Tx Farm Bureau Insurance

Texas Farm Bureau Insurance, often referred to as TFB Insurance, is a trusted name in the Lone Star State's insurance landscape. With a rich history and a strong focus on the unique needs of Texans, this insurance provider has become a staple for many residents. In this comprehensive guide, we delve into the world of TFB Insurance, exploring its services, benefits, and impact on the Texas community.

A Legacy of Protection: The Texas Farm Bureau Insurance Story

Texas Farm Bureau Insurance traces its roots back to the early 20th century when a group of visionary farmers recognized the need for comprehensive insurance coverage tailored to their specific requirements. In 1933, the Texas Farm Bureau was established, and its insurance program soon followed, offering a range of products designed to protect farmers and their families.

Over the decades, TFB Insurance has expanded its reach beyond agriculture, catering to the diverse needs of Texans across the state. Today, it stands as a leading provider of insurance solutions, offering a comprehensive portfolio that includes auto, home, life, and business insurance.

The Impact on Rural Communities

Texas Farm Bureau Insurance’s roots in agriculture have had a profound impact on rural communities. By understanding the unique challenges faced by farmers and ranchers, TFB Insurance has developed specialized coverage options that provide essential protection. This has not only helped secure the livelihoods of many agricultural families but has also contributed to the overall economic stability of rural Texas.

For instance, the company's livestock coverage protects farmers from unforeseen events such as disease outbreaks or natural disasters, ensuring they can recover and continue their operations. Additionally, TFB Insurance's crop insurance plans provide financial security during periods of drought or other adverse weather conditions, a critical aspect of farming in a state as vast and varied as Texas.

| Coverage Type | Description |

|---|---|

| Farmowners Insurance | Covers farm buildings, equipment, and personal property. |

| Livestock Coverage | Protects against livestock loss due to illness, injury, or death. |

| Crop Insurance | Provides financial protection against crop losses from natural disasters or price fluctuations. |

Meeting the Needs of Urban Texans

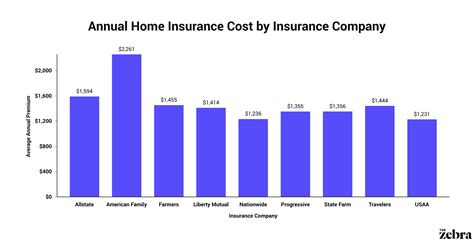

While TFB Insurance’s agricultural heritage is undeniable, its services have evolved to cater to the diverse population of Texas, including those living in urban centers. The company’s auto and home insurance policies offer competitive rates and comprehensive coverage, addressing the specific challenges of urban living, such as congested roads and potential property damage risks.

For instance, TFB Insurance's auto policies provide options for those who live in high-density areas, offering coverage for ridesharing services and rental car reimbursements. Additionally, their home insurance policies take into account the unique climate and weather patterns of Texas, providing protection against hail, wind, and other common natural occurrences.

A Customer-Centric Approach: The TFB Difference

Texas Farm Bureau Insurance prides itself on its customer-centric approach, ensuring that policyholders receive personalized attention and tailored solutions. This commitment to customer service has fostered a strong sense of loyalty among Texans, many of whom have been with the company for generations.

Personalized Service and Local Agents

One of the key aspects of TFB Insurance’s customer-centric model is its network of local agents. These agents, deeply rooted in their communities, provide a level of personalized service that goes beyond traditional insurance transactions. They understand the unique circumstances and needs of their clients, offering guidance and support tailored to individual situations.

For example, an agent might help a new homeowner navigate the intricacies of home insurance, ensuring they understand the coverage they need based on their specific property and location. This level of personalized attention fosters trust and ensures that policyholders receive the right coverage for their circumstances.

Digital Convenience and Accessibility

While TFB Insurance values its local agent network, it also recognizes the importance of digital accessibility in today’s world. The company has invested in a robust online platform, offering policyholders convenient access to their accounts, billing information, and policy details. This digital convenience allows customers to manage their insurance needs quickly and efficiently, anytime, anywhere.

Additionally, TFB Insurance's mobile app provides on-the-go access to policy information, claims management, and even roadside assistance. This blend of personal service and digital innovation ensures that Texans can access the support they need, whether they prefer face-to-face interactions or the convenience of digital tools.

Community Engagement and Giving Back

Texas Farm Bureau Insurance is not just an insurance provider; it’s an integral part of the Texas community. The company has a long history of giving back and supporting various initiatives that strengthen the state’s social fabric.

Supporting Education and Youth Programs

TFB Insurance has a strong commitment to education, believing that investing in the youth of Texas is crucial for the state’s future. The company sponsors numerous educational programs and scholarships, providing financial support to students pursuing various fields of study. This not only helps students achieve their academic goals but also contributes to the development of a skilled and educated workforce.

Additionally, TFB Insurance actively supports youth leadership programs, encouraging young Texans to develop their leadership skills and engage in community service. These initiatives help nurture a generation of responsible and engaged citizens, fostering a sense of community and social responsibility.

Disaster Relief and Community Rebuilding

Texas is no stranger to natural disasters, and TFB Insurance has been at the forefront of disaster relief efforts. The company has a dedicated disaster response team that works tirelessly to assist policyholders in the aftermath of hurricanes, floods, or other catastrophic events. This support includes rapid claims processing, temporary housing assistance, and other resources to help Texans get back on their feet.

Beyond immediate relief, TFB Insurance also contributes to long-term community rebuilding efforts. Through partnerships with local organizations and charities, the company helps fund infrastructure improvements, housing developments, and other initiatives that strengthen the resilience of Texas communities.

The Future of TFB Insurance: Innovation and Growth

As the insurance landscape evolves, Texas Farm Bureau Insurance remains committed to innovation and growth. The company continually invests in technological advancements, ensuring that its products and services remain relevant and accessible to Texans of all backgrounds.

Digital Transformation and Data Analytics

TFB Insurance is leveraging data analytics and artificial intelligence to enhance its operations and provide better insights to policyholders. By analyzing vast amounts of data, the company can identify trends, assess risks more accurately, and offer personalized coverage recommendations. This approach not only benefits customers but also helps TFB Insurance stay ahead of the curve in a rapidly changing industry.

Expanding Product Offerings

While TFB Insurance has a strong presence in traditional insurance sectors, the company is also expanding its product offerings to meet the evolving needs of Texans. This includes exploring new markets, such as pet insurance and identity theft protection, and developing innovative solutions to address emerging risks.

For instance, TFB Insurance recently introduced a cyber liability insurance product, recognizing the growing importance of digital security in today's world. This proactive approach ensures that Texans can protect themselves and their businesses from the evolving threats of the digital age.

Sustainable Practices and Environmental Initiatives

With a deep connection to the land and a commitment to the well-being of Texans, TFB Insurance is also focusing on sustainable practices and environmental initiatives. The company is actively working to reduce its environmental footprint, adopting eco-friendly measures in its operations and encouraging policyholders to do the same.

TFB Insurance has also launched initiatives to promote renewable energy and sustainable farming practices, supporting the transition to a more environmentally conscious future. By aligning its values with the long-term sustainability of Texas, the company is ensuring that its impact extends beyond insurance coverage.

Conclusion: A Trusted Companion for Texans

Texas Farm Bureau Insurance stands as a pillar of strength and support for Texans across the state. With a rich history, a customer-centric approach, and a commitment to community, TFB Insurance has earned its place as a trusted companion for Texans. As the company continues to innovate and grow, it remains dedicated to protecting the livelihoods, properties, and futures of the people it serves.

Whether it's providing specialized coverage for farmers, offering comprehensive protection for urban dwellers, or giving back to the community, TFB Insurance embodies the spirit of Texas. As the Lone Star State continues to thrive and evolve, Texas Farm Bureau Insurance will undoubtedly remain a key player, ensuring the security and prosperity of Texans for generations to come.

Frequently Asked Questions

What types of insurance does Texas Farm Bureau Insurance offer?

+

Texas Farm Bureau Insurance offers a comprehensive range of insurance products, including auto, home, renters, life, health, and business insurance. They also provide specialized coverage for farms, ranches, and livestock.

How can I contact Texas Farm Bureau Insurance for assistance or to make a claim?

+

You can contact Texas Farm Bureau Insurance through their website, by phone, or by visiting one of their local offices. Their customer service team is available to assist with any inquiries or to guide you through the claims process.

Does Texas Farm Bureau Insurance offer discounts on insurance policies?

+

Yes, Texas Farm Bureau Insurance offers a variety of discounts on their insurance policies. These may include discounts for multiple policies, safe driving, good student grades, and more. It’s best to inquire directly with an agent to understand the specific discounts available to you.

What is the process for filing a claim with Texas Farm Bureau Insurance?

+

The claims process with Texas Farm Bureau Insurance involves reporting the incident, providing relevant details, and working with their claims adjusters to assess the damage and determine the appropriate course of action. They aim to make the process as seamless and stress-free as possible for policyholders.

How does Texas Farm Bureau Insurance support its community beyond insurance services?

+

Texas Farm Bureau Insurance is deeply committed to community engagement and giving back. They support various initiatives, including education programs, youth leadership development, disaster relief efforts, and sustainable practices. Through these efforts, they aim to make a positive impact on the lives of Texans beyond their insurance offerings.