Whole Versus Term Life Insurance

The world of life insurance can be a complex maze, often filled with jargon and various policy options that might leave prospective buyers feeling overwhelmed. Two of the most common types of life insurance policies are whole life insurance and term life insurance. These policies have distinct features and cater to different financial needs and life stages. Understanding the nuances between them is crucial for making an informed decision that aligns with your financial goals and circumstances.

This comprehensive guide aims to delve deep into the realm of whole life and term life insurance, exploring their respective advantages, drawbacks, and suitability for various life scenarios. By the end of this article, readers should feel empowered to make an educated choice about which type of life insurance policy best fits their needs, whether they're young professionals starting their financial journey or seasoned investors looking to maximize their estate planning.

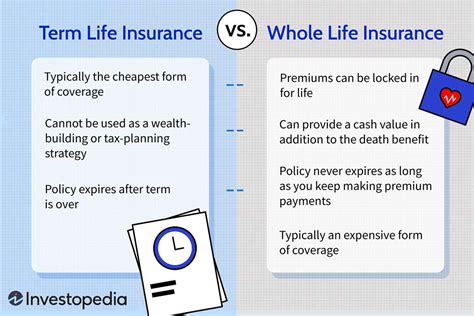

Unraveling Whole Life Insurance: A Comprehensive Overview

Whole life insurance, often referred to as permanent life insurance, is a type of coverage that provides lifetime protection, ensuring your beneficiaries receive a payout upon your passing. But the benefits of whole life insurance extend beyond the mere guarantee of a death benefit. This policy also accrues cash value over time, offering policyholders the flexibility to borrow against this value or even surrender the policy for its cash surrender value.

Key Features of Whole Life Insurance

- Lifetime Coverage: As the name suggests, whole life insurance policies remain active for the entirety of the insured’s life, provided premiums are paid.

- Cash Value Accumulation: These policies build cash value, which can be accessed through loans or withdrawals.

- Fixed Premiums: Premium payments for whole life insurance remain constant throughout the policy’s duration.

- Tax Benefits: The cash value within the policy grows tax-deferred, and any death benefit proceeds are generally tax-free for beneficiaries.

Advantages of Whole Life Insurance

Whole life insurance offers a host of advantages, particularly for those seeking long-term financial security and peace of mind. Here are some key benefits:

- Guaranteed Death Benefit: Whole life insurance ensures your beneficiaries receive a predetermined sum, regardless of when you pass away.

- Cash Value Accumulation: Over time, the policy’s cash value can grow significantly, providing a financial cushion for emergencies or retirement.

- Tax Efficiency: The tax-deferred growth of cash value and tax-free death benefit make whole life insurance an attractive option for estate planning.

- Flexibility: Policyholders can borrow against the cash value or even surrender the policy for its cash surrender value if needed.

Disadvantages and Considerations

While whole life insurance offers many benefits, it’s not without its drawbacks and considerations. Some potential challenges include:

- Higher Costs: Whole life insurance policies typically have higher premiums compared to term life insurance, which can be a significant financial burden for some individuals.

- Limited Investment Options: The cash value within the policy is often invested conservatively, which may not yield high returns.

- Complexity: Understanding the intricacies of whole life insurance, including its cash value accumulation and borrowing options, can be challenging for some.

| Metric | Whole Life Insurance |

|---|---|

| Duration | Lifetime |

| Premiums | Fixed throughout the policy |

| Cash Value | Accumulates over time, accessible through loans or withdrawals |

| Tax Benefits | Cash value grows tax-deferred; death benefit is generally tax-free for beneficiaries |

Exploring Term Life Insurance: A Flexible Option

Term life insurance offers a more flexible and often more affordable alternative to whole life insurance. This type of policy provides coverage for a specified term, ranging from 10 to 30 years, depending on the policy and the insured’s needs. Term life insurance is designed to protect your loved ones during a specific period of your life, such as when you have young children or significant financial obligations.

Key Characteristics of Term Life Insurance

- Defined Term: Term life insurance policies offer coverage for a predetermined period, typically 10, 20, or 30 years.

- Level Premiums: Premiums remain constant throughout the policy’s term.

- No Cash Value: Unlike whole life insurance, term life policies do not accumulate cash value over time.

- Renewable: Many term life policies offer the option to renew at the end of the term, though premiums may increase.

Advantages of Term Life Insurance

Term life insurance is a popular choice for many individuals and families due to its unique advantages:

- Affordability: Term life insurance often has lower premiums compared to whole life insurance, making it accessible to a wider range of budgets.

- Flexibility: The ability to choose the term length allows policyholders to tailor coverage to their specific needs and life stages.

- Simplicity: Term life insurance is straightforward, with no complex cash value accumulation or investment decisions.

- Renewability: Policyholders can often renew their term life insurance policy, providing continued coverage as their needs evolve.

Potential Drawbacks

While term life insurance offers numerous benefits, it’s essential to consider the potential drawbacks and limitations:

- Limited Duration: Term life insurance only provides coverage for a specific period, after which the policyholder may need to renew or seek alternative coverage.

- Increasing Premiums: If the policyholder chooses to renew their term life insurance policy, premiums may increase significantly, especially as they age.

- No Cash Value: Unlike whole life insurance, term life policies do not offer the option to borrow against or surrender the policy for its cash value.

| Metric | Term Life Insurance |

|---|---|

| Duration | Typically 10, 20, or 30 years |

| Premiums | Level throughout the policy term |

| Cash Value | None |

| Renewability | Many policies offer the option to renew at the end of the term |

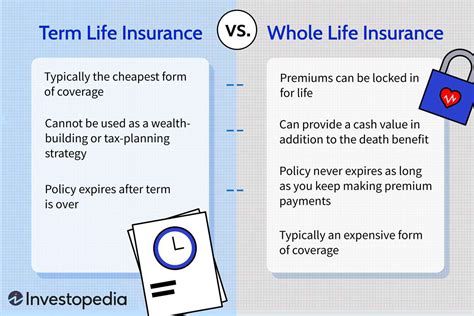

Comparative Analysis: Whole Life vs. Term Life Insurance

When deciding between whole life and term life insurance, it’s essential to weigh the unique features and benefits of each policy against your individual needs and financial goals. Here’s a side-by-side comparison to help you make an informed decision:

| Whole Life Insurance | Term Life Insurance | |

|---|---|---|

| Coverage Duration | Lifetime | Defined term (typically 10, 20, or 30 years) |

| Premiums | Fixed throughout the policy | Level throughout the policy term |

| Cash Value | Accumulates over time, accessible through loans or withdrawals | None |

| Tax Benefits | Cash value grows tax-deferred; death benefit is generally tax-free for beneficiaries | No specific tax benefits |

| Flexibility | Policyholders can borrow against cash value or surrender for cash surrender value | Flexible term lengths; renewable at the end of the term |

Choosing the Right Policy for You

The decision between whole life and term life insurance ultimately depends on your financial goals, life stage, and personal preferences. Here are some factors to consider when making your choice:

- Financial Goals: Do you prioritize long-term financial security, or are you more focused on protecting your loved ones during a specific period of your life?

- Life Stage: If you have young children or significant financial obligations, term life insurance may be a more suitable option. However, if you’re seeking long-term estate planning, whole life insurance could be the better choice.

- Budget: Whole life insurance often comes with higher premiums, so if affordability is a concern, term life insurance might be the more feasible option.

- Flexibility: Whole life insurance offers the flexibility to access cash value, while term life insurance provides flexibility in choosing the term length and the option to renew.

Conclusion: Navigating the Life Insurance Landscape

Choosing between whole life and term life insurance is a critical decision that requires careful consideration of your unique financial circumstances and goals. Whole life insurance provides lifetime coverage and the potential for significant cash value accumulation, making it an attractive option for long-term financial planning. On the other hand, term life insurance offers affordability, flexibility, and simplicity, making it ideal for those seeking temporary coverage or who have specific financial goals.

By understanding the features, benefits, and potential drawbacks of both types of life insurance, you can make an informed decision that ensures your loved ones are protected and your financial future is secure. Remember, life insurance is a powerful tool for financial security, and choosing the right policy can provide peace of mind and stability for years to come.

Frequently Asked Questions (FAQ)

Can I convert my term life insurance policy to a whole life policy later on?

+Yes, many term life insurance policies offer a conversion feature, allowing policyholders to convert their term policy to a whole life policy without a medical exam. However, the conversion option typically has a deadline, so it’s important to review your policy terms carefully.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage will simply expire, and you’ll no longer have insurance protection. However, some policies offer the option to renew or convert to a whole life policy, providing continued coverage.

Are there any tax implications with whole life insurance cash value withdrawals or loans?

+Withdrawals from the cash value of a whole life insurance policy are generally taxed as ordinary income. Loans, on the other hand, are not taxable as long as the policy remains in force. However, it’s important to consult with a tax professional to understand the specific implications for your situation.