Australian Travel Insurance

Australian Travel Insurance: Navigating Your Options and Benefits

When embarking on a journey to the breathtaking land Down Under, it's crucial to consider Australian travel insurance to safeguard your adventure. Australia, with its diverse landscapes, vibrant cities, and unique wildlife, offers an unforgettable travel experience. However, like any international trip, unexpected events can occur, and having the right insurance coverage can provide peace of mind and essential support during your travels.

In this comprehensive guide, we will delve into the world of Australian travel insurance, exploring the various options available, the benefits they offer, and how to make an informed choice. By understanding the nuances of travel insurance in Australia, you can ensure your trip is protected, allowing you to focus on creating unforgettable memories.

Understanding the Basics of Australian Travel Insurance

Australian travel insurance is a specialized form of coverage designed to protect travelers visiting the country. It provides financial protection and assistance in case of unforeseen circumstances, such as medical emergencies, trip cancellations, lost luggage, or personal liability issues. Understanding the basics of Australian travel insurance is essential to make informed decisions and choose the right policy for your needs.

Key Coverage Components

Australian travel insurance policies typically include the following key coverage components:

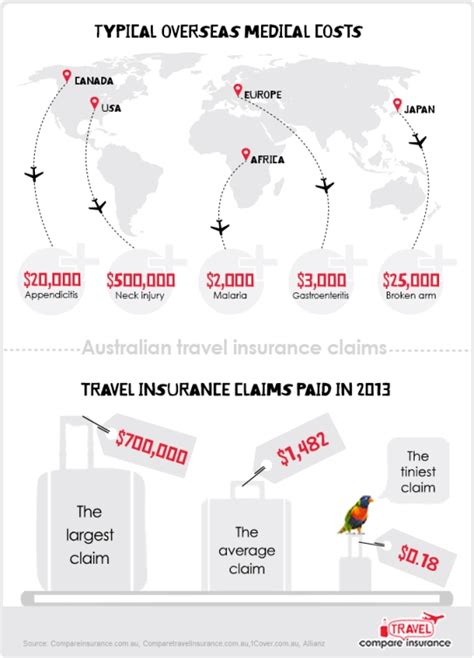

- Medical Expenses: Coverage for unexpected medical treatments, including hospitalization, doctor's fees, and prescription medications. This is especially crucial given the high cost of healthcare in Australia.

- Trip Cancellation and Interruption: Reimbursement for non-refundable trip costs if your travel plans are disrupted due to unforeseen circumstances like illness, natural disasters, or travel advisories.

- Emergency Evacuation: Assistance and coverage for emergency medical transportation, including air ambulance services if necessary.

- Luggage and Personal Belongings: Compensation for lost, stolen, or damaged luggage and personal items during your trip.

- Personal Liability: Protection if you are found legally liable for causing bodily injury or property damage to others during your travels.

- Rental Car Coverage: Some policies may include collision damage waiver for rental cars, providing financial protection in case of accidents.

It's important to note that the level of coverage and the specific terms and conditions can vary significantly between insurance providers and policy types. Therefore, it's crucial to carefully review the policy details and understand the exclusions and limitations before purchasing.

Choosing the Right Australian Travel Insurance Policy

Selecting the appropriate Australian travel insurance policy involves considering various factors and tailoring the coverage to your unique travel needs. Here are some key considerations to help you make an informed decision:

Duration of Stay

Determine the length of your trip to Australia. Some policies offer coverage for short-term trips, while others cater to long-term stays or working holiday visas. Ensure the policy's duration aligns with your travel plans.

Adventure Activities and Sports

If your itinerary includes adventurous activities like skydiving, surfing, or hiking, ensure your policy covers these specific activities. Some insurance providers offer additional coverage for high-risk sports and adventures.

Pre-Existing Medical Conditions

Disclose any pre-existing medical conditions to the insurance provider. Certain policies may offer coverage for specific conditions, while others may require additional premiums or exclusions. Being transparent about your health status is crucial for adequate protection.

Age and Medical Coverage

Consider your age and any potential medical needs. Australian travel insurance policies often have age limits, and the cost and coverage may vary based on age. Ensure the policy provides adequate medical coverage for your specific needs.

Destination and Activities

Think about the regions you plan to visit in Australia. Different areas may have varying risks and activities. For example, traveling to remote areas may require additional emergency evacuation coverage. Assess the activities and locations to choose a policy that suits your travel plans.

Comparison Shopping

Compare quotes and policy details from multiple insurance providers. Consider factors such as coverage limits, deductibles, excess amounts, and any additional benefits offered. Reading reviews and seeking recommendations from fellow travelers can also provide valuable insights.

Benefits of Australian Travel Insurance

Australian travel insurance offers a range of benefits that can provide invaluable support during your travels. Here are some key advantages to highlight:

Financial Protection

Travel insurance protects you from significant financial losses in case of unforeseen events. It provides coverage for non-refundable trip costs, medical expenses, and other unexpected expenses, ensuring you don't bear the full financial burden.

Peace of Mind

Knowing you have comprehensive insurance coverage allows you to relax and enjoy your trip without constant worry. Australian travel insurance provides reassurance, allowing you to fully immerse yourself in the adventure and experience all that Australia has to offer.

Emergency Assistance

In the event of an emergency, travel insurance offers 24/7 assistance and support. From medical emergencies to trip disruptions, insurance providers have dedicated teams to help coordinate and manage your situation, ensuring you receive the necessary care and assistance promptly.

Legal Protection

Travel insurance provides personal liability coverage, protecting you in case you are held legally responsible for causing harm or damage to others. This coverage can be especially crucial when engaging in activities or visiting regions with potential liability risks.

Convenience and Flexibility

Australian travel insurance policies often offer flexible coverage options, allowing you to customize your policy based on your needs. From choosing the level of medical coverage to adding specific adventure activity coverage, you can tailor the policy to match your travel plans.

Performance Analysis and Industry Insights

Understanding the performance and reputation of Australian travel insurance providers is crucial when making your choice. Research and industry insights can provide valuable information to help you select a reliable and reputable insurer.

Provider Reputation and Customer Service

Look for insurance providers with a solid reputation and positive customer reviews. Assess their responsiveness, claim handling process, and overall customer satisfaction. A reliable insurer with excellent customer service can provide peace of mind and efficient support when needed.

Financial Strength and Stability

Consider the financial stability and strength of the insurance provider. Research their financial ratings and ensure they have the resources to honor claims and provide long-term coverage. A financially stable insurer ensures your policy remains valid and reliable throughout your trip.

Claim Settlement Process

Understand the claim settlement process of different insurance providers. Look for providers with a straightforward and efficient claims process, including clear guidelines and timely claim settlements. A seamless claim process can make a significant difference when you need assistance during your travels.

Travel Assistance and Support

Assess the level of travel assistance and support offered by the insurance provider. Look for 24/7 emergency assistance, multilingual support, and a dedicated team to help with medical emergencies, trip disruptions, and other travel-related issues. Comprehensive travel assistance can provide invaluable support during challenging situations.

Evidence-Based Future Implications

As the travel industry continues to evolve, so do the needs and expectations of travelers. Australian travel insurance providers are adapting to meet these changing demands, offering innovative coverage options and enhanced benefits. Here are some future implications and trends to consider:

Digital Transformation

The travel insurance industry is embracing digital technologies to enhance the customer experience. Expect to see more online platforms, mobile apps, and digital tools for policy management, claim submissions, and real-time travel assistance. Digital transformation will streamline processes and provide greater convenience for travelers.

Personalized Coverage

Travelers are seeking more tailored and personalized coverage options. Australian travel insurance providers are likely to offer flexible plans that allow travelers to customize their policies based on their specific needs and preferences. This could include optional add-ons for adventure activities, enhanced medical coverage, or additional baggage protection.

Enhanced Medical Coverage

With the rising costs of healthcare, travelers are placing greater emphasis on robust medical coverage. Australian travel insurance providers may expand their medical benefits, offering higher coverage limits, specialized coverage for pre-existing conditions, and improved access to quality healthcare services during travels.

Sustainable Travel and Eco-Friendly Options

As sustainability becomes a priority for travelers, insurance providers may introduce eco-friendly travel insurance options. These policies could include carbon offset initiatives, support for sustainable travel practices, and incentives for environmentally conscious travelers. By aligning with sustainable travel trends, insurers can appeal to a broader range of conscious travelers.

Travel Bubble and Regional Coverage

The concept of travel bubbles and regional travel may gain prominence in the future. Australian travel insurance providers could offer specialized coverage for specific regions or travel bubbles, providing tailored protection for travelers within these designated areas. This could include enhanced medical coverage, localized emergency assistance, and specific activity coverage relevant to the region.

Travel Insurance for Remote Work and Digital Nomads

With the rise of remote work and digital nomadism, Australian travel insurance providers may develop policies catering to this growing segment of travelers. These policies could offer extended coverage for longer-term stays, including working holiday visas, and provide comprehensive protection for remote workers and digital nomads exploring Australia.

Increased Use of AI and Machine Learning

Artificial intelligence and machine learning technologies are expected to play a larger role in the travel insurance industry. Insurers may leverage AI to improve risk assessment, claim processing, and customer service. This could lead to more efficient and accurate insurance offerings, benefiting both travelers and insurance providers.

FAQ

What is the average cost of Australian travel insurance for a two-week trip?

+

The cost of Australian travel insurance can vary based on factors such as age, destination, and coverage limits. On average, a two-week trip to Australia may cost between 50 to 150 for basic coverage. However, prices can increase for more comprehensive policies or if you have specific needs like pre-existing medical conditions or adventure activity coverage.

Do I need to disclose pre-existing medical conditions when purchasing Australian travel insurance?

+

Yes, it is crucial to disclose any pre-existing medical conditions when purchasing Australian travel insurance. Failure to disclose relevant health information may result in your claim being denied if a related issue arises during your trip. Always be transparent and accurate when providing medical details to ensure adequate coverage.

What happens if I need to make a claim while in Australia?

+

If you need to make a claim while in Australia, contact your insurance provider’s emergency assistance hotline immediately. They will guide you through the claim process, which typically involves providing documentation and evidence of the incident or loss. It’s essential to follow their instructions and keep records of all communications and expenses.

Are there any activities or locations in Australia that require additional insurance coverage?

+

Yes, certain adventure activities and remote locations in Australia may require additional insurance coverage. For example, if you plan to engage in activities like skydiving, scuba diving, or hiking in remote areas, ensure your policy covers these specific activities. Some insurers may offer optional add-ons or specialized policies for such activities.

Can I purchase Australian travel insurance after my trip has started?

+

In most cases, it is advisable to purchase Australian travel insurance before your trip begins. Many policies have restrictions and limitations on purchasing coverage after the trip has started, especially if you are already aware of potential risks or have existing medical conditions. It’s best to secure coverage in advance to ensure comprehensive protection.