Personal Liability Coverage Insurance

Personal liability coverage insurance is a crucial aspect of financial planning and risk management, offering individuals and families peace of mind and protection against potential legal and financial pitfalls. This comprehensive guide aims to explore the intricacies of personal liability coverage, providing an in-depth analysis of its benefits, coverage options, and the key considerations for selecting the right policy.

Understanding Personal Liability Coverage

Personal liability coverage, often referred to as personal liability insurance, is a type of insurance policy that provides financial protection to individuals in the event they are found legally responsible for causing injury or property damage to others. This coverage acts as a safety net, ensuring that individuals can manage the financial consequences of such incidents without facing devastating personal financial losses.

The importance of personal liability coverage cannot be overstated, especially in today's world where lawsuits and liability claims are increasingly common. Whether it's an accident at home, a slip and fall on your property, or an unexpected incident involving your pet, personal liability coverage steps in to cover the associated costs, including medical expenses, property damage repairs, and even legal defense fees.

Key Components of Personal Liability Coverage

Liability Coverage Limits

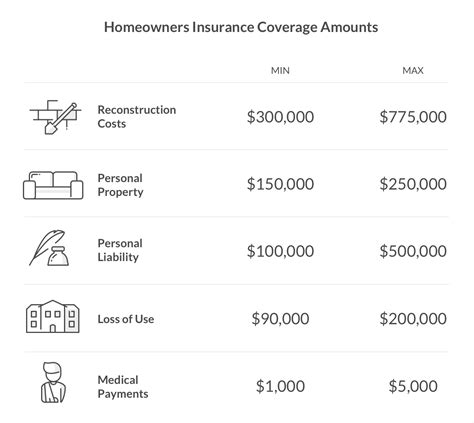

One of the critical aspects of personal liability coverage is the coverage limit, which refers to the maximum amount the insurance company will pay out for a covered claim. This limit can vary significantly depending on the policy and the individual’s needs. It’s essential to select a coverage limit that aligns with your financial situation and the potential risks you face.

For instance, if you have substantial assets or a high-risk occupation, you may require a higher coverage limit to protect your financial well-being. On the other hand, individuals with fewer assets and a lower risk profile may opt for a more modest coverage limit.

| Policy Type | Coverage Limit |

|---|---|

| Standard Homeowner's Policy | $100,000 - $300,000 |

| High-Risk Occupations | $500,000 - $1,000,000 |

| Umbrella Insurance | $1,000,000+ (Excess coverage) |

Covered Incidents and Exclusions

Personal liability coverage typically covers a wide range of incidents, including bodily injury, property damage, and personal injury claims (such as libel or slander). However, it’s important to note that not all incidents are covered, and certain exclusions may apply.

Common exclusions in personal liability coverage include intentional acts, automobile-related incidents (covered by auto insurance), and professional services. Additionally, some policies may have specific exclusions for certain types of pets or high-risk activities.

- Bodily Injury: Covered

- Property Damage: Covered

- Personal Injury Claims: Covered

- Intentional Acts: Excluded

- Automobile-Related Incidents: Excluded (covered by auto insurance)

- Professional Services: Excluded

Legal Defense Coverage

A unique feature of personal liability coverage is the inclusion of legal defense coverage. This aspect of the policy provides financial support for legal fees and expenses if you are sued for a covered incident. Legal defense coverage ensures that you have access to the necessary legal representation to defend yourself against liability claims.

It's important to note that legal defense coverage typically has its own limits, separate from the general liability coverage limit. Therefore, it's crucial to understand the specifics of your policy to ensure you have adequate protection.

Selecting the Right Personal Liability Coverage

Assessing Your Risk Profile

When choosing a personal liability coverage policy, it’s essential to first assess your individual risk profile. This involves considering factors such as your occupation, the number of people living in your household, the type of pets you have, and any high-risk activities you engage in.

For instance, individuals who work in high-risk occupations, such as construction or healthcare, may face a higher risk of liability claims. Similarly, pet owners of certain breeds or individuals who participate in high-risk sports may also require specialized coverage.

Policy Comparison and Customization

Comparing different personal liability coverage policies is crucial to ensure you select the best option for your needs. This involves reviewing the coverage limits, covered incidents, exclusions, and any additional benefits or features offered by each policy.

Additionally, many insurance providers offer customizable personal liability coverage, allowing you to tailor the policy to your specific needs. This may include adding endorsements or riders to cover specific risks or increasing coverage limits for high-value assets.

Working with an Insurance Professional

Navigating the world of personal liability coverage can be complex, and it’s often beneficial to seek the advice of an insurance professional. These experts can guide you through the process, helping you understand the nuances of different policies and ensuring you make an informed decision.

Real-World Examples and Case Studies

Accident on Your Property

Imagine a scenario where a guest slips and falls on your icy driveway, sustaining serious injuries. In this case, personal liability coverage would step in to cover the medical expenses and any legal fees associated with the incident. Without this coverage, you would be responsible for these costs, which could quickly become financially overwhelming.

Dog Bite Incident

Pet owners face a unique set of risks, especially when it comes to liability claims. For instance, if your dog bites a visitor, you could be held legally responsible for their injuries. Personal liability coverage for pet owners includes protection against such incidents, covering medical expenses and legal fees.

Libel and Slander Claims

Personal liability coverage also extends to personal injury claims, such as libel and slander. If you are accused of making false statements about someone, this coverage can provide financial protection for any legal fees and settlements resulting from the claim.

Performance Analysis and Expert Insights

Coverage Adequacy and Satisfaction

According to industry surveys, a significant majority of individuals who have utilized personal liability coverage express satisfaction with their policies. This satisfaction stems from the coverage’s ability to provide financial protection and peace of mind during challenging times.

However, it's important to note that the adequacy of coverage can vary significantly based on individual circumstances. Therefore, regular policy reviews and adjustments are recommended to ensure ongoing protection.

Expert Recommendations

Industry experts emphasize the importance of personalized risk assessments when selecting personal liability coverage. They advise individuals to thoroughly review their risk profile and consult with insurance professionals to ensure their policies align with their unique needs.

Additionally, experts recommend reviewing and updating personal liability coverage regularly, especially after significant life changes such as purchasing a new home, starting a high-risk occupation, or acquiring high-value assets.

Future Implications and Trends

Increasing Awareness and Demand

As legal liability claims become more common and complex, the demand for personal liability coverage is expected to rise. This trend is driven by a growing awareness of the potential financial risks individuals face in various aspects of their lives.

Insurance providers are responding to this demand by offering more comprehensive and customizable personal liability coverage options. This includes the development of specialized policies for high-risk occupations and activities, as well as increased focus on digital tools and resources to simplify the policy selection and management process.

Technological Innovations

The insurance industry is embracing technological advancements to enhance the efficiency and accessibility of personal liability coverage. This includes the use of digital platforms for policy management, real-time risk assessments, and the integration of artificial intelligence for more accurate coverage recommendations.

Additionally, the rise of telemedicine and remote work is prompting insurance providers to adapt their personal liability coverage to include protection for these emerging risks, ensuring individuals are protected even in new and evolving work environments.

Frequently Asked Questions

What is the difference between personal liability coverage and general liability insurance?

+Personal liability coverage is designed for individuals and families, providing protection for their personal assets and legal liabilities. On the other hand, general liability insurance is typically used by businesses to protect against similar risks, but it focuses on commercial operations and assets.

Can personal liability coverage protect me if I am sued for a car accident?

+No, personal liability coverage does not provide protection for car accidents. These incidents are typically covered by auto insurance policies. However, if you have an umbrella insurance policy, it may provide excess liability coverage for auto-related incidents.

How much does personal liability coverage cost?

+The cost of personal liability coverage can vary significantly depending on the policy, coverage limits, and individual risk factors. On average, homeowners can expect to pay between 200 and 500 annually for personal liability coverage. However, this can increase for individuals with higher risk profiles or specialized coverage needs.