Max Insurance

Welcome to an in-depth exploration of Max Insurance, a prominent player in the global insurance industry. With a rich history spanning decades and a diverse range of services, Max Insurance has established itself as a trusted partner for individuals and businesses alike. In this comprehensive article, we delve into the company's journey, its comprehensive offerings, and the unique value it brings to the market.

A Legacy of Excellence: The Story of Max Insurance

Max Insurance’s origins can be traced back to the early 20th century when a visionary entrepreneur, John Maxwell, recognized the growing need for reliable insurance solutions. With a passion for innovation and a commitment to serving the community, Maxwell founded the company in 1922. Since its inception, Max Insurance has undergone significant transformations, adapting to the ever-evolving landscape of the insurance sector.

Over the years, Max Insurance has expanded its reach and diversified its product portfolio. The company's strategic acquisitions and mergers have played a pivotal role in its growth, enabling it to offer a comprehensive suite of insurance services. Today, Max Insurance stands as a global leader, catering to a vast clientele across various industries.

Key Milestones in Max Insurance’s Journey

The evolution of Max Insurance is marked by several significant milestones that have shaped its trajectory. In the 1950s, the company revolutionized the industry by introducing innovative underwriting practices, setting a new standard for risk assessment. This period also saw the expansion of Max Insurance’s international presence, with the establishment of offices in key global markets.

The digital revolution of the late 20th century presented both challenges and opportunities. Max Insurance embraced technology, becoming one of the first insurance companies to offer online policy management and digital claims processing. This move not only enhanced efficiency but also improved customer experience, solidifying Max Insurance's position as a forward-thinking industry leader.

Comprehensive Insurance Solutions: A Diverse Portfolio

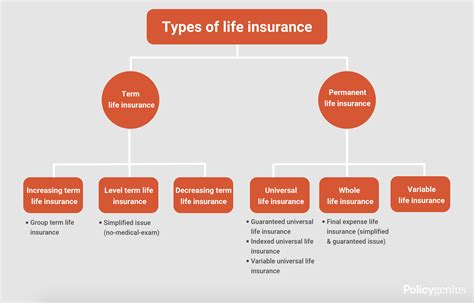

Max Insurance’s success lies in its ability to offer a wide array of insurance products tailored to meet the diverse needs of its clients. The company’s comprehensive portfolio includes:

- Life Insurance: Max Insurance provides a range of life insurance plans, including term life, whole life, and universal life insurance, offering financial protection and peace of mind to policyholders.

- Health Insurance: With a focus on holistic healthcare, Max Insurance offers comprehensive health insurance plans covering medical, dental, and vision care. These plans are designed to meet the unique needs of individuals and families.

- Property and Casualty Insurance: The company's property and casualty insurance division offers protection for homes, businesses, and vehicles. From homeowners' insurance to commercial property insurance, Max Insurance ensures its clients are covered in times of need.

- Specialty Insurance: Recognizing the unique risks faced by specific industries, Max Insurance provides specialized insurance solutions. This includes coverage for maritime operations, aviation, and even cyber risks, ensuring businesses can navigate emerging challenges.

Max Insurance's commitment to innovation is evident in its approach to product development. The company continuously assesses market trends and client needs, resulting in the introduction of cutting-edge insurance solutions. For instance, the recent launch of their parametric insurance products has garnered attention for its ability to provide swift and reliable payouts in the event of natural disasters.

The Impact of Technology: Maximizing Efficiency

In an era where technology plays a pivotal role, Max Insurance has leveraged digital advancements to enhance its operations. The company’s investment in state-of-the-art systems has streamlined processes, improving efficiency and reducing response times. From digital onboarding to real-time claims tracking, Max Insurance’s technological prowess sets it apart in the industry.

Furthermore, the company's dedication to data analytics has enabled it to make informed decisions, optimize pricing strategies, and improve risk management. By harnessing the power of big data, Max Insurance ensures its products remain competitive and aligned with market demands.

| Insurance Category | Key Features |

|---|---|

| Life Insurance | Flexible plans, tax benefits, and death benefit coverage |

| Health Insurance | Comprehensive coverage, network of providers, and wellness incentives |

| Property Insurance | Customizable policies, replacement cost coverage, and disaster protection |

| Casualty Insurance | Liability coverage, business interruption protection, and claims management support |

Exceptional Service: The Max Insurance Difference

What sets Max Insurance apart is its unwavering commitment to delivering exceptional service. The company’s customer-centric approach is evident in its personalized policies, tailored to meet individual and business needs. Max Insurance’s dedicated team of experts provides comprehensive guidance, ensuring clients understand their coverage and feel confident in their insurance choices.

In times of need, Max Insurance's claims management process shines. The company's streamlined approach ensures swift and efficient resolution, minimizing the impact of unexpected events on its clients' lives and businesses. With a focus on empathy and transparency, Max Insurance strives to make the claims process as seamless as possible.

Community Engagement: Beyond Insurance

Max Insurance understands that its role extends beyond providing insurance solutions. The company actively engages with the communities it serves, embracing corporate social responsibility as a core value. Through various initiatives, Max Insurance supports causes ranging from environmental sustainability to education and humanitarian aid.

One notable example is the Max Insurance Foundation, established to promote financial literacy and support education initiatives. The foundation's efforts have had a positive impact on countless lives, empowering individuals to make informed financial decisions and secure their future.

The Future of Max Insurance: Innovation and Growth

As the insurance industry continues to evolve, Max Insurance remains at the forefront, embracing change and driving innovation. The company’s strategic vision is centered on staying ahead of the curve, anticipating emerging risks, and developing innovative solutions to address them.

With a focus on sustainability and environmental consciousness, Max Insurance is actively exploring green insurance products. These initiatives aim to incentivize eco-friendly practices and reduce the environmental impact of its clients' operations. Additionally, the company is investing in research and development to enhance its parametric insurance offerings, ensuring continued relevance in an increasingly digital and data-driven world.

Expanding Horizons: Global Reach and Partnerships

Max Insurance’s global presence is a testament to its success and reputation. The company continues to expand its international footprint, forging partnerships with local insurers and leveraging its expertise to serve new markets. This strategic approach allows Max Insurance to offer localized solutions while maintaining its global standards of excellence.

In conclusion, Max Insurance's journey is a testament to the power of innovation, adaptability, and a customer-centric approach. With a rich history, a diverse range of insurance solutions, and a commitment to excellence, Max Insurance remains a trusted partner for individuals and businesses navigating the complexities of the modern world. As the company continues to evolve, its impact on the insurance industry and the communities it serves is sure to be profound.

How does Max Insurance ensure customer satisfaction?

+Max Insurance prioritizes customer satisfaction through its commitment to personalized service. The company’s expert team provides tailored guidance, ensuring clients understand their coverage and feel supported. Additionally, Max Insurance’s efficient claims management process minimizes disruption during challenging times, fostering a positive customer experience.

What sets Max Insurance’s life insurance plans apart from competitors?

+Max Insurance’s life insurance plans offer flexibility and tax benefits. The company provides a range of options, including term life, whole life, and universal life insurance, allowing individuals to choose the coverage that best suits their needs and financial goals. Furthermore, Max Insurance’s focus on customer service ensures policyholders receive personalized guidance throughout the process.

How does Max Insurance address the unique risks faced by specific industries?

+Max Insurance recognizes the diverse needs of different industries and offers specialized insurance solutions. For instance, the company provides coverage for maritime operations, aviation, and cyber risks. By understanding industry-specific challenges, Max Insurance develops tailored policies to protect businesses and ensure their long-term viability.