The Alliance Insurance

In the dynamic world of insurance, where protection and peace of mind are paramount, The Alliance Insurance stands as a beacon of trust and reliability. With a rich history spanning decades, this insurance powerhouse has solidified its position as a leader in the industry, offering comprehensive coverage tailored to meet the diverse needs of individuals, families, and businesses alike. As we delve into the realm of The Alliance Insurance, we uncover a story of innovation, excellence, and a deep-rooted commitment to safeguarding what matters most to its valued clients.

A Legacy of Excellence: The Evolution of The Alliance Insurance

The journey of The Alliance Insurance began over 50 years ago when a visionary group of insurance experts recognized the need for a company that could provide not just insurance policies, but a holistic approach to risk management and financial security. Since its inception, The Alliance has been at the forefront of the industry, consistently setting new standards and adapting to the ever-changing landscape of insurance.

Over the decades, The Alliance Insurance has witnessed and embraced technological advancements, regulatory changes, and evolving consumer needs. This adaptability has been a key factor in its success, allowing the company to offer innovative products and services that stay ahead of the curve. From its early days as a small, regional insurer to its current status as a global leader, The Alliance has grown exponentially, expanding its reach and influence while maintaining its core values of integrity, customer satisfaction, and financial stability.

Key Milestones in The Alliance’s Journey

The growth and success of The Alliance Insurance can be traced through a series of significant milestones:

- 1970s: Established as a regional insurer, The Alliance quickly gained a reputation for its personalized approach and commitment to customer service.

- 1980s: This decade saw The Alliance expand its offerings, introducing innovative products like comprehensive auto insurance and specialized business coverage.

- 1990s: With the rise of the digital age, The Alliance embraced technology, becoming one of the first insurers to offer online policy management and digital claim submissions.

- 2000s: The Alliance further solidified its position as an industry leader, acquiring several smaller insurers and expanding its global footprint.

- 2010s: This decade was marked by a focus on sustainability and social responsibility, with The Alliance launching initiatives to reduce its environmental impact and support community development.

Today, The Alliance Insurance continues to thrive, offering a diverse range of insurance products and services that cater to a global clientele. Its commitment to innovation, coupled with its deep-rooted values, has made The Alliance a trusted partner for millions of people and businesses worldwide.

The Alliance’s Comprehensive Coverage: Protecting What Matters

At the heart of The Alliance Insurance’s success is its unwavering dedication to providing comprehensive coverage that addresses a wide range of risks. Whether it’s safeguarding your home, protecting your vehicle, or ensuring the continuity of your business, The Alliance has a tailored solution to meet your needs.

Home Insurance: A Secure Haven

The Alliance’s home insurance policies are designed to provide peace of mind to homeowners and renters alike. From natural disasters to accidental damages, their coverage options offer protection for your dwelling, personal belongings, and liability. With customizable policies and competitive rates, The Alliance ensures that your home is protected, allowing you to focus on creating cherished memories within its walls.

| Coverage Options | Key Benefits |

|---|---|

| Dwelling Coverage | Protects the structure of your home against damages. |

| Personal Property Coverage | Covers the replacement or repair of your belongings in case of loss or damage. |

| Liability Coverage | Provides financial protection in case of accidents or injuries on your property. |

| Additional Living Expenses | Covers the cost of temporary housing if your home becomes uninhabitable due to a covered event. |

Auto Insurance: Safe Journeys Ahead

With The Alliance’s auto insurance, you can hit the road with confidence, knowing you have comprehensive protection for your vehicle. Their policies offer coverage for a range of scenarios, from accidents and theft to natural disasters and vandalism. Whether you’re a daily commuter or an occasional driver, The Alliance has a policy that suits your needs and budget.

| Coverage Options | Key Benefits |

|---|---|

| Liability Coverage | Provides financial protection if you're found at fault in an accident. |

| Collision Coverage | Covers damage to your vehicle in case of an accident, regardless of fault. |

| Comprehensive Coverage | Protects your vehicle against theft, vandalism, and damages caused by natural disasters. |

| Medical Payments Coverage | Covers medical expenses for you and your passengers in case of an accident. |

Business Insurance: Fortifying Your Enterprise

The Alliance understands that every business is unique, which is why they offer a wide range of business insurance solutions tailored to specific industries and needs. From small startups to large corporations, their policies provide protection against a myriad of risks, ensuring the continuity and growth of your business.

| Coverage Options | Key Benefits |

|---|---|

| General Liability Insurance | Protects your business against third-party claims, such as property damage or bodily injury. |

| Commercial Property Insurance | Covers your business property, including buildings, equipment, and inventory, against damages and losses. |

| Business Interruption Insurance | Provides financial support if your business operations are disrupted due to a covered event. |

| Professional Liability Insurance | Offers protection for your business against claims of negligence or errors in professional services. |

The Alliance’s Customer-Centric Approach: Beyond Insurance

At The Alliance Insurance, the customer experience goes beyond simply providing insurance policies. The company understands that insurance is about more than financial protection; it’s about peace of mind, security, and building trust. This philosophy is evident in their customer-centric approach, which prioritizes personalized service, education, and support.

Personalized Service: Tailoring Solutions to Your Needs

The Alliance believes in the power of personalized service, understanding that every client’s needs are unique. Their team of experienced insurance professionals takes the time to understand your situation, offering tailored advice and recommendations to ensure you have the right coverage for your specific circumstances. Whether you’re a first-time insurance buyer or a seasoned business owner, The Alliance’s agents work closely with you to create a customized plan that fits your needs and budget.

Educational Resources: Empowering You to Make Informed Decisions

The Alliance Insurance recognizes that insurance can be complex, and making informed decisions is crucial. That’s why they provide a wealth of educational resources to empower their clients. From comprehensive policy guides to informative blogs and webinars, The Alliance ensures that you have the knowledge you need to understand your coverage and make the best choices for your protection.

Exceptional Claim Support: When You Need It Most

In the event of a claim, The Alliance’s commitment to its customers shines through. Their dedicated claims team is known for its efficiency and empathy, ensuring a smooth and stress-free process. With a focus on timely resolution and fair settlements, The Alliance aims to provide the support you need to get back on your feet quickly, whether it’s after a natural disaster, an accident, or a business interruption.

The Alliance’s Commitment to Innovation and Sustainability

Innovation is at the core of The Alliance Insurance’s DNA, driving the company to stay ahead of the curve and deliver cutting-edge solutions. This commitment to innovation is evident in their technology-driven approach, which has revolutionized the way they interact with customers and manage risk.

Technology Integration: Enhancing the Customer Experience

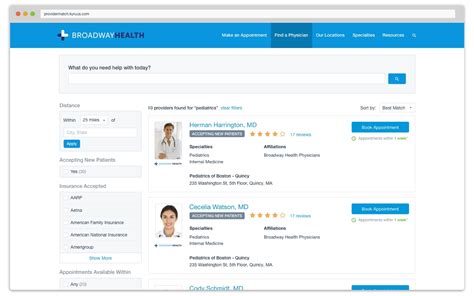

The Alliance has embraced digital transformation, leveraging technology to enhance every aspect of the customer journey. From interactive websites and mobile apps for policy management to AI-powered chatbots for instant support, The Alliance has made insurance more accessible and user-friendly. Their online platforms offer a seamless experience, allowing customers to purchase policies, manage their accounts, and file claims with just a few clicks.

Sustainable Practices: Protecting the Planet

Beyond its commitment to innovation, The Alliance is also dedicated to sustainability and social responsibility. Recognizing the impact of climate change on the insurance industry, The Alliance has implemented a range of initiatives to reduce its environmental footprint and promote sustainable practices. From adopting green office policies to investing in renewable energy projects, The Alliance is leading by example and encouraging its clients and partners to join the sustainability journey.

| Sustainability Initiatives | Impact |

|---|---|

| Green Office Policies | Reducing energy consumption and waste, promoting a healthier work environment. |

| Renewable Energy Investments | Supporting the transition to clean energy, reducing carbon emissions. |

| Community Engagement | Promoting environmental awareness and education, fostering a culture of sustainability. |

How can I get a quote for The Alliance Insurance’s policies?

+Getting a quote from The Alliance Insurance is simple and convenient. You can visit their official website and use the online quote tool, which allows you to input your details and receive a personalized quote within minutes. Alternatively, you can contact their customer service team via phone or email, and an agent will guide you through the process and provide you with a quote based on your specific needs.

What sets The Alliance Insurance apart from other insurers?

+The Alliance Insurance stands out for its commitment to innovation, customer satisfaction, and sustainability. They offer a wide range of customizable insurance products, ensuring that clients receive tailored coverage. Additionally, their focus on technology and digital transformation enhances the customer experience, making insurance more accessible and efficient. The Alliance’s dedication to social responsibility and environmental initiatives further sets them apart as a forward-thinking insurer.

How can I file a claim with The Alliance Insurance?

+Filing a claim with The Alliance Insurance is straightforward. You can initiate the process online through their secure claim portal, which allows you to upload necessary documents and track the progress of your claim in real-time. Alternatively, you can contact their 24⁄7 customer service hotline, where a dedicated claims representative will guide you through the steps and provide the support you need.