Health Insurance For Long Term

In today's dynamic healthcare landscape, understanding the intricacies of long-term health insurance is crucial for anyone seeking comprehensive coverage. This article delves into the realm of long-term health insurance, offering an expert-level guide to help you navigate this complex yet essential aspect of personal finance.

Understanding Long-Term Health Insurance

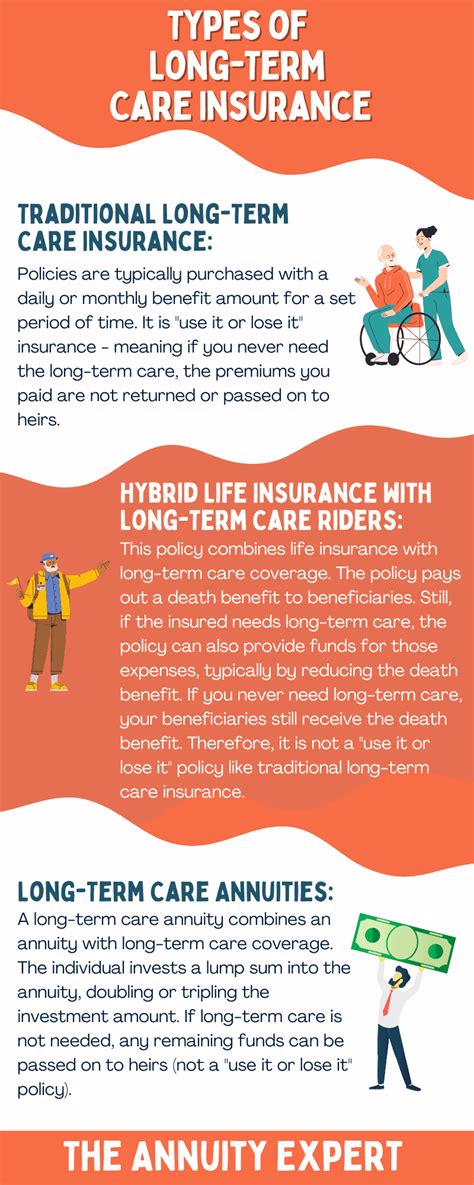

Long-term health insurance is a specialized type of coverage designed to provide financial protection for extended periods of illness or injury. Unlike traditional health insurance plans that focus on acute medical needs, long-term insurance addresses the unique challenges of managing ongoing health conditions or disabilities that may require care over months or even years.

The need for long-term health insurance arises from the reality that medical advancements have enabled people to live longer, but often with chronic conditions that demand continuous care. This type of insurance aims to ensure that individuals have access to the necessary resources to manage their health effectively over an extended timeframe.

Key Components of Long-Term Health Insurance

- Coverage Period: Typically, long-term insurance policies cover a defined period, such as a year or more, with the option to renew annually. This flexibility allows individuals to tailor their coverage to their evolving health needs.

- Benefit Structure: Benefits often include coverage for nursing home care, home healthcare, assisted living, and other services that traditional health insurance might not cover. The exact benefits can vary based on the policy and the provider.

- Eligibility: While anyone can apply for long-term health insurance, acceptance is not guaranteed. Insurance companies often assess an applicant’s health status and may require a medical exam to determine eligibility and premium rates.

One of the critical aspects of long-term health insurance is its focus on providing financial stability during periods of extended care. By offering coverage for a range of services, from skilled nursing care to in-home assistance, these policies aim to ensure that individuals can receive the care they need without facing debilitating financial strain.

Why Choose Long-Term Health Insurance?

The decision to invest in long-term health insurance is a proactive step towards safeguarding one’s future health and financial well-being. Here’s why it can be a crucial component of your overall insurance strategy:

Financial Protection for Extended Care

Long-term health insurance steps in where traditional health insurance might fall short. It covers the costs of care that could extend over months or years, providing a vital safety net against the financial burden of prolonged illness or injury.

| Traditional Health Insurance | Long-Term Health Insurance |

|---|---|

| Covers acute illnesses and injuries | Provides coverage for extended care needs |

| Typically limited duration (e.g., one policy year) | Covers care over an extended period, often renewable annually |

| May not cover all long-term care needs | Includes benefits for nursing home care, home healthcare, and more |

Peace of Mind for the Future

By investing in long-term health insurance, individuals can ensure they have access to the care they need, when they need it. This peace of mind is invaluable, allowing people to focus on their health and well-being without the added stress of financial concerns.

Flexibility and Customization

Long-term health insurance policies offer a degree of flexibility that aligns with individual needs. Policyholders can choose coverage levels, benefit durations, and even specific services they wish to be covered, ensuring a personalized approach to their healthcare planning.

Navigating the Application Process

Applying for long-term health insurance involves several key steps, each designed to ensure the policy is tailored to your specific needs and circumstances. Here’s a detailed breakdown of the process:

Step 1: Assessing Your Needs

The first step is to evaluate your current and potential future healthcare needs. Consider factors such as your age, health status, family history, and any pre-existing conditions. Understanding these factors will help you determine the level of coverage you require.

Step 2: Researching Providers

Not all insurance providers offer long-term health insurance, and those that do may have different policies and benefits. Research and compare various providers to find one that aligns with your needs. Consider factors like coverage options, premium costs, and the provider’s reputation for customer service and claim handling.

Step 3: Understanding Policy Terms

Before applying, carefully review the policy terms and conditions. Pay attention to the benefits covered, any exclusions or limitations, the waiting period (if applicable), and the renewal process. Ensure you understand the policy inside and out to make an informed decision.

Step 4: Completing the Application

The application process typically involves providing detailed information about your health status, including any pre-existing conditions. Be honest and accurate in your responses, as any misrepresentations could lead to claim denials or policy cancellations.

Step 5: Medical Examination (If Required)

Some providers may require a medical examination as part of the application process. This examination helps the insurer assess your health status and determine your eligibility for coverage. It’s important to prepare for this step and be as transparent as possible about your health.

Step 6: Review and Acceptance

Once your application is submitted, the insurer will review your information and decide whether to offer you a policy. If accepted, you’ll receive a policy document outlining the terms of your coverage. Review this document carefully and ask questions if needed to ensure you understand your rights and responsibilities.

Real-Life Benefits of Long-Term Health Insurance

Long-term health insurance offers tangible benefits that can make a significant difference in the lives of policyholders. Here are some real-world scenarios where this type of insurance has proven invaluable:

Case Study: Chronic Illness Management

Imagine a person diagnosed with a chronic condition like multiple sclerosis. Long-term health insurance can provide coverage for ongoing medical expenses, including specialist visits, medications, and physical therapy. This ensures that the individual can access the care they need without financial strain, potentially improving their quality of life.

Case Study: Post-Accident Recovery

In the aftermath of a severe accident, an individual may require extensive rehabilitation and ongoing care. Long-term health insurance can cover the costs of this care, from hospital stays to home healthcare services. This allows the person to focus on their recovery without worrying about the financial implications.

Case Study: Aging and Assisted Living

As people age, they may require assistance with daily activities. Long-term health insurance can cover the costs of assisted living facilities or in-home care, providing a vital support system for older adults and their families. This ensures that seniors can maintain their independence and dignity as they age.

The Future of Long-Term Health Insurance

The landscape of long-term health insurance is evolving, driven by advancements in medical technology and a growing awareness of the importance of proactive healthcare planning. Here’s a glimpse into the future of this essential insurance type:

Technological Innovations

The integration of technology in healthcare is expected to play a significant role in long-term health insurance. From remote monitoring devices to digital health records, these innovations can enhance the efficiency and effectiveness of care, potentially reducing costs and improving outcomes.

Focus on Preventive Care

The future of long-term health insurance is likely to place a greater emphasis on preventive care. By incentivizing healthy behaviors and regular check-ups, insurers can help policyholders avoid or manage chronic conditions, ultimately reducing the need for extensive long-term care.

Tailored Coverage Options

As the industry evolves, we can expect to see more customized coverage options. Insurers may offer policies that are highly personalized, taking into account an individual’s unique health needs, lifestyle, and preferences. This level of customization can ensure that policyholders receive the specific care they require.

Expanded Benefits

Looking ahead, long-term health insurance may expand its benefits to include a broader range of services. This could include coverage for mental health services, wellness programs, and even innovative treatments like stem cell therapy, ensuring that policyholders have access to the latest advancements in healthcare.

How much does long-term health insurance cost?

+The cost of long-term health insurance varies based on factors such as age, health status, and the level of coverage desired. Premiums can range from a few hundred to several thousand dollars per month. It’s essential to shop around and compare policies to find the best coverage at a reasonable price.

Can I combine long-term health insurance with my existing health plan?

+Yes, long-term health insurance can be combined with your existing health plan to provide comprehensive coverage. This allows you to have separate policies for acute and long-term care needs, ensuring you’re prepared for a range of healthcare scenarios.

What happens if my health status changes after I purchase long-term health insurance?

+If your health status changes, it’s important to notify your insurance provider. They may require an updated medical assessment to determine if your coverage needs to be adjusted. Be sure to review your policy terms to understand the process for reporting changes in health status.