Online Life Insurance Quote

In today's digital age, obtaining an online life insurance quote has become an efficient and convenient way to explore and compare insurance options. This process empowers individuals to take control of their financial future and make informed decisions regarding their life insurance coverage. With a few clicks, you can access a wealth of information and receive personalized quotes tailored to your specific needs and circumstances. This article delves into the world of online life insurance quotes, offering a comprehensive guide to help you navigate the process seamlessly.

Understanding Online Life Insurance Quotes

An online life insurance quote is a digital tool that allows individuals to receive an estimate of their life insurance premiums and coverage options without the need for in-person meetings or extensive paperwork. It serves as a valuable starting point for those seeking to understand the cost and coverage implications of different life insurance policies.

The beauty of online quotes lies in their accessibility and convenience. You can access multiple quotes from various insurance providers within a short timeframe, making it easier to compare and contrast different policies. This transparency enables you to make well-informed decisions about your life insurance coverage, ensuring you find a policy that aligns with your financial goals and budget.

How Do Online Life Insurance Quotes Work?

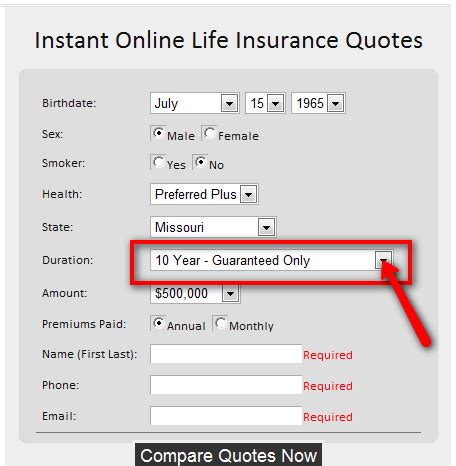

The process of obtaining an online life insurance quote typically involves the following steps:

- Provide Basic Information: You will be asked to input some personal details, such as your name, date of birth, and contact information. This information is necessary for the insurance provider to generate an accurate quote.

- Select Coverage Type: Choose the type of life insurance you are interested in, such as term life, whole life, or universal life insurance. Each type offers different benefits and coverage durations.

- Enter Coverage Amount: Specify the desired coverage amount, which represents the sum of money your beneficiaries would receive upon your passing. This amount should be sufficient to cover any financial obligations and provide for your loved ones.

- Answer Health-Related Questions: Insurance providers may ask a series of questions about your health and lifestyle. These questions help assess your risk level and determine the premium rates. Be honest in your responses to ensure an accurate quote.

- Review and Compare Quotes: After submitting your information, you will receive one or more quotes from the insurance provider. Take the time to review and compare the quotes, considering factors such as coverage, premiums, and additional benefits offered.

- Contact the Provider: If you find a quote that aligns with your needs, you can contact the insurance provider to discuss the next steps, which may include a more detailed application process and potential medical examinations.

| Key Considerations | Details |

|---|---|

| Term Life Insurance | Offers coverage for a specific term, typically ranging from 10 to 30 years. It is ideal for individuals seeking affordable coverage during key life stages. |

| Whole Life Insurance | Provides lifelong coverage and accumulates cash value over time. It offers stability and financial security for your beneficiaries. |

| Universal Life Insurance | Offers flexibility in terms of coverage amounts and premium payments. It allows you to adjust your coverage and premiums based on your changing needs. |

Benefits of Obtaining Online Life Insurance Quotes

The rise of online life insurance quotes has revolutionized the way individuals approach their financial planning. Here are some key advantages of exploring life insurance options online:

Convenience and Accessibility

Online quotes provide unparalleled convenience, allowing you to access and compare insurance options from the comfort of your own home. You can obtain multiple quotes within minutes, saving you time and effort compared to traditional in-person meetings with insurance agents.

Transparency and Comparison

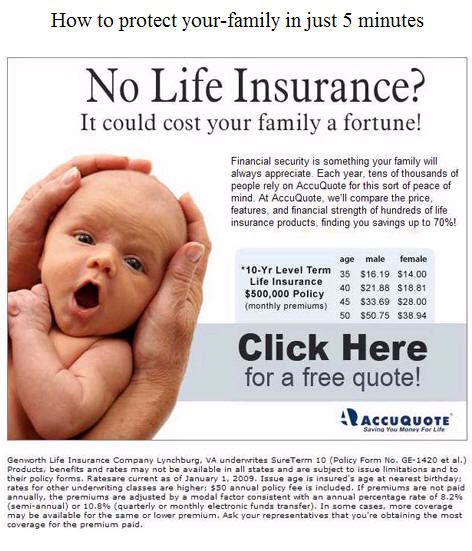

With online quotes, you gain a transparent view of the insurance market. You can easily compare coverage, premiums, and additional benefits offered by different providers. This transparency empowers you to make informed choices that align with your financial goals and budget.

Personalized Estimates

Online life insurance quotes are tailored to your specific circumstances. By providing your personal details and coverage preferences, you receive estimates that reflect your unique needs. This ensures that the quotes you receive are relevant and accurate, helping you make confident decisions about your life insurance coverage.

No Obligation or Pressure

Obtaining online quotes is a risk-free process. You are under no obligation to purchase a policy after receiving a quote. This freedom allows you to explore various options without feeling pressured to make an immediate decision. You can take your time, thoroughly review the quotes, and seek professional advice if needed.

Factors Influencing Online Life Insurance Quotes

When you request an online life insurance quote, several factors come into play that influence the estimated premiums and coverage. Understanding these factors can help you prepare and provide accurate information, resulting in more precise quotes.

Age and Health

Your age and health status are key determinants of your life insurance premiums. Generally, younger individuals with good health conditions are offered lower premiums. As you age or if you have pre-existing health conditions, your premiums may increase.

Lifestyle and Habits

Your lifestyle choices and habits can impact your life insurance quote. For instance, if you engage in high-risk activities such as extreme sports or have a history of substance abuse, your premiums may be higher. Conversely, leading a healthy lifestyle with regular exercise and a balanced diet can result in more favorable quotes.

Family History

Your family’s medical history can influence your life insurance quote. If you have a family history of certain medical conditions or diseases, such as heart disease or cancer, your premiums may be affected. It’s important to be transparent about your family’s medical history when providing information for your quote.

Occupation and Hobbies

Your occupation and hobbies can also impact your life insurance quote. Certain high-risk occupations, such as those in construction or emergency services, may result in higher premiums. Similarly, engaging in risky hobbies like skydiving or motor racing can affect your quote. Be sure to disclose all relevant information to ensure an accurate estimate.

Tips for Maximizing Your Online Life Insurance Quote

To ensure you receive the most accurate and beneficial online life insurance quotes, consider the following tips:

- Be Honest and Transparent: Provide accurate and complete information about your health, lifestyle, and personal circumstances. Honesty is crucial for obtaining precise quotes and ensuring you are not surprised by additional costs or exclusions later on.

- Shop Around: Don't settle for the first quote you receive. Compare quotes from multiple insurance providers to find the best coverage and premiums that suit your needs. Shopping around can help you identify the most competitive rates and options.

- Consider Different Coverage Types: Explore various types of life insurance, such as term, whole, and universal life insurance. Each type offers unique benefits and coverage durations. Understanding your options will help you make an informed decision about the coverage that best aligns with your financial goals.

- Seek Professional Advice: If you are unsure about the best life insurance option for your circumstances, consider consulting with a financial advisor or insurance broker. They can provide expert guidance and help you navigate the complex world of life insurance, ensuring you make the right choice for your financial well-being.

Future of Online Life Insurance Quotes

The landscape of online life insurance quotes is constantly evolving, driven by advancements in technology and changing consumer preferences. Here’s a glimpse into the future of online life insurance quotes:

Enhanced Digital Experiences

Insurance providers are investing in improving their online platforms to offer seamless and intuitive user experiences. Expect to see more user-friendly interfaces, interactive tools, and personalized recommendations that make the quote process even more efficient and engaging.

Integration of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning technologies are likely to play a bigger role in the life insurance quote process. These technologies can analyze vast amounts of data, including medical records and lifestyle patterns, to provide more accurate and personalized quotes. AI-powered chatbots and virtual assistants may also become more prevalent, offering instant support and guidance throughout the quote journey.

Expanded Coverage Options

As the demand for life insurance continues to grow, insurance providers are likely to expand their coverage options to cater to a wider range of needs. This may include specialized policies for specific demographics, such as millennials or retirees, as well as innovative products that offer additional benefits and flexibility.

Focus on Customer Education

Insurance providers are recognizing the importance of educating their customers about life insurance. Expect to see more educational resources and tools on their websites, helping individuals understand the nuances of different policies and make informed decisions. This focus on customer education can empower individuals to choose the right coverage and make the most of their life insurance investments.

Conclusion

Online life insurance quotes have revolutionized the way individuals explore and compare life insurance options. By leveraging the power of the internet, you can access a wealth of information and receive personalized quotes tailored to your needs. The benefits of online quotes, including convenience, transparency, and personalization, make it an attractive and efficient option for those seeking life insurance coverage. As you embark on your journey towards securing your financial future, remember to approach the process with honesty, due diligence, and a willingness to explore the various coverage options available. With the right information and a strategic approach, you can find a life insurance policy that provides peace of mind and ensures the financial well-being of your loved ones.

How accurate are online life insurance quotes?

+Online life insurance quotes provide a good estimate of your premiums and coverage. However, they are not definitive. The accuracy of the quote depends on the information you provide and the assumptions made by the insurance provider. For a more precise quote, you may need to complete a full application and undergo a medical examination.

Can I get multiple online life insurance quotes at once?

+Yes, most online quote platforms allow you to compare quotes from multiple insurance providers simultaneously. This feature makes it easier to shop around and find the best coverage and premiums for your needs.

Do online life insurance quotes affect my credit score?

+No, obtaining an online life insurance quote does not impact your credit score. Insurance providers use soft inquiries, which do not affect your credit rating, to generate your quote.

Can I customize my life insurance policy based on the online quote?

+Yes, online life insurance quotes often provide a starting point for customizing your policy. You can adjust coverage amounts, add riders or additional benefits, and even switch between different types of life insurance to create a policy that meets your specific needs.