Uhg Insurance

Introduction

In the complex world of insurance, finding the right coverage that offers both comprehensive protection and peace of mind is essential. This is where Uhg Insurance steps in, a leading provider known for its innovative approach to safeguarding individuals and businesses. With a reputation built on trust and a range of tailored policies, Uhg Insurance has become a go-to choice for many seeking financial security.

This article aims to delve deep into the world of Uhg Insurance, exploring its unique offerings, the benefits it provides, and how it can empower individuals and businesses to navigate life’s uncertainties with confidence. From understanding the basics of insurance to discovering the specific advantages of Uhg’s services, we will provide an insightful and informative journey into the realm of financial protection.

Understanding Uhg Insurance: A Holistic Approach

The Vision Behind Uhg Insurance

Founded on the principle of empowering individuals to take control of their financial future, Uhg Insurance has evolved into a trusted partner for those seeking comprehensive insurance solutions. With a team of experienced professionals, the company offers a wide array of insurance products designed to meet diverse needs, ensuring that every policyholder receives personalized attention and tailored coverage.

Core Offerings of Uhg Insurance

Uhg Insurance boasts an extensive portfolio of insurance products, including:

Health Insurance: With a focus on providing accessible and affordable healthcare coverage, Uhg’s health insurance plans offer a range of benefits, from routine check-ups to specialized treatments. The company’s network of preferred providers ensures policyholders receive quality care at reduced costs.

Life Insurance: Recognizing the importance of financial security for families, Uhg’s life insurance policies offer substantial death benefits, ensuring loved ones are provided for in the event of an unforeseen tragedy. The company’s flexible plans cater to different life stages, offering whole life, term life, and universal life insurance options.

Property Insurance: Protecting homes and businesses is a priority for Uhg Insurance. Their property insurance policies cover a wide range of perils, including fire, theft, and natural disasters, providing policyholders with the reassurance that their assets are safeguarded.

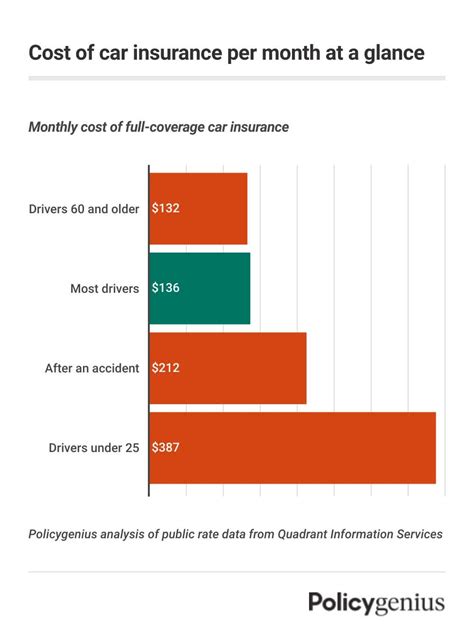

Auto Insurance: With a comprehensive auto insurance offering, Uhg provides coverage for a variety of vehicles, from personal cars to commercial fleets. Policyholders can choose from a range of coverage options, including liability, collision, and comprehensive coverage, ensuring they receive the protection they need.

Business Insurance: Understanding the unique risks faced by businesses, Uhg’s business insurance policies are tailored to provide comprehensive protection. From general liability to workers’ compensation and commercial property insurance, Uhg ensures businesses can operate with confidence, knowing their assets and operations are protected.

Benefits of Choosing Uhg Insurance

By opting for Uhg Insurance, policyholders can expect a range of advantages, including:

Personalized Service: Uhg Insurance believes in providing a personalized approach to insurance, ensuring that each policyholder’s unique needs are met. Their team of dedicated professionals works closely with individuals and businesses to understand their specific circumstances and tailor policies accordingly.

Competitive Pricing: With a commitment to offering affordable insurance solutions, Uhg strives to provide competitive pricing without compromising on coverage. Their extensive network of carriers and partners allows them to negotiate the best rates for their policyholders.

Claim Support: Uhg Insurance understands that filing a claim can be a stressful process. That’s why they provide dedicated claim support, ensuring policyholders receive the assistance they need to navigate the claims process smoothly and efficiently.

Educational Resources: Uhg Insurance believes in empowering its policyholders with knowledge. They offer a range of educational resources, including online tools, webinars, and personalized consultations, to help individuals and businesses make informed decisions about their insurance needs.

The Impact of Uhg Insurance: Real-World Success Stories

Securing Financial Stability for Families

Mr. and Mrs. Johnson, a young couple with two children, understood the importance of financial security. With Uhg Insurance’s life insurance policy, they were able to secure a substantial death benefit, ensuring their family’s financial well-being in the event of an unforeseen tragedy. The policy’s flexible payment options and comprehensive coverage provided them with the peace of mind to focus on their growing family.

Protecting Business Assets and Operations

Acme Inc., a thriving small business, recognized the need for comprehensive insurance coverage to protect their assets and operations. With Uhg Insurance’s business insurance policy, they were able to secure coverage for their commercial property, equipment, and liability risks. The policy’s flexibility allowed them to tailor the coverage to their specific needs, providing the reassurance needed to focus on business growth.

Accessible Healthcare Coverage for Individuals

Ms. Smith, a self-employed individual, struggled to find affordable and comprehensive healthcare coverage. With Uhg Insurance’s health insurance plan, she was able to access a network of preferred providers, ensuring she received quality care at reduced costs. The plan’s flexibility allowed her to choose the coverage options that best suited her needs, providing her with the healthcare security she desired.

Future Outlook: Expanding Horizons with Uhg Insurance

Continuous Innovation and Expansion

Uhg Insurance is committed to staying at the forefront of the insurance industry, continuously innovating and expanding its offerings to meet the evolving needs of its policyholders. The company’s research and development team works tirelessly to identify new risks and develop tailored solutions, ensuring that its insurance products remain relevant and comprehensive.

Embracing Digital Transformation

Recognizing the importance of digital transformation, Uhg Insurance has invested heavily in technology to enhance the customer experience. Their online platform offers policyholders convenient access to their policies, allowing them to manage their coverage, file claims, and receive real-time updates. This digital transformation has streamlined the insurance process, providing policyholders with greater control and efficiency.

Strengthening Partnerships for Enhanced Services

Uhg Insurance understands the value of strong partnerships in delivering exceptional services. The company has established strategic alliances with leading insurance carriers, healthcare providers, and financial institutions, ensuring that policyholders have access to a wide range of specialized services and expertise. These partnerships enhance the overall customer experience, providing policyholders with a comprehensive suite of financial protection solutions.

FAQ: Common Questions about Uhg Insurance

What sets Uhg Insurance apart from other insurance providers?

+Uhg Insurance stands out with its personalized approach, competitive pricing, and dedicated claim support. Their comprehensive range of insurance products and focus on customer education make them a trusted partner for individuals and businesses seeking financial security.

How can I customize my insurance policy with Uhg Insurance?

+Uhg Insurance offers a wide range of customizable options for their insurance policies. Whether it's adjusting coverage limits, adding endorsements, or choosing specific coverage types, policyholders have the flexibility to tailor their policies to their unique needs.

What is the claims process like with Uhg Insurance?

+Uhg Insurance provides a streamlined claims process, with dedicated claim support available to guide policyholders through the entire process. From filing a claim to receiving payment, their team ensures a smooth and efficient experience, minimizing stress during challenging times.

Can I bundle multiple insurance policies with Uhg Insurance?

+Absolutely! Uhg Insurance encourages policyholders to bundle their insurance policies to save time and money. By combining multiple policies, such as auto, home, and life insurance, policyholders can enjoy discounted rates and simplified management of their insurance needs.

Conclusion: Empowering a Secure Future with Uhg Insurance

In an ever-changing world, the importance of financial security and protection cannot be overstated. With Uhg Insurance, individuals and businesses can take control of their future, knowing they have a trusted partner by their side. By offering a comprehensive range of insurance products, personalized service, and a commitment to innovation, Uhg Insurance empowers its policyholders to navigate life’s uncertainties with confidence and peace of mind.

Whether it’s securing a family’s financial future, protecting a business’s assets, or accessing affordable healthcare, Uhg Insurance provides the tools and support needed to thrive. With their continuous focus on customer satisfaction and industry leadership, Uhg Insurance remains a reliable choice for those seeking comprehensive insurance solutions.

Unlock the power of Uhg Insurance today and embark on a journey towards a more secure and prosperous future.