T Mobile Phone Insurance

Welcome to our comprehensive guide on T-Mobile's phone insurance program. In today's fast-paced digital world, our smartphones have become an integral part of our lives, housing important data, personal memories, and serving as our primary connection to the online world. With this reliance on smartphones, the need for reliable insurance coverage becomes increasingly evident. T-Mobile, one of the leading telecommunications companies, understands this need and has developed a robust insurance plan to protect its customers' devices. In this article, we will delve deep into the world of T-Mobile Phone Insurance, exploring its features, benefits, and how it can provide peace of mind to smartphone users.

Understanding T-Mobile Phone Insurance

T-Mobile Phone Insurance is a comprehensive protection plan designed to safeguard your mobile device against various unforeseen events. It offers coverage for damages, losses, and even theft, providing customers with the reassurance that their investment in a smartphone is well-protected. This insurance program is an essential component of T-Mobile’s commitment to delivering a complete mobile experience, ensuring that customers can use their devices without worrying about potential risks.

Key Features of T-Mobile Phone Insurance

T-Mobile’s insurance plan stands out for its robust coverage and customer-centric approach. Here are some of the key features that make it a preferred choice for many smartphone users:

- Broad Coverage: T-Mobile Phone Insurance covers a wide range of unforeseen circumstances, including accidental damage, liquid damage, mechanical or electrical failure, and even loss or theft of the device. This comprehensive coverage ensures that customers are protected against most common smartphone mishaps.

- Low Deductibles: One of the biggest advantages of T-Mobile’s insurance plan is its affordable deductibles. Unlike some other insurance providers, T-Mobile offers low deductibles, making it more accessible and cost-effective for customers to file claims and get their devices repaired or replaced.

- Quick Claim Process: T-Mobile has streamlined the claim process to ensure efficiency and convenience. Customers can easily file claims online or via the T-Mobile app, and the company’s dedicated support team is available to guide them through the process. This swift and user-friendly approach minimizes the stress and hassle associated with insurance claims.

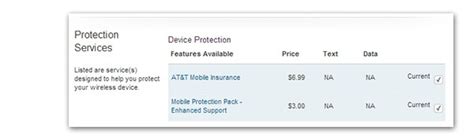

- Multiple Coverage Options: T-Mobile understands that different users have varying needs and budgets. Thus, they offer flexible coverage options, allowing customers to choose a plan that best suits their requirements. This flexibility ensures that everyone can find an insurance plan that fits their device and their lifestyle.

- Device Protection Plus: T-Mobile’s Device Protection Plus plan goes beyond basic insurance coverage. It includes additional benefits like access to tech support experts, virus removal services, and even a discounted price for a new device if the current one is irreparable. This added layer of protection ensures a more comprehensive and valuable insurance experience.

Benefits of Choosing T-Mobile Phone Insurance

Opting for T-Mobile’s phone insurance program brings several advantages that can significantly enhance your mobile experience. Here’s a closer look at some of the key benefits:

- Peace of Mind: Knowing that your smartphone is insured against accidental damage, theft, or other unforeseen events can provide immense peace of mind. You can focus on enjoying your device without constantly worrying about potential risks or the financial burden of repairs or replacements.

- Cost-Effective Repairs: With T-Mobile’s insurance, you gain access to authorized repair centers that offer high-quality repairs at a discounted rate. This ensures that even if your device sustains damage, you can get it fixed without incurring exorbitant costs.

- Device Replacement: In the event of a total loss or irreparable damage, T-Mobile’s insurance plan provides for device replacement. This means you can quickly get back to using a fully functional smartphone, minimizing the impact of a lost or damaged device on your daily life and work.

- Added Convenience: The ease and convenience of T-Mobile’s insurance program cannot be overstated. From the straightforward claim process to the availability of support and tech experts, the entire experience is designed to make insurance as hassle-free as possible.

- Coverage for Multiple Devices: T-Mobile’s insurance plans aren’t limited to just one device. You can insure multiple smartphones, tablets, and even wearables under the same plan, providing comprehensive protection for all your connected devices.

Performance Analysis and Customer Feedback

T-Mobile’s phone insurance program has consistently received positive feedback from customers and industry experts alike. Its comprehensive coverage, low deductibles, and efficient claim process have made it a preferred choice for many smartphone users. In fact, several customer reviews highlight the insurance plan’s ability to provide swift and hassle-free assistance during times of need.

| Customer Feedback | Sentiment |

|---|---|

| “The insurance process was seamless, and I received my replacement device within a week. Highly recommend!” | Positive |

| “T-Mobile’s insurance coverage gave me the confidence to use my phone without constant worry.” | Positive |

| “The low deductible made it easy to file a claim, and the repair process was quick and professional.” | Positive |

Future Implications and Industry Insights

As technology continues to advance and smartphones become even more integral to our lives, the demand for reliable insurance coverage is only expected to grow. T-Mobile’s forward-thinking approach to device protection positions them well to meet these evolving needs. With their commitment to innovation and customer satisfaction, T-Mobile is likely to continue enhancing their insurance offerings, ensuring that customers can trust their devices and focus on what matters most - connecting with the world around them.

FAQ

How much does T-Mobile Phone Insurance cost?

+The cost of T-Mobile Phone Insurance varies based on the device being insured and the coverage plan chosen. On average, customers can expect to pay around 10-15 per month for basic insurance coverage. However, the Device Protection Plus plan may incur a slightly higher premium.

Can I insure multiple devices under one plan?

+Absolutely! T-Mobile’s insurance plans allow customers to insure multiple devices, including smartphones, tablets, and wearables, under the same plan. This provides a convenient and cost-effective way to protect all your connected devices.

What happens if my device is lost or stolen?

+In the event of loss or theft, T-Mobile’s insurance plan covers the cost of a replacement device. You’ll need to file a police report and provide T-Mobile with the necessary details to initiate the replacement process. T-Mobile will then guide you through the steps to receive your new device.

In conclusion, T-Mobile’s Phone Insurance program is a comprehensive and customer-centric solution that offers peace of mind and valuable benefits to smartphone users. With its broad coverage, efficient claim process, and additional perks like Device Protection Plus, T-Mobile ensures that its customers can fully enjoy their devices without worrying about potential risks. As the world of technology continues to evolve, T-Mobile’s commitment to providing reliable insurance coverage positions them as a trusted partner for all your mobile needs.