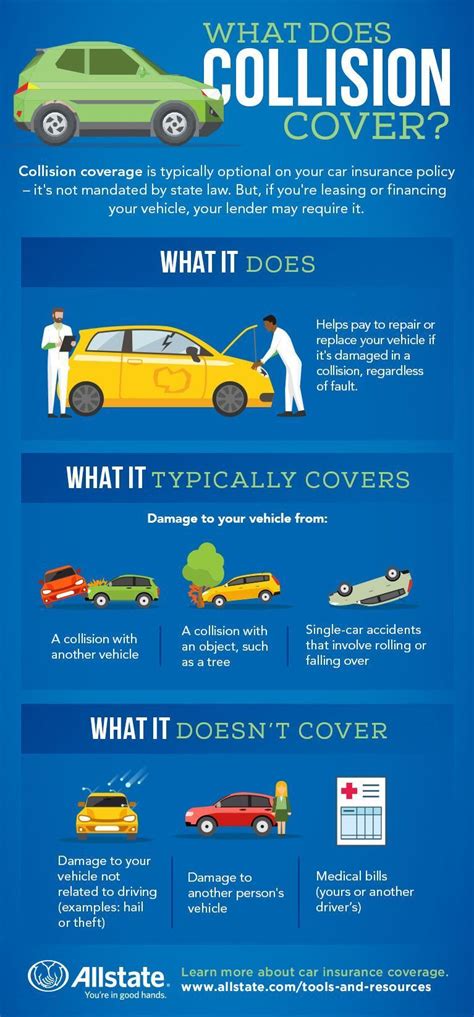

Define Collision Insurance

Collision insurance is an essential component of auto insurance coverage, providing financial protection to policyholders in the event of an accident involving their vehicle. This coverage type plays a crucial role in mitigating the financial risks associated with vehicle damage, ensuring peace of mind for drivers on the road. Understanding collision insurance and its intricacies is vital for anyone seeking comprehensive auto insurance protection.

Understanding Collision Insurance

Collision insurance is a specific type of auto insurance coverage designed to cover the costs associated with repairing or replacing a vehicle that has been damaged in a collision. This coverage extends to various types of accidents, including collisions with other vehicles, objects, or animals. The primary objective of collision insurance is to provide financial assistance to policyholders, ensuring they can cover the expenses related to vehicle repairs or replacement without bearing the full financial burden.

Collision insurance offers comprehensive protection against the financial consequences of accidents, which can be substantial, especially in cases of severe damage. By including collision coverage in their auto insurance policy, drivers can safeguard themselves against potentially devastating financial losses resulting from vehicle damage.

Key Features of Collision Insurance

Collision insurance coverage is characterized by several key features that make it an indispensable part of any comprehensive auto insurance plan:

- Accident Coverage: Collision insurance covers a wide range of accidents, including collisions with other vehicles, stationary objects, and even animals on the road. This broad coverage ensures that policyholders are protected against a variety of potential incidents.

- Repair or Replacement Costs: In the event of a collision, collision insurance covers the costs associated with repairing the damaged vehicle. If the vehicle is deemed a total loss, the insurance provider will pay out the actual cash value of the vehicle, allowing the policyholder to purchase a replacement.

- Deductibles: Collision insurance typically comes with a deductible, which is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Deductibles can vary based on the policy and the chosen coverage level.

- Optional Add-ons: Some insurance providers offer additional coverage options to enhance collision insurance. These add-ons can include rental car coverage, which provides a rental vehicle while the insured vehicle is being repaired, and gap insurance, which covers the difference between the vehicle's actual cash value and the remaining loan balance in case of a total loss.

Benefits of Collision Insurance

Collision insurance offers numerous benefits to policyholders, ensuring they are well-prepared to face the financial challenges that arise from vehicle accidents:

- Financial Protection: Collision insurance provides essential financial protection, ensuring that policyholders can afford the costs associated with repairing or replacing their vehicle after an accident. This protection is particularly valuable for those who rely heavily on their vehicles for daily activities or work.

- Peace of Mind: Knowing that collision insurance is in place gives drivers peace of mind, allowing them to focus on the road without worrying about the financial repercussions of potential accidents. This mental relief can enhance driving experiences and reduce stress levels.

- Enhanced Safety: Collision insurance encourages safer driving practices, as policyholders are more likely to adhere to traffic rules and regulations to avoid accidents. This increased awareness and caution contribute to overall road safety.

- Accident Recovery: In the unfortunate event of an accident, collision insurance ensures that policyholders can quickly recover from the financial setback. The insurance coverage facilitates prompt repairs or replacement, minimizing downtime and enabling a swift return to normalcy.

Choosing the Right Collision Insurance

Selecting the appropriate collision insurance coverage involves careful consideration of several factors to ensure it aligns with individual needs and circumstances:

- Vehicle Value: The value of the insured vehicle plays a significant role in determining the appropriate level of collision insurance coverage. Higher-value vehicles may warrant more comprehensive coverage to ensure adequate protection.

- Deductible Amount: Policyholders can choose their preferred deductible amount, balancing the cost of insurance premiums with their ability to pay out-of-pocket expenses. A higher deductible typically results in lower premiums, while a lower deductible offers more financial protection.

- Additional Coverage Options: Exploring optional add-ons can enhance collision insurance coverage. Rental car coverage and gap insurance, for instance, provide additional peace of mind and financial security in the event of an accident.

- Provider Reputation: Researching and selecting a reputable insurance provider is crucial. A reliable provider ensures prompt claim processing and fair settlements, providing added confidence and security.

Collision Insurance and Comprehensive Coverage

Collision insurance is often paired with comprehensive coverage to create a robust auto insurance policy. Comprehensive coverage protects against non-collision-related incidents, such as theft, vandalism, weather-related damage, and animal collisions. Together, collision and comprehensive coverage offer a comprehensive protection package, ensuring policyholders are prepared for a wide range of potential risks.

| Collision Insurance | Comprehensive Coverage |

|---|---|

| Covers accidents with other vehicles, objects, and animals | Protects against theft, vandalism, and weather-related damage |

| Pays for repairs or replacement in case of a total loss | Provides financial assistance for non-collision-related incidents |

| Includes optional add-ons like rental car coverage | Can be bundled with collision insurance for comprehensive protection |

Frequently Asked Questions (FAQ)

How much does collision insurance typically cost?

+

The cost of collision insurance can vary depending on factors such as the make and model of the vehicle, the policyholder’s driving record, and the chosen coverage limits. On average, collision insurance can add approximately 50% to the cost of a basic liability-only policy. However, it’s important to note that the specific cost will depend on individual circumstances and the insurance provider.

Do I need collision insurance if I have an older vehicle?

+

The decision to purchase collision insurance for an older vehicle depends on its value and the policyholder’s financial situation. If the vehicle has a low market value, it may not be cost-effective to invest in collision insurance. However, for vehicles with sentimental value or those used for specific purposes, collision insurance can provide peace of mind and financial protection.

What happens if my vehicle is totaled in a collision?

+

If your vehicle is deemed a total loss due to a collision, the insurance company will typically pay the actual cash value (ACV) of the vehicle. The ACV is calculated based on the vehicle’s age, condition, and market value at the time of the accident. This payment allows the policyholder to purchase a replacement vehicle.

Can I choose my own repair shop with collision insurance coverage?

+

Yes, policyholders generally have the freedom to choose their preferred repair shop for collision repairs. However, it’s essential to review the insurance policy’s terms and conditions to ensure that the chosen shop is authorized by the insurance provider. Some insurance companies may have a network of preferred repair facilities, offering additional benefits or discounts.

Is collision insurance mandatory in all states?

+

Collision insurance is not mandatory in all states, but it is highly recommended for drivers to have comprehensive auto insurance coverage. While liability insurance is typically required by law, collision and comprehensive coverage are optional. However, lenders may require borrowers to carry collision insurance as part of the loan agreement.

Collision insurance is a vital component of auto insurance, offering financial protection and peace of mind to policyholders. By understanding the key features, benefits, and coverage options, drivers can make informed decisions to ensure they are adequately protected on the road. With the right collision insurance coverage, drivers can navigate the complexities of vehicle accidents with confidence and security.