Car Insurance Comparison Website

Welcome to the comprehensive guide on Car Insurance Comparison Websites, an essential tool for modern drivers seeking the best coverage options. In today's digital age, these platforms have revolutionized the way we shop for auto insurance, offering an efficient and transparent way to compare policies and providers. With the abundance of insurance companies and the complexity of coverage options, using a comparison website has become a necessity to ensure you're getting the right policy at the right price.

In this article, we will delve into the world of car insurance comparison websites, exploring their features, benefits, and how they can help you make informed decisions about your auto insurance. We will also provide real-world examples and insights to illustrate the value of these platforms and guide you through the process of finding the perfect car insurance coverage.

Understanding Car Insurance Comparison Websites

Car insurance comparison websites are online platforms that aggregate information from multiple insurance providers, allowing users to compare policies, prices, and coverage options side by side. These websites serve as a one-stop shop for drivers seeking auto insurance, providing an efficient and convenient way to research and purchase coverage.

The primary goal of these websites is to empower drivers with the knowledge and tools to make informed decisions about their car insurance. By offering a comprehensive overview of the market, these platforms ensure that drivers can easily compare different policies, understand their coverage needs, and find the best deals available.

How Do Comparison Websites Work?

The process of using a car insurance comparison website is straightforward and user-friendly. Here’s a step-by-step guide to understanding how these platforms operate:

- User Input: Users begin by providing basic information about themselves, their vehicle, and their desired coverage. This information includes personal details like age, location, and driving history, as well as vehicle specifics such as make, model, and usage.

- Data Aggregation: Once the user submits their details, the comparison website aggregates data from multiple insurance providers. This data includes quotes, coverage options, and policy details, ensuring a comprehensive view of the market.

- Comparison Tools: The website presents the aggregated data in an easy-to-compare format, often using tables, charts, or side-by-side comparisons. Users can then review and compare policies based on price, coverage limits, deductibles, and additional features.

- Personalized Recommendations: Many comparison websites also offer personalized recommendations based on the user's specific needs and preferences. These recommendations consider factors like the user's budget, desired coverage levels, and any unique circumstances (e.g., young drivers, classic car owners, etc.)

- Purchase or Inquiry: Once users have found a suitable policy, they can either purchase the insurance directly through the comparison website (if available) or contact the insurance provider directly for further inquiries and to complete the purchase process.

By streamlining the insurance shopping process, comparison websites save drivers time and effort, ensuring they can make well-informed decisions without the hassle of researching multiple providers individually.

Key Features of Car Insurance Comparison Websites

Car insurance comparison websites offer a wealth of features and benefits to users. Let’s explore some of the most notable aspects that make these platforms invaluable tools for drivers seeking auto insurance:

Comprehensive Market Overview

One of the primary advantages of car insurance comparison websites is their ability to provide a comprehensive overview of the market. These platforms aggregate data from a wide range of insurance providers, ensuring that users can compare policies from multiple companies simultaneously. This feature is especially beneficial for drivers who want to explore all their options and find the best coverage at the most competitive prices.

By presenting a diverse range of policies, comparison websites enable users to make informed choices, considering factors like coverage limits, deductibles, additional perks, and, of course, the overall cost.

User-Friendly Interface and Tools

Car insurance comparison websites are designed with user experience in mind, offering intuitive interfaces and user-friendly tools to simplify the insurance shopping process. These platforms often feature:

- Easy Navigation: Well-organized categories and filters allow users to quickly find the information they need, whether it's specific coverage types, provider details, or policy comparisons.

- Clear and Concise Information: Comparison websites present policy details, coverage limits, and additional features in a straightforward manner, ensuring users can easily understand the key aspects of each insurance offering.

- Visual Comparison Tools: Many platforms utilize visual aids like charts, graphs, or side-by-side comparisons to help users visualize the differences between policies. This feature is particularly useful for comparing prices, coverage limits, and other critical factors.

With these user-friendly interfaces, drivers can efficiently navigate through the vast array of insurance options, making the process of finding the right coverage a breeze.

Personalized Recommendations

Comparison websites often go beyond basic policy comparisons, offering personalized recommendations tailored to individual user needs. These recommendations are generated based on a variety of factors, including:

- User Preferences: Users can specify their budget, desired coverage levels, and any specific requirements (e.g., coverage for high-risk drivers, teen drivers, or specialized vehicles) to receive tailored policy recommendations.

- Driving History and Risk Assessment: Some platforms may analyze a user's driving history and risk profile to suggest policies that cater to their specific needs. This ensures that drivers with a clean record or those with high-risk profiles can find appropriate coverage options.

- Location and Local Regulations: Comparison websites may also consider the user's location and local regulations when providing recommendations. This ensures that users are presented with policies that comply with regional laws and requirements.

By offering personalized recommendations, car insurance comparison websites ensure that drivers can quickly identify policies that align with their unique circumstances and requirements.

Real-Time Quotes and Price Comparison

A critical feature of car insurance comparison websites is their ability to provide real-time quotes from multiple providers. Users can enter their details once and instantly receive a list of quotes, allowing for quick and accurate price comparisons.

By aggregating quotes, these platforms eliminate the need for users to visit multiple insurance provider websites or make numerous phone calls. Instead, drivers can compare prices side by side, ensuring they find the most competitive rates available.

| Insurance Provider | Annual Premium | Coverage Limits | Deductible |

|---|---|---|---|

| Provider A | $1,200 | $50,000 | $500 |

| Provider B | $1,150 | $100,000 | $1,000 |

| Provider C | $1,350 | $75,000 | $750 |

In the table above, you can see a simplified example of how a comparison website might present real-time quotes from different providers, allowing users to quickly assess the best value for their insurance needs.

Additional Resources and Guides

Car insurance comparison websites often go the extra mile by providing valuable resources and guides to educate users about insurance-related topics. These resources can include articles, blog posts, or interactive tools that address common questions and concerns, such as:

- Understanding different coverage types (liability, collision, comprehensive, etc.)

- Tips for saving money on car insurance

- Guidelines for choosing the right coverage limits

- Advice on switching insurance providers

- Resources for specific situations (e.g., high-risk drivers, teenage drivers, etc.)

By offering these additional resources, comparison websites ensure that users not only find the right policy but also gain a deeper understanding of the insurance landscape, empowering them to make more confident decisions.

The Benefits of Using Comparison Websites

Using car insurance comparison websites offers a multitude of advantages to drivers seeking auto insurance. Let’s explore some of the key benefits that make these platforms an essential tool in the insurance shopping process:

Time and Effort Savings

One of the most significant advantages of car insurance comparison websites is the time and effort they save users. Instead of visiting multiple insurance provider websites or making countless phone calls, drivers can input their information once and instantly receive a list of quotes and policy options.

This streamlined process eliminates the need for repetitive data entry and allows users to compare policies side by side, making it easier and quicker to find the right coverage. By leveraging comparison websites, drivers can save valuable time and energy, ensuring they can focus on other important tasks while still finding the best insurance deal.

Enhanced Transparency and Comparison

Car insurance comparison websites bring a new level of transparency and clarity to the insurance shopping experience. By presenting policies from multiple providers in a side-by-side format, these platforms allow users to easily compare coverage limits, deductibles, additional features, and, most importantly, prices.

This enhanced transparency ensures that drivers can make well-informed decisions, understanding the nuances of each policy and its value proposition. With a comprehensive view of the market, users can confidently choose the insurance that best fits their needs and budget.

Access to a Wide Range of Providers

Comparison websites aggregate data from a diverse range of insurance providers, ensuring that users have access to a broad spectrum of policies and coverage options. This includes both major insurance companies and smaller, regional providers, offering a comprehensive view of the market.

By comparing policies from various providers, drivers can explore different coverage types, additional perks, and pricing structures. This access to a wide range of options ensures that users can find the insurance that suits their unique circumstances and preferences, whether they're looking for comprehensive coverage or more specialized policies.

Personalized Recommendations and Support

Many car insurance comparison websites offer personalized recommendations based on individual user needs and preferences. These recommendations take into account factors like budget, desired coverage levels, and any specific requirements, ensuring that users are presented with policies that align with their unique circumstances.

Additionally, comparison websites often provide customer support or guidance to assist users throughout the insurance shopping process. This support can include answering questions, offering advice, or helping users navigate complex insurance terminology and concepts. With this added layer of support, drivers can feel confident in their decisions and have a smoother experience when selecting their car insurance coverage.

Potential for Cost Savings

One of the most appealing aspects of car insurance comparison websites is their ability to help users save money on their insurance premiums. By comparing policies from multiple providers, drivers can identify the most competitive rates and find insurance that fits their budget without compromising on coverage.

Comparison websites make it easy to assess different policies and their associated costs, allowing users to quickly identify the best value for their money. This potential for cost savings is particularly beneficial for drivers who are price-conscious or those who need to find insurance within a limited budget.

The Process of Using a Comparison Website

Using a car insurance comparison website is a straightforward and user-friendly process. Here’s a step-by-step guide to help you navigate the experience:

Step 1: Gather Your Information

Before starting your search, gather all the necessary information about yourself, your vehicle, and your desired coverage. This includes personal details like your age, driving history, and location, as well as vehicle specifics such as make, model, and usage.

Having this information readily available will streamline the process and ensure you can provide accurate details when requested by the comparison website.

Step 2: Choose a Reputable Comparison Website

Select a reputable and trusted car insurance comparison website to ensure you’re getting accurate and reliable information. Look for websites with positive reviews, a strong reputation in the industry, and a user-friendly interface. Some popular and well-regarded comparison websites include:

- InsuranceQuotes.com

- TheZebra.com

- PolicyGenius.com

- Geico.com (for GEICO policyholders)

Research and choose a platform that aligns with your needs and preferences, ensuring a positive and efficient comparison experience.

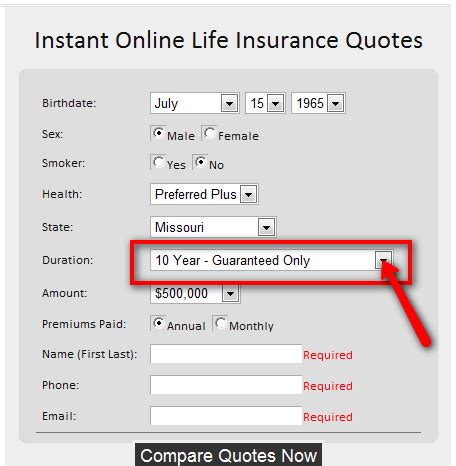

Step 3: Input Your Details

Once you’ve selected a comparison website, input your personal and vehicle information. Be as accurate and detailed as possible to receive the most relevant and accurate quotes and policy recommendations.

Many comparison websites will guide you through a series of questions or forms to gather this information. Ensure you understand each question and provide honest and precise answers to ensure the best results.

Step 4: Compare Policies and Prices

After inputting your details, the comparison website will present you with a list of policies and quotes from multiple insurance providers. Take the time to carefully review and compare each option, considering factors like coverage limits, deductibles, additional features, and, of course, the price.

Use the comparison tools and visual aids provided by the website to evaluate policies side by side and make informed decisions. Ensure you understand the nuances of each policy and how it aligns with your specific needs and budget.

Step 5: Choose Your Preferred Policy

Once you’ve thoroughly compared the available policies, select the one that best fits your needs and budget. Consider not only the price but also the coverage limits, deductibles, and any additional features that may be valuable to you.

If you have any doubts or questions, reach out to the comparison website's customer support or contact the insurance provider directly for clarification. Ensure you fully understand the terms and conditions of the policy you've chosen before proceeding.

Step 6: Purchase or Make an Inquiry

After selecting your preferred policy, you can either purchase the insurance directly through the comparison website (if this option is available) or contact the insurance provider directly to complete the purchase process.

If you choose to purchase through the comparison website, follow the provided instructions and ensure you have all the necessary information and documentation ready. If you opt to contact the provider directly, reach out to their customer service or sales team to finalize the purchase and obtain your insurance policy.

Tips for Maximizing Your Comparison Experience

To ensure you get the most out of your car insurance comparison experience, here are some valuable tips to keep in mind:

Be Honest and Accurate

When inputting your information on a comparison website, be honest and accurate to receive the most relevant and accurate quotes and policy recommendations. Misrepresenting your details or providing false information can lead to inaccurate results and potential issues down the line.

Provide precise information about your driving history, vehicle details, and any unique circumstances (e.g., teenage drivers, high-risk drivers, etc.) to ensure you get tailored recommendations and quotes that align with your actual needs.

Explore Different Coverage Types

Car insurance policies come in various forms, each with its own set of coverage limits and additional features. Explore different coverage types to understand which ones best fit your needs. Some common coverage types include:

- Liability Coverage: This covers damages or injuries you cause to others in an accident.

- Collision Coverage: Covers repairs or replacements for your vehicle if you're involved in a collision, regardless of fault.

- Comprehensive Coverage: Provides protection against non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who has little or no insurance.

- Medical Payments Coverage: Covers medical expenses for you and your passengers if injured in an accident.

Understanding these coverage types and their benefits will help you make informed decisions when comparing policies.

Consider Your Budget and Needs

While comparing policies, consider your budget and specific needs to find the right balance between coverage and cost. Assess your financial situation and determine how much you’re willing and able to spend