Typical Car Insurance Cost

Understanding the typical cost of car insurance is essential for anyone looking to own a vehicle. This article aims to provide an in-depth analysis of the factors that influence car insurance rates and offer a comprehensive overview of what drivers can expect to pay for their automotive coverage.

The Factors Influencing Car Insurance Costs

The cost of car insurance is determined by a multitude of factors, each playing a significant role in the overall premium. These factors can be broadly categorized into three main groups: driver-related factors, vehicle-related factors, and external factors. Let’s delve into each of these categories to gain a clearer understanding.

Driver-Related Factors

The driver’s profile is a crucial aspect that insurance companies consider when calculating premiums. Age, gender, and driving history are primary considerations. Generally, younger drivers, especially those under 25, tend to pay higher premiums due to their lack of experience on the road. Statistically, this demographic is more likely to be involved in accidents, which translates to increased insurance costs. Gender can also play a role, with some insurers charging different rates for male and female drivers based on historical data.

Driving history is another critical factor. Drivers with a clean record, free of accidents and traffic violations, often enjoy lower premiums. Conversely, those with a history of accidents or traffic offenses may face higher insurance costs. The number of years a driver has been insured also influences rates; longer-term insured drivers may benefit from loyalty discounts or reduced premiums.

Additionally, the frequency of driving can impact insurance costs. High-mileage drivers, those who travel long distances regularly, may pay more due to the increased risk of accidents. Conversely, low-mileage drivers, often seen in urban areas where public transport is prevalent, may enjoy lower premiums.

Vehicle-Related Factors

The type of vehicle being insured is another significant factor in determining insurance costs. Generally, newer, more expensive vehicles will attract higher premiums due to their replacement and repair costs. Luxury vehicles, sports cars, and SUVs often fall into this category. Conversely, older, more affordable cars may have lower insurance costs.

The make and model of the vehicle also play a role. Some vehicles are more prone to accidents or theft, which can increase insurance costs. Additionally, the safety features of a vehicle can influence rates; cars with advanced safety technologies may be eligible for discounts.

The primary use of the vehicle is another consideration. Personal vehicles used for daily commutes or pleasure may have different insurance rates compared to commercial vehicles used for business purposes. The location where the vehicle is primarily garaged can also impact insurance costs, as urban areas with higher population densities often have higher accident rates.

External Factors

External factors, those beyond the control of the driver or the vehicle, can also significantly influence insurance costs. These include the geographic location of the driver, the type of coverage chosen, and the economic environment.

Geographic location plays a crucial role in determining insurance rates. Areas with high accident rates, dense traffic, or a higher incidence of car theft often have higher insurance premiums. Conversely, rural areas with lower population densities and fewer accidents may have lower insurance costs.

The type of coverage chosen also impacts insurance costs. Comprehensive coverage, which includes protection against damage from natural disasters, theft, or vandalism, will typically be more expensive than liability-only coverage, which only covers damages to other vehicles or property.

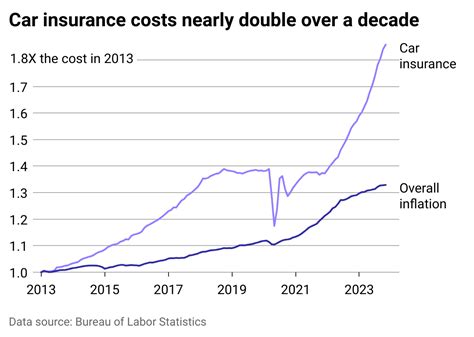

Economic factors, such as inflation and the cost of vehicle repairs, can also influence insurance rates. In times of economic uncertainty or when the cost of vehicle repairs rises, insurance premiums may increase to cover these costs.

Average Car Insurance Costs

The average cost of car insurance can vary widely depending on the factors discussed above. According to recent industry data, the average annual premium for car insurance in the United States is around $1,674. However, this figure is just an average, and actual costs can range significantly based on individual circumstances.

For instance, a young driver with a clean record living in a suburban area might pay around $1,200 to $1,500 per year for insurance. In contrast, an older, experienced driver with a history of accidents living in an urban area could pay upwards of $2,000 or more annually.

| Driver Profile | Average Annual Premium |

|---|---|

| Young Driver (Under 25) | $1,200 - $1,800 |

| Experienced Driver (Over 25) | $1,000 - $1,500 |

| High-Risk Driver (Accident History) | $1,800 - $3,000 |

It's important to note that these averages are just estimates and can vary significantly based on the specific circumstances and insurance company. Additionally, insurance costs can fluctuate over time due to changing market conditions and personal circumstances.

Strategies to Reduce Car Insurance Costs

While the cost of car insurance is influenced by various factors, there are strategies that drivers can employ to potentially reduce their premiums. Here are some tips:

- Maintain a clean driving record: Avoid accidents and traffic violations to keep your insurance costs down.

- Choose a safe vehicle: Opt for vehicles with good safety ratings, as they may be eligible for insurance discounts.

- Increase your deductible: A higher deductible can lower your premium, but it also means you'll pay more out-of-pocket in the event of a claim.

- Bundle your insurance policies: Combining multiple insurance policies, such as auto and home insurance, can often lead to discounts.

- Shop around: Compare quotes from multiple insurance companies to find the best rates for your specific circumstances.

- Take advantage of discounts: Many insurers offer discounts for good students, safe drivers, and other specific circumstances.

The Future of Car Insurance Costs

The landscape of car insurance is constantly evolving, and several trends and technologies are shaping the future of automotive coverage. These include the increasing use of telematics, the rise of electric vehicles, and the potential impact of autonomous driving technology.

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to monitor and analyze a vehicle’s performance and driver behavior. This technology is being increasingly adopted by insurance companies to offer usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive insurance.

With usage-based insurance, drivers can opt to have their driving behavior monitored in exchange for potentially lower premiums. This system rewards safe driving habits and can lead to significant savings for responsible drivers. However, it's important to note that this also means higher premiums for drivers who exhibit risky behavior.

The Impact of Electric Vehicles

The rise of electric vehicles (EVs) is also expected to influence car insurance costs. EVs have lower maintenance costs and are often seen as safer vehicles, which could lead to reduced insurance premiums. However, the initial cost of EVs is typically higher, and their specialized repair needs may lead to increased insurance costs.

Autonomous Driving Technology

The advent of autonomous driving technology is another factor that could significantly impact car insurance costs in the future. As self-driving cars become more prevalent, the number of accidents is expected to decrease, potentially leading to lower insurance premiums. However, the initial cost of autonomous vehicles and the complexity of insuring them may present challenges.

Additionally, the liability implications of autonomous driving are still being debated. If a self-driving car is involved in an accident, who is at fault? The driver, the vehicle manufacturer, or the software developer? These questions are yet to be fully resolved, and they could have a significant impact on insurance costs and coverage.

Conclusion

Understanding the typical cost of car insurance is a complex task, as it is influenced by a multitude of factors. From driver-related factors like age and driving history to vehicle-related factors like make and model, and external factors like geographic location and economic conditions, each plays a significant role in determining insurance premiums.

While the average annual premium for car insurance in the United States is around $1,674, actual costs can vary widely based on individual circumstances. By adopting strategies like maintaining a clean driving record, choosing a safe vehicle, and taking advantage of discounts, drivers can potentially reduce their insurance costs.

Looking ahead, the future of car insurance costs is likely to be shaped by emerging technologies like telematics, the rise of electric vehicles, and the potential widespread adoption of autonomous driving. These trends are expected to bring about significant changes in the automotive insurance landscape, offering both challenges and opportunities for drivers and insurance providers alike.

How do insurance companies determine car insurance rates?

+Insurance companies use a complex algorithm that considers various factors, including the driver’s age, gender, driving history, and the type of vehicle being insured. External factors like the geographic location and economic environment also play a role. This data is used to assess the risk associated with insuring a particular driver and vehicle, which ultimately determines the insurance premium.

What is the difference between liability-only and comprehensive coverage?

+Liability-only coverage is the most basic form of car insurance, covering damages to other vehicles or property in the event of an accident caused by the insured driver. Comprehensive coverage, on the other hand, provides broader protection, including coverage for damage caused by natural disasters, theft, or vandalism, in addition to liability coverage.

Can I reduce my car insurance costs by bundling my policies?

+Yes, many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. By combining your policies, you can often save money on your overall insurance costs.