Insurance Quotes Home Auto

The Comprehensive Guide to Insurance Quotes: Unlocking the Best Deals for Your Home and Auto

In the realm of personal finances and asset protection, insurance plays a pivotal role. Obtaining the right insurance coverage for your home and automobile is not just a wise financial decision but a necessity. This guide aims to delve deep into the world of insurance quotes, offering you an expert perspective on how to navigate this often-complex landscape, ensuring you secure the most advantageous deals tailored to your specific needs.

Understanding insurance quotes is the first step towards becoming a savvy consumer in this domain. Insurance quotes are essentially the estimates provided by insurance companies detailing the costs and coverage options for your home and vehicle. These quotes are highly individualized, taking into account various factors such as the location, size, and age of your home, as well as the make, model, and usage of your vehicle. By analyzing these quotes, you can make informed decisions, ensuring you receive the best value for your insurance premiums.

Home Insurance Quotes: Securing Your Castle

Your home is more than just a physical structure; it's a sanctuary, an investment, and a cornerstone of your financial stability. Therefore, ensuring it is adequately protected with the right home insurance is paramount. When requesting home insurance quotes, there are several key factors to consider.

Understanding Coverage Options

Home insurance policies typically offer a range of coverage options, including:

- Dwelling Coverage: This covers the physical structure of your home, including walls, roofs, and foundations. It is crucial to ensure this coverage matches the replacement cost of your home, not just its market value.

- Personal Property Coverage: This protects your belongings, from furniture and appliances to clothing and electronics. Ensure the coverage limit is sufficient to replace all your possessions.

- Liability Coverage: This safeguards you against lawsuits arising from accidents or injuries that occur on your property. It's an essential component to protect your financial well-being.

- Additional Living Expenses: In the event of a covered loss that makes your home uninhabitable, this coverage helps with temporary living expenses, such as hotel stays or restaurant meals.

Factors Influencing Home Insurance Quotes

Several factors can impact the cost of your home insurance quotes. These include:

- Location: Homes in areas prone to natural disasters like hurricanes, tornadoes, or wildfires may face higher insurance premiums. Similarly, areas with high crime rates may also see increased costs.

- Home Age and Construction: Older homes or those with outdated electrical or plumbing systems may pose higher risks, leading to increased premiums. Modern construction materials and features can sometimes lower costs.

- Home Value and Size: The value and size of your home directly influence the cost of insurance. Larger homes generally require higher premiums.

- Claim History: If you've had multiple insurance claims in the past, especially for similar incidents, it can negatively impact your future quotes.

| Home Insurance Factors | Impact on Quotes |

|---|---|

| Location | Higher in disaster-prone or high-crime areas |

| Home Age and Construction | Older homes or outdated systems may increase costs |

| Home Value and Size | Larger homes generally require higher premiums |

| Claim History | Multiple claims can lead to higher future quotes |

Auto Insurance Quotes: Navigating the Roads with Confidence

Your vehicle is not just a means of transportation; it's a reflection of your lifestyle and often a significant financial investment. Auto insurance ensures you're protected in the event of accidents, theft, or other mishaps. When comparing auto insurance quotes, several key considerations come into play.

Understanding Auto Insurance Coverage

Auto insurance policies offer a range of coverage options, including:

- Liability Coverage: This is mandatory in most states and covers bodily injury and property damage you cause to others in an accident.

- Collision Coverage: This pays for damage to your vehicle resulting from a collision, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP) or Medical Payments Coverage: These cover medical expenses for injuries sustained in an accident, regardless of fault.

Factors Influencing Auto Insurance Quotes

The cost of your auto insurance quotes can be influenced by various factors, including:

- Vehicle Type and Usage: Sports cars or luxury vehicles may cost more to insure, and vehicles used for business purposes can also increase premiums.

- Driving Record: A clean driving record with no accidents or violations can lead to lower insurance costs. Conversely, a history of accidents or traffic violations may result in higher premiums.

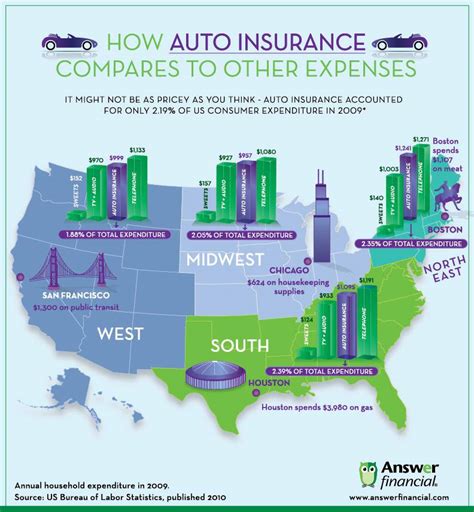

- Location and Mileage: Drivers in urban areas or those with high annual mileage may face increased insurance costs due to the higher risk of accidents.

- Credit Score: Believe it or not, your credit score can impact your auto insurance rates. Many insurance companies use credit-based insurance scores to assess risk, so maintaining a good credit score can help keep costs down.

| Auto Insurance Factors | Impact on Quotes |

|---|---|

| Vehicle Type and Usage | Sports cars or business use can increase costs |

| Driving Record | Clean records lead to lower premiums; accidents or violations increase costs |

| Location and Mileage | Urban areas or high mileage may result in higher risks and costs |

| Credit Score | A good credit score can help lower insurance rates |

Comparative Analysis: Home vs. Auto Insurance Quotes

While home and auto insurance quotes share some similarities, there are also distinct differences. Home insurance quotes focus on the physical structure and contents of your home, as well as liability risks associated with your property. On the other hand, auto insurance quotes primarily center around the vehicle itself, your driving record, and the risks associated with operating a motor vehicle.

Both types of insurance are essential for protecting your assets and ensuring financial stability. By understanding the factors that influence these quotes and taking the time to compare multiple options, you can make informed decisions and secure the best coverage at the most competitive rates.

Future Implications and Industry Trends

The insurance landscape is constantly evolving, with new technologies and consumer trends shaping the industry. As we move forward, several key trends are expected to impact insurance quotes for both home and auto policies.

Emerging Technologies

The integration of technology in the insurance industry is transforming the way quotes are generated and policies are managed. For instance, telematics devices in vehicles can track driving behavior, offering personalized insurance rates based on actual driving habits. Similarly, smart home devices can provide real-time data on home usage, potentially leading to more accurate and personalized home insurance quotes.

Consumer Empowerment

With the rise of online comparison tools and insurance marketplaces, consumers now have more power than ever to shop around for the best insurance deals. This increased transparency and ease of comparison are driving competition among insurance providers, leading to more competitive pricing and improved customer service.

Sustainable and Green Initiatives

As environmental concerns grow, insurance companies are beginning to offer incentives for sustainable practices. For instance, homeowners who install solar panels or implement energy-efficient upgrades may qualify for reduced insurance rates. Similarly, drivers who opt for electric or hybrid vehicles may benefit from lower auto insurance premiums.

The Future of Insurance Quotes

Looking ahead, the future of insurance quotes is likely to be shaped by continued technological advancements, changing consumer preferences, and evolving environmental and social factors. Insurance companies that embrace these changes and adapt their offerings accordingly are poised to thrive in this dynamic landscape.

For consumers, staying informed about these trends and understanding how they can impact insurance quotes is essential for making the most of their insurance coverage. By staying ahead of the curve, you can ensure you're not only getting the best deals today but also positioning yourself for the insurance landscape of tomorrow.

FAQs

What is the difference between home insurance and homeowners insurance?

+Home insurance and homeowners insurance are often used interchangeably, but there can be subtle differences. Home insurance typically refers to the basic coverage for the structure of your home, while homeowners insurance is a more comprehensive policy that includes coverage for the structure, personal belongings, liability, and additional living expenses.

How often should I review my home and auto insurance quotes?

+It’s a good idea to review your insurance quotes annually, especially when your policy renews. This allows you to ensure you’re still getting the best coverage and rates based on your current circumstances. Additionally, significant life changes like moving, getting married, or purchasing a new vehicle can prompt a review of your insurance needs.

Can I bundle my home and auto insurance policies to save money?

+Yes, bundling your home and auto insurance policies with the same provider is often a great way to save money. Many insurance companies offer multi-policy discounts, so by combining your home and auto insurance, you can take advantage of these savings.

What are some common discounts available for auto insurance policies?

+Auto insurance companies offer a variety of discounts, including safe driver discounts, good student discounts, loyalty discounts, and discounts for certain vehicle safety features. It’s always worth inquiring about these discounts when requesting quotes to see if you’re eligible for any savings.