State Farm Business Insurance

In the realm of business ownership, one of the most critical decisions is selecting the right insurance coverage. State Farm, a well-established name in the insurance industry, offers a comprehensive range of business insurance policies designed to protect entrepreneurs and their ventures. This article delves into the intricacies of State Farm's business insurance, exploring its features, benefits, and how it can safeguard your commercial interests.

Understanding State Farm Business Insurance

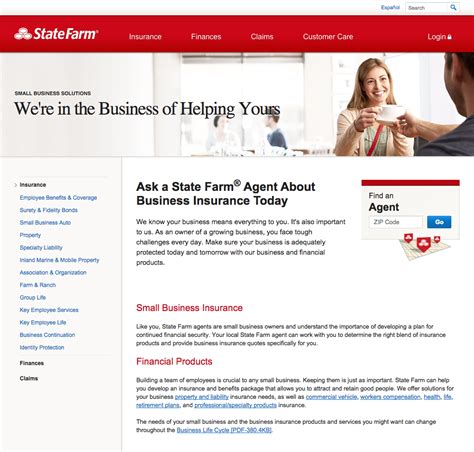

State Farm’s business insurance portfolio is tailored to meet the diverse needs of small to medium-sized enterprises. It encompasses a wide array of coverage options, ensuring that businesses, regardless of their nature or size, can find the protection they require. From liability insurance to property coverage and specialized policies, State Farm aims to provide a safety net for various business operations.

One of the standout features of State Farm's business insurance is its customization. Understanding that every business is unique, the company offers flexible policies that can be adapted to fit specific needs. Whether you operate a retail store, manage a professional service firm, or run an online business, State Farm's agents can guide you through the process of selecting the right coverage.

Key Coverage Options

State Farm’s business insurance covers a broad spectrum of potential risks. Here’s an overview of some of the key coverage options:

- Business Owners Policy (BOP): A BOP is a package policy designed for small businesses, combining property, liability, and business interruption coverage. It offers a cost-effective solution for businesses with relatively simple insurance needs.

- General Liability Insurance: This type of insurance protects businesses from various liability claims, including bodily injury, property damage, and personal and advertising injury. It's crucial for businesses that interact with the public or have employees.

- Commercial Property Insurance: This coverage safeguards the physical assets of a business, including buildings, equipment, inventory, and furniture. It can also cover loss of income in the event of a covered loss.

- Business Income (Interruption) Insurance: This policy helps businesses continue to pay expenses and maintain income in the event they have to suspend operations due to a covered loss, such as a fire or natural disaster.

- Commercial Auto Insurance: For businesses that rely on vehicles, this insurance provides coverage for cars, trucks, and vans used for business purposes. It can include liability, comprehensive, and collision coverage.

- Professional Liability Insurance (Errors & Omissions): Designed for professionals like consultants, accountants, and real estate agents, this insurance protects against negligence claims and errors in service delivery.

State Farm also offers specialized coverage for unique business needs, such as cyber liability insurance, workers' compensation, and business umbrella policies, which provide additional liability coverage above and beyond other policies.

Benefits and Features of State Farm Business Insurance

State Farm’s business insurance policies offer several advantages that make them an attractive option for entrepreneurs:

Comprehensive Coverage

State Farm’s policies are designed to provide a comprehensive safety net for businesses. Whether it’s protecting physical assets, safeguarding against liability claims, or ensuring business continuity, State Farm’s coverage options aim to cover a wide range of potential risks.

Customization

One of the standout features of State Farm’s business insurance is its adaptability. Policies can be tailored to the specific needs of a business, ensuring that coverage aligns with the unique risks and exposures of the venture. This customization ensures that businesses are not paying for unnecessary coverage while still maintaining adequate protection.

Experienced Agents

State Farm’s network of local agents is a significant advantage. These agents are knowledgeable about the insurance needs of businesses in their community. They can provide personalized advice and guidance, helping business owners navigate the complex world of commercial insurance.

Claims Handling

State Farm has a reputation for efficient and fair claims handling. In the event of a covered loss, their claims process is designed to be straightforward and timely. This can be crucial for businesses, as it minimizes downtime and helps them get back on their feet quickly after an incident.

| Key Benefit | Description |

|---|---|

| Customizable Policies | State Farm offers tailored insurance solutions to fit the unique needs of each business. |

| Expert Advice | Local agents provide valuable guidance, helping business owners make informed insurance decisions. |

| Efficient Claims Process | State Farm is known for its streamlined and fair claims handling, ensuring businesses receive prompt assistance when they need it most. |

How State Farm Business Insurance Works

State Farm’s business insurance policies operate on the principle of indemnification. This means that in the event of a covered loss, the policyholder is reimbursed for their losses up to the policy limits. The level of coverage and the specific terms of the policy will depend on the type of business, its size, and the risks it faces.

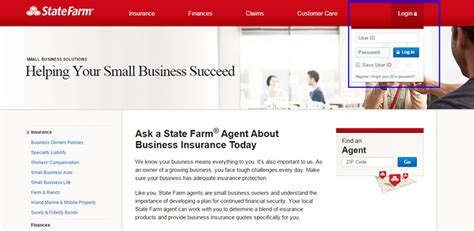

The process of obtaining State Farm business insurance typically involves the following steps:

- Assessment: A State Farm agent will assess the business's unique needs, including the nature of the business, its size, and the risks it faces. This step is crucial in determining the appropriate coverage.

- Policy Selection: Based on the assessment, the agent will recommend specific policies or a combination of policies that provide the necessary coverage. This may include a BOP, liability insurance, property insurance, or other specialized policies.

- Customization: The policy can then be customized to fit the business's specific needs. This may involve adjusting coverage limits, adding endorsements for specific risks, or excluding certain coverages that are not relevant to the business.

- Underwriting: State Farm will review the application and assess the risk associated with the business. This step may involve additional questions or requests for documentation to ensure the policy is accurately priced.

- Policy Issuance: Once the underwriting process is complete and the policy is approved, State Farm will issue the policy, providing the business owner with a certificate of insurance and a detailed policy document outlining the coverage and terms.

- Ongoing Management: As the business grows and changes, it's important to review the insurance coverage regularly to ensure it remains adequate. State Farm agents can assist with policy updates and provide advice on additional coverage as needed.

Case Studies: Real-World Applications

To illustrate the effectiveness of State Farm’s business insurance, let’s consider two case studies:

Case Study 1: Retail Store

Imagine a small retail store that sells specialty items. The store owner, Ms. Johnson, is concerned about potential risks, including property damage, theft, and liability claims from customers. She seeks advice from a State Farm agent, who recommends a BOP, which combines property and liability coverage. This policy provides protection for the store’s physical assets, including its inventory, and also covers liability claims, such as if a customer slips and falls in the store.

One day, a fire breaks out in the store, causing significant damage. Thanks to her State Farm BOP, Ms. Johnson is able to file a claim and receive compensation for the loss of her inventory and the cost of repairs. The policy also covers business interruption, providing her with income protection while the store is closed for repairs.

Case Study 2: Online Business

Mr. Smith operates an online business that provides consulting services to clients worldwide. His primary concern is professional liability, as he wants to ensure he’s protected against potential negligence claims. A State Farm agent recommends a professional liability policy, which covers errors and omissions in his work.

During a project, Mr. Smith realizes he made a mistake that could potentially cost his client significant financial losses. However, thanks to his professional liability insurance, he is able to file a claim with State Farm. The insurance company covers the cost of rectifying the error and also provides legal defense if the client decides to pursue legal action.

Conclusion: Why Choose State Farm Business Insurance

State Farm’s business insurance offers a comprehensive and customizable solution for entrepreneurs. With a wide range of coverage options, experienced agents, and a reputation for efficient claims handling, State Farm provides a solid foundation for protecting your business. Whether you’re a small retail store owner or an online business operator, State Farm’s policies can be tailored to meet your specific needs, ensuring your venture is protected against a wide range of potential risks.

FAQ

What is the cost of State Farm business insurance?

+The cost of State Farm business insurance can vary widely based on the type of business, its size, and the specific coverage needed. Factors such as the business’s location, the nature of its operations, and its claim history can also impact the cost. To get an accurate estimate, it’s best to consult with a State Farm agent who can provide a personalized quote based on your business’s unique needs.

Can State Farm business insurance be customized for unique business needs?

+Yes, one of the strengths of State Farm’s business insurance is its flexibility. Policies can be tailored to fit the specific needs of a business. Whether you require additional coverage for unique risks or want to adjust coverage limits, State Farm’s agents can guide you in creating a policy that aligns with your business’s requirements.

What is the process for filing a claim with State Farm business insurance?

+If you need to file a claim with State Farm business insurance, the process typically involves notifying your State Farm agent or representative as soon as possible after the incident. They will guide you through the necessary steps, which may include completing claim forms, providing documentation, and potentially coordinating with adjusters or investigators. It’s important to have your policy details and contact information readily available when filing a claim.

Does State Farm offer any discounts on business insurance policies?

+Yes, State Farm offers various discounts on its business insurance policies. These may include multi-policy discounts (if you have multiple policies with State Farm), a claims-free discount, and discounts for certain safety measures or risk control practices implemented in your business. It’s worth discussing these potential discounts with your State Farm agent to see if you’re eligible and how they can lower your insurance costs.

How often should I review and update my State Farm business insurance policy?

+It’s recommended to review your State Farm business insurance policy annually or whenever there are significant changes to your business. This could include expansions, new products or services, changes in staffing, or alterations to your physical premises. Regular reviews ensure that your insurance coverage remains aligned with your business’s evolving needs and risks.