Car Insurance Full Coverage Cost

Car insurance is an essential aspect of vehicle ownership, offering financial protection and peace of mind to drivers. However, understanding the costs associated with full coverage car insurance can be complex, as it involves various factors and coverage options. In this comprehensive guide, we delve into the world of car insurance full coverage costs, providing an in-depth analysis to help you navigate this critical aspect of automotive ownership.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a comprehensive policy that offers extensive protection for your vehicle and liability coverage. It typically includes two main components: collision coverage and comprehensive coverage. Let’s break down these components and explore the factors that influence their costs.

Collision Coverage

Collision coverage is a vital aspect of full coverage car insurance. It provides financial protection in the event of an accident involving your vehicle, regardless of who is at fault. This coverage pays for repairs or replacements if your car sustains damage due to a collision with another vehicle, an object, or even a pedestrian. Here’s a deeper look at collision coverage:

Factors Affecting Collision Coverage Costs:

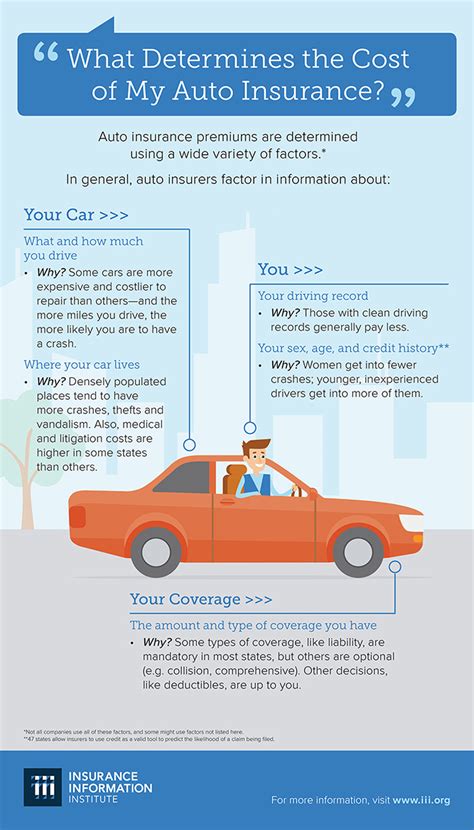

- Vehicle Type and Age: The make, model, and age of your vehicle play a significant role in determining collision coverage costs. Newer, more expensive cars generally require higher coverage limits, leading to increased premiums.

- Driving History: Your driving record is a key factor. A clean driving history with no accidents or violations can lead to lower collision coverage costs, as insurance providers view you as a lower risk.

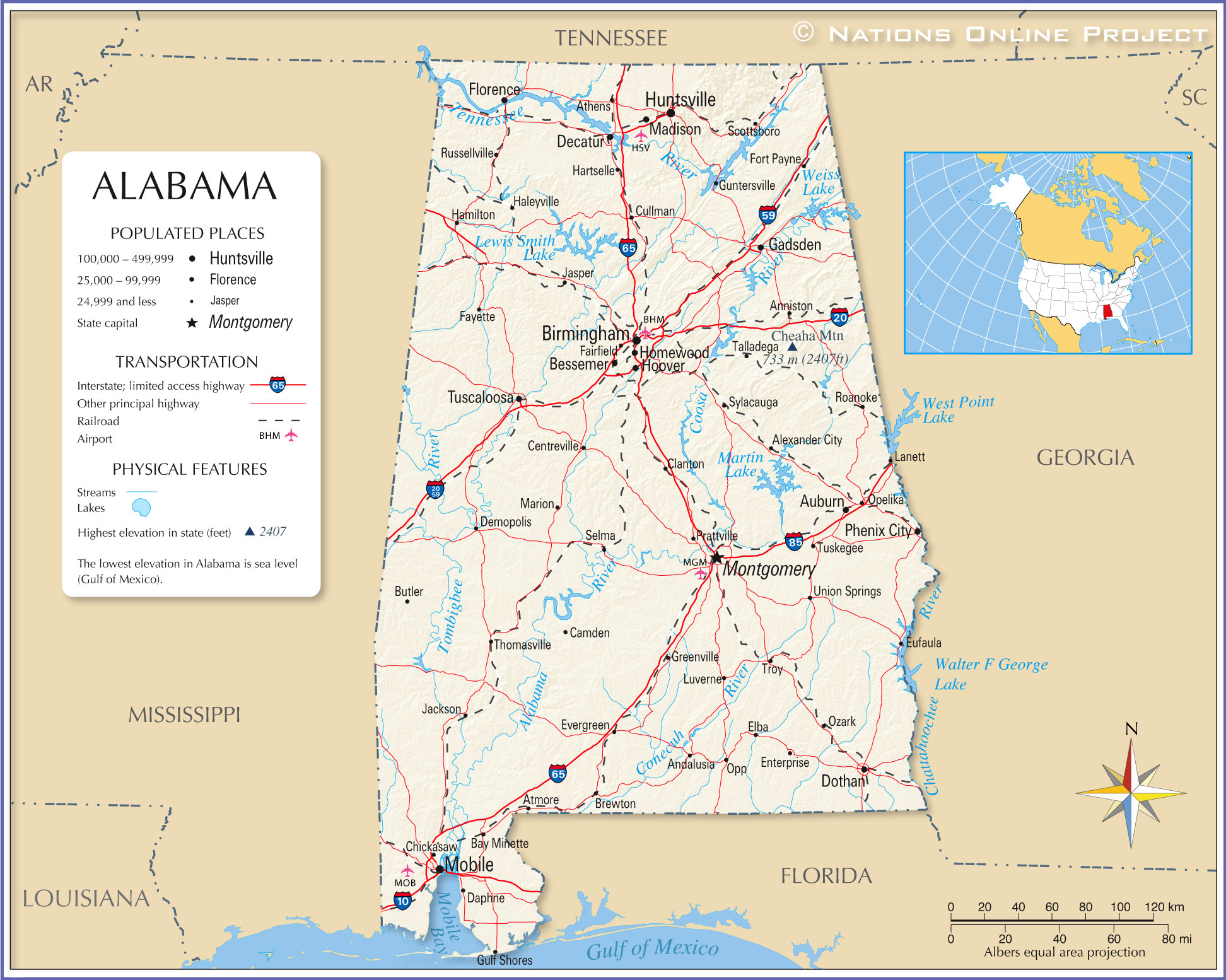

- Location: The area where you reside and drive can impact collision coverage costs. Urban areas with higher traffic density and a greater risk of accidents may result in higher premiums.

- Coverage Limits: The amount of coverage you choose for collision coverage directly affects your premiums. Higher coverage limits offer more protection but come at a cost.

Comprehensive Coverage

Comprehensive coverage is another critical component of full coverage car insurance. It provides protection against damages caused by incidents other than collisions, such as theft, vandalism, natural disasters, and animal-related incidents. Here's a closer look at comprehensive coverage:

Factors Affecting Comprehensive Coverage Costs:

- Location and Crime Rate: The area where your vehicle is primarily garaged can impact comprehensive coverage costs. High-crime areas or regions prone to natural disasters may result in higher premiums.

- Vehicle Value: The worth of your vehicle is a significant factor. Comprehensive coverage costs may increase for high-value vehicles, as the potential loss is greater.

- Deductible Choice: Your deductible, the amount you pay out of pocket before insurance coverage kicks in, affects comprehensive coverage costs. A higher deductible often leads to lower premiums.

- Coverage Add-ons: Optional coverage add-ons, such as glass coverage or rental car reimbursement, can impact comprehensive coverage costs.

Additional Factors Influencing Full Coverage Costs

Beyond collision and comprehensive coverage, several other factors contribute to the overall cost of full coverage car insurance. Understanding these factors can help you make informed decisions when selecting an insurance policy.

Deductibles and Coverage Limits

The deductibles and coverage limits you choose for your policy can significantly impact your insurance costs. Higher deductibles typically result in lower premiums, as you assume more financial responsibility in the event of a claim. Conversely, higher coverage limits offer more protection but come at a higher cost.

Driver Profile and Discounts

Your driver profile, including age, gender, marital status, and driving record, plays a crucial role in determining your insurance premiums. Additionally, insurance providers offer various discounts to attract and retain customers. Common discounts include safe driver discounts, multi-policy discounts, and loyalty discounts. By taking advantage of these discounts, you can potentially reduce your full coverage car insurance costs.

Insurance Provider and Policy Options

The insurance provider you choose and the specific policy options they offer can also impact your full coverage costs. Different providers have unique pricing structures, coverage options, and customer service offerings. It’s essential to compare multiple providers and their policies to find the best fit for your needs and budget.

State Regulations and Laws

State regulations and laws can influence the cost of full coverage car insurance. Some states have mandatory minimum coverage requirements, while others may have specific laws related to insurance premiums and discounts. Understanding the regulations in your state can help you navigate the insurance landscape effectively.

The Cost of Full Coverage Car Insurance: Real-World Examples

To provide a tangible understanding of full coverage car insurance costs, let’s explore some real-world examples. These examples will give you an idea of the range of premiums you might encounter based on different scenarios and factors.

Example 1: Young Driver with a Clean Record

Let’s consider a 25-year-old driver with a clean driving record residing in an urban area. They own a 2018 Toyota Corolla and are looking for full coverage car insurance. Based on their profile and vehicle, they can expect the following approximate premiums for a standard policy:

| Coverage Type | Premium (Monthly) |

|---|---|

| Collision Coverage | $120 |

| Comprehensive Coverage | $80 |

| Total Full Coverage Premium | $200 |

Example 2: Experienced Driver with a Claim History

Now, let’s examine the case of a 40-year-old driver with a minor accident on their record from a few years ago. They drive a 2020 Honda Civic and are seeking full coverage car insurance. Given their profile and vehicle, their approximate premiums might look like this:

| Coverage Type | Premium (Monthly) |

|---|---|

| Collision Coverage | $150 |

| Comprehensive Coverage | $90 |

| Total Full Coverage Premium | $240 |

Example 3: High-Value Vehicle and Custom Coverage

Imagine a luxury car enthusiast who owns a 2022 Mercedes-Benz S-Class. They want full coverage insurance tailored to their high-value vehicle and include additional coverage options. Their approximate premiums could be as follows:

| Coverage Type | Premium (Monthly) |

|---|---|

| Collision Coverage (High-Value Vehicle) | $250 |

| Comprehensive Coverage (Enhanced) | $120 |

| Custom Coverage Add-ons | $50 |

| Total Full Coverage Premium | $420 |

Tips for Managing Full Coverage Car Insurance Costs

While full coverage car insurance is essential, it’s understandable that you want to keep costs under control. Here are some practical tips to help you manage and potentially reduce your insurance premiums:

- Shop Around: Compare quotes from multiple insurance providers. Shopping around can reveal significant differences in premiums and coverage options.

- Bundle Policies: Consider bundling your car insurance with other policies, such as home or renters insurance. Many providers offer multi-policy discounts.

- Review Deductibles: Assess your financial situation and consider adjusting your deductibles. Higher deductibles can lead to lower premiums, but ensure you can afford the out-of-pocket expense if needed.

- Explore Discounts: Take advantage of available discounts, such as safe driver discounts, loyalty discounts, and good student discounts (if applicable). Ask your insurance provider about potential savings.

- Maintain a Clean Record: A clean driving record can lead to lower premiums. Avoid accidents and violations to keep your insurance costs down.

- Consider Usage-Based Insurance: Some providers offer usage-based insurance programs that track your driving habits and reward safe driving with lower premiums.

- Regularly Review Your Policy: Periodically review your insurance policy to ensure it aligns with your current needs and circumstances. You might find opportunities to adjust coverage or deductibles to save money.

The Future of Full Coverage Car Insurance Costs

As the automotive and insurance industries evolve, the cost of full coverage car insurance is likely to undergo changes. Here are some potential future implications and trends to consider:

- Technological Advancements: Advances in automotive technology, such as autonomous driving features and enhanced safety systems, may impact insurance costs. Vehicles with advanced safety features could potentially lead to lower premiums.

- Data-Driven Insurance: The use of data analytics and telematics in insurance underwriting is becoming more prevalent. This trend could result in more personalized insurance pricing based on individual driving behaviors.

- Electric and Alternative Vehicles: The growing popularity of electric vehicles (EVs) and alternative fuel vehicles may influence insurance costs. Insurers may develop specific policies and pricing structures for these vehicles.

- Regulatory Changes: Changes in state regulations and laws related to insurance could impact premiums. Stay informed about any upcoming legislative changes that may affect your insurance costs.

- Competition and Innovation: The insurance industry is constantly evolving, with new players and innovative products entering the market. Increased competition could drive down premiums and offer more affordable options.

Conclusion

Understanding the costs associated with full coverage car insurance is a critical step in ensuring you have adequate protection for your vehicle and financial well-being. By exploring the factors that influence collision and comprehensive coverage costs, as well as considering additional factors like deductibles and discounts, you can make informed decisions when selecting an insurance policy. Remember to regularly review your coverage and explore opportunities to manage and potentially reduce your insurance premiums.

Stay informed about industry trends and changes, as the future of full coverage car insurance costs is likely to be shaped by technological advancements, data-driven insurance practices, and evolving regulatory landscapes. With a comprehensive understanding of the factors at play, you can navigate the insurance market with confidence and secure the best coverage for your needs.

How do I choose the right insurance provider for full coverage car insurance?

+When selecting an insurance provider, consider factors such as their financial stability, customer service reputation, and the range of coverage options they offer. Research online reviews and seek recommendations from trusted sources. Compare quotes from multiple providers to find the best fit for your needs and budget.

Can I customize my full coverage car insurance policy to save money?

+Yes, customizing your policy can help you save money. Assess your specific needs and consider adjusting coverage limits, deductibles, and optional add-ons. For example, if you have an older vehicle, you might consider lowering your collision coverage limits to reduce premiums. Always consult with your insurance provider to ensure you maintain adequate protection.

Are there any common mistakes to avoid when purchasing full coverage car insurance?

+One common mistake is choosing the cheapest policy without considering the coverage it provides. Cheap policies may have significant gaps in coverage, leaving you vulnerable in the event of an accident. Another mistake is failing to review your policy annually. Insurance needs can change, so it’s essential to regularly assess your coverage and make necessary adjustments.