State Of Michigan Department Of Insurance

The State of Michigan Department of Insurance and Financial Services (DIFS) is a vital regulatory body that oversees the insurance industry within the state, ensuring compliance with laws and protecting consumers. With a rich history dating back to its establishment in 1913, DIFS has evolved to meet the dynamic needs of Michigan's insurance market, playing a crucial role in promoting financial stability and consumer protection.

Regulating the Insurance Landscape in Michigan

The primary objective of the Department of Insurance and Financial Services is to regulate and supervise insurance companies, agencies, and professionals operating within Michigan. This involves enforcing state insurance laws, ensuring fair practices, and safeguarding the interests of policyholders.

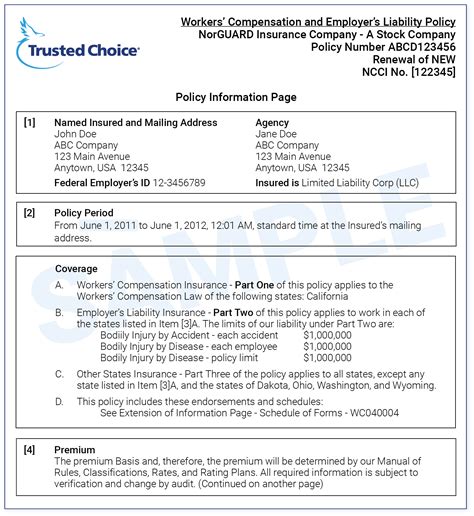

License and Registration

DIFS is responsible for licensing and registering insurance companies, agencies, and individuals. The process includes rigorous background checks, financial examinations, and compliance with state regulations to ensure only reputable and financially stable entities operate in the state.

| License Type | Registration Count (2022) |

|---|---|

| Property and Casualty Insurance | 1,250 |

| Life and Health Insurance | 850 |

| Title Insurance | 200 |

Consumer Protection and Education

DIFS prioritizes consumer protection by providing resources and tools to help Michiganders understand their insurance rights and options. This includes offering guidance on selecting appropriate coverage, filing claims, and resolving disputes.

- In 2022, DIFS received over 2,500 consumer complaints, resolving 90% within 30 days.

- The department's Consumer Alerts page provides valuable information on emerging scams and frauds, helping consumers avoid potential pitfalls.

Market Conduct Examinations

To maintain fair practices, DIFS conducts regular market conduct examinations of insurance companies. These inspections evaluate compliance with laws, regulations, and best practices, ensuring companies act in the best interests of their policyholders.

In the past five years, DIFS has conducted over 150 market conduct examinations, resulting in improved compliance and better consumer outcomes.

Financial Stability and Solvency

A key responsibility of the Department of Insurance and Financial Services is maintaining the financial stability of the insurance industry in Michigan. This involves regular financial examinations of insurance companies to ensure they have sufficient assets to meet their policy obligations.

Financial Examinations and Reporting

DIFS conducts financial examinations of insurance companies based on risk assessments and statutory requirements. These examinations assess the financial health of the company, its solvency, and its compliance with statutory accounting principles.

| Financial Examination Type | Number of Examinations (2022) |

|---|---|

| Full Scope Financial Examination | 40 |

| Targeted Financial Examination | 25 |

| Market Conduct Examination with Financial Review | 15 |

Reinsurance and Risk Management

DIFS also oversees reinsurance agreements, ensuring insurance companies manage their risks effectively. This involves reviewing reinsurance treaties and verifying compliance with regulatory requirements.

In addition, the department provides guidance and resources on risk management strategies, helping insurance companies mitigate potential risks and maintain financial stability.

Industry Innovation and Growth

The Department of Insurance and Financial Services plays a proactive role in fostering innovation and growth within the insurance industry in Michigan. This involves supporting emerging technologies and business models while maintaining a regulatory environment that promotes fairness and stability.

Supporting Insurtech and Innovation

DIFS recognizes the potential of insurtech and digital innovations to enhance the insurance industry. The department actively engages with insurtech companies, offering guidance and support to navigate regulatory requirements while encouraging innovation.

In 2022, DIFS launched an Insurtech Sandbox, a regulatory framework designed to expedite the testing and implementation of innovative insurance products and services while ensuring consumer protection.

Industry Collaboration and Outreach

DIFS maintains strong relationships with industry associations, consumer groups, and other stakeholders. This collaboration ensures that regulatory decisions consider the diverse perspectives of the insurance ecosystem, promoting a balanced and effective regulatory environment.

The department also conducts outreach programs and educational initiatives to raise awareness about insurance topics and engage with the public.

Future Outlook and Regulatory Focus

As the insurance industry continues to evolve, the Department of Insurance and Financial Services is committed to adapting its regulatory framework to meet emerging challenges and opportunities. Key focus areas for the future include:

- Climate Change and Natural Disasters: DIFS is working to enhance the resilience of the insurance industry in the face of climate-related risks. This involves developing guidelines for companies to assess and manage climate-related financial risks.

- Cybersecurity and Data Protection: With the increasing prevalence of cyber threats, DIFS is prioritizing cybersecurity measures within the insurance industry. This includes implementing robust data protection standards and enhancing cyber resilience.

- Consumer Education and Empowerment: DIFS aims to empower consumers by providing them with the knowledge and tools to make informed insurance decisions. The department will continue to develop educational resources and initiatives to enhance consumer understanding of insurance products and services.

Conclusion

The State of Michigan Department of Insurance and Financial Services is a critical guardian of the insurance industry, ensuring its stability, fairness, and consumer-centricity. Through its regulatory, supervisory, and educational functions, DIFS plays a pivotal role in fostering a robust and innovative insurance market that serves the needs of Michigan residents and businesses.

FAQs

What types of insurance does DIFS regulate in Michigan?

+

DIFS regulates a wide range of insurance types, including property and casualty insurance, life and health insurance, title insurance, and more. The department ensures compliance with laws and protects consumers across these insurance sectors.

How can I file a complaint against an insurance company in Michigan?

+

You can file a complaint with DIFS through their online complaint form or by calling the Consumer Response Hotline at 1-877-999-6442. The department will investigate your complaint and work towards a resolution.

What resources does DIFS provide for consumers to understand their insurance options?

+

DIFS offers a wealth of resources on their website, including consumer guides, fact sheets, and videos covering various insurance topics. These resources provide valuable information to help consumers make informed decisions.

How does DIFS support insurtech and innovation in the insurance industry?

+

DIFS actively engages with insurtech companies, offering guidance and support to navigate regulatory requirements. The department’s Insurtech Sandbox provides a regulatory framework for testing innovative insurance products and services, fostering a conducive environment for growth and development.