Covid Test Insurance

In the wake of the global COVID-19 pandemic, the necessity for accessible and affordable testing has become a critical aspect of healthcare and travel planning. As a result, Covid Test Insurance has emerged as an innovative solution to ensure individuals can access testing services without incurring significant financial burdens.

This article delves into the world of Covid Test Insurance, exploring its origins, key features, and the impact it has had on individuals and businesses alike. By understanding this unique insurance offering, we can appreciate its role in supporting public health initiatives and facilitating safe travel during these unprecedented times.

The Birth of Covid Test Insurance: A Response to an Urgent Need

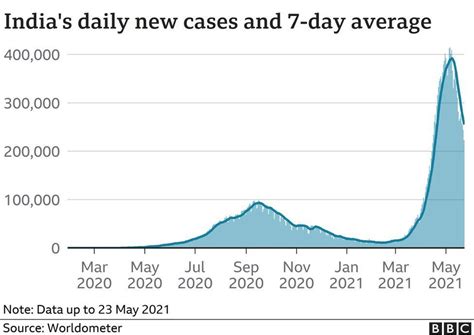

The onset of the COVID-19 pandemic presented an unprecedented challenge to global healthcare systems and the general public. With the rapid spread of the virus, the demand for testing skyrocketed, often overwhelming healthcare facilities and testing centers.

In this context, Covid Test Insurance emerged as a creative solution, offering individuals and families financial protection against the costs associated with COVID-19 testing. This innovative insurance product aimed to address the growing need for accessible testing, ensuring that financial constraints did not prevent individuals from getting tested when necessary.

The development of Covid Test Insurance was a collaborative effort between healthcare providers, insurance companies, and public health experts. By combining their expertise, they created a specialized insurance plan that covered the costs of COVID-19 testing, whether for symptomatic individuals, close contacts of confirmed cases, or those requiring testing for travel purposes.

One of the key advantages of Covid Test Insurance is its ability to provide peace of mind. In a time of heightened anxiety and uncertainty, knowing that one's testing costs are covered can alleviate financial stress and encourage individuals to seek testing promptly if needed.

Real-World Impact: A Case Study

To understand the tangible benefits of Covid Test Insurance, let’s consider the experience of Ms. Sarah, a 35-year-old professional who frequently travels for work. With international borders reopening, Ms. Sarah found herself navigating the complex landscape of travel restrictions and testing requirements.

On one of her trips, Ms. Sarah was required to undergo a COVID-19 test within 72 hours of her departure. The cost of the test was $250, which could have been a significant financial burden for her, especially considering the unpredictability of travel during the pandemic.

However, Ms. Sarah had the foresight to purchase Covid Test Insurance before her trip. With this insurance coverage, she was reimbursed for the full cost of her test, allowing her to focus on her work and travel plans without worrying about unexpected expenses.

This real-life example illustrates how Covid Test Insurance can make a tangible difference in the lives of individuals, providing financial support and peace of mind during a challenging time.

Key Features and Benefits of Covid Test Insurance

Covid Test Insurance offers a range of features and benefits that make it an appealing option for individuals and families.

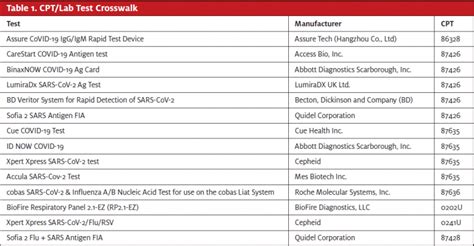

- Comprehensive Coverage: The insurance typically covers the cost of COVID-19 testing, including PCR tests, rapid antigen tests, and antibody tests. This comprehensive coverage ensures that policyholders can access the necessary tests without worrying about out-of-pocket expenses.

- Quick and Efficient Claims Process: Insurers understand the urgency of testing, especially in the context of travel. As such, they have streamlined the claims process, allowing for prompt reimbursement of testing costs. This efficient process ensures that policyholders can focus on their testing needs without the added stress of navigating complex claims procedures.

- Travel-Related Benefits: Covid Test Insurance often extends beyond just covering testing costs. Many policies also provide benefits such as trip cancellation or interruption coverage in case an individual tests positive for COVID-19 during their trip. This added protection gives travelers peace of mind, knowing that they are financially protected if their travel plans are disrupted due to a positive test result.

- Flexibility and Customization: Insurance providers recognize that individuals have unique needs and circumstances. As such, Covid Test Insurance policies often offer customizable options, allowing policyholders to choose coverage levels and benefits that align with their specific requirements. This flexibility ensures that individuals can find an insurance plan that suits their needs and budget.

A Comparative Analysis: Covid Test Insurance vs. Traditional Health Insurance

While traditional health insurance plans provide essential coverage for various medical expenses, they often fall short when it comes to covering the specific costs associated with COVID-19 testing. This is where Covid Test Insurance steps in to fill the gap.

| Coverage Aspect | Traditional Health Insurance | Covid Test Insurance |

|---|---|---|

| COVID-19 Testing Costs | May cover, but often subject to deductibles and co-pays | Full coverage for testing costs, no out-of-pocket expenses |

| Urgency and Timeliness | Claims process can be lengthy, potentially impacting timely testing | Streamlined claims process ensures prompt reimbursement |

| Travel-Related Benefits | Limited or no coverage for travel-specific needs | Includes trip cancellation and interruption coverage for COVID-19 positive cases |

| Customization and Flexibility | Standardized plans with limited customization options | Offers customizable coverage to meet individual needs |

As the table illustrates, Covid Test Insurance provides specialized coverage that addresses the unique challenges posed by the pandemic. By offering comprehensive coverage, a quick claims process, and travel-specific benefits, it ensures that individuals can navigate the complexities of testing and travel with greater ease and financial protection.

The Future of Covid Test Insurance: Evolving to Meet Changing Needs

As the world adapts to the new normal post-pandemic, the role of Covid Test Insurance is also evolving. While the initial focus was on providing financial protection for testing, the insurance industry is now exploring ways to expand its scope and relevance.

One potential direction is the integration of Covid Test Insurance with other health-related insurance products. This could involve bundling Covid Test Insurance with traditional health insurance plans, offering a more holistic approach to healthcare coverage. By doing so, individuals would have access to a comprehensive insurance package that covers a wide range of healthcare needs, including COVID-19-specific expenses.

Additionally, as the focus shifts towards long-term health consequences of COVID-19, such as Long COVID, there is a growing need for insurance coverage that addresses these ongoing health challenges. Covid Test Insurance could potentially evolve to include coverage for the diagnosis and treatment of Long COVID, providing much-needed financial support for individuals dealing with the long-term effects of the virus.

Furthermore, with the increasing emphasis on mental health during the pandemic, there is an opportunity for Covid Test Insurance to incorporate mental health support services. This could involve providing coverage for therapy sessions, counseling, or even virtual support groups, ensuring that individuals have access to the mental health resources they need during these challenging times.

Conclusion: Navigating the New Normal with Covid Test Insurance

In a world still grappling with the impact of COVID-19, Covid Test Insurance has emerged as a vital tool to support public health initiatives and facilitate safe travel. Its comprehensive coverage, efficient claims process, and travel-specific benefits have made it an invaluable resource for individuals and families navigating the complexities of testing and travel during the pandemic.

As we look towards the future, the evolution of Covid Test Insurance promises to continue, adapting to the changing needs of a post-pandemic world. Whether through integration with traditional health insurance, addressing the long-term health consequences of COVID-19, or incorporating mental health support, Covid Test Insurance is poised to play a crucial role in shaping the future of healthcare coverage.

By understanding the origins, features, and future implications of Covid Test Insurance, we can appreciate its significance in supporting individuals and families during these uncertain times. As the world continues to adapt and recover, this innovative insurance product will undoubtedly remain a vital component of our healthcare landscape.

Is Covid Test Insurance only for international travel?

+No, Covid Test Insurance is not limited to international travel. While it is particularly beneficial for travelers navigating complex international testing and travel requirements, it can also be useful for domestic travel, especially in regions with varying testing guidelines.

What is the average cost of Covid Test Insurance?

+The cost of Covid Test Insurance can vary depending on the provider, coverage level, and duration of the policy. On average, policies range from 20 to 100 for a single trip, with the cost increasing for longer durations or more comprehensive coverage.

How quickly can I expect reimbursement for my COVID-19 test costs?

+Most insurance providers aim to process claims within 7-14 days of receiving the necessary documentation. However, it’s essential to check with your specific insurer for their exact turnaround time and any requirements for submitting claims.