Health Insurance Coverage Quotes

Navigating the complex world of health insurance can be a daunting task, especially when you're seeking accurate coverage quotes. The process involves understanding various factors that influence insurance premiums, from individual health conditions to the chosen level of coverage. This article aims to provide a comprehensive guide to understanding health insurance coverage quotes, offering insights into the key elements that impact these quotes and strategies to secure the best possible coverage for your unique needs.

Understanding Health Insurance Coverage Quotes

Health insurance coverage quotes are tailored estimates of the cost of health insurance plans, specific to an individual’s circumstances. These quotes are influenced by a range of factors, including age, gender, location, health status, and the desired level of coverage. Insurance companies use these variables to assess the potential risk of insuring an individual and, consequently, determine the premium they will pay.

The primary objective of insurance companies is to ensure they can cover the costs of providing healthcare services to their policyholders. This means that individuals with higher health risks, such as those with pre-existing conditions or a history of frequent healthcare utilization, may face higher insurance quotes. On the other hand, individuals with a lower risk profile, such as young, healthy adults, often benefit from more affordable coverage options.

Factors Influencing Health Insurance Quotes

Several key factors play a significant role in shaping health insurance coverage quotes. Understanding these factors can help individuals make more informed decisions about their health insurance coverage and potentially negotiate better terms.

- Age and Gender: Age is a critical determinant of health insurance quotes. Generally, younger individuals are considered a lower risk and thus receive more affordable quotes. Gender can also impact quotes, with some insurance companies charging different rates for men and women based on their typical healthcare needs and utilization patterns.

- Health Status: Pre-existing medical conditions, chronic illnesses, and the overall health status of an individual can significantly influence insurance quotes. Insurance companies often require medical examinations or reviews of medical history to assess an individual's health risk accurately.

- Location: The geographic location of an individual can affect insurance quotes due to variations in healthcare costs and the availability of medical services. Regions with higher healthcare costs or a limited number of healthcare providers may see higher insurance premiums.

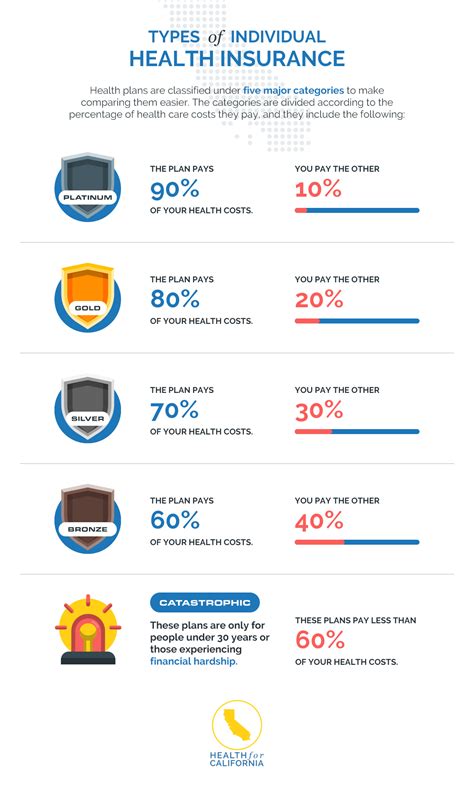

- Level of Coverage: The type and extent of coverage chosen by an individual significantly impact insurance quotes. Higher coverage plans, which offer more comprehensive benefits and lower out-of-pocket expenses, typically come with higher premiums. Conversely, lower coverage plans, while more affordable, may expose individuals to higher out-of-pocket costs when utilizing healthcare services.

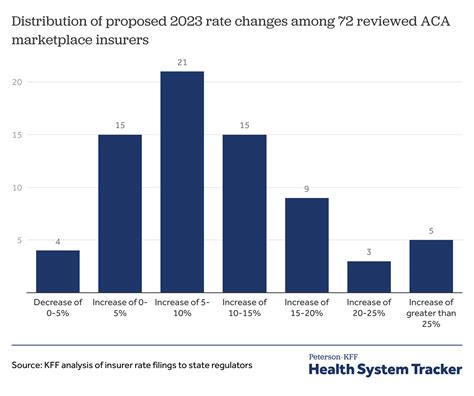

It's important to note that while these factors are standard across most insurance companies, the weight given to each factor can vary. This means that shopping around and comparing quotes from different providers can often lead to significant differences in premiums, even for individuals with similar profiles.

Strategies for Securing the Best Health Insurance Coverage

When seeking the best health insurance coverage, it’s crucial to adopt a strategic approach. Here are some key strategies to consider:

Compare Multiple Quotes

Comparing quotes from different insurance providers is a fundamental step in securing the best coverage. Online platforms and insurance brokers can provide a wealth of information, allowing you to compare plans, benefits, and premiums side by side. This comparison process ensures you’re not only getting the best price but also the coverage that aligns with your specific healthcare needs.

Assess Your Healthcare Needs

Understanding your healthcare needs is vital to making informed decisions about insurance coverage. Consider your past and potential future healthcare utilization, including regular check-ups, ongoing treatments, or any anticipated medical procedures. By assessing your needs, you can select a plan that offers the right level of coverage without unnecessary add-ons that drive up premiums.

Explore Different Coverage Levels

Health insurance plans come in various levels of coverage, from basic plans with limited benefits to comprehensive plans offering extensive coverage. While basic plans may be more affordable, they often come with higher out-of-pocket expenses. Conversely, comprehensive plans, while more expensive, can provide significant peace of mind and financial protection. Exploring different coverage levels and understanding the associated benefits and costs can help you strike the right balance between affordability and adequate coverage.

Consider Group Plans

Group health insurance plans, offered through employers or associations, often provide more favorable terms than individual plans. These plans leverage the group’s collective bargaining power to negotiate lower premiums and more comprehensive coverage. If you’re eligible for a group plan, it’s worth exploring the benefits it offers and comparing them to individual plans to determine the most cost-effective and beneficial option.

Negotiate with Insurance Providers

Negotiating with insurance providers is a viable strategy, especially if you have a strong understanding of the market and your healthcare needs. By providing detailed information about your health status, healthcare utilization, and financial situation, you may be able to negotiate a more favorable premium. Insurance companies are often open to discussions, particularly if they believe you’re a low-risk individual or if you’re willing to make certain concessions, such as opting for a higher deductible.

Utilize Government Programs

For individuals who may struggle to afford health insurance, government programs can provide a vital safety net. Programs like Medicaid, Medicare, and the Children’s Health Insurance Program (CHIP) offer coverage to eligible individuals and families based on income and other factors. These programs can significantly reduce or eliminate the cost of health insurance, making quality healthcare more accessible.

The Future of Health Insurance Coverage Quotes

The landscape of health insurance coverage quotes is continually evolving, driven by advancements in technology, shifts in healthcare policies, and changes in consumer behavior. Here’s a glimpse into the potential future of health insurance coverage quotes:

Digital Transformation

The digital revolution has already begun to transform the health insurance industry. Online platforms and mobile apps are making it easier for individuals to compare plans, obtain quotes, and manage their insurance policies. This digital transformation is expected to continue, with insurance companies investing in technology to streamline processes, improve customer service, and offer more personalized insurance products.

Personalized Insurance

Advances in healthcare technology and data analytics are paving the way for more personalized insurance offerings. By leveraging individual health data, insurance companies can offer tailored plans that address specific health concerns or risks. This shift towards personalized insurance could lead to more accurate and competitive quotes, especially for individuals with unique healthcare needs.

Value-Based Care Models

The healthcare industry is increasingly moving towards value-based care models, where payment is linked to the quality and outcomes of care rather than the quantity of services provided. This shift could influence insurance coverage quotes, with plans incentivizing individuals to seek preventative care and make healthier lifestyle choices. Value-based care models have the potential to reduce overall healthcare costs and make insurance more affordable and accessible.

Expanded Government Programs

There is ongoing debate and speculation about the future of government-sponsored healthcare programs. While the specifics are uncertain, there is a possibility that these programs could be expanded, offering more comprehensive coverage to a wider range of individuals. Such an expansion could significantly impact the private health insurance market, potentially driving down premiums and increasing accessibility.

Conclusion

Understanding health insurance coverage quotes is a critical aspect of ensuring you have the right coverage for your needs. By familiarizing yourself with the factors that influence quotes and adopting strategic approaches to securing coverage, you can navigate the complex world of health insurance with confidence. The future of health insurance coverage quotes looks promising, with digital transformation, personalized insurance, and value-based care models offering the potential for more affordable, accessible, and tailored insurance solutions.

What is the best age to buy health insurance?

+The best age to buy health insurance is subjective and depends on individual circumstances. However, it’s generally advisable to have health insurance from a young age to establish coverage and take advantage of lower premiums associated with youth. Additionally, having insurance from an early age can help you build a continuous coverage history, which is often rewarded with more favorable terms and rates as you age.

How do pre-existing conditions impact health insurance quotes?

+Pre-existing conditions can significantly impact health insurance quotes. Insurance companies often consider the nature and severity of these conditions when assessing risk and determining premiums. While the Affordable Care Act (ACA) prohibits insurance companies from denying coverage based on pre-existing conditions, they can still factor these conditions into their pricing, leading to higher premiums for individuals with complex health histories.

Are there any ways to reduce health insurance premiums?

+Yes, there are several strategies to potentially reduce health insurance premiums. These include comparing quotes from multiple providers, opting for higher deductibles (if financially feasible), taking advantage of employer-sponsored group plans, and considering government-sponsored programs like Medicaid or Medicare if eligible. Additionally, maintaining a healthy lifestyle and avoiding risky behaviors can help keep premiums lower over time.