Insurance Car New Jersey

In the state of New Jersey, car insurance is a legal requirement for all vehicle owners, and it plays a crucial role in ensuring the safety and financial protection of drivers and their passengers. With its diverse landscape, ranging from urban centers to rural areas, New Jersey presents unique challenges and considerations when it comes to auto insurance. This comprehensive guide aims to delve into the world of car insurance in New Jersey, offering expert insights and practical advice to help residents navigate the complexities of this essential coverage.

Understanding the Car Insurance Landscape in New Jersey

New Jersey is known for its robust and comprehensive approach to auto insurance. The state operates under a no-fault insurance system, which means that, in the event of an accident, each driver's insurance company covers their respective medical expenses and other related costs, regardless of who caused the accident. This system is designed to streamline the claims process and provide quicker access to medical treatment for injured parties.

However, New Jersey also offers optional coverage types that drivers can choose to enhance their protection. These include:

- Liability Coverage: This type of insurance covers damages caused to others in an accident where the policyholder is at fault. It includes both bodily injury and property damage liability.

- Personal Injury Protection (PIP): PIP coverage is mandatory in New Jersey and covers medical expenses, lost wages, and other related costs for the policyholder and their passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects policyholders in cases where the at-fault driver has insufficient or no insurance coverage.

- Collision Coverage: Collision insurance covers the cost of repairing or replacing the policyholder's vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Comprehensive insurance provides protection against non-accident related incidents such as theft, vandalism, weather damage, and collisions with animals.

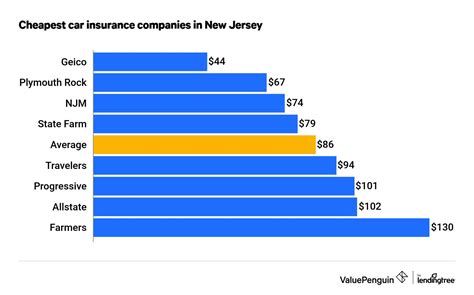

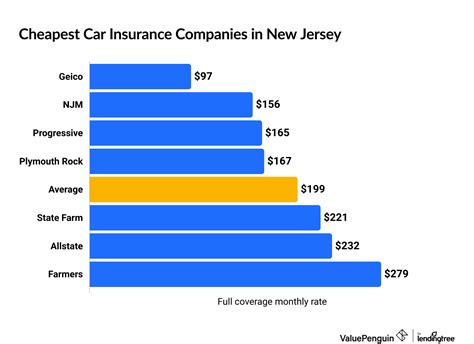

The cost of car insurance in New Jersey can vary significantly depending on various factors, including the driver's age, driving history, vehicle type, and location. According to recent data, the average annual premium for car insurance in New Jersey is approximately $1,500, although this can range from as low as $700 to over $3,000 depending on individual circumstances.

Key Considerations for New Jersey Drivers

When shopping for car insurance in New Jersey, it's essential to keep a few key considerations in mind to ensure you're getting the best coverage for your needs and budget.

Minimum Coverage Requirements

New Jersey has specific minimum coverage requirements that all drivers must meet. These include:

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability (per person) | $15,000 |

| Bodily Injury Liability (per accident) | $30,000 |

| Property Damage Liability | $5,000 |

| Personal Injury Protection (PIP) | $15,000 (medical expenses) and $250,000 (essential services and lost income) |

Note: These minimum requirements may not be sufficient for all drivers, especially those with significant assets to protect. It's recommended to consider higher coverage limits to ensure adequate protection.

Factors Affecting Premiums

Several factors can influence the cost of car insurance premiums in New Jersey. These include:

- Driver's Age and Gender: Younger drivers and those under the age of 25 often pay higher premiums due to their perceived higher risk. Gender can also play a role, with some insurers charging slightly different rates for male and female drivers.

- Driving Record: A clean driving record with no accidents or violations can lead to lower premiums. Conversely, a history of accidents or traffic violations can significantly increase insurance costs.

- Vehicle Type: The make, model, and age of your vehicle can impact your insurance rates. Sports cars and luxury vehicles often have higher premiums due to their potential for higher repair costs.

- Location: The area where you live and drive can affect your insurance rates. Urban areas with higher populations and traffic volumes tend to have higher insurance costs due to increased accident risks.

- Credit Score: In New Jersey, insurers are allowed to consider credit scores when determining premiums. A good credit score can lead to lower insurance rates, while a poor credit score may result in higher costs.

Tips for Choosing the Right Car Insurance in New Jersey

With a wide range of insurance providers and coverage options available, choosing the right car insurance policy in New Jersey can be daunting. Here are some expert tips to help you make an informed decision:

Assess Your Coverage Needs

Before shopping for car insurance, take the time to understand your specific coverage needs. Consider factors such as the value of your vehicle, your personal assets, and your tolerance for risk. If you have significant assets, you may want to consider higher liability limits to protect yourself in the event of a serious accident.

Compare Quotes from Multiple Providers

Don't settle for the first insurance quote you receive. Compare quotes from at least three to five different providers to get a sense of the market rates and the range of coverage options available. Online comparison tools can be a great starting point, but it's also beneficial to speak directly with insurance agents to discuss your specific needs and any potential discounts you may be eligible for.

Understand the Policy Terms and Conditions

When reviewing insurance quotes, pay close attention to the policy terms and conditions. Look for any exclusions or limitations that may affect your coverage. Make sure you understand the deductibles, coverage limits, and any additional fees or surcharges that may apply.

Consider Discounts and Bundling Options

Many insurance providers offer discounts for various reasons, such as good driving records, safe driving courses, multi-policy discounts (when you bundle your auto insurance with other types of insurance, like homeowners or renters insurance), or even discounts for certain professions or affiliations. Be sure to ask about available discounts and see if you qualify for any of them.

Read Reviews and Seek Recommendations

Researching insurance providers and reading customer reviews can provide valuable insights into the quality of their service and claims handling. Online review platforms and social media groups can be great resources for gathering feedback from other policyholders. Additionally, seeking recommendations from friends, family, or trusted advisors can help you find reputable insurance providers.

Choose a Reputable and Financially Stable Provider

It's essential to choose an insurance provider that is financially stable and has a good reputation for paying claims promptly and fairly. Check with independent rating agencies like AM Best or Moody's to assess the financial strength of the insurance company you're considering. A financially stable insurer ensures that they will be able to pay out claims even in the event of a large-scale disaster or widespread claims.

The Future of Car Insurance in New Jersey

The car insurance landscape in New Jersey is constantly evolving, driven by advancements in technology, changes in driving behaviors, and shifts in regulatory frameworks. Here are some key trends and developments to watch out for in the coming years:

Usage-Based Insurance (UBI)

Usage-Based Insurance, also known as Pay-As-You-Drive (PAYD) or Pay-How-You-Drive (PHYD), is an innovative approach to car insurance that uses real-time data to assess a driver's risk profile. With the increasing adoption of telematics and connected car technologies, UBI programs are becoming more prevalent. These programs use devices or smartphone apps to track driving behaviors such as mileage, driving speed, acceleration, and braking, and adjust insurance premiums accordingly.

Autonomous Vehicles and Insurance

The advent of autonomous vehicles (AVs) is expected to revolutionize the car insurance industry. As AVs become more prevalent on New Jersey roads, insurers will need to adapt their policies and pricing models to account for the reduced risk of human error. This could lead to significant changes in liability coverage and potentially lower insurance costs for drivers of AVs.

Regulatory Changes and Reforms

The New Jersey Department of Banking and Insurance (DOBI) periodically reviews and updates insurance regulations to ensure fairness and consumer protection. Keep an eye out for any proposed changes or reforms that may impact car insurance policies and premiums. For example, the DOBI has previously considered reforms to the state's no-fault insurance system to address rising insurance costs and fraud.

Telematics and Data Privacy

As telematics and data collection become more integral to the car insurance industry, concerns around data privacy and security will continue to grow. Insurers will need to strike a balance between utilizing data to assess risk and protect policyholders while also respecting consumer privacy rights. Stay informed about any developments in data privacy regulations and how they may impact your insurance coverage.

FAQs

What are the penalties for driving without insurance in New Jersey?

+Driving without car insurance in New Jersey can result in severe penalties, including a fine of up to $500 for a first offense, suspension of your driver’s license and vehicle registration, and even possible imprisonment. It’s important to maintain continuous insurance coverage to avoid these consequences.

Can I choose my own repair shop after an accident in New Jersey?

+Yes, New Jersey is a “choice state,” which means you have the right to choose your own repair shop after an accident. However, if your vehicle is insured under a no-fault policy, you must use a repair shop that is authorized by your insurance company for repairs covered by your Personal Injury Protection (PIP) benefits.

How often should I review and update my car insurance policy in New Jersey?

+It’s recommended to review your car insurance policy annually or whenever there are significant changes in your life, such as getting married, buying a new car, or moving to a new location. Regular reviews ensure that your coverage remains adequate and that you’re taking advantage of any available discounts.

What is the average car insurance premium increase after an at-fault accident in New Jersey?

+The increase in car insurance premiums after an at-fault accident can vary depending on several factors, including the severity of the accident, your driving record, and the insurance provider. On average, you can expect your premiums to increase by 20-40% after an at-fault accident, but it could be higher for more severe accidents or if you have a history of multiple accidents.

Are there any discounts available for car insurance in New Jersey?

+Yes, there are several discounts available for car insurance in New Jersey. These may include multi-policy discounts, good student discounts, safe driver discounts, anti-theft device discounts, and more. It’s worth discussing these options with your insurance provider to see if you qualify for any savings.