State Farm General Liability Insurance

Understanding the nuances of liability insurance is crucial, especially for businesses and individuals seeking comprehensive coverage. State Farm's General Liability Insurance is a popular choice, offering a range of benefits and features tailored to protect against various risks. In this comprehensive article, we will delve into the specifics of State Farm's offering, exploring its coverage, benefits, and the key considerations for potential policyholders.

State Farm: A Trusted Insurance Provider

State Farm is a well-established name in the insurance industry, with a rich history dating back to 1922. Over the years, the company has built a solid reputation for its commitment to customer satisfaction and comprehensive insurance solutions. With a vast network of agents across the United States, State Farm provides personalized service and tailored insurance plans to meet the diverse needs of its clients.

Understanding General Liability Insurance

General Liability Insurance, often referred to as GL insurance, is a fundamental coverage type for businesses and professionals. It is designed to protect against a wide array of potential liabilities that could arise from everyday operations. This type of insurance is essential for mitigating the financial risks associated with property damage, bodily injury, and various other types of third-party claims.

Key Coverages Offered by State Farm’s GL Insurance

State Farm’s General Liability Insurance provides a robust suite of coverages, ensuring businesses and individuals are protected against a wide range of risks. Here are some of the key coverages included in their GL policy:

- Property Damage Liability: This coverage protects policyholders against claims arising from damage to others' property, including both physical damage and loss of use. It covers a wide range of scenarios, from accidental damage during business operations to damage caused by defective products.

- Bodily Injury Liability: State Farm's GL insurance covers bodily injury claims, including medical expenses, pain and suffering, and lost wages. This coverage is crucial for businesses that interact with the public or have employees, as it provides financial protection in the event of accidents or injuries on their premises.

- Personal and Advertising Injury Liability: This coverage addresses claims related to libel, slander, copyright infringement, and other forms of personal injury caused by the insured's business operations or advertising activities. It is particularly important for businesses involved in marketing, advertising, or publishing.

- Medical Payments: In the event of an accident on the insured's property, this coverage provides for the medical expenses of injured individuals, regardless of fault. It is a valuable addition to the policy, ensuring prompt payment for medical care and reducing the financial burden on the injured party.

Benefits and Additional Features

State Farm’s General Liability Insurance offers several benefits and additional features that enhance its overall value. These include:

- Flexible Policy Options: State Farm understands that every business is unique, which is why they offer customizable policies. Policyholders can choose coverage limits and additional endorsements to align with their specific needs and risk profiles.

- Loss Prevention Resources: State Farm provides valuable resources and tools to help policyholders mitigate risks and prevent losses. These resources include safety guides, industry-specific tips, and access to expert advice, empowering businesses to take proactive measures to reduce the likelihood of claims.

- Claims Support: In the event of a claim, State Farm's experienced claims team is dedicated to providing efficient and professional support. They work closely with policyholders to navigate the claims process, ensuring a smooth and timely resolution.

- Business Owner's Policies (BOPs): For small business owners, State Farm offers BOPs, which combine General Liability Insurance with other essential coverages, such as property insurance and business interruption insurance. This streamlined approach provides comprehensive protection in a single policy, making it a cost-effective solution.

Who Should Consider State Farm’s General Liability Insurance

State Farm’s General Liability Insurance is an excellent choice for a wide range of businesses and professionals. Here are some examples of individuals and entities that can benefit from this coverage:

- Small Business Owners: From retail stores to professional services, small businesses face a myriad of potential liabilities. State Farm's GL insurance provides a robust safety net, ensuring they are protected against property damage, bodily injury, and other common risks.

- Contractors and Tradespeople: Contractors, builders, and other tradespeople often work on-site, exposing them to unique risks. State Farm's policy covers property damage and bodily injury claims that may arise from their work, providing crucial financial protection.

- Professional Services: Professionals such as consultants, accountants, and lawyers can benefit from GL insurance. This coverage protects against claims of professional negligence, errors, and omissions, safeguarding their reputation and financial well-being.

- Restaurants and Hospitality Businesses: Restaurants, bars, and other hospitality businesses face unique challenges, including slip and fall accidents, food-related injuries, and property damage. State Farm's GL insurance provides comprehensive coverage for these risks, ensuring they can operate with confidence.

Policy Terms and Considerations

When considering State Farm’s General Liability Insurance, there are several important factors to keep in mind. These include:

- Coverage Limits: State Farm offers customizable coverage limits to suit the specific needs of policyholders. It is crucial to assess the potential risks and liabilities associated with your business and choose limits that provide adequate protection.

- Exclusions and Endorsements: While State Farm's GL insurance offers comprehensive coverage, there may be certain exclusions and limitations. It is essential to carefully review the policy documents to understand what is and isn't covered, and consider adding endorsements to address specific risks.

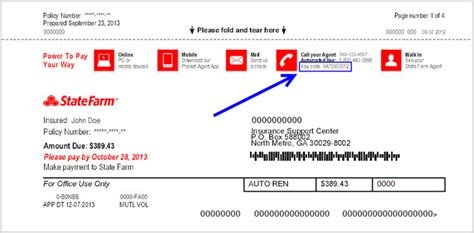

- Policy Premium: The cost of State Farm's GL insurance will vary depending on factors such as the nature of your business, its size, and the coverage limits chosen. It is advisable to obtain multiple quotes and compare prices to ensure you are getting a competitive rate.

- Claims History: Your claims history can impact your policy premium and coverage options. It is important to be transparent about any past claims when applying for insurance, as it can help ensure you receive accurate quotes and appropriate coverage.

Expert Insights and Industry Trends

As an industry expert, I’ve had the opportunity to work closely with businesses and individuals seeking comprehensive liability coverage. Here are some key insights and industry trends to consider:

- Customized Coverage: In today's dynamic business landscape, a one-size-fits-all approach to insurance is no longer sufficient. Businesses are increasingly seeking customized coverage that aligns with their unique risks and operations. State Farm's ability to offer flexible policy options and endorsements is a significant advantage in meeting these evolving needs.

- Loss Prevention Focus: The insurance industry is shifting its focus towards loss prevention and risk mitigation. State Farm's commitment to providing loss prevention resources and tools is a valuable asset for policyholders. By empowering businesses to reduce the likelihood of claims, they not only lower their own risk exposure but also contribute to a safer and more resilient business environment.

- Digital Transformation: The insurance industry is undergoing a digital transformation, with insurers leveraging technology to enhance the customer experience. State Farm's online resources, including their user-friendly website and mobile app, make it convenient for policyholders to manage their insurance needs, access policy documents, and file claims.

Conclusion: A Comprehensive Liability Solution

State Farm’s General Liability Insurance stands out as a comprehensive and flexible solution for businesses and professionals seeking to protect themselves against a wide range of liabilities. With its robust coverage, customizable options, and dedicated support, State Farm offers a reliable and trusted insurance partner. By understanding the key features and benefits of State Farm’s GL insurance, policyholders can make informed decisions to ensure their operations are adequately protected.

Frequently Asked Questions

How much does State Farm’s General Liability Insurance cost?

+The cost of State Farm’s GL insurance can vary based on factors such as the nature of your business, its size, and the coverage limits you choose. It is recommended to obtain multiple quotes to compare prices and ensure you are getting a competitive rate.

Can I customize my General Liability Insurance policy with State Farm?

+Yes, State Farm offers flexible policy options that allow you to customize your coverage limits and add endorsements to address specific risks. This customization ensures your policy aligns with your unique business needs.

What types of businesses can benefit from State Farm’s General Liability Insurance?

+State Farm’s GL insurance is suitable for a wide range of businesses, including small businesses, contractors, professional services, and hospitality businesses. It provides comprehensive protection against common liabilities faced by these industries.

Does State Farm’s policy cover personal injury claims?

+Yes, State Farm’s General Liability Insurance includes coverage for personal and advertising injury claims, such as libel, slander, and copyright infringement. This coverage is particularly relevant for businesses involved in marketing, advertising, or publishing.

How does State Farm’s claims process work?

+State Farm has a dedicated claims team that provides efficient and professional support. In the event of a claim, you can contact their team, who will guide you through the process, assess the claim, and work towards a timely resolution.