Automobile Insurance Illinois

Automobile insurance is an essential aspect of owning and operating a vehicle, providing financial protection and peace of mind to drivers across the United States. In the state of Illinois, auto insurance is not only a legal requirement but also a crucial consideration for any motorist. This comprehensive guide will delve into the world of automobile insurance in Illinois, covering the unique regulations, coverage options, and tips to ensure you're adequately protected while navigating the roads of the Prairie State.

Understanding the Legal Requirements for Auto Insurance in Illinois

Every state in the US has its own set of rules and regulations regarding auto insurance, and Illinois is no exception. Understanding these requirements is the first step toward ensuring compliance and protection. In Illinois, the minimum liability coverage mandated by law is:

| Bodily Injury Liability | Property Damage Liability |

|---|---|

| $25,000 per person / $50,000 per accident | $20,000 per accident |

This means that every registered vehicle in Illinois must carry insurance that can cover, at a minimum, these amounts in the event of an accident. However, it's important to note that these minimums might not be sufficient to cover the costs of a serious accident. As such, many experts recommend carrying higher limits, especially in a densely populated state like Illinois.

Beyond these basic liability requirements, Illinois also mandates that all registered vehicles carry uninsured/underinsured motorist coverage (UM/UIM). This coverage protects you in the event that you're involved in an accident with a driver who doesn't have enough insurance to cover your damages. The minimum UM/UIM limits in Illinois are the same as the liability limits: $25,000 per person / $50,000 per accident.

Optional Coverages: Tailoring Your Policy to Your Needs

While the legal requirements provide a baseline, many drivers choose to enhance their coverage to better protect themselves and their assets. Here are some of the optional coverages you might want to consider adding to your Illinois auto insurance policy:

Collision Coverage

This coverage pays for damage to your vehicle in the event of a collision, regardless of who is at fault. It's particularly beneficial for newer vehicles or those with outstanding loans, as it can cover the cost of repairs or the replacement value of the vehicle.

Comprehensive Coverage

Comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, natural disasters, or hitting an animal. It's an important addition to your policy if you live in an area prone to such incidents.

Medical Payments Coverage (MedPay)

MedPay provides coverage for medical expenses incurred by you or your passengers in the event of an accident, regardless of fault. It can help cover a wide range of medical costs, from emergency room visits to ongoing rehabilitation.

Personal Injury Protection (PIP)

PIP, often called "no-fault" coverage, provides additional medical coverage and can also cover lost wages and other related expenses. Illinois does not require PIP, but it's available as an option for added protection.

Rental Car Reimbursement

If you're involved in an accident and your vehicle is being repaired or is declared a total loss, rental car reimbursement coverage can help cover the cost of renting a temporary vehicle.

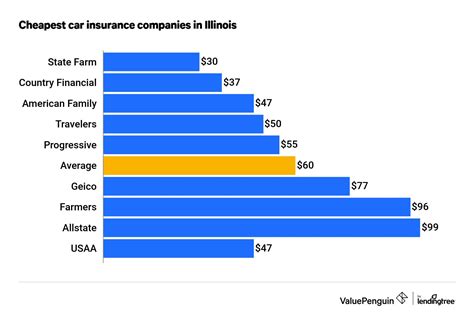

The Cost of Auto Insurance in Illinois

The cost of auto insurance in Illinois can vary significantly based on several factors, including your age, driving record, the type of vehicle you drive, and where you live. According to recent data, the average cost of auto insurance in Illinois is around $1,100 per year, but this can range from as low as $600 to well over $2,000 depending on your circumstances.

Factors that can influence the cost of your premium include:

- Age and Gender: Younger drivers and males tend to pay higher premiums due to their statistically higher risk of accidents.

- Driving Record: A clean driving record can lead to significant savings, while violations and accidents can increase your rates.

- Vehicle Type: More expensive vehicles, high-performance cars, and those with a higher risk of theft can lead to higher premiums.

- Location: Urban areas tend to have higher rates due to increased traffic and the higher risk of accidents and theft.

It's worth noting that Illinois is known for having relatively high auto insurance rates compared to the national average. This is due in part to the state's dense population and the high number of vehicles on the road, which can lead to more frequent accidents and claims.

Tips for Saving on Auto Insurance in Illinois

Shop Around

Insurance rates can vary significantly between providers, so it’s important to compare quotes from multiple companies. Online tools and insurance brokers can help streamline this process.

Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance.

Increase Your Deductible

Choosing a higher deductible can lower your premium, but it’s important to ensure you can afford the deductible in the event of a claim.

Take Advantage of Discounts

Many insurers offer discounts for a variety of reasons, such as good student discounts, safe driver discounts, or discounts for completing a defensive driving course.

Maintain a Clean Driving Record

A clean driving record can lead to significant savings. Avoid speeding, always wear your seatbelt, and never drive under the influence.

The Future of Auto Insurance in Illinois

As technology advances, the auto insurance industry is evolving. In Illinois, as in many other states, the use of telematics and usage-based insurance (UBI) is becoming more common. These programs use data from your driving habits to adjust your premium, potentially offering significant savings to safe drivers.

Additionally, with the rise of electric vehicles (EVs) and autonomous driving technology, the auto insurance landscape is likely to change even further. As these technologies become more prevalent, insurance providers will need to adapt their policies and pricing structures to accommodate these new risks and opportunities.

Staying informed about these developments and being proactive in your insurance choices can help ensure you're getting the best coverage at the most competitive price.

What happens if I drive without insurance in Illinois?

+Driving without insurance in Illinois is illegal and can result in serious consequences. If caught, you may face fines, license suspension, and even jail time in severe cases. Additionally, if you’re involved in an accident while uninsured, you could be held personally liable for all damages, which can be financially devastating.

How often should I review my auto insurance policy?

+It’s a good idea to review your auto insurance policy annually, or whenever your circumstances change significantly. This ensures your coverage remains adequate and that you’re taking advantage of any discounts or policy enhancements that might be available.

Can I get auto insurance with a suspended license in Illinois?

+Obtaining auto insurance with a suspended license can be challenging, but it’s not impossible. Some insurance companies may be willing to insure you, but the rates are likely to be higher, and you may face additional restrictions. It’s best to consult with an insurance broker who specializes in high-risk insurance to explore your options.

What are some common mistakes to avoid when choosing auto insurance in Illinois?

+Some common mistakes to avoid include choosing a provider solely based on price without considering coverage, failing to read the policy documents thoroughly, and neglecting to ask about discounts you might be eligible for. It’s also important to ensure your policy aligns with your specific needs and circumstances.