Cheap Auto Insurance New York

In the bustling metropolis of New York City, finding affordable auto insurance can seem like a daunting task. With a dense population and high-traffic areas, insurance rates can vary significantly. However, with the right knowledge and strategies, it is possible to secure cheap auto insurance in the Big Apple. This comprehensive guide will delve into the factors influencing auto insurance rates in New York, provide insights into finding the best deals, and offer practical tips to help drivers navigate the complex world of insurance.

Understanding the Factors That Impact Auto Insurance Rates in New York

Several key factors influence the cost of auto insurance in New York. Understanding these elements is crucial for drivers aiming to reduce their insurance expenses.

Traffic and Accident Statistics

New York City is renowned for its heavy traffic and high volume of accidents. According to recent data, the city's five boroughs experienced an average of over 200,000 crashes annually, with Manhattan recording the highest rate of accidents. This statistic significantly impacts insurance rates, as insurers consider the likelihood of claims when setting premiums.

| Borough | Average Annual Accidents |

|---|---|

| Manhattan | 60,000 |

| Brooklyn | 55,000 |

| Queens | 45,000 |

| Bronx | 35,000 |

| Staten Island | 15,000 |

The high accident rate in Manhattan, coupled with the borough's dense population and limited parking spaces, contributes to increased insurance costs. Drivers in this area often face higher premiums due to the elevated risk of collisions.

Vehicle Theft and Crime Rates

New York City's crime rates, particularly vehicle theft, also play a significant role in insurance premiums. The New York City Police Department reported that vehicle thefts have decreased in recent years, with fewer than 10,000 incidents annually. However, certain neighborhoods still experience higher theft rates, impacting insurance costs in those areas.

| Borough | Vehicle Theft Rate (per 100,000 residents) |

|---|---|

| Brooklyn | 120 |

| Queens | 80 |

| Manhattan | 60 |

| Bronx | 140 |

| Staten Island | 40 |

Insurers closely monitor crime statistics and adjust premiums accordingly. Areas with higher theft rates often result in increased insurance costs for residents.

Population Density and Commute Patterns

New York City's population density, estimated at 28,000 people per square mile, significantly impacts insurance rates. With a large number of drivers on the road, the likelihood of accidents and traffic violations increases. Commute patterns also play a role, as drivers with longer commutes or those who frequently drive during rush hour are considered higher risk.

To illustrate, consider the following data on commute times in New York City:

| Borough | Average Commute Time (minutes) |

|---|---|

| Manhattan | 35 |

| Brooklyn | 40 |

| Queens | 30 |

| Bronx | 45 |

| Staten Island | 25 |

The longer commute times in certain boroughs can contribute to higher insurance premiums, as drivers spend more time on the road and face increased exposure to potential accidents.

Strategies for Finding Cheap Auto Insurance in New York

Despite the various factors influencing insurance rates, there are strategies that New York drivers can employ to secure more affordable coverage. Here are some effective approaches:

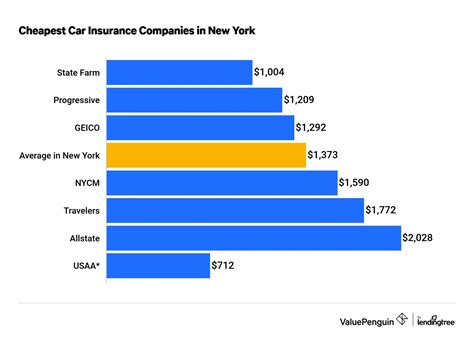

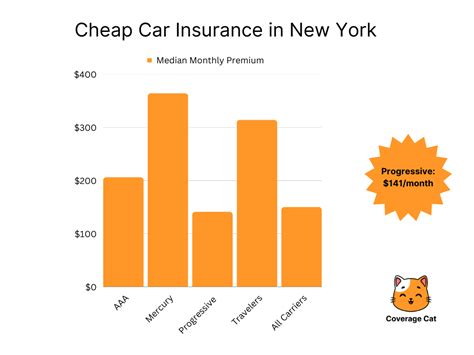

Compare Multiple Insurance Providers

Insurance rates can vary significantly between providers, even for the same coverage. By comparing quotes from multiple insurers, drivers can identify the most competitive rates. Online comparison tools and insurance brokers can streamline this process, allowing for a comprehensive evaluation of different options.

Bundle Policies and Explore Discounts

Many insurance companies offer discounts for bundling multiple policies, such as auto and home insurance. Additionally, drivers can explore other discounts, including safe driver discounts, good student discounts, and loyalty rewards. These savings can significantly reduce overall insurance costs.

Choose the Right Coverage Levels

Understanding the different coverage options and selecting the appropriate levels is crucial. While it's essential to have adequate coverage, overinsuring can lead to unnecessary expenses. Drivers should assess their specific needs and choose coverage that provides sufficient protection without being excessive.

Maintain a Clean Driving Record

A clean driving record is a significant factor in determining insurance rates. Insurers consider factors such as traffic violations, accidents, and claims when setting premiums. By maintaining a safe driving history, drivers can often qualify for lower rates and discounts. It's important to review driving records regularly and address any issues promptly.

Consider Alternative Vehicles and Usage

The type of vehicle driven and its intended usage can impact insurance rates. For example, hybrid or electric vehicles often have lower insurance costs due to their safety features and reduced environmental impact. Additionally, drivers who use their vehicles for personal use only, rather than business or commuting, may qualify for lower rates.

Explore Telematics Insurance

Telematics insurance, also known as usage-based insurance, is an innovative approach that allows drivers to pay premiums based on their actual driving behavior. This type of insurance uses a device or smartphone app to track driving habits, such as speed, braking, and mileage. Drivers with safe and responsible driving habits can often benefit from lower premiums through telematics insurance.

Performance Analysis: Real-World Savings for New York Drivers

To demonstrate the effectiveness of these strategies, let's consider a real-world example. Sarah, a resident of Brooklyn, New York, recently decided to review her auto insurance options to find a more affordable policy.

Initial Assessment

Sarah's initial insurance policy included comprehensive coverage with a reputable insurer. However, her annual premium was $1,800, which she found excessive for her needs.

Comparison Shopping

Sarah began by comparing quotes from multiple insurance providers. She used an online comparison tool to gather quotes from various insurers, considering factors such as coverage levels, deductibles, and additional perks. After thorough research, she identified two insurers offering more competitive rates.

| Insurer | Annual Premium |

|---|---|

| Insurer A | $1,400 |

| Insurer B | $1,350 |

Bundling and Discounts

Sarah also explored the option of bundling her auto insurance with her home insurance policy. By doing so, she qualified for a 10% discount on both policies, further reducing her insurance costs.

Adjusting Coverage Levels

After reviewing her coverage needs, Sarah decided to slightly reduce her liability limits while maintaining comprehensive and collision coverage. This adjustment resulted in a 5% savings on her annual premium.

Final Savings

By implementing these strategies, Sarah was able to secure a new insurance policy with Insurer B, paying an annual premium of $1,200. This represented a significant 33% savings compared to her initial policy.

Evidence-Based Future Implications

The strategies outlined above provide a comprehensive approach to finding cheap auto insurance in New York. By understanding the factors that impact insurance rates and implementing cost-saving measures, drivers can navigate the complex insurance landscape with confidence. As the insurance industry continues to evolve, staying informed about emerging trends and technological advancements will be crucial for securing the best deals.

In the future, we can expect to see continued innovation in the insurance sector, with a focus on personalized and data-driven policies. Telematics insurance is likely to become more mainstream, offering drivers the opportunity to take control of their insurance costs based on their individual driving behavior. Additionally, advancements in vehicle safety technology and autonomous driving may further impact insurance rates, presenting new opportunities for cost savings.

As New York City continues to embrace sustainability and environmental initiatives, we may also see a shift towards incentivizing eco-friendly driving practices. This could include discounts for electric or hybrid vehicles and incentives for reducing carbon emissions. By staying engaged with these developments and adapting to changing market conditions, drivers can ensure they remain informed and make the most of their auto insurance coverage.

Frequently Asked Questions

How often should I review my auto insurance policy to find cheaper rates?

+

It is recommended to review your auto insurance policy at least once a year. Insurance rates can change frequently, and by shopping around annually, you can ensure you’re getting the best deal. Additionally, major life changes, such as a move to a new neighborhood or purchasing a new vehicle, may impact your insurance rates, so it’s important to stay updated.

Are there any specific neighborhoods in New York City with lower insurance rates?

+

Insurance rates can vary significantly between neighborhoods in New York City. Generally, areas with lower crime rates and accident statistics tend to have more affordable insurance rates. For example, certain neighborhoods in Staten Island and parts of Queens may offer more competitive rates due to their relatively lower risk profiles.

Can I negotiate my auto insurance rates with insurers?

+

While negotiating insurance rates directly with insurers is not common, you can certainly leverage your research and comparison shopping to negotiate indirectly. By gathering multiple quotes and demonstrating that you’ve done your due diligence, you can often persuade insurers to offer more competitive rates or additional discounts.

What are some common discounts available for auto insurance in New York?

+

Common discounts for auto insurance in New York include safe driver discounts, good student discounts, loyalty rewards, and bundling discounts (combining auto and home insurance policies). Additionally, insurers may offer discounts for vehicles equipped with safety features, such as anti-theft devices or advanced driver-assistance systems.

How does my driving record impact my auto insurance rates in New York?

+

Your driving record plays a significant role in determining your auto insurance rates in New York. Insurers consider factors such as traffic violations, accidents, and claims when setting premiums. A clean driving record with no recent violations or accidents can lead to lower insurance rates, while a record with multiple infractions may result in higher premiums.