Geico Insurance Reviews

Geico Insurance Reviews: Unveiling the Truth Behind the Gecko’s Charm

In the world of insurance, Geico has become a household name, with its witty commercials and iconic gecko capturing the attention of millions. But beyond the clever marketing, what do Geico insurance reviews reveal about the company’s offerings and customer satisfaction? In this comprehensive analysis, we delve into the experiences of policyholders, uncovering the strengths, weaknesses, and unique aspects of Geico’s insurance services. By examining real-world feedback and industry insights, we aim to provide an in-depth understanding of Geico’s reputation and its standing in the competitive insurance market.

Unraveling Geico's Customer Experience

Geico, short for Government Employees Insurance Company, has grown to become one of the largest auto insurance providers in the United States. With its expansion into various insurance sectors, including homeowners, renters, and life insurance, Geico aims to cater to a diverse range of consumer needs. Let's explore the key aspects that shape Geico's customer experience, based on extensive reviews and industry observations.

1. Auto Insurance: A Comprehensive Overview

Geico's auto insurance offerings have been a focal point for many policyholders. Here's a breakdown of the key features and feedback:

- Coverage Options: Geico provides a range of coverage types, including liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Customers appreciate the flexibility to customize their policies based on their specific needs.

- Pricing: Geico is known for its competitive pricing, often offering lower rates compared to its competitors. Reviewers highlight the company's ability to provide cost-effective insurance solutions without compromising on coverage.

- Claims Process: The claims process is a critical aspect of any insurance provider. Geico receives mixed reviews in this regard. While some customers praise the company's efficient and prompt handling of claims, others express frustration with lengthy processes and difficulty reaching claims adjusters.

- Discounts: Geico offers a variety of discounts to attract and retain customers. These include multi-policy discounts, good driver discounts, military discounts, and discounts for safe driving practices. Policyholders appreciate the opportunity to save on their insurance premiums.

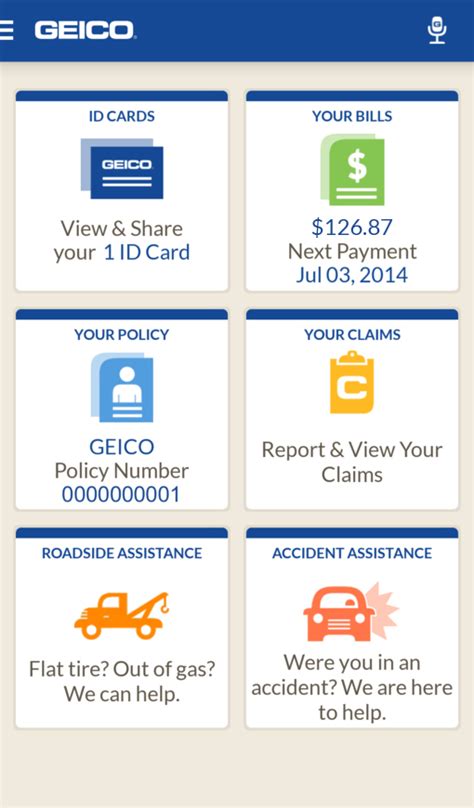

- Digital Experience: Geico's online and mobile platforms are highly regarded for their user-friendliness and convenience. Customers can easily manage their policies, make payments, and access policy documents through the Geico website and mobile app. This digital convenience is a significant selling point for tech-savvy policyholders.

| Coverage Type | Average Cost |

|---|---|

| Liability Insurance | $300 - $500 per year |

| Collision Insurance | $350 - $600 per year |

| Comprehensive Insurance | $200 - $350 per year |

| Personal Injury Protection (PIP) | $150 - $300 per year |

| Uninsured/Underinsured Motorist Coverage | $100 - $250 per year |

2. Home and Renters Insurance: Protecting Your Space

Geico's expansion into home and renters insurance has provided policyholders with a one-stop shop for their insurance needs. Here's what reviews reveal about these offerings:

- Homeowners Insurance: Geico's homeowners insurance policies cover a range of perils, including fire, theft, and natural disasters. Policyholders appreciate the comprehensive coverage and the ability to customize their policies to include additional protections, such as flood or earthquake insurance.

- Renters Insurance: Geico's renters insurance policies are designed to protect tenants against losses related to their personal property and liability. Customers highlight the affordability and convenience of bundling renters insurance with their auto insurance policies.

- Claims Satisfaction: Geico's claims process for home and renters insurance receives generally positive feedback. Policyholders appreciate the company's timely response and efficient handling of claims, especially during challenging times such as natural disasters.

- Additional Perks: Geico offers various perks with its home and renters insurance policies, such as identity theft protection and discounted rates for bundling multiple policies. These additional benefits add value to the overall insurance experience.

3. Life Insurance: Providing Peace of Mind

Geico's entry into the life insurance market has provided policyholders with an additional layer of financial protection. Here's an overview of Geico's life insurance offerings:

- Term Life Insurance: Geico offers term life insurance policies with coverage periods ranging from 10 to 30 years. These policies provide affordable coverage for a specified term, making them suitable for individuals with short-term financial obligations or those seeking temporary protection.

- Whole Life Insurance: Geico also provides whole life insurance, a permanent insurance policy that offers lifetime coverage and builds cash value over time. This option is ideal for individuals seeking long-term financial protection and wealth accumulation.

- Policy Features: Geico's life insurance policies include various features such as accelerated death benefit riders, which provide access to policy funds in case of a terminal illness, and waiver of premium riders, which waive premium payments in case of total disability.

- Pricing and Availability: Geico's life insurance policies are competitively priced, with options available for individuals with varying health conditions. The company offers simplified issue policies for those with minor health concerns and fully underwritten policies for individuals with more complex health histories.

Geico's Unique Selling Points and Industry Standing

Geico's success in the insurance industry can be attributed to several unique selling points and strategic initiatives. Here's a closer look at what sets Geico apart:

- Digital Innovation: Geico has embraced digital transformation, leveraging technology to enhance the customer experience. The company's mobile app and online platform offer policyholders a seamless and convenient way to manage their insurance needs, from policy adjustments to claims reporting.

- Customer-Centric Approach: Geico prioritizes customer satisfaction and has implemented various initiatives to improve the overall customer experience. The company's 24/7 customer service, quick claim response times, and personalized policy recommendations have earned it a reputation for excellent customer service.

- Community Engagement: Geico actively engages with its local communities through various initiatives, such as sponsoring community events and supporting charitable causes. This commitment to social responsibility has helped Geico foster a positive brand image and build strong relationships with its customers.

- Diverse Product Portfolio: Geico's expansion into various insurance sectors, including auto, home, renters, and life insurance, has allowed the company to cater to a wide range of consumer needs. This diversification has not only strengthened Geico's market position but also provided policyholders with a comprehensive insurance solution.

Industry Comparisons and Geico's Competitive Edge

When comparing Geico to other leading insurance providers, several key differentiators emerge. Here's a closer look at how Geico stacks up against its competitors:

1. Pricing and Value

Geico is known for its competitive pricing, often offering lower premiums compared to its peers. This cost advantage has made Geico a popular choice for budget-conscious consumers. However, it's essential to note that pricing can vary based on individual factors such as location, driving record, and policy preferences. While Geico may offer attractive rates, it's crucial to compare quotes from multiple providers to ensure you're getting the best value for your insurance needs.

2. Customer Service and Claims Handling

Geico's commitment to customer service is evident in its 24/7 availability and efficient claims handling. The company's focus on providing prompt and personalized assistance has earned it a strong reputation for customer satisfaction. However, it's important to note that individual experiences may vary, and some policyholders may encounter challenges or delays during the claims process. It's advisable to thoroughly research and consider real-world reviews when assessing Geico's customer service and claims handling capabilities.

3. Digital Innovation and Convenience

Geico has excelled in leveraging digital technology to enhance the customer experience. The company's mobile app and online platform offer policyholders a seamless and convenient way to manage their insurance needs. From policy adjustments to claims reporting, Geico's digital tools provide a level of convenience that sets it apart from many traditional insurance providers. However, it's worth considering that some policyholders may prefer personal interactions or find certain digital processes less intuitive. It's essential to evaluate your own preferences and comfort level with technology when assessing Geico's digital offerings.

Geico's Future Outlook and Industry Impact

As the insurance industry continues to evolve, Geico is well-positioned to thrive and make a lasting impact. Here's a glimpse into Geico's future outlook and potential contributions to the industry:

1. Technological Advancements

Geico has demonstrated a commitment to staying at the forefront of technological innovation. The company is likely to continue investing in digital tools and platforms to enhance the customer experience further. From improved claim processing to advanced risk assessment algorithms, Geico's technological advancements will play a pivotal role in streamlining processes and delivering efficient insurance solutions.

2. Expanded Product Offerings

Geico's diversification into various insurance sectors has been a key driver of its success. The company is expected to continue expanding its product portfolio, offering policyholders a comprehensive suite of insurance solutions. By catering to a wider range of consumer needs, Geico will solidify its position as a trusted provider for all insurance-related requirements.

3. Community Engagement and Social Responsibility

Geico's commitment to community engagement and social responsibility is a testament to its values-driven approach. The company is likely to continue supporting charitable causes and sponsoring community events, fostering positive relationships with its customers and contributing to societal well-being. This focus on giving back will further enhance Geico's brand reputation and solidify its standing as a responsible corporate citizen.

Conclusion

In conclusion, Geico's insurance reviews reveal a company that has successfully carved out a strong position in the competitive insurance market. With its focus on customer satisfaction, digital innovation, and community engagement, Geico has earned a loyal customer base and a positive industry reputation. While individual experiences may vary, Geico's commitment to providing comprehensive insurance solutions, competitive pricing, and exceptional customer service positions it as a reliable choice for policyholders seeking peace of mind and financial protection.

How does Geico’s pricing compare to other insurance providers?

+Geico is known for its competitive pricing, often offering lower premiums compared to its peers. However, pricing can vary based on individual factors such as location, driving record, and policy preferences. It’s recommended to obtain quotes from multiple providers to ensure you’re getting the best value for your insurance needs.

What sets Geico apart from other insurance companies?

+Geico’s unique selling points include its digital innovation, customer-centric approach, community engagement, and diverse product portfolio. The company’s focus on technology, excellent customer service, and commitment to social responsibility sets it apart from many traditional insurance providers.

How does Geico handle claims?

+Geico is known for its efficient claims handling and 24⁄7 customer service. The company aims to provide prompt and personalized assistance to policyholders. However, individual experiences may vary, and it’s important to consider real-world reviews when assessing Geico’s claims handling capabilities.

What are the benefits of choosing Geico for my insurance needs?

+Choosing Geico offers several benefits, including competitive pricing, excellent customer service, digital convenience, and a diverse range of insurance products. Geico’s commitment to customer satisfaction and technological innovation ensures a seamless and reliable insurance experience.