Florida Marketplace Insurance

In the vast landscape of healthcare, understanding insurance options is crucial, especially when navigating the unique healthcare system of Florida. This guide aims to demystify Florida Marketplace Insurance, providing a comprehensive overview to assist individuals and families in making informed decisions about their healthcare coverage.

Unraveling Florida Marketplace Insurance

Florida Marketplace Insurance, also known as the Florida Health Insurance Marketplace, is a vital component of the state’s healthcare infrastructure. Established under the Affordable Care Act (ACA), this marketplace serves as a platform for Floridians to compare and enroll in qualified health plans. It offers a range of insurance options, providing coverage for medical services and treatments, ensuring residents have access to essential healthcare services.

The Florida Health Insurance Marketplace is particularly significant as it caters to the diverse healthcare needs of the state's population, offering plans that comply with federal guidelines while allowing for customization to suit individual and family requirements. This marketplace plays a pivotal role in ensuring that residents have access to affordable, comprehensive healthcare, promoting overall health and well-being across the state.

Understanding Plan Options

Florida Marketplace Insurance offers a spectrum of plan options, each designed to cater to specific healthcare needs and preferences. These plans can be broadly categorized into:

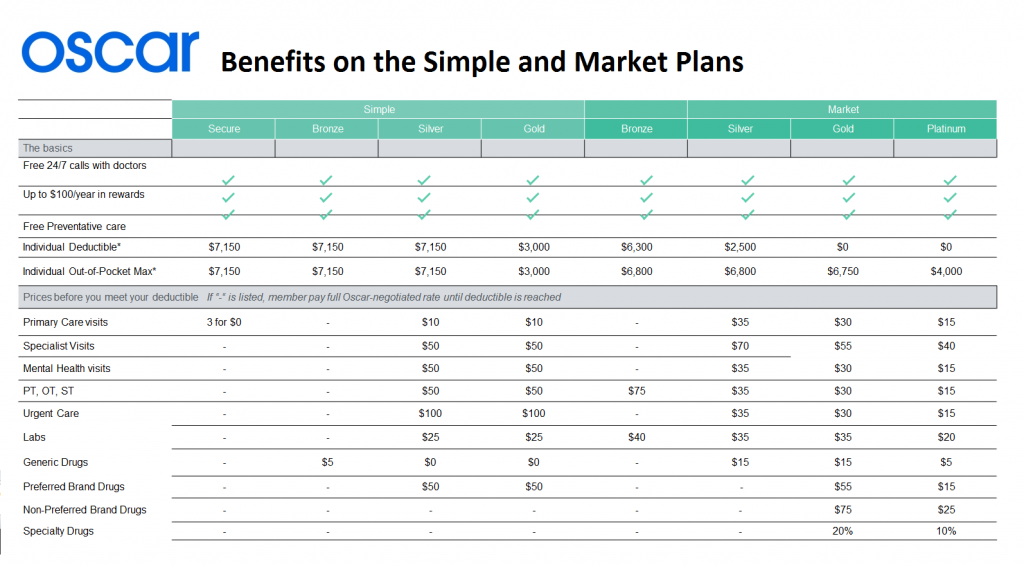

Bronze Plans

Bronze plans are known for their lower premiums, making them an attractive option for those on a tight budget. However, these plans typically come with higher deductibles and out-of-pocket costs. They are ideal for individuals who anticipate minimal healthcare needs or those who can afford to pay more out-of-pocket when needed.

Silver Plans

Silver plans strike a balance between premiums and out-of-pocket costs. They are a popular choice as they offer a reasonable monthly premium while still providing a good level of coverage. Silver plans are suitable for individuals and families who anticipate a moderate level of healthcare usage.

Gold Plans

Gold plans are renowned for their comprehensive coverage, offering lower out-of-pocket costs and higher premiums. These plans are designed for individuals and families who anticipate frequent doctor visits, require specialized care, or have chronic health conditions. The higher premiums of gold plans are often offset by reduced financial burdens when accessing healthcare services.

Platinum Plans

Platinum plans are the most expensive in terms of premiums but offer the lowest out-of-pocket costs. They are tailored for individuals with significant healthcare needs, providing extensive coverage for a wide range of medical services. Platinum plans are ideal for those who prioritize comprehensive coverage and are willing to pay higher premiums for peace of mind.

| Plan Type | Premium Range | Out-of-Pocket Costs | Suitability |

|---|---|---|---|

| Bronze | Lowest | Highest | Budget-conscious, minimal healthcare needs |

| Silver | Moderate | Moderate | Moderate healthcare usage |

| Gold | Higher | Lower | Frequent healthcare needs, specialized care |

| Platinum | Highest | Lowest | Extensive healthcare needs, comprehensive coverage |

Key Considerations for Enrollment

When navigating Florida Marketplace Insurance, several factors should be taken into account to ensure you choose the right plan for your healthcare needs:

Healthcare Usage: Evaluate your past and anticipated healthcare usage. If you anticipate frequent doctor visits or require specialized care, consider plans with lower out-of-pocket costs.

Prescription Needs: If you rely on prescription medications, ensure your plan covers these adequately. Some plans may offer better coverage for prescriptions, which can significantly impact your overall healthcare costs.

Network Providers: Check the network of providers associated with each plan. Ensure that your preferred doctors, specialists, and hospitals are in-network to avoid unexpected costs.

Dental and Vision Coverage: Consider whether you require dental and vision coverage. Some plans offer these as add-ons, allowing you to customize your coverage to your specific needs.

Financial Assistance: Explore the financial assistance options available through the marketplace. Income-based subsidies can make healthcare more affordable, ensuring you get the coverage you need without straining your finances.

Navigating Open Enrollment

The Open Enrollment Period for Florida Marketplace Insurance is a crucial time for residents to review their healthcare coverage and make changes as needed. This period typically occurs annually, offering a window of opportunity to enroll in a new plan or make adjustments to an existing one.

During Open Enrollment, it's essential to thoroughly review your current plan and assess whether it still meets your healthcare needs. Life changes such as marriage, the birth of a child, or a significant change in income can impact the suitability of your current plan. It's also a time to compare new plans and explore potential savings or additional benefits that may be available.

The Open Enrollment Period is a busy time on the Florida Health Insurance Marketplace website. To ensure a smooth experience, it's advisable to start your research and comparison early. This allows you to make informed decisions without feeling rushed. Consider seeking the assistance of a healthcare navigator or broker who can guide you through the process and answer any questions you may have.

Remember, failing to enroll or make changes during the Open Enrollment Period can result in being locked into your current plan for another year, unless you qualify for a Special Enrollment Period due to a qualifying life event. Therefore, it's important to mark the Open Enrollment dates in your calendar and stay informed about any changes or updates to the marketplace.

Utilizing Marketplace Resources

The Florida Health Insurance Marketplace offers a wealth of resources to assist residents in understanding and navigating their healthcare options. These resources are designed to provide clarity and support throughout the enrollment process:

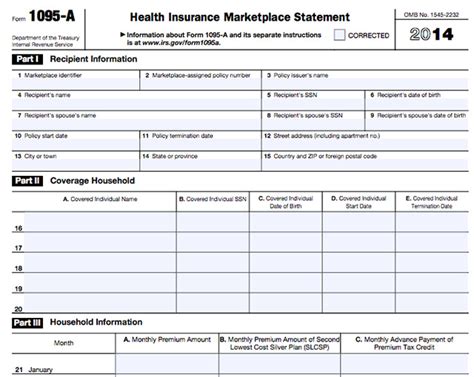

Online Tools: The marketplace website features interactive tools that allow you to compare plans, estimate costs, and determine eligibility for financial assistance. These tools simplify the decision-making process, making it easier to choose a plan that aligns with your healthcare needs and budget.

Educational Materials: A range of educational materials, including brochures, fact sheets, and videos, are available to explain the intricacies of healthcare coverage. These resources provide valuable insights into plan types, benefits, and potential costs, empowering you to make informed choices.

Community Outreach: The marketplace actively engages with communities across Florida, hosting events and workshops to educate residents about their healthcare options. These initiatives provide an opportunity to ask questions, seek guidance, and connect with others who may have similar healthcare needs and concerns.

Customer Support: A dedicated customer support team is available to assist with any queries or concerns you may have. Whether you need help understanding plan details, navigating the enrollment process, or resolving issues, the support team is there to provide guidance and support.

Future Outlook and Industry Insights

The landscape of healthcare insurance is constantly evolving, and Florida Marketplace Insurance is no exception. As the state’s population grows and healthcare needs change, the marketplace must adapt to ensure it remains accessible and responsive to the diverse needs of Floridians.

Industry experts predict continued growth in the demand for healthcare services, driven by an aging population and advancements in medical technology. This increased demand is expected to influence the development of new plan options, with a focus on innovative approaches to coverage and cost management. As such, Florida Marketplace Insurance is likely to evolve to incorporate these changes, offering plans that are more tailored to the evolving healthcare landscape.

Furthermore, the marketplace is anticipated to enhance its digital capabilities, making it even easier for residents to access information, compare plans, and enroll in coverage. The integration of digital tools and platforms is expected to streamline the enrollment process, providing a more efficient and user-friendly experience for Floridians seeking healthcare coverage.

In addition to technological advancements, Florida Marketplace Insurance is also likely to see an increased emphasis on preventative care and wellness initiatives. These initiatives aim to promote healthier lifestyles and reduce the need for costly medical interventions, ultimately benefiting both individuals and the healthcare system as a whole. By encouraging preventative measures, the marketplace can contribute to a healthier population and more sustainable healthcare system.

FAQ

What is the Affordable Care Act (ACA) and how does it impact Florida Marketplace Insurance?

+The Affordable Care Act, often referred to as Obamacare, is a federal law that aims to make healthcare more accessible and affordable. It established health insurance marketplaces, including the Florida Health Insurance Marketplace, where individuals and families can compare and enroll in qualified health plans. The ACA sets standards for these plans, ensuring they offer essential health benefits and providing financial assistance to make coverage more affordable.

Are there any income-based subsidies available through Florida Marketplace Insurance?

+Yes, income-based subsidies are available to help make healthcare more affordable. These subsidies are designed to reduce the cost of monthly premiums for individuals and families with lower incomes. The amount of subsidy you’re eligible for depends on your household income and family size. You can use the marketplace’s online tools to estimate your potential savings and determine your eligibility.

Can I enroll in a Florida Marketplace Insurance plan outside of the Open Enrollment Period?

+In general, you need to enroll during the Open Enrollment Period to get coverage for the upcoming year. However, there are certain qualifying life events, such as marriage, birth of a child, or loss of other health coverage, that can trigger a Special Enrollment Period. During a Special Enrollment Period, you can enroll in a plan or make changes to your existing coverage outside of the regular Open Enrollment window.

How can I compare different plans and choose the right one for my needs?

+Comparing plans can be done using the online tools provided by the Florida Health Insurance Marketplace. These tools allow you to input your healthcare needs, preferences, and budget to generate a list of plans that meet your criteria. You can then review the details of each plan, including premiums, deductibles, and covered services, to make an informed decision. It’s also beneficial to consider factors like network providers and prescription drug coverage when making your choice.