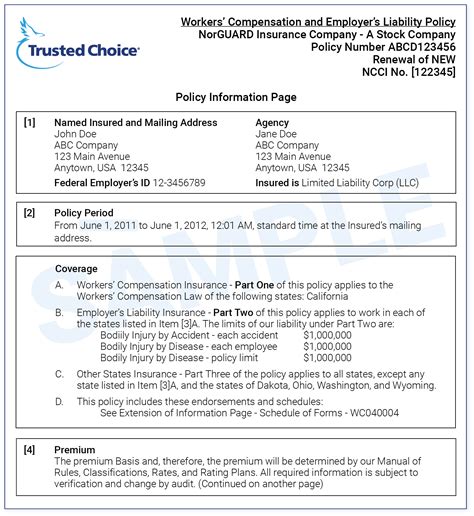

Workers Compensation Insurance Policy

Workers' compensation insurance is a vital aspect of any business, ensuring the well-being and financial security of employees in the event of work-related injuries or illnesses. This type of insurance provides a safety net for both employees and employers, offering peace of mind and protection against potential financial burdens. With a rich history dating back to ancient civilizations, the concept of compensating workers for injuries has evolved significantly over time, and today, it plays a crucial role in maintaining a fair and sustainable workplace environment.

Understanding Workers’ Compensation Insurance

Workers’ compensation, often referred to as workman’s comp or simply comp, is a form of insurance coverage mandated by state laws in the United States. It provides wage replacement and medical benefits to employees who suffer work-related injuries or illnesses, regardless of fault. This insurance system is designed to be a no-fault system, meaning that injured workers are entitled to benefits without having to prove that their employer was at fault for the injury.

The primary purpose of workers' compensation is to ensure that injured workers receive prompt medical treatment and financial support during their recovery. It also protects employers from costly lawsuits and provides a structured process for handling workplace injuries, which can be beneficial for both parties involved.

Key Components of a Workers’ Compensation Policy

A typical workers’ compensation insurance policy covers various aspects of an employee’s well-being and financial needs, including:

- Medical Benefits: This covers the cost of medical treatment, including doctor visits, hospital stays, medications, and rehabilitation services. It ensures that injured workers receive the necessary care to recover fully.

- Income Benefits: These benefits replace a portion of an employee’s lost wages while they are unable to work due to their injury. The amount and duration of income benefits vary depending on the state and the severity of the injury.

- Vocational Rehabilitation: In cases where an injury results in permanent disability, workers’ compensation can provide vocational rehabilitation services to help the employee return to work or find suitable alternative employment.

- Death Benefits: If a work-related injury results in the death of an employee, workers’ compensation provides benefits to their surviving dependents, ensuring financial support during a difficult time.

The Benefits of Workers’ Compensation for Employers

Implementing a robust workers’ compensation insurance policy offers numerous advantages to employers, beyond simply meeting legal requirements. Here are some key benefits:

Legal Compliance and Risk Management

Every state in the U.S. has laws mandating that employers provide workers’ compensation coverage. By obtaining the appropriate insurance, employers ensure they are compliant with these laws, avoiding potential legal penalties and lawsuits. Additionally, workers’ compensation policies help manage risks associated with workplace injuries, providing a structured process for handling claims and reducing the financial impact of such incidents.

Attracting and Retaining Talented Employees

Offering comprehensive workers’ compensation coverage is an attractive benefit for potential employees. It demonstrates a commitment to employee welfare and can help attract top talent. Moreover, by providing prompt and fair compensation for workplace injuries, employers foster a positive work environment and enhance employee retention.

Reduced Absenteeism and Improved Productivity

Workers’ compensation policies that offer timely medical treatment and income benefits encourage employees to seek immediate care for injuries. This proactive approach can lead to faster recovery times, reducing absenteeism and minimizing the impact on productivity. By addressing injuries promptly, employers can maintain a healthier and more productive workforce.

The Role of Insurance Carriers and Third-Party Administrators

In the workers’ compensation landscape, insurance carriers and third-party administrators (TPAs) play crucial roles in ensuring the smooth operation of the system. Insurance carriers provide the financial backing for workers’ compensation policies, assuming the risk of paying benefits to injured workers. They assess the risk associated with different industries and occupations and set premiums accordingly.

Third-party administrators, on the other hand, handle the day-to-day administration of workers' compensation programs. They process claims, coordinate medical care, and manage the overall administration of the insurance policy. TPAs can be especially beneficial for smaller businesses that may not have the resources to manage workers' compensation claims internally.

Choosing the Right Insurance Carrier and TPA

Selecting an insurance carrier and TPA is a critical decision for employers. Here are some factors to consider when making this choice:

- Financial Stability: Opt for insurance carriers with a strong financial rating to ensure they can meet their obligations in the event of numerous or large claims.

- Industry Expertise: Look for carriers and TPAs with experience in your specific industry. They will have a better understanding of the unique risks and challenges faced by your business.

- Claims Handling: Assess the carrier’s and TPA’s claims management process. Efficient and fair claims handling is essential for the well-being of your employees and the financial health of your business.

- Customer Service: Excellent customer service is vital. Choose a carrier and TPA that prioritize responsiveness and provide support throughout the policy period.

Real-World Examples of Workers’ Compensation Claims

To illustrate the impact and importance of workers’ compensation, let’s explore a couple of real-world scenarios:

Scenario 1: Workplace Accident

John, a construction worker, suffers a severe fall from a ladder while on the job. He sustains multiple fractures and requires immediate medical attention. Thanks to his employer’s workers’ compensation insurance, John receives prompt treatment at a nearby hospital. The insurance policy covers all medical expenses, including surgery and physical therapy, ensuring John’s recovery. Additionally, the income benefits provided by the policy help John and his family maintain their financial stability during his extended absence from work.

Scenario 2: Occupational Illness

Emily, a factory worker, develops severe respiratory issues after prolonged exposure to harmful chemicals in the workplace. Her condition deteriorates, and she is diagnosed with occupational asthma. With workers’ compensation coverage in place, Emily can access specialized medical treatment and receive income benefits while she recovers. The insurance policy also facilitates her transition to a safer work environment within the same company, ensuring her long-term health and career prospects.

Performance Analysis and Industry Insights

The performance of workers’ compensation insurance policies is closely monitored by regulatory bodies and industry experts. Here are some key performance indicators and insights:

Claim Denial Rates

Low claim denial rates are indicative of a fair and efficient workers’ compensation system. A study by the National Council on Compensation Insurance (NCCI) reveals that the average denial rate for workers’ compensation claims in the U.S. is approximately 12%. This means that for every 100 claims filed, only 12 are denied, highlighting the effectiveness of the system in providing benefits to injured workers.

Return-to-Work Rates

High return-to-work rates are a positive outcome for both employees and employers. A successful workers’ compensation program should facilitate a swift and safe return to work for injured employees. According to a report by the Workers Compensation Research Institute (WCRI), the average return-to-work rate for injured workers is approximately 78%, demonstrating the system’s effectiveness in helping employees regain their livelihoods.

Industry-Specific Challenges

Different industries face unique challenges when it comes to workers’ compensation. For instance, the construction industry, known for its high-risk nature, often deals with a higher incidence of severe injuries. On the other hand, industries with a high prevalence of repetitive strain injuries, such as manufacturing or data entry, may face challenges in accurately assessing and managing these types of claims.

Future Implications and Industry Trends

The workers’ compensation industry is continually evolving to meet the changing needs of employers and employees. Here are some key trends and implications to watch for:

Emphasis on Preventative Measures

There is a growing focus on workplace safety and injury prevention. Employers are investing in ergonomic improvements, safety training, and technology to reduce the risk of injuries. This proactive approach not only minimizes the number of claims but also creates a safer and more productive work environment.

Telemedicine and Remote Claim Management

The rise of telemedicine and remote work has had a significant impact on workers’ compensation. Telemedicine allows injured workers to receive medical consultations and follow-up care without physically visiting a clinic, improving accessibility and convenience. Additionally, remote claim management systems streamline the claims process, making it more efficient and less burdensome for all parties involved.

Data-Driven Decision Making

Advanced analytics and data-driven insights are transforming the workers’ compensation landscape. By analyzing historical claim data, industry trends, and employee health records, insurers and TPAs can make more informed decisions about risk assessment, claim management, and policy design. This data-driven approach enhances the overall efficiency and effectiveness of the workers’ compensation system.

Frequently Asked Questions

How does workers’ compensation insurance work for self-employed individuals or small business owners?

+Workers’ compensation insurance is typically mandatory for employers with employees, but self-employed individuals and sole proprietors have the option to purchase coverage for themselves. This coverage provides the same benefits as traditional workers’ comp, ensuring that business owners are protected in the event of work-related injuries.

What happens if an employer fails to provide workers’ compensation insurance as required by law?

+Employers who fail to provide the mandated workers’ compensation coverage can face significant penalties, including fines, civil lawsuits, and even criminal charges. Additionally, injured employees may be able to sue their employer directly for damages, bypassing the workers’ compensation system.

Are there any exclusions or limitations to workers’ compensation coverage?

+While workers’ compensation coverage is comprehensive, there are certain exclusions and limitations. For instance, injuries sustained while under the influence of drugs or alcohol, intentional self-inflicted injuries, and injuries resulting from willful misconduct may not be covered. It’s important to review the specific policy terms and conditions to understand any exclusions.

How can employers reduce the cost of workers’ compensation insurance?

+Employers can take several steps to reduce the cost of workers’ compensation insurance. This includes implementing robust safety protocols to minimize workplace injuries, investing in employee training and education, and maintaining a positive safety culture. Additionally, working with experienced insurance brokers can help employers find the most cost-effective coverage options.