Dental Plans Insurance

Dental health is an essential aspect of overall well-being, and many individuals recognize the significance of maintaining good oral hygiene. However, the cost of dental care can be a significant burden, especially for those without insurance coverage. This is where dental plans and insurance come into play, offering a range of benefits to help individuals and families access affordable and quality dental services. In this comprehensive guide, we will delve into the world of dental plans and insurance, exploring the various options available, their features, and how they can provide financial protection and peace of mind.

Understanding Dental Plans and Insurance

Dental plans and insurance are designed to provide financial coverage for dental procedures, helping individuals manage the costs associated with dental care. These plans typically involve a contract between an insurance company and the policyholder, outlining the terms, conditions, and benefits of the coverage. By enrolling in a dental plan, individuals gain access to a network of dental providers who have agreed to offer their services at discounted rates, making dental care more affordable and accessible.

Dental insurance plans can be offered through various channels, including employers as part of employee benefits packages, purchased individually, or provided through government-sponsored programs. The coverage and benefits offered by dental plans can vary widely, depending on the specific plan and the needs of the policyholder. It is crucial to understand the different types of dental plans and their features to make an informed decision.

Types of Dental Plans

There are several types of dental plans available, each with its own unique features and coverage options. Here are some of the most common types of dental plans:

- Dental Health Maintenance Organization (DHMO): DHMO plans typically require members to choose a primary care dentist within the network. These plans often cover a wide range of preventive services at 100% coverage, with minimal or no out-of-pocket expenses. However, DHMO plans may have limited flexibility when it comes to choosing specialists or undergoing more complex procedures.

- Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility compared to DHMO plans. Members can choose any dentist, whether in-network or out-of-network. In-network providers agree to charge predetermined fees for services, while out-of-network providers may charge higher rates. PPO plans often provide coverage for a broad range of dental procedures, including preventive, basic, and major services.

- Dental Indemnity Plans: These plans allow members to visit any dentist of their choice without any network restrictions. Dental indemnity plans typically reimburse a fixed amount for covered services, based on a predetermined fee schedule. Members may need to pay the full cost upfront and then submit claims for reimbursement.

- Discount Dental Plans: Instead of providing insurance coverage, discount dental plans offer members access to a network of dental providers who agree to offer reduced rates on their services. Members pay an annual fee to enroll in the plan and then receive discounts on various dental procedures. These plans are ideal for individuals seeking affordable dental care without the traditional insurance model.

Key Features and Benefits of Dental Plans

Dental plans offer a range of features and benefits that can significantly impact the dental care experience. Understanding these aspects is crucial when choosing a dental plan that aligns with your needs and preferences.

Coverage for Preventive Care

One of the primary advantages of dental plans is the coverage they provide for preventive dental care. Most plans cover routine check-ups, cleanings, X-rays, and other preventive services that help maintain good oral health. By prioritizing preventive care, dental plans aim to catch potential issues early on, reducing the need for more extensive and costly treatments down the line.

| Preventive Services Covered | Typical Coverage |

|---|---|

| Dental Check-ups | Usually covered at 100% |

| Professional Cleanings | Typically included in preventive care coverage |

| X-rays | Covered as part of preventive services |

| Fluoride Treatments | May be included, especially for children |

Coverage for Basic and Major Procedures

Dental plans also provide coverage for a range of basic and major dental procedures. Basic procedures include fillings, root canals, and extractions, while major procedures encompass more complex treatments like dental implants, crowns, and bridges. The extent of coverage for these procedures varies depending on the plan and the specific insurance provider.

| Dental Procedures | Typical Coverage |

|---|---|

| Fillings (Amalgam) | Covered at varying percentages, typically around 70-80% |

| Root Canals | Partial coverage, ranging from 50-70% |

| Dental Extractions | Covered at a moderate percentage, often around 60-70% |

| Dental Implants | Coverage varies, some plans offer partial coverage while others may exclude implants entirely |

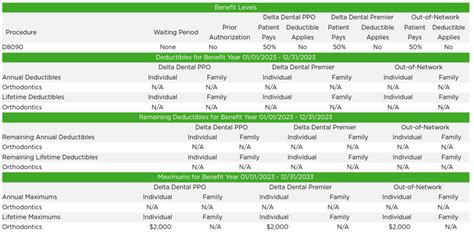

Annual Maximums and Deductibles

Dental plans often come with annual maximums, which represent the maximum amount the insurance company will pay towards dental expenses within a calendar year. These maximums can vary significantly between plans, with some offering higher limits to accommodate more extensive dental needs. Additionally, dental plans may have deductibles, which are the out-of-pocket costs the policyholder must pay before the insurance coverage kicks in.

Understanding the annual maximums and deductibles is crucial when assessing the financial implications of a dental plan. It is essential to consider your anticipated dental expenses and choose a plan with appropriate coverage limits and deductibles.

Network of Dental Providers

Dental plans typically have networks of preferred dental providers who have agreed to offer their services at discounted rates. These networks can vary in size and scope, with some plans offering a more extensive network of providers, ensuring greater convenience and accessibility. It is important to review the network of providers before enrolling in a dental plan to ensure that your preferred dentists or specialists are included.

Selecting the Right Dental Plan

Choosing the right dental plan can be a complex decision, as it involves considering various factors and assessing your unique dental needs and preferences. Here are some key considerations to guide you in selecting the most suitable dental plan:

Assess Your Dental Needs

Start by evaluating your current and anticipated dental needs. Consider factors such as your oral health history, any existing dental issues, and the frequency of dental visits you anticipate. If you have a history of extensive dental work or anticipate needing more complex procedures, a plan with higher coverage limits and more comprehensive benefits may be a better fit.

Compare Plan Options

Research and compare different dental plan options available to you. Consider factors such as the network of providers, coverage limits, annual maximums, deductibles, and the range of procedures covered. Online comparison tools and insurance brokers can be valuable resources to help you navigate the various plan options and find the best fit for your needs.

Evaluate Cost and Budget

Dental plans come with varying premium costs, and it is essential to consider your budget when selecting a plan. Assess the monthly or annual premiums, as well as any additional out-of-pocket expenses such as deductibles and co-pays. Strike a balance between the plan’s cost and the coverage it provides to ensure you can afford the plan and maximize its benefits.

Review the Plan’s Network

Take the time to review the network of dental providers associated with each plan. Ensure that your preferred dentists or specialists are included in the network, especially if you have an established relationship with specific providers. A plan with a comprehensive network can provide greater flexibility and convenience when accessing dental care.

Maximizing Your Dental Plan Benefits

Once you have selected and enrolled in a dental plan, it is crucial to understand how to maximize its benefits to get the most value out of your coverage. Here are some tips to help you make the most of your dental plan:

Schedule Regular Dental Check-ups

Take advantage of the preventive care benefits offered by your dental plan. Schedule regular dental check-ups and cleanings to maintain good oral health and catch any potential issues early on. Most dental plans cover these preventive services at 100%, so make sure to utilize this coverage to stay on top of your dental hygiene.

Understand Your Plan’s Coverage

Familiarize yourself with the specific details of your dental plan’s coverage. Know which procedures are covered, the percentage of coverage for each, and any limitations or exclusions. This knowledge will help you make informed decisions about your dental care and avoid unexpected out-of-pocket expenses.

Choose In-Network Providers

Whenever possible, choose dental providers who are in-network with your insurance plan. In-network providers have agreed to charge predetermined fees for their services, which can result in significant cost savings. By utilizing in-network providers, you can maximize your insurance benefits and minimize out-of-pocket expenses.

Review Your Benefits Annually

Dental plans and their coverage can change from year to year. It is essential to review your plan’s benefits annually to stay informed about any changes or updates. This includes understanding any modifications to the network of providers, coverage limits, or the range of procedures covered. By staying up-to-date, you can make informed decisions and plan your dental care accordingly.

FAQs

Can I use my dental insurance for cosmetic procedures?

+

Dental insurance coverage for cosmetic procedures can vary depending on the specific plan. While some plans may cover a portion of cosmetic treatments like teeth whitening or orthodontic work, others may exclude these procedures entirely. It is important to review your plan’s coverage details to understand the extent of coverage for cosmetic procedures.

What happens if I exceed my annual maximum for dental expenses?

+

If you exceed your annual maximum for dental expenses, you will be responsible for paying any additional costs out of pocket. It is important to plan your dental treatments and procedures accordingly to stay within the coverage limits of your dental plan. However, some plans may offer an option to purchase additional coverage if needed.

Can I switch dental plans if I’m not satisfied with my current one?

+

Switching dental plans is possible, but it may be subject to certain restrictions and conditions. It is advisable to review your existing plan’s terms and conditions, as well as any potential waiting periods or limitations that may apply when switching to a new plan. Additionally, consider the enrollment periods and deadlines for making changes to your dental coverage.

Are there any age restrictions for dental insurance plans?

+

Dental insurance plans typically do not have age restrictions for adults. However, for children, there may be specific pediatric dental plans or coverage options available. It is important to review the plan’s details and eligibility criteria to ensure it aligns with your family’s needs.

Can I use my dental insurance for emergency dental care?

+

Yes, dental insurance plans often cover emergency dental care. However, the extent of coverage may vary depending on the specific plan and the nature of the emergency. It is recommended to review your plan’s coverage details and contact your insurance provider to understand the process and any potential limitations or restrictions.

In conclusion, dental plans and insurance play a vital role in making dental care more accessible and affordable for individuals and families. By understanding the different types of plans, their features, and how to maximize their benefits, you can make informed decisions and ensure your oral health is well-protected. Remember to assess your dental needs, compare plan options, and choose a plan that aligns with your budget and preferences. With the right dental plan, you can maintain a healthy smile and enjoy the peace of mind that comes with financial protection.