Qualify For Usaa Insurance

The United Services Automobile Association, better known as USAA, is a leading financial services group in the United States, catering specifically to the military community and their families. One of the most sought-after services USAA offers is its insurance coverage, renowned for its competitive pricing and comprehensive benefits. However, gaining access to these insurance products is not as straightforward as with traditional insurance providers. The eligibility criteria are unique, reflecting the organization's exclusive focus on military personnel and their families.

In this article, we will delve into the intricacies of qualifying for USAA insurance, exploring the specific requirements, the application process, and the benefits that make USAA insurance such an attractive option. By the end of this guide, you'll have a comprehensive understanding of the steps you need to take to become a USAA member and unlock the advantages of their insurance offerings.

Eligibility Requirements for USAA Insurance

USAA's eligibility criteria are rooted in its founding principle of serving those who serve our country. To qualify for USAA insurance, you must be affiliated with the U.S. military in some capacity. Here's a breakdown of the specific eligibility requirements:

- Active Duty Military: If you're currently serving in any branch of the U.S. Armed Forces, you're eligible to apply for USAA insurance. This includes the Army, Navy, Air Force, Marine Corps, and Coast Guard.

- Veterans: Veterans who have honorably served in the U.S. military can also qualify for USAA insurance. The minimum service requirement is typically two years, but this can vary based on specific circumstances.

- National Guard and Reserve Members: Members of the National Guard and Reserve components of the U.S. Armed Forces are also eligible. However, there might be certain conditions, such as a minimum number of drill days completed, that must be met.

- Military Academy Cadets and Midshipmen: Students at U.S. military academies, such as the U.S. Military Academy, U.S. Naval Academy, U.S. Air Force Academy, and the U.S. Coast Guard Academy, are eligible for USAA membership.

- Immediate Family Members: Spouses, children, and in some cases, siblings and parents of eligible USAA members can also qualify for insurance coverage through USAA. The exact relationship and eligibility requirements can vary, so it's essential to check the specific guidelines.

Determining Eligibility: A Step-by-Step Guide

While the above criteria provide a general overview, the process of determining your eligibility can be more nuanced. Here's a step-by-step guide to help you navigate the process:

- Assess Your Military Affiliation: Begin by evaluating your current or past military status. If you're an active-duty service member, veteran, or part of the National Guard or Reserves, you likely meet the basic eligibility criteria. Military academy cadets and midshipmen should also proceed to the next step.

- Review USAA's Official Eligibility Guidelines: USAA provides detailed information on its website about who is eligible for membership. Take the time to read through these guidelines to understand the specific requirements that apply to your situation. This includes understanding any minimum service requirements or other conditions that might impact your eligibility.

- Check Your Family's Eligibility: If you're a military spouse or child, you might be eligible for USAA insurance through your family member's membership. USAA has specific guidelines for family members, so be sure to review these to understand your eligibility status.

- Gather Necessary Documentation: Once you've determined that you meet the basic eligibility requirements, gather the necessary documentation. This might include proof of military service, such as a DD Form 214 (for veterans) or a current military ID (for active-duty members). For family members, you might need to provide proof of your relationship to the eligible USAA member.

- Contact USAA: If you have any questions or concerns about your eligibility, don't hesitate to contact USAA directly. Their customer service team can provide guidance and help you understand your specific situation. You can reach out to them via phone, email, or live chat.

The Application Process for USAA Insurance

Once you've confirmed your eligibility, the next step is to apply for USAA insurance. The application process is straightforward and can be completed online, over the phone, or in person at a USAA office. Here's an overview of the key steps involved:

- Choose Your Insurance Type: USAA offers a wide range of insurance products, including auto, home, renters, life, health, and more. Determine which type of insurance you need and assess your specific coverage requirements. USAA's website provides detailed information on each type of insurance, including coverage options and pricing.

- Complete the Application Form: USAA's application form is designed to be user-friendly and straightforward. You'll need to provide basic information about yourself, your military status or relationship to an eligible USAA member, and the type of insurance you're applying for. The form might also require details about your current insurance needs and preferences.

- Submit Supporting Documents: Along with the application form, you'll need to provide supporting documents to verify your eligibility and insurance needs. This could include proof of military service, such as a DD Form 214 or a current military ID, as well as any other relevant documentation. USAA's website provides a comprehensive list of the documents required for each type of insurance.

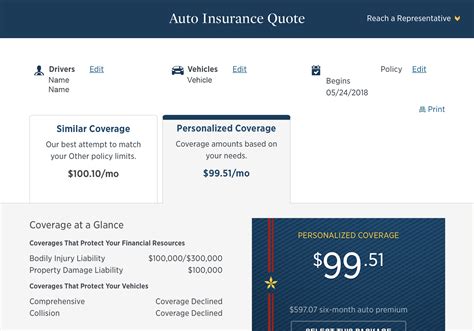

- Review and Accept the Quote: Once you've submitted your application and supporting documents, USAA will review your information and provide a quote for your chosen insurance coverage. Carefully review the quote, ensuring that it aligns with your insurance needs and budget. If you're satisfied with the quote, you can proceed to accept it and finalize your insurance application.

- Policy Activation: After accepting the quote, USAA will activate your insurance policy. This might involve setting up your payment method and schedule, as well as providing you with your policy details and any necessary documentation. At this stage, you'll have access to your USAA insurance coverage, and you can start enjoying the benefits of being a USAA member.

Benefits of USAA Insurance

USAA insurance is renowned for its competitive pricing and comprehensive coverage. Here are some of the key benefits that make USAA insurance an attractive option for military personnel and their families:

- Discounts and Special Offers: USAA offers a range of discounts and special offers to its members, including military discounts, loyalty discounts, and bundle discounts. These can significantly reduce the cost of your insurance coverage, making it even more affordable.

- Comprehensive Coverage Options: USAA provides a wide range of insurance products to meet the diverse needs of its members. Whether you're looking for auto insurance, home insurance, renters insurance, life insurance, or health insurance, USAA has you covered. Each insurance type offers customizable coverage options to ensure you get the right level of protection for your specific needs.

- Military-Focused Benefits: As a military-focused organization, USAA offers insurance benefits tailored to the unique needs of military personnel and their families. This includes deployment coverage for service members, as well as special provisions for military spouses and children. USAA's insurance products are designed to provide peace of mind and support to those who serve our country.

- Excellent Customer Service: USAA is renowned for its exceptional customer service. The organization's customer service team is highly trained and dedicated to providing personalized support to its members. Whether you have questions about your policy, need to file a claim, or want to make changes to your coverage, USAA's customer service team is always ready to assist.

Conclusion: Unlocking the Advantages of USAA Insurance

Qualifying for USAA insurance is a rewarding process for those who are eligible. By understanding the eligibility requirements and following the application process, you can unlock the numerous benefits that USAA insurance offers. From competitive pricing and comprehensive coverage to military-focused benefits and excellent customer service, USAA insurance is designed to meet the unique needs of the military community.

As you navigate the eligibility and application process, remember that USAA is dedicated to supporting those who serve our country. Whether you're an active-duty service member, veteran, or military family member, USAA is here to provide you with the insurance coverage and financial services you need to thrive.

FAQs

Can I apply for USAA insurance if I’m not currently serving in the military but have served in the past?

+

Yes, veterans who have honorably served in the U.S. military can qualify for USAA insurance. However, there might be specific eligibility requirements, such as a minimum service duration, that must be met. It’s recommended to review USAA’s official guidelines and contact their customer service team for clarification.

Are immediate family members of USAA members automatically eligible for insurance coverage through USAA?

+

No, immediate family members of USAA members are not automatically eligible. However, they might be eligible for insurance coverage through USAA if they meet specific criteria. This typically includes being a spouse, child, or in some cases, a sibling or parent of an eligible USAA member. It’s essential to review USAA’s guidelines for family member eligibility and gather the necessary documentation.

What types of insurance does USAA offer, and how do I choose the right one for my needs?

+

USAA offers a comprehensive range of insurance products, including auto insurance, home insurance, renters insurance, life insurance, health insurance, and more. To choose the right insurance for your needs, assess your specific coverage requirements. Consider factors such as your assets, liabilities, and personal circumstances. USAA’s website provides detailed information on each insurance type, including coverage options and pricing, to help you make an informed decision.

How can I contact USAA for assistance with my eligibility or insurance application process?

+

USAA offers multiple channels for you to reach out for assistance. You can contact them via phone, email, or live chat. Their customer service team is dedicated to providing personalized support and guidance throughout the eligibility and application process. Don’t hesitate to reach out if you have any questions or concerns.

Are there any additional benefits or discounts available to USAA insurance members?

+

Yes, USAA offers a range of additional benefits and discounts to its insurance members. This includes military discounts, loyalty discounts, and bundle discounts. USAA also provides exclusive access to a variety of financial services and products, such as banking, investing, and retirement planning. By becoming a USAA member, you gain access to a comprehensive suite of financial services tailored to the military community.