Individual Medical Insurance Texas

Individual medical insurance is an essential aspect of healthcare coverage for many residents of Texas, a state known for its diverse population and unique healthcare landscape. With a large population and varying economic conditions, ensuring access to quality healthcare through individual insurance plans is crucial. This article delves into the intricacies of individual medical insurance in Texas, exploring the options, benefits, and considerations for those seeking coverage.

Understanding Individual Medical Insurance in Texas

In the Lone Star State, the healthcare system operates under a unique framework, and individual medical insurance plays a vital role in providing access to essential medical services. Texas, with its robust economy and diverse demographics, presents a complex market for healthcare insurance. Understanding the nuances of individual insurance plans is key to making informed decisions.

The Texas Healthcare Market

Texas boasts a thriving healthcare industry, with a multitude of providers, hospitals, and clinics offering a wide range of medical services. However, the state’s unique regulatory environment and population distribution pose challenges for insurance providers and consumers alike. With a large uninsured population and a diverse economic landscape, the demand for individual medical insurance is significant.

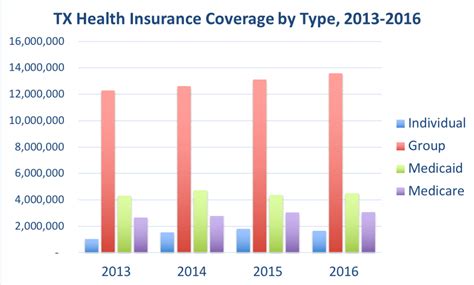

Key statistics highlight the importance of individual insurance in Texas: Over 4 million residents are estimated to be enrolled in individual medical insurance plans, with a growing trend towards personalized coverage. This trend reflects the state's commitment to ensuring access to healthcare for its residents, especially in light of the complexities surrounding healthcare reform.

Individual vs. Group Insurance

Individual medical insurance differs from group insurance plans offered by employers. While group plans often provide comprehensive coverage, individual plans offer flexibility and customization tailored to the specific needs of the policyholder. This makes individual insurance an attractive option for self-employed individuals, those between jobs, or those who are not eligible for group coverage.

Individual plans in Texas typically offer a range of benefits, including coverage for doctor visits, hospitalizations, prescription medications, and preventative care. The level of coverage and benefits varies depending on the specific plan chosen, with options ranging from basic coverage to more comprehensive plans with additional benefits.

| Plan Type | Coverage Benefits |

|---|---|

| Bronze Plans | Covers essential health benefits with lower premiums and higher deductibles. |

| Silver Plans | Provides a balance between premiums and out-of-pocket costs, offering a wide range of benefits. |

| Gold Plans | Offers comprehensive coverage with lower deductibles and higher premiums. |

| Platinum Plans | Provides the highest level of coverage with the lowest out-of-pocket costs. |

Navigating the Individual Insurance Market in Texas

Exploring the individual insurance market in Texas can be a daunting task, given the multitude of options and considerations. From understanding the nuances of different plans to navigating the enrollment process, there are several key aspects to consider.

Plan Options and Comparisons

Texas residents have a variety of individual insurance plans to choose from, each with its own set of benefits, premiums, and coverage limits. It’s essential to compare plans based on individual needs and preferences. Some key factors to consider include:

- Premiums: The monthly cost of the plan, which can vary significantly depending on the level of coverage and the insurance provider.

- Deductibles and Out-of-Pocket Costs: Understanding the deductible (the amount paid out-of-pocket before insurance coverage kicks in) and other out-of-pocket costs, such as co-pays and co-insurance, is crucial.

- Network of Providers: Many plans have networks of healthcare providers, and it's important to ensure that your preferred doctors and hospitals are included in the plan's network.

- Benefit Packages: Compare the specific benefits offered by each plan, including coverage for prescriptions, specialist visits, and preventative care.

- Plan Flexibility: Some plans offer more flexibility in terms of changing coverage levels or adding additional benefits over time.

The Enrollment Process

Enrolling in an individual medical insurance plan in Texas involves several steps, including:

- Research and Comparison: Utilize online resources, insurance brokers, or government websites to research and compare different plans.

- Application and Eligibility: Determine your eligibility for various plans and complete the application process, providing accurate information about your medical history and personal details.

- Premium Payment: Once enrolled, you'll be responsible for paying the monthly premiums to maintain your coverage.

- Understanding Coverage: Familiarize yourself with the specifics of your chosen plan, including what is and isn't covered, and how to access your benefits.

Key Considerations for Individual Insurance in Texas

When navigating the individual insurance market in Texas, there are several important considerations to keep in mind to ensure you make the right choice for your healthcare needs.

Pre-Existing Conditions

One of the most critical aspects of individual insurance is the coverage of pre-existing conditions. Under the Affordable Care Act (ACA), insurance providers cannot deny coverage or charge higher premiums based solely on a pre-existing condition. However, it’s essential to understand how your specific plan handles pre-existing conditions and what, if any, waiting periods or exclusions may apply.

Essential Health Benefits

The ACA also mandates that all individual insurance plans must cover a set of essential health benefits. These benefits include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative services, and more. Ensure that your chosen plan provides adequate coverage for these essential services.

Prescription Drug Coverage

Prescription medications can be a significant expense, and ensuring adequate coverage is crucial. Compare plans based on their prescription drug formularies (lists of covered medications) and any associated costs, such as co-pays or co-insurance.

Preventative Care

Preventative care services, such as annual check-ups, screenings, and vaccinations, are essential for maintaining good health and can help detect potential health issues early on. Look for plans that offer comprehensive coverage for preventative care, often with no out-of-pocket costs.

Future Implications and Trends

The landscape of individual medical insurance in Texas is continually evolving, influenced by healthcare reforms, technological advancements, and changing consumer needs. Understanding these trends and their potential impact is essential for making informed decisions.

Healthcare Reform and Policy Changes

The Affordable Care Act (ACA) has significantly impacted the individual insurance market, ensuring access to coverage for all, regardless of pre-existing conditions. However, with ongoing political debates and potential policy changes, the future of the ACA remains uncertain. Keeping abreast of any changes to healthcare reform policies is crucial for understanding the stability and accessibility of individual insurance plans.

Technological Advancements and Digital Health

The healthcare industry is experiencing a digital revolution, with an increasing focus on telemedicine and digital health solutions. Many insurance providers are now offering virtual doctor visits, remote monitoring, and digital health platforms as part of their coverage. These advancements can enhance access to care and reduce costs, making individual insurance plans more attractive and efficient.

Consumer Preferences and Customization

As consumer preferences evolve, there is a growing demand for customized and flexible insurance plans. Individuals are seeking coverage that aligns with their specific needs and lifestyles. Insurance providers are responding by offering a wider range of plan options, from basic coverage for those on a budget to more comprehensive plans with additional benefits tailored to specific health concerns.

FAQ

Can I qualify for individual medical insurance with a pre-existing condition in Texas?

+

Yes, thanks to the Affordable Care Act (ACA), insurance providers in Texas cannot deny coverage or charge higher premiums based solely on a pre-existing condition. However, it’s important to review the specific terms and conditions of your chosen plan to understand any waiting periods or exclusions that may apply.

How do I find the best individual insurance plan for my needs in Texas?

+

Start by researching and comparing different plans based on your specific needs. Consider factors such as premiums, deductibles, network of providers, and benefit packages. You can utilize online resources, insurance brokers, or government websites to find the plan that best fits your healthcare requirements and budget.

Are there any subsidies or tax credits available for individual insurance in Texas?

+

Yes, depending on your income and family size, you may be eligible for subsidies or tax credits to help offset the cost of individual insurance. These subsidies are available through the Health Insurance Marketplace (Healthcare.gov) and can make insurance more affordable. It’s worth checking your eligibility to see if you qualify for any financial assistance.

What happens if I need to see a specialist or require a hospital stay under my individual insurance plan?

+

The process can vary depending on your specific plan and the circumstances. In general, you’ll need to verify that the specialist or hospital is within your plan’s network to ensure coverage. You may need to obtain a referral from your primary care physician, and there may be associated costs, such as co-pays or co-insurance, depending on your plan’s terms.

Can I switch individual insurance plans during the year in Texas, or am I locked into my current plan?

+

In Texas, you can typically switch individual insurance plans during the annual Open Enrollment Period, which usually occurs in the fall. However, there may be special enrollment periods if you experience a qualifying life event, such as marriage, divorce, birth or adoption of a child, or loss of other health coverage. It’s important to review the enrollment periods and plan accordingly to ensure a smooth transition.