Cheapest Driving Insurance

When it comes to driving, one of the most important considerations is finding affordable and comprehensive insurance coverage. The cost of car insurance can vary significantly depending on various factors, and finding the cheapest option that still meets your needs can be a challenge. In this comprehensive guide, we will delve into the world of driving insurance, exploring the key factors that influence premiums, comparing different policies, and providing expert tips to help you secure the most cost-effective coverage.

Understanding the Factors That Impact Insurance Premiums

The price of driving insurance is determined by a multitude of variables, each playing a crucial role in assessing the risk associated with insuring a particular driver. These factors can be broadly categorized into personal attributes, vehicle characteristics, and driving behavior.

Personal Attributes

Insurance providers carefully consider an individual’s age, gender, and marital status when calculating premiums. Generally, younger drivers tend to be associated with higher risk due to their relative inexperience on the road. As a result, insurance rates for teenagers and young adults can be significantly higher compared to more mature drivers.

Gender is another factor that insurance companies take into account. Historically, male drivers have been perceived as higher-risk due to their involvement in more accidents. However, this distinction is becoming less pronounced as insurance practices evolve to reflect more accurate risk assessments.

Marital status also influences insurance rates. Married individuals are often viewed as more responsible and mature, leading to lower premiums. This perception is based on the idea that married couples tend to exhibit safer driving behaviors and are more likely to take precautions to avoid accidents.

Vehicle Characteristics

The type of vehicle you drive is a significant determinant of insurance costs. Sports cars and high-performance vehicles, for instance, are generally more expensive to insure due to their higher risk of accidents and higher repair costs. On the other hand, smaller, more economical cars often come with lower insurance premiums.

The age and condition of your vehicle also play a role. Older vehicles may have lower insurance costs, especially if they are not considered high-value or have lower repair costs. Additionally, the safety features equipped in your car can impact insurance rates; vehicles with advanced safety systems may be eligible for discounts.

Driving Behavior

Your driving history and behavior are perhaps the most influential factors when it comes to insurance premiums. A clean driving record with no accidents or traffic violations is highly favorable and can lead to substantial discounts on your insurance policy.

Conversely, a history of accidents, especially those where you were at fault, can significantly increase your insurance rates. Similarly, receiving traffic citations for speeding or other violations can also result in higher premiums. Insurance companies closely monitor these indicators of driving behavior to assess the risk associated with insuring a particular driver.

Comparing Different Insurance Policies

Now that we have a better understanding of the factors that impact insurance premiums, let’s explore how to compare different policies to find the cheapest option that suits your needs.

Understanding Coverage Options

Insurance policies offer a range of coverage options, each with its own set of benefits and costs. It’s crucial to understand these options to make an informed decision. Here are some common coverage types and their implications:

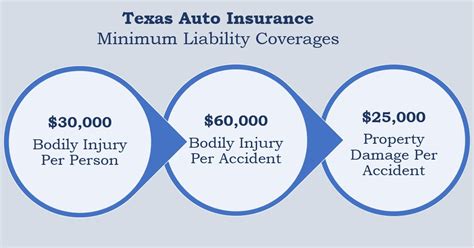

- Liability Coverage: This is the most basic form of insurance, covering damages to other people’s property or injuries to others if you are found at fault in an accident. It does not cover damage to your own vehicle.

- Collision Coverage: This coverage pays for repairs to your vehicle if you’re involved in an accident, regardless of fault. It typically comes with a deductible, which is the amount you pay out of pocket before your insurance kicks in.

- Comprehensive Coverage: Comprehensive insurance covers damages to your vehicle caused by events other than accidents, such as theft, vandalism, natural disasters, or collisions with animals. Like collision coverage, it usually has a deductible.

- Personal Injury Protection (PIP): PIP provides coverage for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault. It’s a crucial component of insurance, especially in states with no-fault laws.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Comparing Quotes from Multiple Providers

To find the cheapest insurance, it’s essential to compare quotes from multiple providers. Each insurance company uses its own formula to calculate premiums, so rates can vary significantly between providers. Here’s a step-by-step guide to comparing quotes:

- Obtain Quotes: Use online comparison tools or directly contact insurance companies to request quotes. Ensure you provide consistent information about your driving history, vehicle details, and desired coverage levels to get accurate quotes.

- Compare Premiums: Compare the annual premiums offered by each provider. Don’t forget to factor in any discounts that may be available, such as those for safe driving, multiple policies, or loyalty.

- Evaluate Coverage: Beyond just the price, assess the coverage limits and deductibles offered. Ensure the policy provides adequate coverage for your needs and that you understand any exclusions or limitations.

- Consider Reputation and Customer Service: Research the reputation of the insurance companies you’re considering. Look for reviews and ratings to gauge their reliability and customer satisfaction. Good customer service can be invaluable if you ever need to file a claim.

Tips for Securing the Cheapest Driving Insurance

While comparing quotes is essential, there are additional strategies you can employ to further reduce the cost of your driving insurance.

Improve Your Driving Record

One of the most effective ways to lower your insurance premiums is to maintain a clean driving record. Avoid accidents and traffic violations, as they can significantly increase your rates. If you have a less-than-perfect record, consider taking a defensive driving course. Many insurance companies offer discounts for completing such courses, and it can also help improve your driving skills.

Bundle Policies

If you have multiple vehicles or if you also need home or renters insurance, consider bundling your policies with the same provider. Many insurance companies offer multi-policy discounts, which can lead to substantial savings.

Raise Your Deductible

Increasing your deductible can significantly reduce your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you’re essentially taking on more financial responsibility in the event of an accident, which can lead to lower premiums.

Choose a Safer Vehicle

The type of vehicle you drive can have a significant impact on your insurance rates. Sports cars and high-performance vehicles tend to be more expensive to insure due to their higher risk of accidents and more costly repairs. Opting for a safer, more economical car can lead to lower insurance premiums.

Explore Discounts

Insurance companies offer a variety of discounts to their customers. Some common discounts include safe driver discounts, good student discounts (for young drivers with good grades), loyalty discounts, and discounts for having certain safety features in your vehicle, such as anti-lock brakes or air bags. Be sure to ask your insurance provider about any discounts you may be eligible for.

Maintain a Good Credit Score

Believe it or not, your credit score can also impact your insurance premiums. Many insurance companies use credit-based insurance scores to assess risk and set premiums. Maintaining a good credit score can help you secure lower insurance rates. If you have a lower credit score, consider taking steps to improve it, such as paying bills on time and reducing debt.

Future Implications and Considerations

As the insurance industry continues to evolve, several trends and developments are shaping the landscape of driving insurance. Here are some key considerations for the future:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is becoming increasingly common. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, offer premiums based on real-time driving data. This technology can reward safe drivers with lower premiums, while also providing insurers with more accurate risk assessments.

Advancements in Vehicle Safety

The continuous development of advanced driver-assistance systems (ADAS) and autonomous driving technologies is expected to have a significant impact on insurance rates. As these systems become more sophisticated and widespread, they are likely to reduce the frequency and severity of accidents, leading to lower insurance premiums over time.

Data Analytics and Personalized Pricing

Insurance companies are leveraging big data and analytics to develop more personalized pricing models. By analyzing vast amounts of data, insurers can identify specific risk factors and offer tailored insurance products. This trend is expected to lead to more accurate and fair pricing for individual policyholders.

The Rise of Insurtech

Insurtech companies are disrupting the traditional insurance industry with innovative technologies and business models. These startups are often more agile and customer-centric, offering digital-first experiences and potentially more competitive pricing. As the insurtech sector continues to grow, it may drive greater competition and further reduce insurance costs.

Regulatory Changes and Industry Standards

The insurance industry is heavily regulated, and changes in legislation can impact the cost and availability of coverage. Keep an eye on any proposed or enacted regulatory changes in your region that may affect driving insurance. Additionally, industry standards and guidelines, such as those related to claims handling or fraud prevention, can also influence insurance practices and pricing.

How often should I review my insurance policy to ensure I’m getting the best rates?

+It’s recommended to review your insurance policy annually, especially when your policy is up for renewal. This allows you to compare rates and coverage options with other providers to ensure you’re still getting the best deal. Additionally, any significant life changes, such as getting married, buying a new car, or moving to a different area, should prompt a review of your insurance needs and potential savings.

Can I get car insurance without a license or a car?

+While it’s possible to purchase liability-only insurance without a car, most insurance companies require you to have a valid driver’s license to obtain a policy. Some companies may offer limited coverage for individuals who don’t own a vehicle, such as non-owner liability insurance, which can be useful for rideshare drivers or those who frequently rent cars.

What is the difference between comprehensive and collision coverage?

+Comprehensive coverage provides protection for damages to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. Collision coverage, on the other hand, covers damages to your vehicle if you’re involved in an accident, regardless of fault. Both coverages typically come with deductibles, and the choice between them depends on your vehicle’s value, driving habits, and personal risk tolerance.