers may charge additional fees for specific services, such as policy endorsements or claim processing. It's essential to review the terms and conditions of your policy to understand any potential fees. However, these fees are often lower compared to traditional insurance brokers.