Compare Insurances

Welcome to a comprehensive guide that delves into the world of insurance, a crucial aspect of financial planning and risk management. In today's complex and uncertain world, understanding the nuances of insurance is more important than ever. This article aims to provide an in-depth analysis, comparison, and expert insights into various types of insurance, empowering readers to make informed decisions about their financial well-being.

Unraveling the Insurance Landscape: A Comprehensive Guide

Insurance is a financial safety net, designed to protect individuals, businesses, and assets from potential risks and uncertainties. It serves as a contract between the policyholder and the insurance company, offering financial compensation in the event of specific losses or damages. With a wide array of insurance types available, navigating the insurance landscape can be daunting. This guide aims to demystify the process, offering a clear and concise comparison to help readers choose the right insurance coverage for their unique needs.

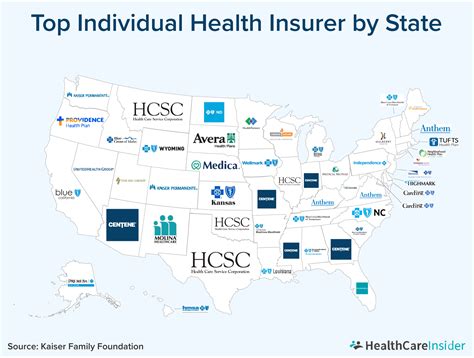

Health Insurance: Protecting Your Well-being

Health insurance is perhaps one of the most vital types of insurance, providing coverage for medical and surgical expenses. With rising healthcare costs, having adequate health insurance is essential to ensure access to quality medical care without incurring crippling financial burdens.

Key Features of Health Insurance

Health insurance policies typically cover a range of medical services, including doctor visits, hospital stays, prescription medications, and sometimes even preventive care and wellness programs. The level of coverage can vary widely, from basic plans with high deductibles to comprehensive plans that cover a broad spectrum of medical needs.

| Health Insurance Category | Coverage |

|---|---|

| Individual Plans | Designed for single individuals, offering personalized coverage. |

| Family Plans | Covers multiple family members, providing comprehensive protection. |

| Group Health Plans | Often offered by employers, providing cost-effective coverage for employees. |

Life Insurance: Securing Your Legacy

Life insurance is a financial product designed to provide a monetary benefit to a designated beneficiary upon the death of the insured individual. It serves as a safety net for families, ensuring financial stability and security in the event of an untimely demise.

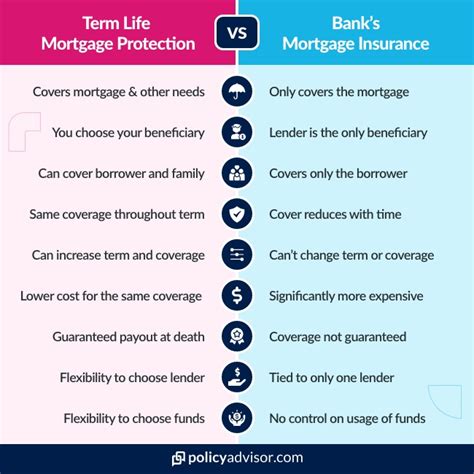

Types of Life Insurance

There are primarily two types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10 to 30 years, and is generally more affordable. On the other hand, permanent life insurance, including whole life and universal life insurance, offers coverage for the insured’s entire life and also includes a savings or investment component.

| Life Insurance Type | Key Features |

|---|---|

| Term Life Insurance | Affordable, offers coverage for a specific term, ideal for covering temporary needs. |

| Whole Life Insurance | Provides lifetime coverage, includes a cash value component that grows over time. |

| Universal Life Insurance | Flexible policy with adjustable premiums and coverage, allowing for customization. |

Auto Insurance: Protecting Your Ride

Auto insurance is a contract between the policyholder and the insurance company, designed to protect the insured from financial loss in the event of an accident or theft. It is a legal requirement in most countries and provides essential coverage for vehicle owners.

Auto Insurance Coverage Options

Auto insurance policies typically include liability coverage, which covers bodily injury and property damage to others caused by the insured driver. It also often includes comprehensive and collision coverage, which protect against damage to the insured vehicle from accidents, theft, or natural disasters.

| Auto Insurance Coverage | Description |

|---|---|

| Liability Coverage | Covers injuries and damages caused to others by the insured driver. |

| Comprehensive Coverage | Protects against damage caused by non-collision events like theft, fire, or natural disasters. |

| Collision Coverage | Covers damage to the insured vehicle from collisions. |

Home Insurance: Safeguarding Your Haven

Home insurance, also known as homeowner’s insurance, is a type of property insurance that covers a private residence against damages. It provides financial protection against disasters like fires, hurricanes, theft, and other misfortunes.

Key Components of Home Insurance

Home insurance policies typically include coverage for the structure of the home, as well as the contents inside. It often includes liability coverage, which protects the homeowner in the event of accidents or injuries that occur on the property. Additional coverage, such as flood insurance or earthquake insurance, may be required depending on the location and specific risks.

| Home Insurance Coverage | Description |

|---|---|

| Dwelling Coverage | Covers the physical structure of the home. |

| Personal Property Coverage | Protects the contents of the home, including furniture, electronics, and clothing. |

| Liability Coverage | Provides protection against lawsuits and medical payments for others injured on the property. |

Travel Insurance: Peace of Mind on the Go

Travel insurance is a specialized type of insurance that covers the costs and losses associated with travel, whether it’s for leisure or business. It provides financial protection against unforeseen events like trip cancellations, medical emergencies, lost luggage, or travel delays.

Travel Insurance Benefits

Travel insurance policies typically include trip cancellation and interruption coverage, which refunds a portion of prepaid expenses if the trip is canceled or interrupted due to covered reasons. It also provides emergency medical and dental coverage, covering expenses for unexpected illnesses or injuries during the trip. Additional benefits may include baggage delay or loss coverage and travel assistance services.

| Travel Insurance Coverage | Description |

|---|---|

| Trip Cancellation and Interruption | Covers prepaid expenses if the trip is canceled or interrupted due to covered reasons. |

| Emergency Medical and Dental | Provides coverage for unexpected medical or dental expenses during the trip. |

| Baggage Delay or Loss | Reimburses expenses for essential items if luggage is delayed or lost. |

The Future of Insurance: Innovations and Trends

The insurance industry is undergoing a digital transformation, leveraging technology to enhance customer experiences and streamline processes. From digital underwriting and claims processing to the use of artificial intelligence and machine learning for risk assessment, the future of insurance is set to be more efficient and customer-centric.

Emerging Trends in Insurance

The rise of parametric insurance, which uses parameters like weather data to trigger payouts, is a notable trend. Additionally, the use of telematics in auto insurance, where driving behavior is monitored to determine premiums, is gaining traction. The insurance industry is also exploring blockchain technology for enhanced security and efficiency in record-keeping and transactions.

Conclusion: Empowering Your Financial Future

Insurance is an essential tool for managing risk and protecting your financial well-being. By understanding the various types of insurance and their coverage, you can make informed decisions to secure your future. Remember, insurance is not a one-size-fits-all proposition, and it’s crucial to tailor your coverage to your unique needs and circumstances.

How do I choose the right insurance policy for my needs?

+Choosing the right insurance policy involves assessing your specific needs and risks. Consider factors like your health status, family’s financial needs, the value of your assets, and potential risks you face. Compare different policies, understand the coverage they offer, and choose one that provides adequate protection at a reasonable cost.

What are the benefits of bundling multiple insurance policies with one provider?

+Bundling multiple insurance policies, such as home and auto insurance, with one provider can offer several benefits. It often results in cost savings through multi-policy discounts. Additionally, it simplifies the insurance process, as you have a single point of contact for all your insurance needs, and it can provide better coordination of coverage and claims.

How often should I review and update my insurance coverage?

+It’s recommended to review your insurance coverage annually or whenever there is a significant change in your life or circumstances. This could include events like getting married, buying a new home, starting a business, or having a child. Regular reviews ensure that your coverage remains adequate and up-to-date with your changing needs.