Military And Life Insurance

The intersection of military service and life insurance is a critical topic that deserves thorough exploration. For individuals serving in the military, understanding the nuances of life insurance is essential, as it not only provides financial security for their families but also serves as a safeguard for their future and peace of mind during their active duty. This comprehensive guide aims to delve into the various aspects of military and life insurance, offering expert insights and practical advice.

Understanding the Military’s Life Insurance Benefits

Military personnel have access to a range of life insurance options specifically designed to meet their unique needs. The Servicemembers’ Group Life Insurance (SGLI) is a vital program offered by the Department of Veterans Affairs (VA). SGLI provides low-cost term life insurance coverage to active duty service members, reservists, and National Guard members. Here’s a detailed look at what it entails:

Servicemembers’ Group Life Insurance (SGLI)

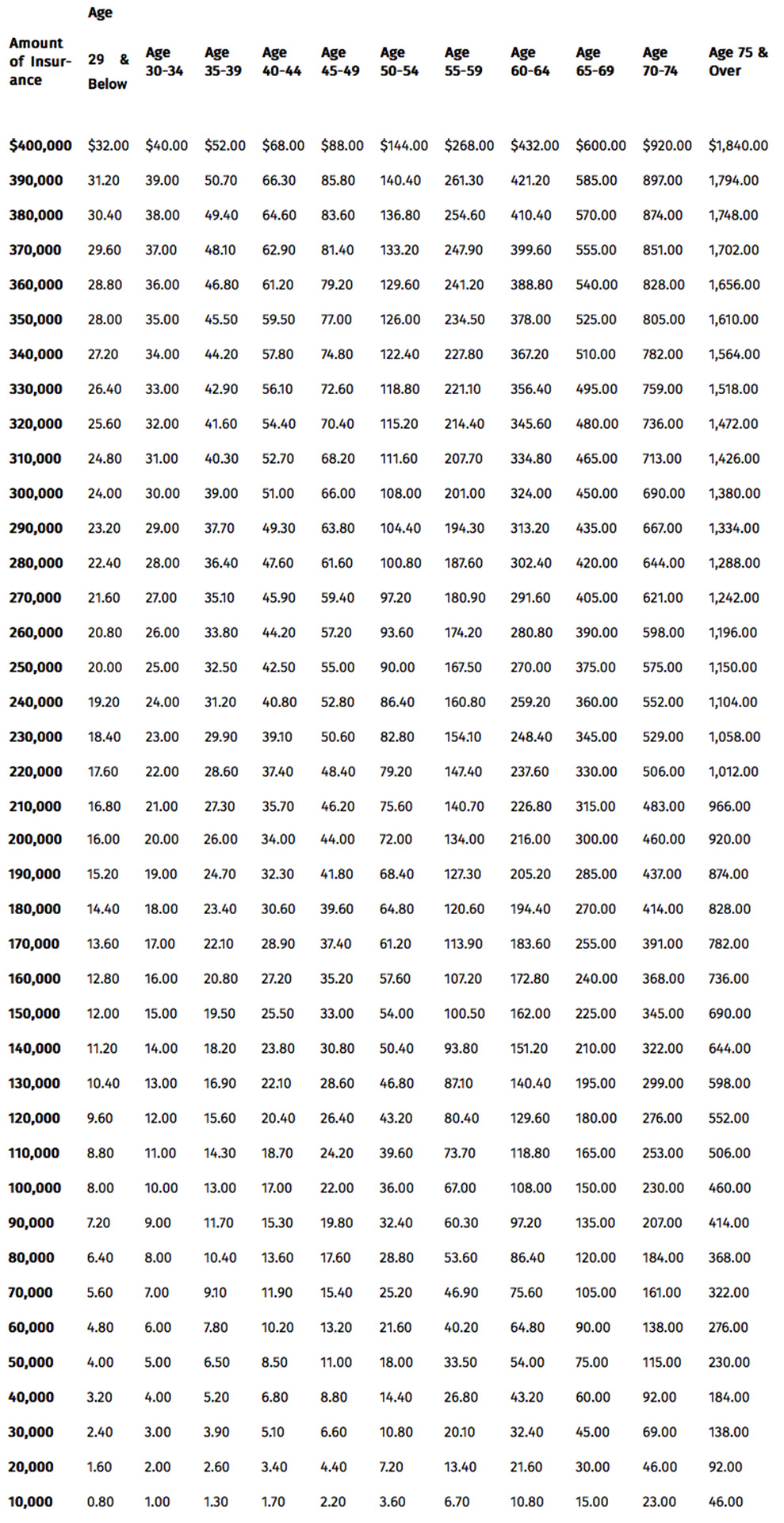

SGLI offers a maximum coverage amount of $400,000, ensuring that military personnel and their families are adequately protected. The premium rates are based on the service member’s age and are deducted directly from their pay, making it a convenient and affordable option. Moreover, SGLI provides additional benefits, including the opportunity to convert the policy to a private plan upon separation from the military, ensuring continued coverage.

| Age | Premium Rate ($ per month) |

|---|---|

| Under 30 | $18.30 |

| 30-34 | $27.45 |

| 35-39 | $36.60 |

| 40-44 | $45.75 |

| 45-49 | $54.90 |

| 50-54 | $64.05 |

| 55-59 | $73.20 |

| 60-64 | $82.35 |

| 65-69 | $91.50 |

| 70-74 | $100.65 |

Supplemental Life Insurance Options

While SGLI is a fundamental benefit, military personnel may require additional coverage, especially if they have a growing family or significant financial obligations. Here are some supplemental insurance options to consider:

Family Servicemembers’ Group Life Insurance (FSGLI)

FSGLI is designed to provide life insurance coverage for the spouses and dependent children of service members enrolled in SGLI. It offers a maximum coverage of 100,000</strong> for spouses and <strong>10,000 for each dependent child. FSGLI ensures that the entire family is protected, offering peace of mind during times of uncertainty.

Service Members’ Group Life Insurance (VGLI)

Upon leaving the military, service members can convert their SGLI coverage to a private life insurance policy known as VGLI. This conversion ensures continuity of coverage, allowing veterans to maintain their protection even after their active duty ends. VGLI provides a maximum coverage amount of $400,000, with premium rates based on the veteran’s age and health status.

The Importance of Tailored Coverage

Every military service member’s situation is unique, and so are their insurance needs. It’s crucial to tailor the coverage to individual circumstances. Here are some factors to consider when selecting the right life insurance plan:

- Family Size and Dependents: Ensure that your policy covers not only yourself but also your spouse and children. FSGLI can be a vital addition to your primary SGLI coverage.

- Financial Obligations: Consider your outstanding debts, such as mortgages, loans, or educational expenses. Adequate coverage can ensure that these obligations are met even in your absence.

- Future Goals: Think about your long-term financial goals, such as funding your children's education or planning for retirement. Life insurance can be a crucial tool to achieve these goals.

- Health and Lifestyle: Your health and lifestyle choices can impact the premium rates and coverage options available to you. It's essential to be transparent about your health status when applying for insurance.

Performance Analysis and Expert Tips

When it comes to choosing the right life insurance policy, performance analysis is key. Here’s a breakdown of the key performance indicators (KPIs) to consider:

Claim Settlement Ratio

The claim settlement ratio is a critical metric that indicates the insurance company’s ability to honor its commitments. A higher ratio suggests that the company is efficient in settling claims, ensuring timely payouts to beneficiaries.

Policy Persistence

Policy persistence refers to the rate at which policyholders continue their coverage over time. A higher persistence rate indicates customer satisfaction and the insurance company’s ability to retain its clients.

Expert Tips for Military Personnel

- Review Coverage Regularly: As your circumstances change, so might your insurance needs. Regularly review your coverage to ensure it aligns with your current situation.

- Understand Conversion Rights: Be aware of your conversion rights, especially when transitioning from active duty to veteran status. Understanding these rights can help you maintain continuous coverage.

- Seek Professional Advice: Consulting with a financial advisor or insurance expert can provide valuable insights tailored to your specific needs.

The Future of Military Life Insurance

The landscape of military life insurance is evolving, and several trends are shaping its future. Here’s a glimpse into what the future might hold:

Digital Transformation

The insurance industry is increasingly embracing digital technologies, and military life insurance is no exception. Expect to see more online portals, mobile apps, and digital tools for managing your insurance policies, making the process more convenient and efficient.

Enhanced Coverage Options

As the needs of military personnel evolve, so will the coverage options. Insurers are likely to introduce more flexible and comprehensive plans, offering tailored solutions for different life stages and circumstances.

Focus on Wellness and Prevention

With a growing emphasis on wellness and prevention, insurance companies may offer incentives and discounts for service members who adopt healthy lifestyles or participate in preventive healthcare programs.

Can I increase my SGLI coverage amount during my service?

+Yes, you can increase your SGLI coverage by submitting a request to the SGLI program. However, this option is typically available for specific life events such as marriage, birth of a child, or adoption.

What happens if I fail to pay my SGLI premiums while on active duty?

+In most cases, the government will pay the premium on your behalf, ensuring your coverage remains active. However, it’s essential to check with your finance office to understand the specific policies in your branch of service.

Can I purchase additional life insurance while serving in the military?

+Absolutely! While SGLI is a vital benefit, you can supplement it with private life insurance policies. Many insurance companies offer special rates and benefits for military personnel.