Call The General Insurance

In the dynamic landscape of insurance, companies must continuously innovate to meet the evolving needs of their customers. Call The General Insurance, a prominent player in the industry, has established itself as a trusted provider of auto insurance solutions with a unique approach to customer engagement. This article delves into the intricacies of Call The General Insurance, exploring its history, services, and the factors that have contributed to its success.

A Legacy of Service: The Story of Call The General Insurance

Call The General Insurance, or CTGI as it is affectionately known, traces its roots back to the early 2000s. Founded by a group of visionary entrepreneurs with a deep understanding of the insurance market, CTGI set out to revolutionize the way auto insurance was delivered. Their mission was simple yet powerful: to provide exceptional customer service and affordable coverage to drivers across the United States.

Over the years, CTGI has expanded its reach, building a solid reputation for integrity and reliability. Through a combination of innovative technology, a dedicated team of professionals, and a customer-centric approach, the company has become a go-to choice for many drivers seeking comprehensive and cost-effective auto insurance solutions.

The Core Values of Call The General Insurance

At the heart of CTGI’s success are its core values, which guide every aspect of its operations. These values include a commitment to excellence, an emphasis on ethical business practices, and a passion for delivering outstanding customer experiences. By adhering to these principles, CTGI has not only built a loyal customer base but has also attracted some of the brightest minds in the insurance industry.

The company's culture of continuous improvement and adaptability has enabled it to stay ahead of the curve, embracing new technologies and market trends to offer its customers the best possible service. This commitment to staying at the forefront of the industry has solidified CTGI's position as a leader in the highly competitive auto insurance market.

Services Offered by Call The General Insurance

CTGI offers a comprehensive range of auto insurance policies tailored to meet the diverse needs of its customers. Whether you’re a young driver just starting out, a seasoned motorist, or a business owner with a fleet of vehicles, CTGI has a policy that fits your requirements.

Auto Insurance Policies

CTGI’s auto insurance policies provide comprehensive coverage for a variety of scenarios. These policies include liability protection, collision coverage, comprehensive protection against theft and natural disasters, and medical payments to cover injuries sustained in an accident. Additionally, CTGI offers uninsured and underinsured motorist coverage, ensuring that policyholders are protected even when involved in an accident with a driver who lacks adequate insurance.

The company also provides specialized policies for high-risk drivers, offering SR-22 and FR-44 insurance to help drivers comply with legal requirements after certain traffic violations. These policies demonstrate CTGI's commitment to providing coverage for all types of drivers, regardless of their driving history.

| Policy Type | Coverage Highlights |

|---|---|

| Standard Auto Insurance | Liability, Collision, Comprehensive, Medical Payments |

| High-Risk Driver Insurance | SR-22, FR-44, Specialized Coverage |

| Fleet Insurance | Cost-Effective Solutions for Business Owners |

Fleet Insurance

For business owners with a fleet of vehicles, CTGI offers tailored fleet insurance solutions. These policies are designed to provide cost-effective coverage while taking into account the unique risks associated with managing a fleet. With a dedicated team of fleet insurance specialists, CTGI ensures that business owners receive the support and expertise they need to protect their assets and their livelihood.

Additional Services and Benefits

Beyond its core insurance offerings, CTGI provides a range of additional services and benefits to enhance the overall customer experience. These include 24⁄7 customer support, online policy management tools, and discounts for safe driving and multi-policy bundles. The company also offers accident forgiveness programs and claims assistance to help policyholders navigate the often complex process of filing and resolving insurance claims.

The Technology Advantage: CTGI’s Digital Transformation

In today’s digital age, insurance companies must leverage technology to enhance their services and remain competitive. Call The General Insurance has embraced this challenge head-on, investing in cutting-edge technology to revolutionize its operations and improve the customer experience.

Digital Tools for Customer Engagement

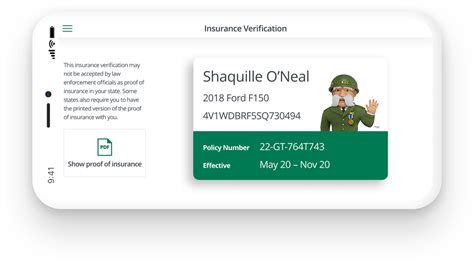

CTGI’s online platform offers a seamless and intuitive experience for customers. Policyholders can manage their policies, make payments, and file claims with just a few clicks. The company’s mobile app, available on both iOS and Android devices, provides an additional layer of convenience, allowing customers to access their insurance information on the go.

Through these digital tools, CTGI has not only improved efficiency but also enhanced customer satisfaction. Policyholders can now take control of their insurance needs, making changes and updates to their policies whenever necessary, without having to wait for assistance from customer service representatives.

Data-Driven Insights and Personalized Recommendations

CTGI leverages advanced data analytics to gain insights into its customer base and the market as a whole. By analyzing vast amounts of data, the company can identify trends, predict customer behavior, and offer personalized recommendations to its policyholders. This data-driven approach enables CTGI to provide tailored coverage that meets the unique needs of each customer, fostering a deeper level of trust and loyalty.

Enhancing Claims Management with Technology

The company’s innovative claims management system utilizes advanced technology to streamline the claims process. CTGI’s system enables policyholders to file claims online, providing a fast and convenient way to initiate the claims process. Additionally, the system leverages artificial intelligence and machine learning to automate certain aspects of claims handling, such as damage assessment and fraud detection, further expediting the resolution of claims.

The Impact of Call The General Insurance on the Industry

Call The General Insurance’s commitment to innovation and customer-centricity has had a significant impact on the insurance industry as a whole. The company’s success has inspired other insurers to adopt more customer-friendly approaches, improve their digital offerings, and enhance their claims management processes.

Shaping Industry Standards

CTGI’s emphasis on transparency and ethical practices has set a new standard for the industry. By prioritizing customer satisfaction and delivering on its promises, the company has demonstrated that exceptional service and affordable coverage can coexist. This has led to a shift in industry norms, with more insurers recognizing the importance of building trust and loyalty with their customer base.

Driving Technological Advancements

The company’s embrace of technology has accelerated the industry’s digital transformation. CTGI’s success with its digital initiatives has encouraged other insurers to invest in technology, recognizing the potential for improved efficiency, enhanced customer experiences, and cost savings. This has led to a wave of innovation, with insurers developing new digital tools and platforms to stay competitive in the evolving market.

Empowering Customers Through Education

CTGI’s focus on customer education is another aspect that sets it apart. The company provides a wealth of resources, including blog posts, articles, and guides, to help customers better understand their insurance policies and the claims process. This commitment to education empowers customers to make informed decisions and navigate the often complex world of insurance with confidence.

What sets Call The General Insurance apart from other insurance providers?

+Call The General Insurance stands out for its customer-centric approach, innovative use of technology, and commitment to providing affordable coverage. The company’s dedication to delivering exceptional service and its focus on ethical business practices have earned it a reputation as a trusted provider in the auto insurance market.

How does CTGI’s digital platform enhance the customer experience?

+CTGI’s digital platform offers a seamless and intuitive experience, allowing customers to manage their policies, make payments, and file claims online. This convenience empowers policyholders to take control of their insurance needs, improving overall satisfaction and reducing the need for customer service interventions.

What additional services does CTGI provide to its policyholders?

+In addition to its core insurance offerings, CTGI provides 24⁄7 customer support, online policy management tools, and discounts for safe driving and multi-policy bundles. The company also offers accident forgiveness programs and claims assistance, ensuring policyholders have the support they need throughout their insurance journey.